Boeing seeing more airplane buyers paying cash, financing than ever before

Growing global demand and the profitability of airlines in North America have pushed Boeing, the world's largest airplane maker, to increase production rates on two of its most successful aircraft models.

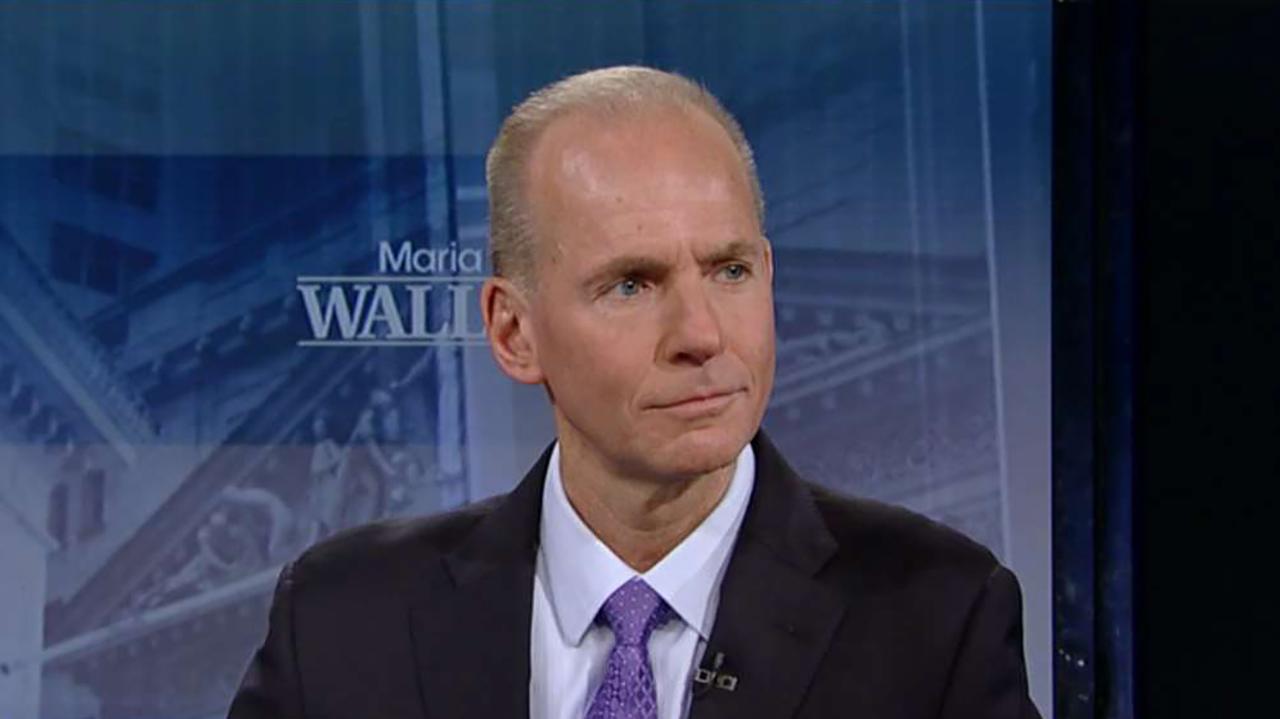

“We're seeing more customers with near-term demand and in the ability to either finance or pay cash than we've ever seen,” Boeing Chief Financial Officer Greg Smith told FOX Business.

The company will now produce 57 737s a month (up from 52) and will increase production of its 787 Dreamliner to 14 per month (from 12). The U.S. airplane maker has nearly 5,900 aircraft currently on backlog, valued at $490 billion. Over the course of the next 20 years, Boeing forecasts 8,800 airplanes will need to be delivered to airlines.

787-9 Paint Hangar Roll Out (Boeing)

“When you look at the assets that are in North America today … almost half of that is being replaced with much more efficient … [aircraft] than what they're operating today,” Smith said, regarding operating costs. “So that's creating a lot of demand.”

Boeing shares have gained 20 percent year-to-date and are approaching their all-time closing high ($392.30), which was set on Oct. 3, 2018. The stock finished the week at $387.43.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BA | THE BOEING CO. | 242.97 | +6.05 | +2.55% |

The ramp-up in production also carries a risk that Boeing has experienced before, according to analysts.

That includes pileups of unfinished aircraft at its Renton, Washington assembly plant due to late arrivals of CFM’s LEAP-1B engines for the 737 MAX model and delayed deliveries of 737 fuselages made by Spirit AeroSystems.

Boeing CEO Dennis Muilenburg previously said the company is getting in front of those challenges by sending Boeing personnel to CFM – a joint venture between General Electric and French company Safran Aircraft Engines – and their sub-tier suppliers to address concerns and help make sure the engine maker can meet the increased demand.

“The suppliers are now in much better position to have experienced those … teething issues,” Josh Sullivan of Seaport Global Securities told FOX Business. “So, the supply chain is much healthier this year.”

Boeing 737 MAX; Renton Factory; 1st 737 Max on line. (Boeing)

While global traffic grew 6.6 percent through November last year, which is faster than the world’s GDP, according to Muilenburg, the U.S. still ranks lower when compared to other markets, particularly Asia. Because of this, Boeing forecasts 16,000 aircraft will need to be delivered to airlines in the region over the next two decades.

“There’s a lot of replacement opportunity there near term and long term,” Smith said. “There's also more growth there, and that just goes to the fundamentals of what's happening within their society and their economy, with the growth in middle class and in the real desire to travel … within the region but also outside of the region.”

CLICK HERE TO GET THE FOX BUSINESS APP

And while Boeing hasn’t released an outlook for employment in 2019, the company still sees a demand for jobs as the rate of production and other programs increase or moderate. The aerospace giant brought in more than 30,000 workers last year (not all net hires – some due to the rate of attrition and retirement), and focuses on hiring the right talent.

“There's always going to be strong demand for high-tech jobs in our industry, and we want to make sure we're well positioned to be the employer of choice,” Smith said. “We spend a lot of time on where we're attracting talent, how we're attracting talent. Our own even personal engagement, whether it's in schools or in the trade organizations, really trying to recruit and making sure that we've got a good pipeline going forward to … even replace the folks that will even just be going through natural attrition.”