What U.S. Retirees Can Learn From New Zealand and Australia

Less retirement savings, soaring healthcare costs and concerns that Social Security could have a shortfall in the coming years are just some of the fears Americans have when it comes to retirement. While more Americans worry about their financial fate during their golden years, their counterparts in New Zealand and Australia are not as worried.

Both New Zealand and Australia rank among the top countries in the world when it comes to retirement security according to Natixis Global Asset Management. Ed Farrington, executive vice president at Natixis, says both countries make retirement savings a priority. The countries have retirement systems in place which rely on participation from the government, the employer and the individual.

“These countries have all three legs of the stool firmly in tact so that means there is a government system in place that is well funded and allows folks to have some certainty that they will have benefits over time,” Farrington says. "There is an employer incentive in place for folks to save at the workplace and there are incentives in place for individuals."

Nation of Savers

What sets New Zealand and Australia apart is a strong emphasis on individual savings and it starts at an early age. Financial literacy is included in many school curriculums. Individuals are also encouraged to save once they start working.

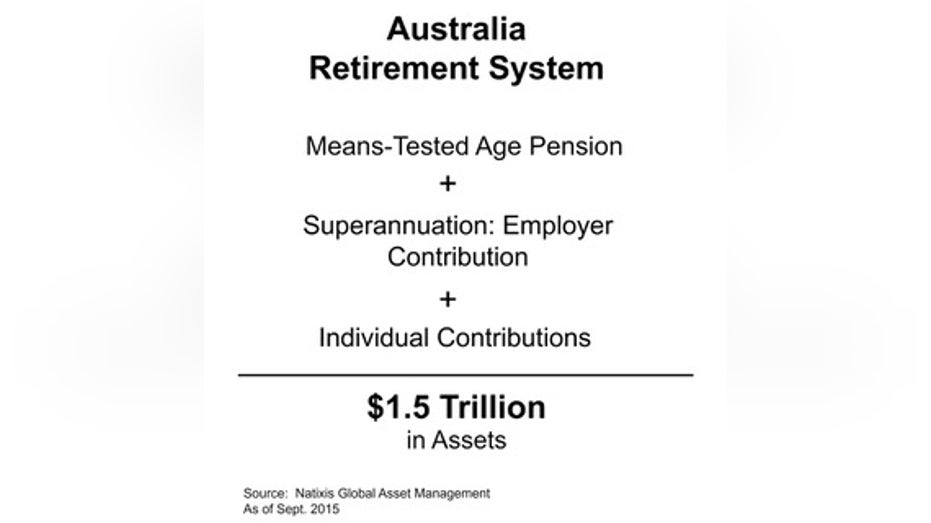

As part of Australia's Superannuation program, employers contribute 9.5 percent of a worker’s pay to an employee retirement savings account. The percentage will gradually rise to 12 percent by 2020. Unlike the U.S. where it is voluntary, employers in Australia are required to set up these retirement savings accounts for employees. The Center for Retirement Research at Boston College estimates more than 90 percent of Australian workers have an individual retirement savings account. Compare that to the U.S., where less than half of workers participate in a 401(k) or work-sponsored retirement savings plan.

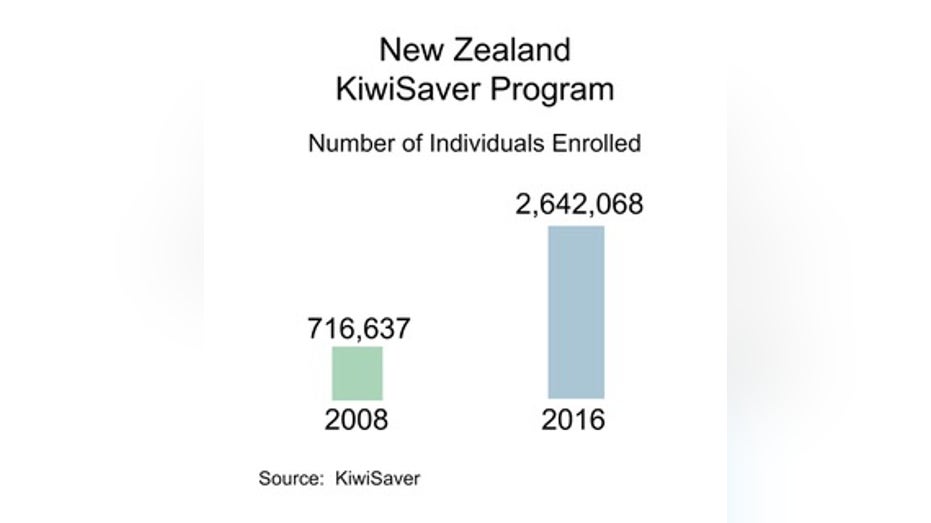

In New Zealand, the country has its own individual savings program called KiwiSaver. It is a voluntary work-based program where a portion of a worker’s salary is set aside in a retirement savings account. Employers also contribute at least 3 percent of a worker’s wages. While KiwiSaver is voluntary, it is an auto-enrollment plan. This means savings are automatically taken out of a worker’s paycheck but the employee can choose to opt out if he or she does not want to participate. This is different than the U.S. where workers have to sign up to participate in a 401(k) plan and often times they fail to do so.

“People tend to start the KiwiSaver plan and once they start the plan, they realize it’s not that hard to put away a little money,” Farrington says. “Now you see incredibly strong results. You see high participation, about 60 percent of folks are participating.”

The Safety Net

Australia’s Age Pension, the equivalent to Social Security, works as a supplement to individual savings. The system is means-tested. Unlike Social Security in the U.S., which is paid out to anyone who has paid into the system, retirement benefits in the Age Pension are delivered based on certain income requirements and the level of need. About 50 percent of the age-eligible population receive a full pension benefit. Thirty percent receive a partial pension and 20 percent, those with higher-incomes, receive no pension at all. The Australian government expects the number of people receiving a full pension will gradually decrease as incomes and individual savings rise. Analysts say the system has lowered poverty rates among the elderly and has helped contain government costs.

New Zealand has its own government safety net called Superannuation. A flat-rate, universal benefit paid to those 65 years of age or older who meet certain residency requirements. Amounts paid vary depending on marital status and an applicant’s current living situation.

Lessons to Learn

One thing that helps Australia and New Zealand better manage their retirement systems is having relatively small populations. Australia has a population of about 24 million people, just under the population of Texas. New Zealand, meantime, has about 4.5 million people, around the size of Kentucky. The numbers are small compared to the 324 million-plus people living in the United States.

While New Zealand and Australia may be smaller in size, Farrington says there are still lessons for the U.S. to learn. Following their lead, he says the U.S. needs to make saving for retirement a priority with the government, employers and individuals all participating. This also includes adopting programs that give broad access and make saving for retirement easier for individuals.