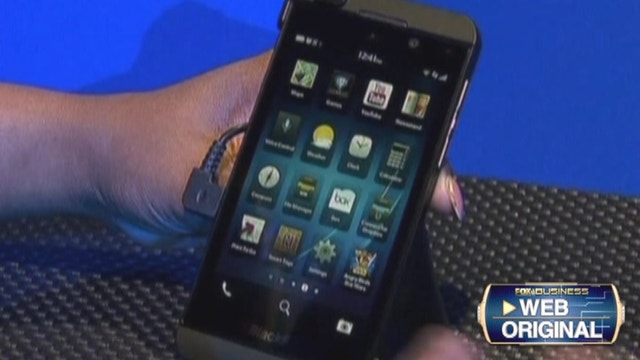

Tech Rewind: BlackBerry’s Buyout and Applied Materials’ Merger

The week began with a big announcement out of the mobile sector, as troubled smartphone-maker BlackBerry (NASDAQ:BBRY) announced it reached a deal with one of its largest shareholders, Fairfax Financial Holdings, which would pay $9 for each outstanding share. The offer is valued at $4.7 billion, but the deal still has to undergo weeks of due diligence, during which time BlackBerry can seek out rival bids. No other potential suitors stepped up this week, and the company, which once led the smartphone sector, has long trailed rivals Apple and Samsung in market share and sales. On Friday, BlackBerry announced weaker-than-expected second-quarter sales and wireless carrier T-Mobile said it would stop stocking the company’s devices in its stores. Shares of BlackBerry fell 8% this week. On Tuesday a massive merger in the semiconductor space was announced when chip equipment-maker Applied Materials (NASDAQ:AMAT) said it plans to combine with competitor Tokyo Electron in an all-stock deal valued at $9.3 billion. If the deal is approved by regulators, the new company, which makes the manufacturing equipment that produces semiconductors, would be worth $29 billion. Applied Materials shareholders would own 68%, while shareholders of Tokyo Electron would own about 32%. Tokyo Electron’s chief executive officer Tetsuro Higashi will be named chairman, and Gary Dickerson, current chief executive officer for Applied, would remain CEO of the new company. In an exclusive interview with FOX Business’ Liz Claman on Tuesday, Applied Materials executive chairman Mike Splinter said the two companies’ product lines were “complementary” and there was almost no overlap. “With our scale we should actually be able to produce at lower cost, and help our customers produce their products at lower costs,” Splinter said. “We’re convinced that the complementary nature of our product lines will allow this deal to progress smoothly,” he continued. Splinter said the merger will have to be approved in six countries. Oracle Corp. (NASDAQ:ORCL) chief executive officer Larry Ellison celebrated a big win in San Francisco on Wednesday when Oracle Team USA toppled Emirates Team New Zealand to win the America’s Cup yacht race. Team USA won eight races in a row to clinch a miraculous comeback victory, after Team New Zealand led by seven wins. As he celebrated the victory on Wednesday, Oracle shareholders complained that Ellison’s pay package, valued at nearly $77 million, was too high considering the software behemoth’s mixed performance; the stock is up just 4% year-over-year. The company’s annual meeting, set for Oct. 31, could see debate over executive pay. Chinese e-commerce marketplace giant Alibaba, whose initial public offering is highly anticipated by investors worldwide, ceased talks with the Hong Kong Stock Exchange this week and is now looking to list on a U.S.-based exchange. In a blog post on Thursday, Joe Tsai, co-founder and executive vice chairman of Alibaba Group, argued the Hong Kong Stock Exchange’s refusal to accept Alibaba’s governance structure, which would give more power to Tsai and the company’s 28 partners to guide the company without excessive influence from the capital markets, was based on tradition and is a strategy that is becoming obsolete. Analysts expect an Alibaba IPO to be worth as much as $70 billion, which would rival Facebook’s offering and make it one of the largest IPOs from the tech sector in years.