Manhattan DA ordered to turn over sex assault records to JPMorgan Chase amid lawsuit over Epstein ties

Epstein had a long relationship with Jes Staley, who resigned from JPMorgan Chase over his connections to the pedophile

JPMorgan Chase CEO says other states should learn from Florida and Texas's "pro-business" culture

JPMorgan Chase CEO Jamie Dimon praised Florida and Texas's "pro-business", "pro-America" policies during an interview with Bloomberg TV Monday. Dimon was being interviewed at a JPMorgan conference being held in Miami.

JPMorgan Chase & Co. has requested documents from the Manhattan district attorney's office about a complaint made against executive Jes Staley, who is accused of protecting deceased financier Jeffrey Epstein.

An order from a federal judge requires Manhattan District Attorney Alvin Bragg to turn over statements, records of statements from a victim identified only as Jane Doe.

The DA's office declined to comment on the matter to Fox Business.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.10 | -0.30 | -0.09% |

JP MORGAN SUES FORMER EXECUTIVE OVER JEFFREY EPSTEIN TIES, POTENTIAL DAMAGES

A split of Jeffrey Epstein and Jes Staley, who was forced to step down from JPMorgan Chase over ties to Epstein. (/Evan Agostini/Invision/AP, File)

The bank is suing Staley, alleging that during his employment at the bank, he protected Epstein. Staley, who worked at JPMorgan from 1979 to 2013, submitted his motion to dismiss the lawsuit in April.

On Wednesday, a judge ruled it could proceed. Staley has denied the allegations against him.

The bank is seeking for Staley to cover losses that it could potentially wrack up in two other lawsuits and to get back the compensation it paid him from 2006 to 2013.

JPMorgan Chase is facing lawsuits alleging it facilitated and profited from sex trafficking by Epstein. Epstein’s 15 years as a JPMorgan client ran from 1998 to 2013.

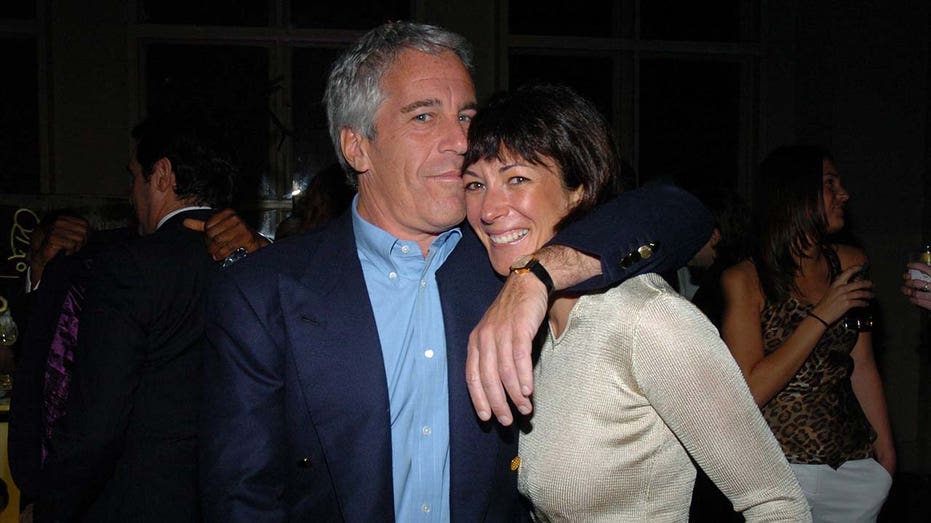

Jeffrey Epstein and Ghislaine Maxwell (Photo by Joe Schildhorn/Patrick McMullan via Getty Images, File / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Late last year, the U.S. Virgin Islands sued the bank on claims the bank "knowingly facilitated, sustained, and concealed the human trafficking network operated by Jeffrey Epstein from his home and base in the Virgin Islands, and financially benefitted from this participation, directly or indirectly, by failing to comply with federal banking regulations," as previously reported by FOX Business.