GE shares hit 2009 low as dividend gets cut to one cent

General Electric shares slipped to the lowest level since 2009, breifly falling below the $10 level, after the company disclosed that the Securities Exchange Commission (SEC) is expanding its ongoing investigation into accounting practices to include a $22 billion goodwill charge the company took in the third quarter related to acquisitions made in its power business.

This after the troubled industrial giant slashed its dividend to one cent.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GE | GE AEROSPACE | 320.81 | +14.60 | +4.77% |

"The SEC expanded the scope of its ongoing investigation to include the goodwill charge," said GE's Chief Financial Officer Jamie Miller on the company's third-quarter earnings conference call. "The Department of Justice is also investigating this charge and the other areas we have previously reported are part of the SEC's investigation,” the executive added, noting that GE is cooperating with the SEC and DOJ.

The former Dow component said it will cut its quarterly dividend to $0.01 per share starting in December, allowing it to retain $3.9 billion in cash per year compared to the prior payout level.

This as third-quarter revenue missed Wall Street's expectations. It reported revenue of $29.57 million, less than the $29.92 million analysts anticipated. Earnings per share also fell short of expectations, at an adjusted $0.14 per share vs. $0.20 per share.

In addition, GE said it will divide its struggling power business into two units.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GE | GE AEROSPACE | 320.81 | +14.60 | +4.77% |

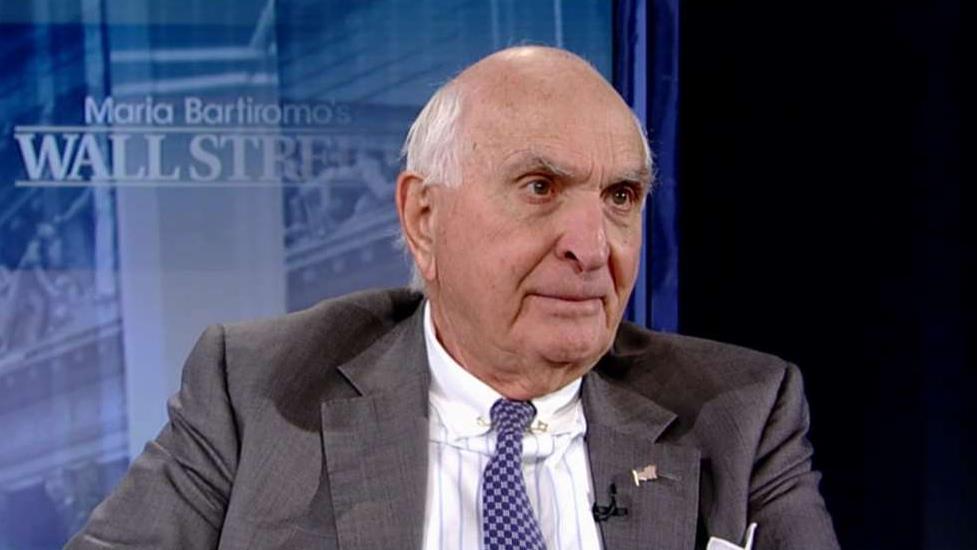

The results are the first under Larry Culp, 55, who was appointed as chairman and CEO on Oct. 1, replacing John Flannery who held the role for just under two years, failing to push a much needed turnaround.

Commenting on the results, Culp said that “GE is a fundamentally strong company,” and that they are “on the right path to create a more focused portfolio, strengthen the balance sheet.”

“We are on the right path to create a more focused portfolio and strengthen our balance sheet. My priorities in my first 100 days are positioning our businesses to win, starting with Power, and accelerating deleveraging. We are moving with speed to improve our financial position, starting with the actions announced today. I look forward to updating you further on our progress in early 2019,” Culp said.

Shares of GE have lost 36 percent this year.