The Future of Mobility - What's Next?

“The future of mobility: What’s next?”, published as part of the Deloitte series on the future of mobility, analyzes the impending and rapidly approaching transformation of the mobility ecosystem that we currently experience today. “Throughout hundreds of conversations with corporate executives, government leaders, technologists, and academics around the globe,” the Deloitte authors attempt to address what the new ecosystem will look like, how it will operate, how quickly it will arrive, as well as the strategies the key players may employ and the transformations they’ll undergo.

A Shift to a Future State

While there is disagreement about how quickly a transformation will take place, Deloitte has seen agreement that a current shift is taking place: moving away from personally owned and driven vehicles and towards a future centered around driverless vehicles and shared mobility.

Moves are being made by stalwarts of the industry and disruptors alike, as both technology companies and automakers attempt to develop autonomous vehicles. Big players like GM (NYSE:GE), Ford (NYSE:F), and Daimler (ETR:DAI) have realized that collaboration is key, and have partnered with or invested in disruptors like Lyft, Maven, Velodyne, Civil Maps, Moovel, and Car2Go.

The government is also contributing to the shift, with the US Department of Transportation (DOT) having launched the Smart Cities Challenge to drive innovation and experiment with “cheaper, faster, safer, and more convenient and efficient transportation.” Pilot programs and regulation changes in the states of Nevada, Michigan, Pennsylvania, and Florida are accelerating the implementation of future mobility systems, and at this rate, Deloitte projects that it wouldn’t be surprising to see large-scale, in-market pilot programs in the next year; giving us a glimpse at tangible examples of what the future will look like.

Despite the rapid change on the horizon, it’s quite difficult to predict how quickly technology will be adopted. Deloitte modeling finds that significant change will begin within five years, but just look at the contrasting rates at which television and radio became widespread compared to the Internet and cell phones; consumer attitudes, consumption patterns, and regulatory developments would affect changes accordingly.

Accessing Current Capabilities

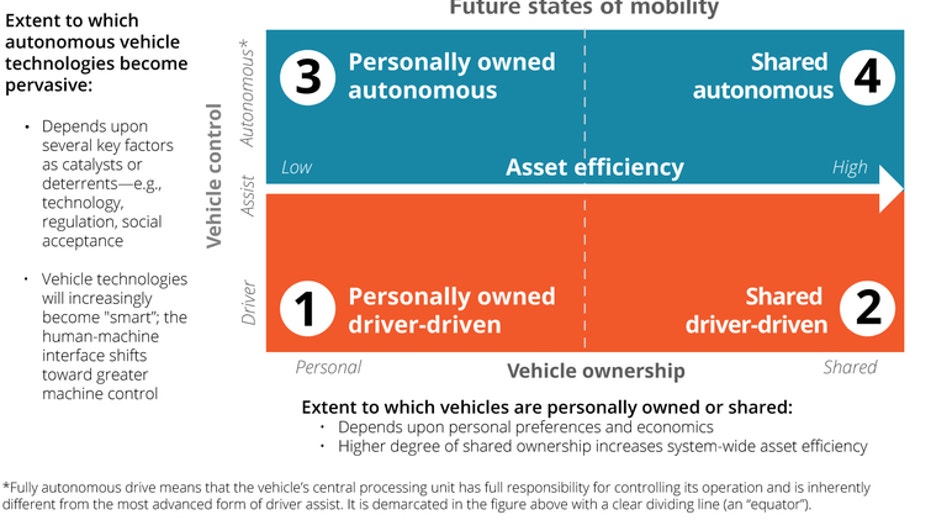

In the previous installment of “The Future of Mobility”, the authors argued that four “future states” would emerge based on who owns and operates vehicles (see Figure 1).

During the first state, personally owned driver-driven, private ownership remains dominant, but driver-assist technologies are incorporated. In a shared driver-driven state, private ownership of vehicles declines as ridesharing and carsharing increase and spread to new markets. A personally owned autonomous state entails private ownership remaining the consumer preference, but highly customizable and personalized vehicles would use autonomous drive technology. The shared autonomous state would provide “seamless mobility,” with a wide range of passenger experiences at varying price points available to meet consumer needs, first taking off in urban areas and then permeating the suburbs.

As companies begin to stake out positions in preparation for the emerging future of mobility, they will look to design “new products, services, and solutions that serve each future state and multiple modes of travel simultaneously.” So while auto manufacturing is expected to continue, it will become increasingly more complex and customizable in order to meet the various transportation needs of its consumers and demands brought about by each mobility state.

With these changes in products and experiences, there will likely be alterations to the current manufacturing process. “The traditional capabilities of vehicle manufacturers and suppliers will need to expand, collaborating with autonomous vehicle technology suppliers, software developers, and others to provide a much broader range of product choices.” Specifically, allowing for cost- and time-efficient customization capabilities is key.

Autonomous driving technology--which will likely permeate into the train, bus, truck, and other transit markets eventually as well--is currently being pursued by nearly all major automakers looking to position themselves for the future. Decisions will have to be made about whether their current capabilities are sufficient, or if they need to redesign their business model to cater to one, multiple, or all four future states. Deloitte’s article emphasizes reducing supply times, giving customers access to product design as well as product customization, and incorporating autonomous drive equipment.

A New Mobility Ecosystem

With research showing that each driver in the U.S. travels an average of 46 minutes per day, Deloitte believes that companies will also look to capitalize on the in-transit experience, making this a “defining feature of the future of mobility.” Volvo (STO:VOLV-B) has partnered with Netflix (NASDAQ:NFLX) to enable streaming during the commute, and other automakers have similar arrangements to stream audio in vehicles; so it is evident that the arms race among “experience enablers” is already underway.

Whether travelers want to shop--like in the UK, where 20% of consumers’ online shopping takes place during commutes, as tracked by Zapp or be entertained, be productive, or have food delivered, the goal of future mobility is to “seamlessly and intuitively assist passengers with where they are going, how they get there, and what they do along the way.”

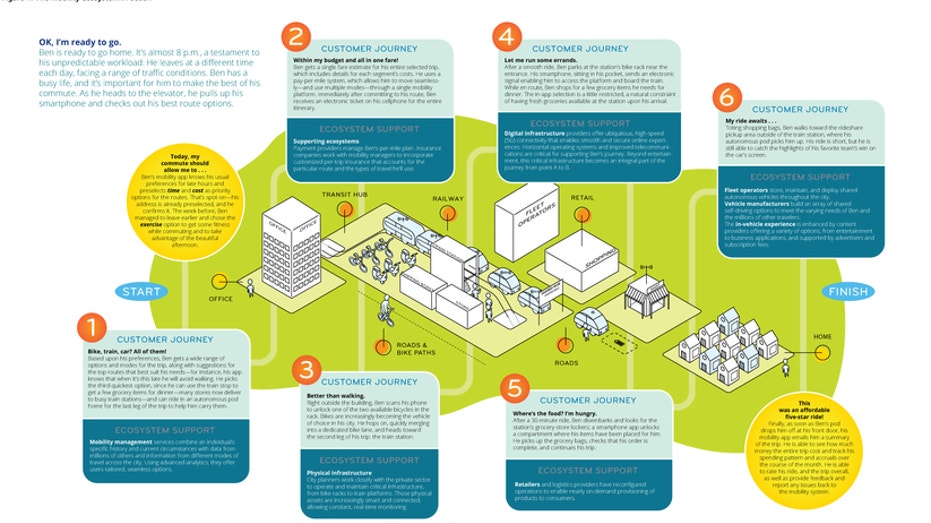

Tailoring your commute --and preferences along the way--will depend on your commute history, the specifics of your trip, and your social media and content-consuming patterns; all fueled by data and infrastructure. Figure 4 ‘The mobility ecosystem in action’ explores potential future commuting options and the ecosystem support that would enable these options to become a reality.

The infrastructure to support and enable these technologies--and others like route optimization based on traffic patterns and smart tolls--is essential. Deloitte pitches data as the new oil, with telecommunication, cybersecurity, and operating system providers competing to provide “fast, safe, reliable, and ubiquitous connectivity for all the data that the future mobility ecosystem requires.”

In order to achieve this, companies would look to offer seamless connectivity; enabling all participants to be online regardless of time and location, and connecting all vehicles and devices in the entire ecosystem in a secure network. Deloitte predicts that an integrator will emerge, taking on the role of mobility manager and connecting the consumer to these technologies that are being worked on.

For this company, that would entail developing things like data collection to safely store and access information needed for traffic, travel times, etc.; predictive analytics to pair users with recommendations based on their preferences; and logistics systems to schedule and allocate vehicles where needed while managing the fleet of vehicles. But, as the article points out, “the roles and capabilities described here are illustrative, not exhaustive.” So much could change with this many variables at play.

What's Coming?

Change is coming sooner rather than later; providing new commuting options for consumers, new ways for content creators to deliver to their customers, and new opportunities for businesses to take part in facilitating this change.

Both industry incumbents and newcomers aspiring to make an impact should take steps to ensure their place in a new mobility ecosystem. The companies involved will have to take into account the many factors in play: consumer preferences, the government setting regulations, the city and state implementing the systems and providing up-keep, the financing and insurance changes that will result from safe and more collaborative vehicles, and what the future infrastructure will be able to accommodate.

Many players will compete for these new opportunities; including the household names, and others who have not yet emerged. Some are already well-positioned for the future, while others need to evaluate their capabilities and make strategic decisions based on what’s coming next. Those who are going to be successful should start now to identify what their role will be in the new mobility ecosystem, and plan to deliver value the customers demand, even if it means drastically transforming how they currently operate.