How to Fight Bogus Charges on Medical Bills

Health-care reform turned one last week, but Americans are still facing massive medical bills.

A recent study from Deloitte reveals consumers spent $363 billion in health care during that period, 14.7% more than traditionally reported by official government accounts, mostly due to costs that fall outside of traditional health-care spending

On top of that, about 80% of medical bills contain errors, according to Christie Hudson, vice president of Medical Billing Advocates of America, making already-expensive bills higher.

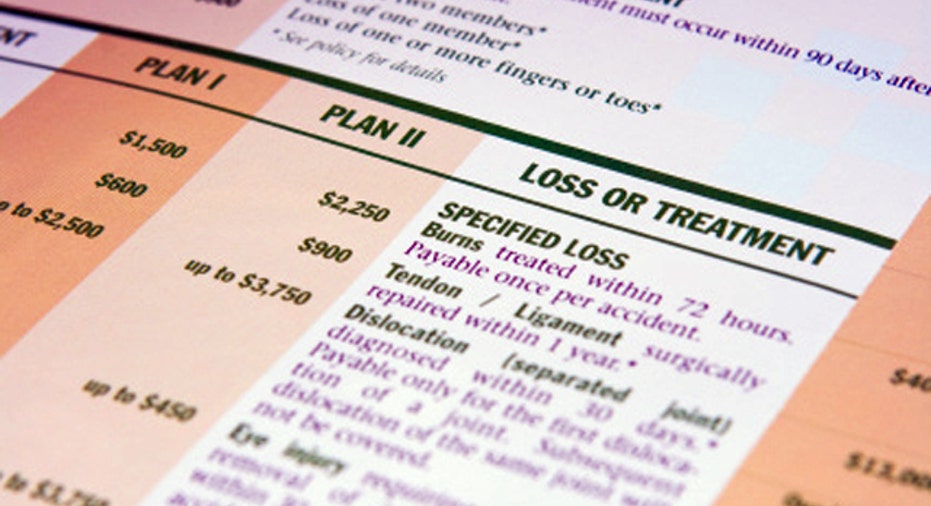

Today's complex medical-billing system, guided by hundreds of pages of procedure codes, allows fraud, abuse and human error to go undetected, Hudson says.

“Until the fraud is detected in these bills … the cost of health care is just going to increase. It’s not accidental. We’ve been fighting these overcharges…they continue to happen and we continue to get them removed from bills.”

These errors, which are hard to detect because medical bills are written in a mysterious code, can result in overcharges that run from a few dollars to tens of thousands.

“The sad truth is that a really, really, really antiquated system has been granted as a standard by the insurance companies and the providers and the hospitals,” says Steve Parente, professor of finance at the Carlson School of Management at the University of Minnesota.

“Roughly $250 billion is moving through those codes,” he says.

Billing errors can put a strain on people’s finances and according to a report from the Federal Reserve in December, medical bills account for more than half of all debts in collection.

“It is difficult for a consumer to audit their own bill,” says Becky Stephenson, co-president of the Alliance of Claims Assistance Professionals and owner of Versa Claim.

But there are steps patients can take if they suspect bogus medical charges and Federal and compliance billing guidelines are on your side.

Request an Itemized Bill

“The No.1 rule that we tell individuals is never pay the summary bill,” Hudson says.

Federal law requires any medical facility to provide itemized invoices upon request, Stephenson says, and if you’ve been a patient in a hospital for a couple of days, that bill could be 15 pages long.

Make Sure Services were Ordered by Your Physician

If your physician didn’t order a test or procedure in writing, you can’t be charged for it, Stephenson says. If there’s a question over a charge, ask your physician to confirm the request in your medical records.

Also be sure to check all the dates of procedures and tests are correct.

If You Don’t Understand it, Question it

“If I can’t figure out what [a charge] is for, then I’m going to question it,” Stephenson says. “You have to be a smart consumer.”

Challenge denials for procedures with your insurance company, you can determine whether something is truly not covered on your plan or is a clerical error.

“There could be a modifier missing from a claim or the diagnosis code could be incorrect,” Hudson says.

Look for Duplicate Charges

Bills for surgeries have the most opportunity for errors, according to Stephenson. “So many items are charged for your care. There could be duplicates, especially where items are implanted like pacemakers. Every screw they put in is in individual charge. You have to have imagine how many people are entering charges on behalf of that patient… mistakes are made.”

Upcoding mistakes, when a provider bills for a more costly procedure than what was performed, are another common mistake on medical bills. To fight these charges, compare your medical records against the bill.

Also make sure that you are not charged for any take-home items you did not receive, such as crutches or casts.

Be Skeptical of Unbundled Charges

“[Non-billable items] are the most common errors we see,” Hudson says. “That’s when you’re being charged for items that are factored into another charge, like being charged for items in a tray or kit being used for surgery. They’re double billing.”

Patients should not be charged for items such as soap, shampoo, toothbrushes and toilet paper, which are typically included in a hospital’s "room and board" charge or a "doctor’s office visit" fee.

When you see such charges, “those are red flags that a hospital doesn’t have good billing practices,” Stephenson says.

Look closely at bills from laboratories.

“A lot of times [the lab] can use one code for all the different services they are doing. If they bill five different codes, it’s more costly that way. We do see that a lot,” Hudson says.

Request an Internal Audit

Many large clinics and hospitals have in-house auditors, according to the experts, so take advantage of them to review your bill.

“It should not take longer than 30 days to have a dispute resolved for the individual. Put everything in writing,” Hudson says.

Always try to negotiate the total amount of the bill if you can pay it in full.

“A lot of providers out there will negotiate. They will settle your bill to get it paid in full,” Hudson says. “If you see errors on your bill and you’re able to point those out, that’s just going to give you a stronger background to negotiate your bill.”

Hire a Professional Billing Advocate

Not every bill is worth the battle, but if your suspect fraud and are unable to make headway on your own, consider calling in a professional billing advocate.

These professionals are familiar with medical codes and tend to charge up to 35% of the amount they save you.