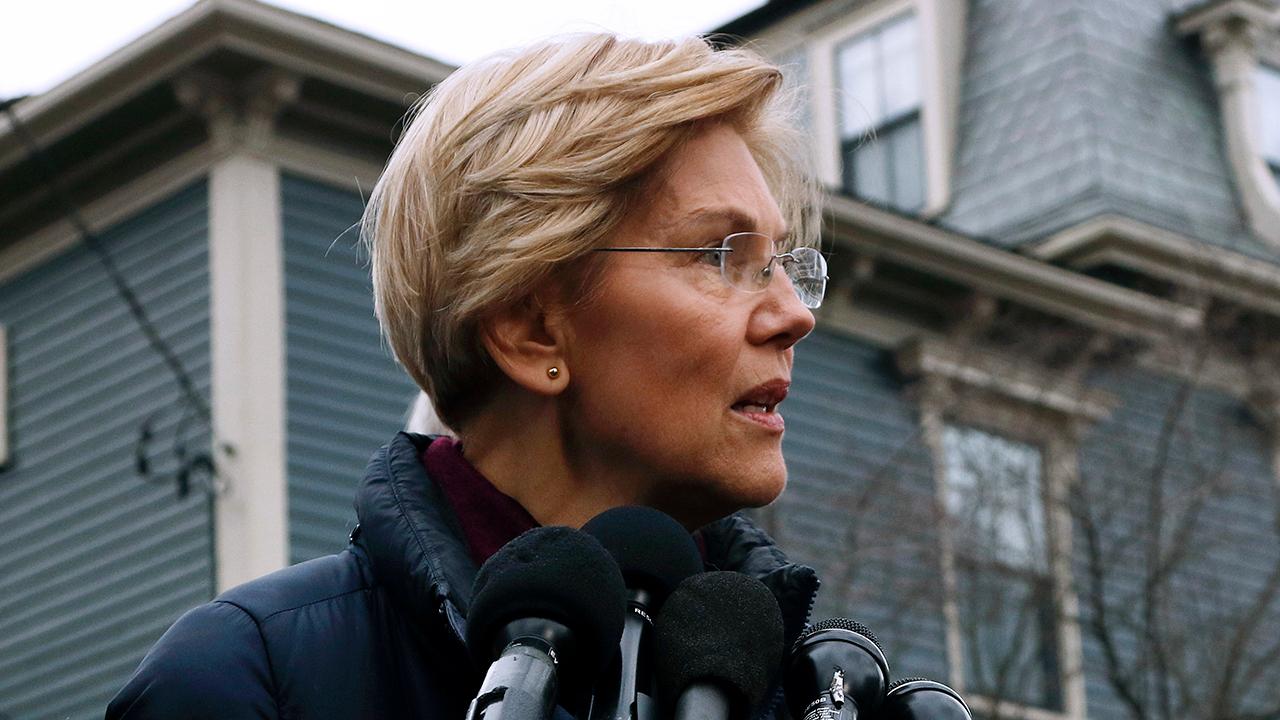

Elizabeth Warren wants Wells Fargo removed from college campuses

Elizabeth Warren takes on capitalism

The Daily Signal’s Kelsey Harkness and Democratic strategist Al Mottur discuss Sen. Elizabeth Warren’s (D-Mass.) remarks on capitalism.

Sen. Elizabeth Warren slammed Wells Fargo this week for overcharging college students with what she described as exorbitant fees, demanding the scandal-ridden bank be kicked off of campuses.

The Massachusetts Democratic and likely presidential candidate said Thursday that her review of the long-delayed Consumer Financial Protection Bureau (CFPB) report revealed that fees charged to college students by Wells Fargo for debit cards and other financial products were more than three times higher than the average charges by other financial institutions.

According to the CFPB report, Wells Fargo charged college students at the 31 institutions they have a presence at an average of $46.99 in fees annually, the highest of the banks examined across 573 colleges and more than three times higher than other banks.

The CFPB report was produced in 2017, but only released in Dec. 2018 as a result of a Freedom of Information Act request.

"Wells Fargo has a history of aggressively and sometimes illegally squeezing its customers to boost its profits, and this report illustrates that the bank is deploying similar tactics on America's college campuses to target vulnerable students," she said in a statement, adding, "These high fees, which are an outlier within the industry, demonstrate conclusively that Wells Fargo does not belong on college campuses."

The study was based on close to 600 marketing agreements between colleges and 14 financial institutions and an analysis of approximately 1.3 million student bank accounts opened under these agreements. Most students, the CFPB found, paid no fees at all. Wells Fargo, however, charged the highest fees, ultimately collecting more than half of all fees paid by college students, despite only providing about one-quarter of the accounts.

Warren sent a letter to all 31 colleges where Wells Fargo provides financial services alerting them to the fees. She also said she requested that Wells Fargo provide additional information about the high fees, its partnership with the colleges and a breakdown of the different types of fees by Feb. 5.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WFC | WELLS FARGO & CO. | 94.63 | +0.70 | +0.75% |

Wells Fargo is no stranger to scandals: In April, the Consumer Financial Protection Bureau slapped the bank with a record $1 billion fine for misbehavior in its auto and mortgage businesses, like charging customers for auto insurance they didn’t need, or pushing some to default on their loans and lose their cars through repossession.

CLICK HERE TO GET THE FOX BUSINESS APP

That followed a 2016 enforcement action by the CFPB, which dinged Wells Fargo with a $100 million fine for opening 2 million phony accounts