What College Students Need to Know About Health Insurance

Health insurance might be the last thing on most college students minds, but an accident or serious illness that brings unplanned medical bills could saddle uninsured students with debt.

At the college age, health insurance has never been more affordable, says Terry Lester, advisor at MyInsuranceExpert.com. They can get plans starting in the $10 to $50 a month range with very generous benefits. Its not as scary or threatening as what they might think.

Not only is it beneficial to have insurance for financial reasons, but your school may require it. According to a 2008 U.S. Government Accountability Office study, about 30% of colleges nationwide required students to have health insurance and some states have their own insurance requirements as well.

College student have three main options for coverage: being covered under a parents policy, being insured through the university, or taking out an individual policy. We talked with insurance experts about what students should consider about each option.

Parents health insurance plan

Under the 2010 health-care reform law, students and young adults can stay on their parents plans until the age of 26. And according to the experts, a parents plan generally cannot exclude a student with pre-existing health issues.

Lester explains that it is important for students to review and understand what a parents policy actually covers. Some providers do not cover students that attend school out of state or charge higher deductibles and co-pays based on location.

If youre looking at a regional carrier on a parents plan, they may not address a students everyday needs, he says. They might cover your emergencies very nicely, but youve got to be covered for more than just emergencies.

Anita Barkin, president of the American College Health Association and director of university health services at Carnegie Melon University, explains that ongoing medical treatments and follow up care such as physical therapy, may not be covered under a parents plan and advises students find out from the insurance provider if extended medical needs are included.

The student is then facing a choice of having to fly home, disrupting their education to get the care they need because they dont have coverage in the area where theyre attending school, she says. Sometimes the students will not get the care that they need and theyll just elect to forgo the follow up care.

To avoid any coverage gaps after graduation, students should get on their parents policy within 30 days after walking across the stage.

College-sponsored insurance plan

College students may have the option of obtaining an insurance policy through their university. In the same GAO study from 2008, an estimated 57% of colleges nationwide offered health insurance plans to their students. Of those schools, 82% of four-year public colleges nationwide offered student insurance plans in the 2007-2008 academic year, compared with 71% of four-year private nonprofit colleges and 29% of two year public colleges.

What were finding is that sometimes when parents look at the cost to keep the student on their plan and the cost of the student health insurance plan, sometimes its either a break-even [scenario] or there may be a little advantage of going with the student insurance plan if there is better coverage in the location where the student is going to attend school, says Barkin.

Barkin explains that college-sponsored health insurance plans are designed to meet the needs of the college population, usually providing good coverage for preventive health care, mental health care and prescription medications.

The annual premium for college health plans can vary by school, plan design and geographic location, according to Barkin.

What I suggest students do is to look at the level of coverage they have with their parents plan and compare it in terms of cost and benefits, including deductibles and co-pays, with the student health plan that is being offered by the school that theyre going to attend, she says.

Individual health insurance plan

If a student is unable to be covered under a parents plan and if a school-sponsored plan is not available, another option is take out an individual insurance policy with a nationwide provider, suggest the experts.

Lester explains that some individual insurance plans do not include mental health provisions with the exception of rehabilitation and substance abuse. The experts suggest looking at the pre-existing condition clauses as well and warn students with a pre-existing mental health condition that an individual health insurance plan might not be the best fit.

Mental health care is a critical piece and sometimes a piece thats left out, says Barkin. Students will evaluate an insurance plan looking at the medical benefit and fail to really look for the mental health benefit.

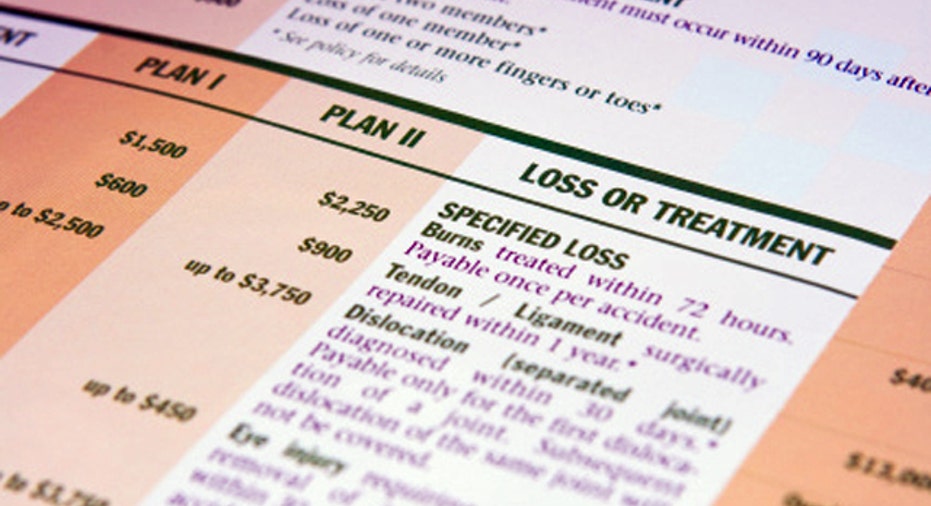

The experts suggest that before students commit to any kind of insurance plan, they research the conditions of the plan: deductibles, co-pays, the out of pocket limits, and the maximum coverage.

When youre looking at health plans, you want to look at if its permanent, but is it cost effective from a premium standpoint? says Lester. You dont want a plan that is so rich in benefits, that the premium is so costly that youre not going to be able to sustain the premiums long term.