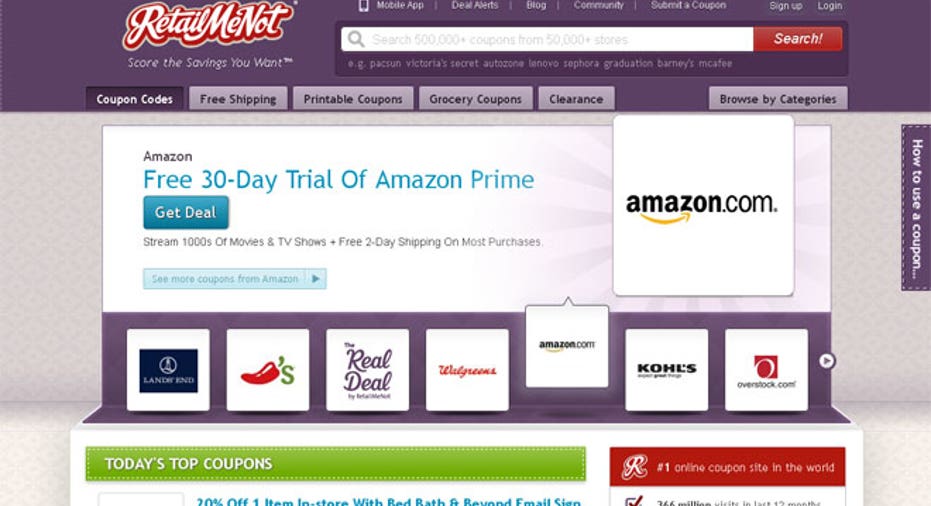

No Early Discounts: Coupon Service RetailMeNot Soars 26% After IPO

RetailMeNot (NASDAQ:SALE) closed almost 32% above its initial public offering price Friday morning, marking a bullish first act on Wall Street for the world’s largest digital coupon provider.

The positive start comes after the Austin-based company raised about $190 million Thursday evening by selling just over 9 million shares to the public.

The company is listing its stock on Nasdaq OMX Group’s (NASDAQ:NDAQ) Nasdaq Stock Market under the appropriate ticker symbol of “SALE.”

After pricing its stock at $21 Thursday night, RetailMeNot opened at $26.50 Friday morning, representing a 26% premium to the IPO price. In more recent trading, the stock was up 28.4% to $26.96.

The stock extended those initial gains and closed at $27.70, up 31.9% from the IPO price.

RetailMeNot, which offered coupons on over 60,000 retailers and brands last year, generated a 53% jump in profits in 2012 to $26 million, while revenue soared 80% to $144.7 million.

The company said it plans to use the proceeds to pay accumulated and dividends on preferred stock as well as for working capital and “other” corporate purposes.

The IPO was led by Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and Credit Suisse (NYSE:CS), while Jefferies, Royal Bank of Canada’s (NYSE:RY) RBC Capital Markets and Stifel, Nicolaus (NYSE:SF) acted as co-lead managers.