Road Rage: Bumpy Highways Cost Americans

America’s roads are in desperate need of repair. In the meantime, commuters and businesses are paying the price.

Eighteen percent of all major roads are in poor condition, and another 40% are in mediocre or fair condition, according to data compiled by transportation research group TRIP. In urban areas, the number of poor roadways increases to 28%. The latest edition of the Report Card for America’s Infrastructure from the American Society of Civil Engineers, which issues grades every four years, gave roads a “D.”

Groups such as the ASCE have urged government agencies to allocate greater funding for roads to address deteriorating conditions. The matter will only get worse as the number of miles driven continues to climb. The Federal Highway Administration expects mileage to grow an average of 0.8% every year through 2043, driven largely by trucks.

The ASCE called for $220 billion in new transportation funding between 2010 and 2040. That includes $196 billion for highway pavements and bridges, out of which 37% is needed just to address existing deficiencies.

With an additional investment of $157 billion per year, the U.S. can recover $3.1 trillion in GDP, nearly double the GDP of Mexico. The ASCE said congested urban roads cost $121 million in wasted time and fuel every year.

Economic Cost

Bumpy roads cost Americans, businesses and the U.S. economy.

TRIP estimated that U.S. motorists shell out $109 billion in extra vehicle repair expenses from driving on rough roads. The hardest-hit region is the Far West, where 53% of vehicle miles were spent on deficient pavement in 2010. Mid-Atlantic states (44%) also have a large share of deficient roads, while the Southeast (14%) has the smoothest roads.

According to the ASCE, deficient surface transportation infrastructure (ie., lousy roads) will cost the country nearly $3 trillion by 2040, including $1.1 trillion in added business expenses tied to vehicle repairs and transportation delays. Household budgets account for the remaining $1.9 billion. Given the cost to businesses, employee income in 2040 faces $252 billion in lost value.

The ASCE also estimated that the U.S. will lose more than $72 billion in foreign exports if the nation’s highway system is not brought up to speed.

Funding Debate

Meanwhile, the federal government’s highway funding is running dry. President Barack Obama recently signed a $305 billion bill, called the FAST Act, that will keep the Highway Trust Fund solvent through 2020 and increase funding by 15%. The Highway Trust Fund was on pace to run out of cash in June.

The Congressional Budget Office determined that public transportation spending has declined as a percentage of GDP since 1959, although the federal government spent far more on highways than any other type of infrastructure in 2014. Federal funds accounted for 28% of spending on roads. State and local governments covered the rest.

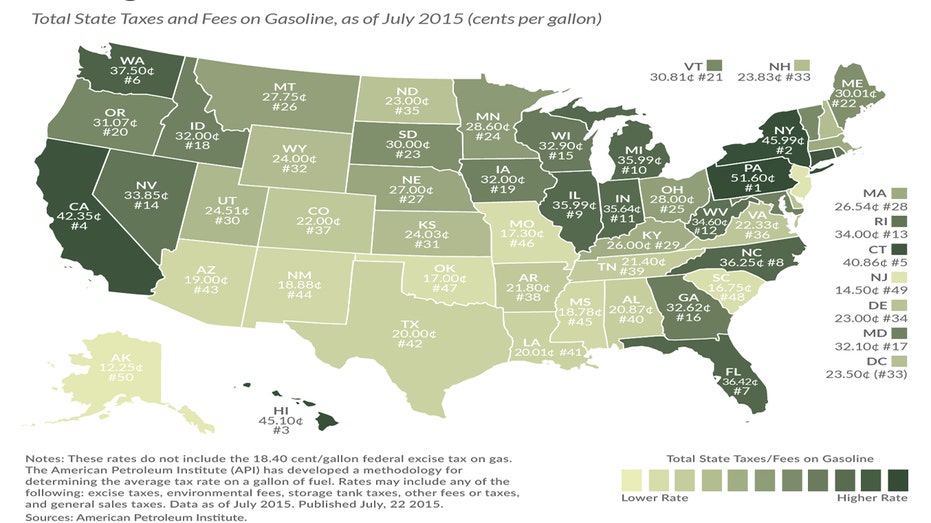

Some lawmakers are looking to raise gas taxes to create more cash for road repairs, especially now that pump prices are under $2 a gallon on average. In Missouri, Gov. Jay Nixon is pushing a proposal that would increase the state’s gas tax by 1.5 cents a gallon, while taxes on diesel would tick 3.5 cents higher. Americans pay an average of 26.49 cents a gallon in state gas taxes, according to the Energy Information Administration.

The FAST Act maintains the federal gas tax of 18.4 cents, which last saw a hike in 1993, but the bill does authorize a study to evaluate alternatives.

Is Gas Tax Enough?

However, critics of the government’s handling of infrastructure have targeted wasteful spending and a propensity inside Congress to use Highway Trust Fund dollars for other projects. In testimony before the Senate Finance Committee, economist Stephen Moore argued that last year’s estimated gas-tax revenue of $39 billion was enough to build and repair federally owned roads.

“Overall, about 25% of fuel tax funding is diverted to non-highway projects including bike paths, trails, museums, and so on. These may be very worthwhile projects, but why should gas and diesel tax revenues fund them?” asked Moore, a Distinguished Visiting Fellow at the Heritage Foundation, a conservative think tank.

Also, the Highway Trust Fund consists of two accounts: one for roads, and one for public transportation. The Mass Transit Account received about $8 billion in 2015, or 15% of the entire Highway Trust Fund.

“Congress should begin addressing the highway funding shortage by [ensuring] that every dollar of gas tax paid by motorists goes to building the roads that they make use of,” Moore said.

A report by the United States Public Interest Research Group Education Fund identified 12 highway projects costing $24 billion that it deemed unnecessary. According to Smart Growth America, state road funding between 2009 and 2011 focused on paving new roads rather than repairing existing ones. Fifty-five percent of those funds paid for expanding 1% of America’s state-owned network of roads, while the remaining dollars were spent repairing and maintaining the other 99% of roads.