How to Reduce Your Medical Insurance Bill

The weak economy has kept a lid on health-care spending and forced cash-strapped Americans to postpone care, but there are steps consumers can take to save money on health-care costs.

Health-care spending ticked up 3.9% in 2010, bringing the total size of the country’s health-care system to $2.6 trillion, or $8,402 per person, according to a report released by the U.S. Centers for Medicare and Medicaid Services.

For consumers with health insurance either through their employer or purchased on their own, it pays to be a good consumer, says Dr. Jeffrey Rice, chief executive officer of Healthcare Blue Book. Rice advises patients to ask their providers how much a procedures cost before having anything done, and do some research. If your provider’s charges are higher than the fair price, then ask for a discount or go elsewhere, he says.

Choose your provider carefully, adds Cheryl Fish-Parcham, deputy director of Health Policy at Families USA. “You need to make sure you have good coverage at a good price.” Understand what your plan covers, and what your out-of-pocket costs will be in case you get sick. If your coverage is lacking, experts suggest setting up a separate emergency fund to cover the cost of unexpected care.

Some plans have a tighter provider network but a more affordable monthly fee, like a health maintenance organization or point of service, while others have a broader network of providers, like a preferred provider organization or completely open plan, says Sabrina Corlette, research professor at the Health Policy Institute at Georgetown University.

A plan with a wider network tends to have higher premiums and cost sharing through copayments and co-insurance, or the amount consumers pay for prescription drugs. In an HMO, for example, you may have to pay more to see an out-of-network doctor. Evaluate your and any beneficiaries’ health situations before deciding what kind of plan will best suit your needs.

On average, the cost for single and family coverage under employer-based plans is $941 and $4,148 for an HMO plan; $1,002 and $4,072 for a PPO plan; and $784 and $5,333 for a POS plan, according to Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2011.

If your plan premiums increase by more than 10% from last year, Fish-Parcham suggests asking your insurance department or the U.S. Department of Health and Human Services to review the hike. As part of the Affordable Care Act, these reviews are intended to determine whether a premium hike is justified as it reflects trends in medical costs rather than insurance company profits. In September 2012, state-specific thresholds addressing health care trends in a state will replace the 10%-threshold. If the increase is unreasonable, insurance companies will charge a more modest rate increase to plan participants, according to HHS regulations.

In some states, plan participants may get money back as part of the Affordable Care Act. “If a plan has an excessive amount of profit and administrative expenses, consumers will start to see rebates,” says Fish-Parcham. “Ideally, companies will lower costs instead of giving rebates.”

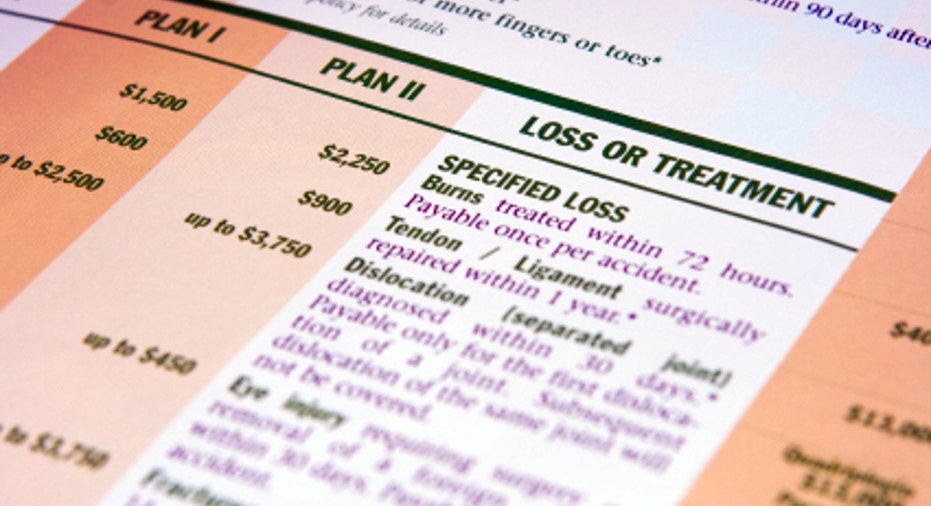

Even with health insurance, not all treatments and procedures are fully covered, or covered at all. “If you have a chronic condition, you may have a better idea of what costs you have to look out for,” says Fish-Parcham. In a few months, as part of the Affordable Care Act, insurance plans will be required to give standard summaries of benefits, such as out-of-pocket costs for injuries and illnesses, to help provide transparency to consumers.

“The most important thing in health care is to be informed, ask good questions, and understand the services your provider suggests to make the best decision,” advises Rice. Even with a health insurance plan like a PPO, prices still vary significantly. Under a PPO plan, the price for a colonoscopy, for example, can vary from $750 to $4,000 if you’re in network depending on the facility, while the out-of-network price starts at $1,200, according to Rice. “If you didn’t know how much the costs vary, you wouldn’t know to ask for a discount or to shop around.”

“Because of negotiated rates, insurance companies typically pay only about 40% of the full charge,” says Carrie McLean, consumer health insurance expert at eHealthInsurance. She suggests offering to pay up front or working with your doctor or hospital to create a payment plan to receive discounts of up to 30% off the full charge.

Many employers offer Flexible Spending Accounts (FSA) to help plan participants manage out-of-pocket costs like co-payments for doctor visits, prescription drugs, contact lenses, and eyeglasses. Employees deposit pre-tax dollars in FSAs to cover anticipated expenses during the year. “The downside is that if you don’t spend the money, it’s ‘use or lose,’” says Corlette.

Employers are increasingly offering wellness programs in an effort to curb their health-care costs, and can be beneficial to employees as well. For those programs offering discounts, employees may qualify if they improve their health by, for example, attending smoking cessation classes, losing weight or exercising at a gym. “Programs are all very diverse and different,” says Corlette.

To save on out-of-pocket costs, Fish-Parcham advises consumers use generic prescription drugs when possible, and ask for a cheaper alternative. “If you’re taking an expensive medicine, make sure your doctor knows you’re having trouble paying for the medicine. Your doctor may be able to prescribe a different medicine that may be cheaper and do the same thing.” If you are unable to change your medicine, sometimes you can appeal your insurance company so that they cover the drug at a lower cost, she adds.

You can also lower expenses by enrolling in a prescription drug discount program offered at many drug stores. Some programs charge a nominal fee for membership and provide participants with discounts for generic or both name brand and generic drugs. You can ask your pharmacist for details or look on your drug store’s website.

If you have a spouse or dependents, your employer-based plan may be more costly than if you purchased an individual plan for different family members. “Different people have different health insurance needs, and this is true within families too,” says McLean. “You may be able to save money by covering family members under two or more separate health insurance plans.”