Russia’s Rusal makes $200 million Kentucky aluminum investment

Rusal is seeking to pour $200 million in Kentucky-based Braidy Industries, the Russian aluminum giant’s first investment in the country since resolving a sanctions dispute with the Trump administration.

Under the terms of the 10-year agreement with controlling company En+ Group, Rusal will be Braidy’s sole-source provider of low-carbon aluminum for its new $1.6 billion rolling mill slated to open in 2020 in northeast Kentucky, the firms said on Sunday. The investment will give Rusal a 40 percent share in the facility and En+ Group Executive Chairman Lord Gregory Barker will serve as co-chairman of the new mill alongside Braidy CEO Craig Bouchard.

The aluminum industry is racing to lower the amount of carbon emitted in the production process. Alongside Rusal’s efforts, Pittsburgh-based Alcoa Corp., Apple Inc. and Rio Tinto Group are developing a process that would rid carbon from the smelting process, replacing it with oxygen emissions. For Braidy, Rusal was the only supplier that could provide the necessary 200,000 tons of low-carbon slab a year, according to Bouchard.

“When you combine low-cost, highest-quality [and] lowest carbon imprint, that turns into a competitive advantage. There is no other company that will be able to do what we are doing,” he told FOX Business.

It’s also a coup for the firm that is in the midst of trying to raise the $1.7 billion needed for construction of the facility. Last month, Braidy again extended the deadline for a sale of its stock to June 15 due to the pending Rusal investment, which was not disclosed at the time of the announcement. The company has also received a direct $15 million investment from Kentucky.

And for Rusal, the world’s second-largest aluminum producer, the deal is the first of what the firm hopes is a long list of other partnerships with American companies.

“The U.S. is where the growth is going to be in the future,” said Barker. “We see a renaissance in U.S. added-value manufacturing, advanced manufacturing.”

The deal requires board approval from both companies, expected by early summer.

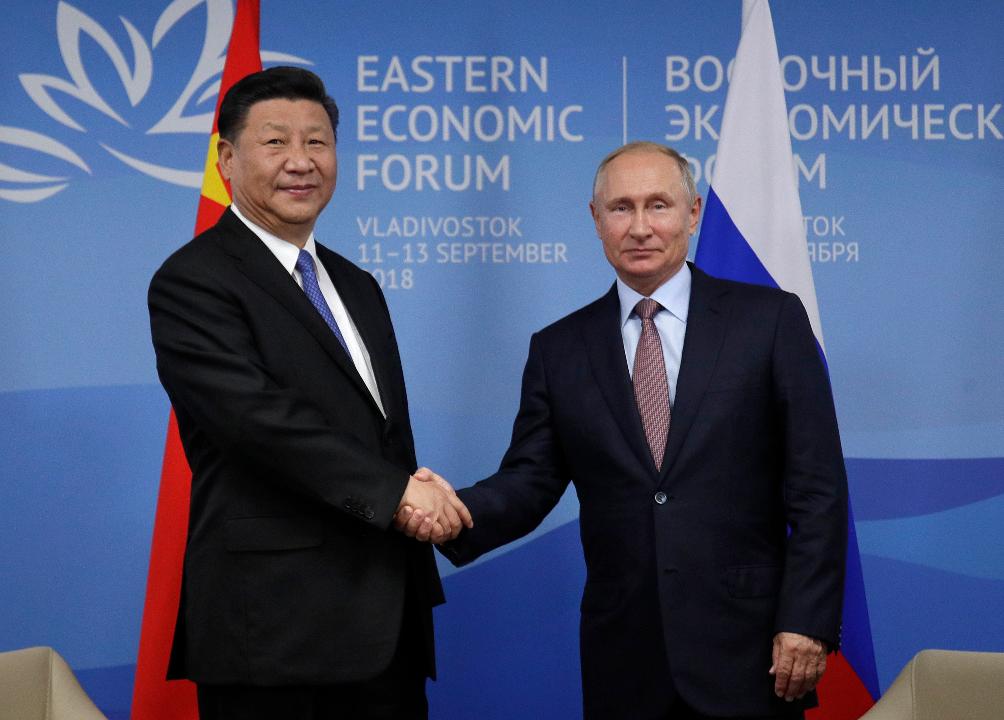

The announcement comes months after En+ Group and Rusal reached an agreement with the Treasury Department to lift sanctions on the Russian company after it removed founder Oleg Deripaska – a close ally of President Vladimir Putin -- and reduced his stake in the firms.

The two companies also agreed to “unprecedented transparency,” including ongoing auditing and new reporting requirements, the agency said in a January statement. After the announcement, En+ Group also overhauled its leadership to include more independent directors on its board.

“We are treading cautiously,” Barker said. “We’re acting responsible and we are reaping the commercial benefit of the sweeping changes to corporate governance that were put in place.”

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50135.87 | +20.20 | +0.04% |

| SP500 | S&P 500 | 6964.82 | +32.52 | +0.47% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23238.66991 | +207.46 | +0.90% |

One major allure of the deal for Rusal is the proximity of Braidy’s new firm to the domestic automotive industry. Ford Motor Co., General Motors and Toyota all have plants in Kentucky.

“Within a 250-mile radius sits 50 percent of the U.S. automotive manufacturing facilities. It is ideally located to serve the end users of this product that we wish to align ourselves with,” Barker said.

Bouchard said the sanctions dispute and potentially negative perception of a U.S. company partnering with a Russian firm given the ongoing dispute between the two nations -- driven by what federal officials have called an attempt by the Kremlin to influence the 2016 presidential election -- were overshadowed by the Rusal’s ability to provide the materials Braidy needed.

“Am I aware of it? Of course,” he said. “It’s come up very little in my thinking.”

Bouchard has not discussed the deal with the Trump administration.

Monday's announcement marks the latest in a slew of other deals that bolster Kentucky’s status as a burgeoning headquarters for manufacturing in the U.S. Nucor Corp. is investing $1.3 billion in a new plant in Brandenburg, Ky., while Aleris Corp. in 2017 opened a new $400 million facility in the state. Century Aluminum is also expanding its operations in Kentucky.

Combined, they are poised to create thousands of new jobs in the state and could spur renewed interest in Kentucky from companies seeking to capitalize on low-carbon materials.

“This has caused a resurgence in optimism, in hope and in actual physical, tangible investment,” Republican Gov. Matt Bevin said in an interview.

CLICK HERE TO GET THE FOX BUSINESS APP

For Bevin, last year’s sanctions dispute also does not taint the deal with Braidy, telling FOX Business that "capital is capital and you need it in order to get deals moving."