Tech CEO ditching Silicon Valley Bank after ‘mad scramble’ to acquire payroll funds

Childcare company Winnie had its accounts frozen when SVB collapsed Friday, threatening payroll fulfillment

SVB depositor Sara Mauskopf tells story of having funds frozen by failed bank

Winnie CEO and co-founder Sara Mauskopf discusses her scramble to meet payroll after having all of her business's money frozen during the Silicon Valley Bank collapse.

Silicon Valley Bank's (SVB) collapse Friday sparked fears for investors, account holders and the banking industry at large. After accounts were frozen and millions were lost, one tech company is "absolutely" ditching the bank.

"I think the plan of just having one bank was not a very safe plan," Winnie CEO and co-founder Sara Mauskopf said on "Varney & Co" Tuesday. "We're going to have money in multiple places. Part of that was we had to do that based on our agreement with SVB, and those terms, now, I can see were not very favorable to companies."

Winnie had been with SVB for around seven years before its accounts were frozen in the failure. The collapse created a "mad scramble" where Mauskopf had to scour options for cash to fulfill payroll Monday.

"It was very, very scary," Mauskopf told host Stuart Varney. "I was calling everyone I knew to see who had cash they could wire to me on Monday so that I could make payroll. I mean, people don't just have cash sitting around trying to give you, especially over a weekend. So that was a mad scramble."

TECH CEO WITH MILLIONS IN SILICON VALLEY BANK: ‘INNOVATION IN THE STARTUP WORLD IS BLEEDING TODAY’

After finally getting access to accounts on Monday, Mauskopf was able to wire funds to new accounts.

A customer stands outside of a shuttered Silicon Valley Bank (SVB) headquarters on March 10, 2023 in Santa Clara, California. Silicon Valley Bank was shut down on Friday morning by California regulators and was put in control of the U.S. Federal Depo (Justin Sullivan/Getty Images / Getty Images)

Mauskopf co-founded Winnie, "a marketplace for child care built on powerful data systems and backed by a trusted community of parents and providers," back in 2016. The platform helps connect parents with "high-quality child care."

The company is just one of the numerous tech startups connected to SVB that is now facing a wave of financial problems.

SVB suffered $1.8 billion in losses last week as it faced a liquidity crisis caused by bad investments in bonds. The bank's share price fell 60% last week and the FDIC stepped in Friday to take over the bank's operations as depositors panicked and rushed to withdraw their money.

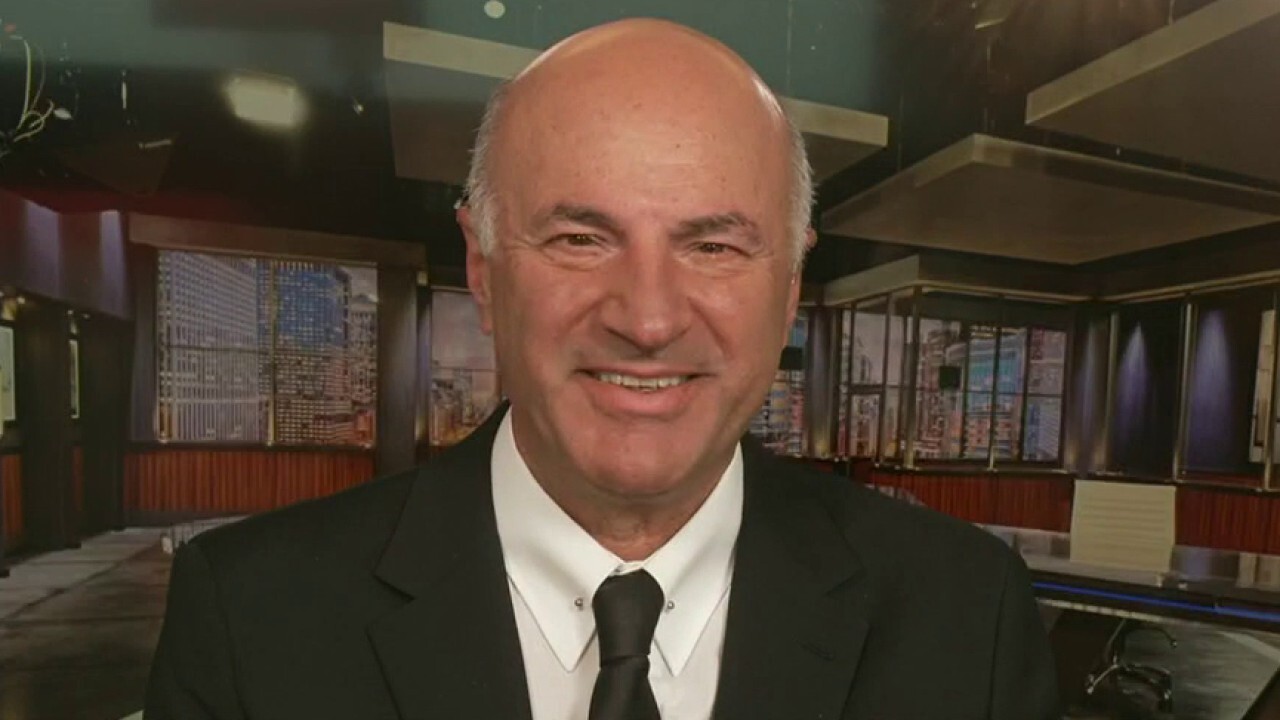

Silicon Valley Bank has become the 'poster boy for idiot management': Kevin O'Leary

O'Leary Ventures Chairman Kevin O'Leary raises moral hazards and 'unintended consequences' from regulators' bailout of Silicon Valley Bank.

In the Tuesday segment, Mauskopf recalled how she "drove to the bank" Friday morning and saw the FDIC notice on the door.

"All of our money was completely frozen. We didn't have a dollar anywhere else," Mauskopf told Varney.

SILICON VALLEY BANK COLLAPSE: HERE'S WHO BENEFITED FROM THEIR EXECUTIVE, PAC DONATIONS

While companies like Winnie are trying to get back to operating their businesses as usual, lawmakers and experts are busy trying to uncover the cause of the collapse.

Larry Summers, a Harvard University professor who served in both the Clinton and Obama administrations, shared his opinion on what caused the collapse in a Tweet on Monday.

He argued that the collapse came because SVB's managers "committed one of the most elementary errors in banking: borrowing money in the short term and investing in the long term."

The Treasury Department, Federal Reserve, and the Federal Deposit Insurance Corporation (FDIC) said in a joint statement Sunday that depositors of the Silicon Valley Bank will have access to all of their money – following the bank’s failure on Friday – at no loss to American taxpayers.

"Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system," the joint statement read. "This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth."

CLICK HERE TO READ MORE ON FOX BUSINESS

Since then, the Biden administration expressed it's gearing up to investigate the collapse of Silicon Valley Bank, which had been the 16th-largest bank in the United States before it went under after a run on the bank last week.

The Justice Department is also in the early stages of investigating SVB's failure, Fox News has confirmed. The news was first reported by the Wall Street Journal, which said the Securities and Exchange Commission is also investigating.

FOX Business' Chris Pandolfo and Bradford Betz contributed to this report.