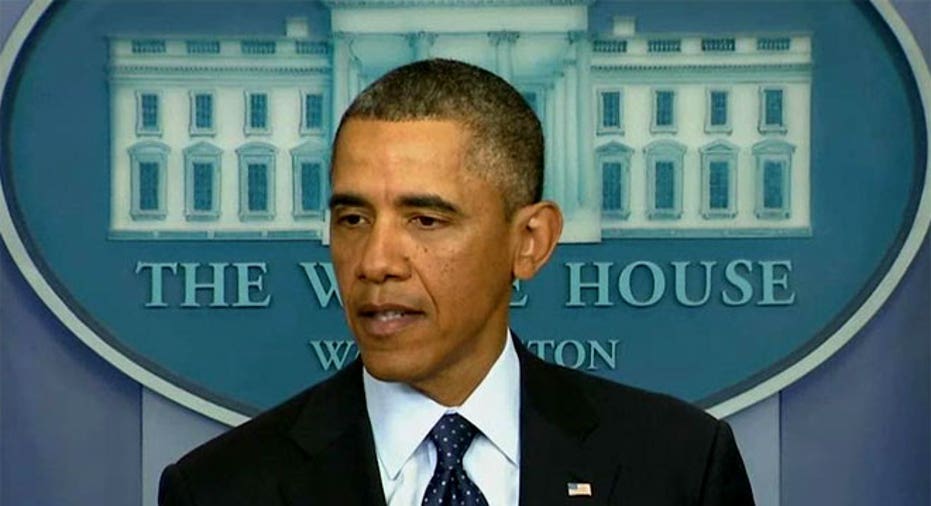

What Obama’s Budget Proposal Means for Your Wallet

President Obama presented his $3.77 trillion federal budget proposal for 2014 Wednesday that includes cuts on entitlement programs as well as tax increases on the wealthy.

The proposals are a compromise of sorts from the president to please both Democrats and Republicans to get lawmakers to make serious movements on deficit- reduction talks.

“The budget isn’t just about how to get the deficit in line,” says David Kamin, associate professor of Law at NYU. “It is about where [Obama] is putting resources and making decisions about overall spending.”

The proposal includes reining in an additional $1.8 trillion in deficit reduction in the next 10 years and also proposes a switch to how inflation is calculated and would impact Social Security benefits.

Here’s a look at what’s included in the president’s budget and what it means for consumers’ bottom lines:

Reforming Entitlements

The president calls for a shift on how beneficiaries of government entitlement programs, such as Social Security, are calculated to a chained Consumer Price Index method. The measure would change how inflation is calculated and would reduce annual Social Security cost of living adjustments.

“This reduces Social Security benefits for people over time by changing the way inflation is measured,” Kamin says. “This is for older Americans and is a real cut—the administration didn’t want to go along with this, but was willing to do so as a compromise.

Isabel Sawhill, senior fellow at the Brookings Institute, says Obama’s proposal makes sense for taxpayers.

“This means the growth of benefits would be slower, and many experts think the change is perfectly justified because it recognizes the fact that when prices go up on some goods or services, people buy cheaper goods or services,” Sawhill says. “This would accommodate that reality.”

There have been some discussions of making exceptions for the very old or low- income elderly as far as these entitlements are concerned, Sawhill says.

On the Medicare side, Obama’s proposal asks the more affluent to pay higher premiums, Sawhill says, as part of a push to cut $400 billion from Medicare and health programs over the next 10 years.

“Their subsidies will be quite large, and they will pay more out of pocket,” she says. “It’s still a fairly small group, but people care about this because they envision they will one day be on it.”

Education and Infrastructure

As first laid out in his State of the Union address, Obama’s budget includes a program to offer preschool to all 4-year-olds from low and moderate income families. The sweeping program would be paid for with increased taxes on tobacco products.

“To help workers earn the skills they need to fill those jobs, we'll work with states to make high- quality pre-school available to every child in America. And we're going to pay for it by raising taxes on tobacco products that harm our young people. It's the right thing to do,” Obama said in a statement Wednesday.

The budget also calls for $50 billion in infrastructure investments, as well as $40 billion in a “Fix it First” initiative, which would provide immediate cash to fix infrastructure nationwide as well as create jobs. He is also proposing $1 billion to launch 15 manufacturing innovation institutes across the country.

The Tax Code

The tax portion of the budget calls for revenue increase that total $1 trillion over the next decade. Obama’s proposal raises $580 billion in restricting what the top 2% of earning families can deduct, according to Kamin.

The budget proposal also includes the so-called “Buffett Rule,” which says millionaires won’t pay less than 30% of their income in taxes annually.

The proposal also includes a limit t o the amount of savings you can put away for retirement that are tax beneficial, Sawhill says.

“This is especially for those near retirement age, who are struggling to save money for that purpose,” she says. “It will only affect the reasonably well-off. The cutoff is $3 million in savings, if you have that you will not get these benefits.”

But Will it Pass?

Kamin says Obama’s budget would impact the majority of American households, it’s not likely to pass Congress.

“The pattern has been the House of Representatives not working with the White House on these initiatives,” he says. “We will likely see a continuation of the current gridlock.”