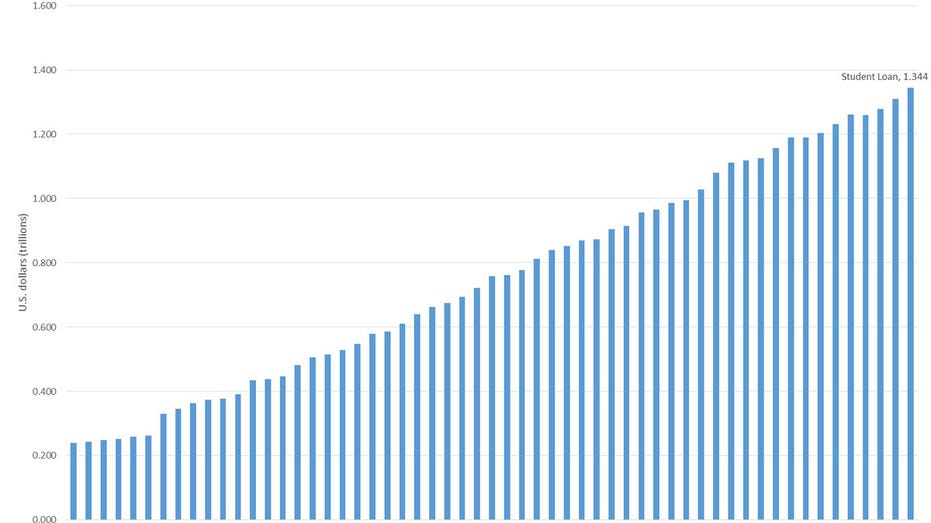

Student loan debt up more than 450% since 2003

While total U.S. household debt in the first quarter of 2017 surpassed its $12.68 trillion peak reached during the recession, according to data from the New York Fed, it’s the astronomical increase in student loan debt that is perhaps the most shocking.

Outstanding student loan balances have increased more than 457% since 2003, according to a FOX Business analysis of statistics from the Federal Reserve Bank of New York's Center for Microeconomic Data. In the first quarter of 2003, $241 billion in student loans were outstanding, compared with the first quarter of 2017, when that number jumped to $1.34 trillion. In the first quarter of 2017 alone, student loan debt jumped 2.6%.

The New York Fed notes in a recent report that student loan balances have increased each of the 18 years it has been releasing the analysis, while other household dues have been less consistent.

From the first quarter of 2003 to the first quarter of 2017, student loan debt rose the fastest out of all types of household debt. Mortgage debt, for example, increased only 74% to $8.6 trillion. Auto loan debt jumped 82% to more than $1.16 trillion. Overall household debt was up 75% over the same timeframe.

Not only that, but student loan delinquencies have also remained high. According to the New York Fed, 11% of total student loan debt was at least 90 days delinquent or in default during the first quarter of this year. The amount of balances transitioning into delinquency has averaged about 10% annually over the past five years.

Meanwhile, the price of higher education continues to skyrocket. For the 2016-2017 school year, the average cost for a private, nonprofit four-year degree, including room and board, was more than $45,300, according to data from The College Board – a 3.4% increase over the previous year. For a public, four-year in-state education over the same time period, that number increased 2.7% to $20,090.