Bernie Sanders pushes to break up big banks

Sen. Bernie Sanders, I-Vt., has introduced a bill to break up the nation’s largest financial institutions, warning that if we don’t we are at risk of another financial crisis.

On Wednesday, Sanders said that the nation’s largest financial institutions should not be allowed to get so big, noting that the four largest financial institutions in the United States are an average of 80 percent larger than they were before they were bailed out during the Great Recession.

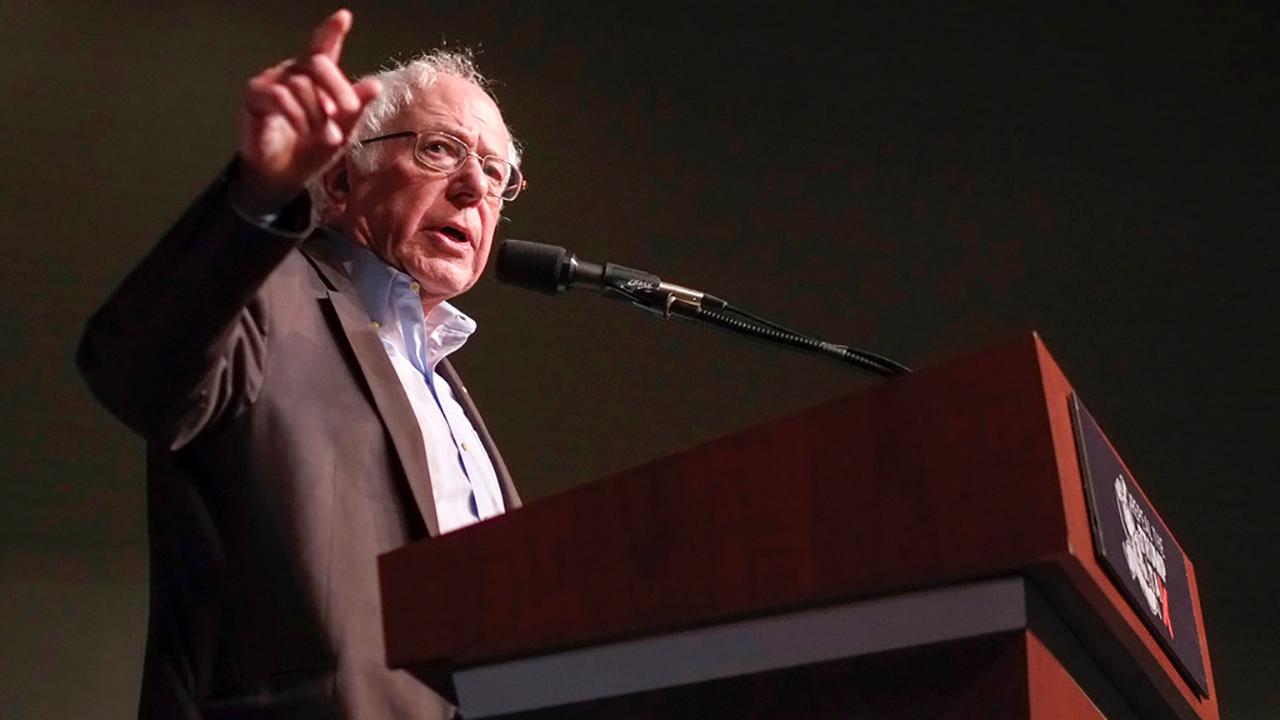

“The time is now to break these big banks up,” Sanders said in a video message discussing the bill.

Sanders was joined by Rep. Brad Sherman, D-Calif., and Simon Johnson, former chief economist at the International Monetary Fund and current MIT professor in making the case for breaking up the big banks.

Sanders wants the size of the largest financial institutions in the country capped so that they are exposed to no more than 3 percent of America’s gross domestic product. That is equivalent to about $584 billion. This means six banks would need to be broken up, including JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley. Beyond banks there are financial institutions that are greater than $584 billion in size, including MetLife and American International Group.

Sanders noted that the issue is not only preventing another collapse, but also combating the lack of competition from having few large players.

The six largest banks have more than $10 trillion in assets, equivalent to above 54 percent of GDP, according to the Vermont senator.

Sanders has long pushed his belief that Wall Street needs to be reformed.

According to the St. Louis Federal Reserve, there is some research that suggests putting size limits on banks could raise the cost of providing banking services.

Commenting on the legislation to adress "too big to fail" Kevin Former, president and CEO of Financial Services Forum said, “To have a large, strong economy that supports households and businesses big and small, you must have large, strong, global banks. The banking industry and governments around the globe have made enormous strides during the past decade to ensure that large banks are safe and sound and that no institution is too big to fail. Policymakers must neither ignore the progress that has been made nor the essential role of large financial institutions in our economy.”