Bernie Madoff shared traits with serial killer Ted Bundy, filmmaker says: ‘A heavy toll of destruction’

The late financier who led the biggest Ponzi scheme in U.S. history is the subject of a Netflix docuseries, 'Madoff: The Monster of Wall Street'

Bernie Madoff died in a federal prison

Bernie Madoff, who orchestrated the largest ponzi scheme in history, died in federal prison at the age of 82.

Bernie Madoff, the disgraced financier who led the biggest Ponzi scheme in U.S. history, has been compared to one of the nation’s most prolific serial killers.

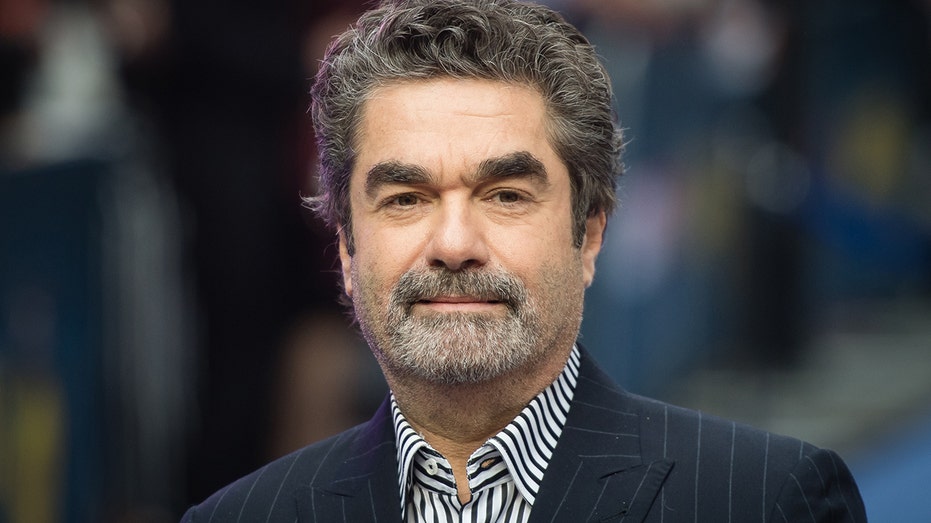

The notorious con artist is the subject of a new Netflix special premiering Wednesday, "Madoff: The Monster of Wall Street." The docuseries, directed by Oscar-nominated filmmaker Joe Berlinger, features new interviews with victims, whistleblowers and investigators as they tell a financial cautionary tale.

Madoff died in 2021 at age 82 while serving a 150-year prison term.

The notorious Ponzi schemer, who died in 2021, is the subject of a new Netflix docuseries, "Bernie Madoff: The Monster of Wall Street." (Netflix / Fox News)

"I wanted to widen the lens on white-collar crimes and how incredibly destructive they can be," Berlinger told FOX Business. "I felt like there is a chance that we’re going to have another financial crisis because things are just overheated. And I thought it might be timely. … This case has been covered a lot, but not in the way that I feel I have covered it. Not with the clarity of explanation of just how obvious the fraud was and just how many co-conspirators there were."

BERNIE MADOFF, MASTERMIND OF VAST PONZI SCHEME, DIES IN FEDERAL PRISON AT AGE 82

Bernie Madoff was born in 1938 in a lower middle-class Jewish neighborhood in Queens, N.Y. (Netflix / Fox News)

"Normally, the way the story is told is that there’s one financial evil genius who did all of these terrible things," he shared. "But he was enabled by a lot of co-conspirators and a lot of institutions that should have known better. There was zero oversight by the hedge funds who were investing in him. The amount of times he could have been stopped is astonishing. That has been talked about but not fully dissected. The simplicity of the fraud and how easily it should have been found out hasn’t been, in my opinion, covered like this before."

In 2008, Madoff was arrested amid allegations that his company, Bernard L. Madoff Investment Securities, had swindled billions of dollars from his clients. Some of his high-profile victims included Steven Spielberg, former New York Mets owner Fred Wilpon, actor Kevin Bacon and Nobel Peace Prize winner Elie Weisel, a Holocaust survivor. Many others were elderly retirees who lost their entire life savings.

Filmmaker Joe Berlinger said he saw similarities between Bernie Madoff, left, and serial killer Ted Bundy. (Getty Images / Getty Images)

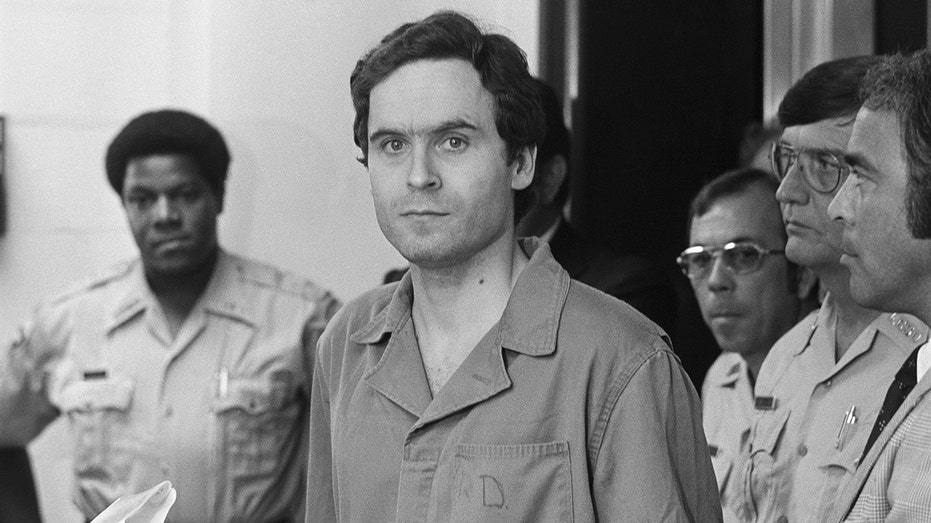

In 2009, The New York Times reported that some forensic psychologists saw similarities between Madoff and serial killers, particularly Ted Bundy. They explained that "whereas Mr. Bundy murdered people, Mr. Madoff murdered wallets, bank accounts and people’s sense of financial trust and security.

"Like Mr. Bundy, Mr. Madoff used a sharp mind and an affable demeanor to create a persona that didn’t exist, according to this view, and lulled his victims into a false sense of security," they noted. "And when publicly accused, he seemed to show no remorse."

CLICK HERE TO READ MORE ON FOX BUSINESS

Berlinger agreed with the findings. And he would know. He previously directed two projects focusing on Bundy’s crimes.

Filmmaker Joe Berlinger has previously done projects focusing on serial killers, such as Ted Bundy, John Wayne Gacy and Jeffrey Dahmer. (Samir Hussein/WireImage / Getty Images)

"Absolutely," said Berlinger. "One of our interview subjects actually called him a financial serial killer. The thing that defines a serial killer the most is extreme narcissism. You can’t do these things to people if you have any kind of empathy for another human being. That can be applied to Bernie. He was a narcissist who lacked any kind of empathy. He could look a widow in the eye and tell her, ‘Please give me all your money. I will take good care of you,’ and put that into his Ponzi scheme. And the position he put his children in — complete lack of empathy."

Ted Bundy was executed in 1989. (Getty Images / Getty Images)

"Obviously, the murder of somebody is the worst thing that could happen," Berlinger stressed. "I’m not drawing that equivalency. But the act of the serial killer has a tremendous ripple effect, as do the acts of Bernie Madoff. He destroyed lives, destroyed families. He even destroyed his own family. There’s a heavy toll of destruction."

For decades, Madoff enjoyed an image as a self-made financial guru whose Midas touch somehow defied market fluctuations. A former chairman of the NASDAQ stock market, he attracted a devoted legion of investment clients. He enjoyed a lavish lifestyle that included a $7 million Manhattan penthouse apartment; an $11 million estate in Palm Beach, Florida; a $4 million Long Island, New York home; and property in the south of France, along with private jets and a yacht.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

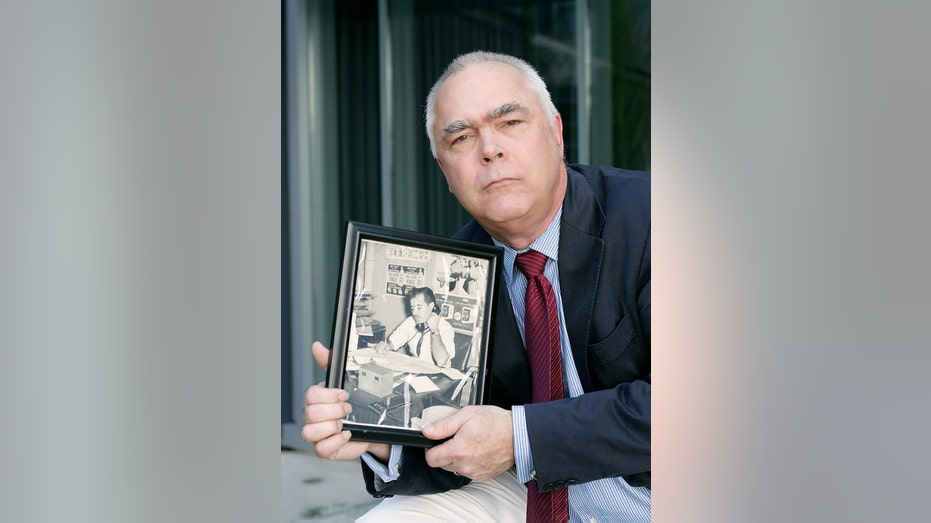

George Christin holds a photo of his father-in-law Arthur Schwartz, a deceased Russian immigrant whose fortune was stolen in Bernie Madoff's Ponzi scheme. It robbed his mother-in law of her retirement savings. (Matthew West/MediaNews Group/Boston Herald via Getty Images / Getty Images)

Behind closed doors, Madoff wiped out people’s fortunes and ruined charities. Some victims, even in their 80s and 90s, later described how they had to go back to work just to make ends meet. Those who dreamed of a peaceful retirement were left with nothing. The New York Times reported that at least two victims took their lives while others lost their homes.

In 2008, Madoff confessed to his sons that his business was "all just one big lie." After the meeting, a lawyer for the family contacted regulators, who alerted federal prosecutors and the FBI.

A judge issued a forfeiture order stripping Madoff of all his personal property, including real estate, investments and $80 million in assets. One of his sons, Mark, killed himself on the second anniversary of his father’s arrest in 2010. Madoff’s brother, Peter, who helped run the business, was sentenced to 10 years in prison in 2012 despite claims he was in the dark about his brother's misdeeds. Madoff’s other son, Andrew, died from cancer in 2014 at age 48.

Bernie Madoff's crimes hurt thousands of families, including his own. (Netflix / Fox News)

In 2022, Madoff’s sister, Sondra Wiener, and her husband Marvin Wiener were both found dead in what investigators said was an apparent murder-suicide in Florida, according to news reports.

LOOK BACK AT BERNIE MADOFF'S MOST HIGH-PROFILE VICTIMS

That same year, the Department of Justice announced that the Madoff Victim Fund (MVF) began its eighth distribution of approximately $372 million in funds forfeited to the U.S. government. In this distribution, payments were sent to 27,219 victims across the globe. At the time, it was revealed that the total amount distributed exceeded $4 billion to more than 40,000 victims as compensation for losses they suffered.

"I think Bernie would’ve gone on for another 10 to 20 years," said Berlinger. "It all comes down to poor regulation and oversight by people who should have been regulating. There’s also greed, which makes people look the other way."

Numerous victims have come forward over the years to describe how they lost their entire life savings at the hands of Bernie Madoff. (New York Daily News Archive via Getty Images / Getty Images)

In 2019, while discussing his projects on Bundy, Berlinger told Fox News Digital, "The people who do the most evil are often the people you least expect. … I think that’s sadly an important lesson. People need to earn your trust. And even when they earn your trust they can sometimes betray it."

The same lesson can be applied here, he said.

"Bernie said it himself, ‘Wall Street is a for-profit business,’" said Berlinger. "There are two people on each side of the trade. For every winner, there’s a loser. The whole nature of the business is to make money. No one on Wall Street is there to be your friend or to protect you. It’s a for-profit business that is sometimes rife with fraud, oversight and poor regulation."

KEVIN BACON SAYS HE'S RECOVERED 'A PORTION' OF MONEY FROM BERNIE MADOFF’S INFAMOUS PONZI SCHEME

Bernie Madoff pleaded guilty in March 2009 to securities fraud and other charges. (Getty Images / Getty Images)

"My advice is to diversify," Berlinger warned. "And if you’re making alternative investments, you need to make sure that thorough due diligence is done. Who’s holding the securities? Is there proof of those securities? Who is your auditor? The lesson remains the same. If something is too good to be true, it probably is."

If you or someone you know is having thoughts of suicide, please contact the National Suicide Prevention Lifeline at 1-800-273-TALK (8255).

The Associated Press contributed to this report.