Coronavirus relief often pays workers more than work

When combined with state benefits, weekly government payouts create incentives that employers say complicate efforts to reopen businesses

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

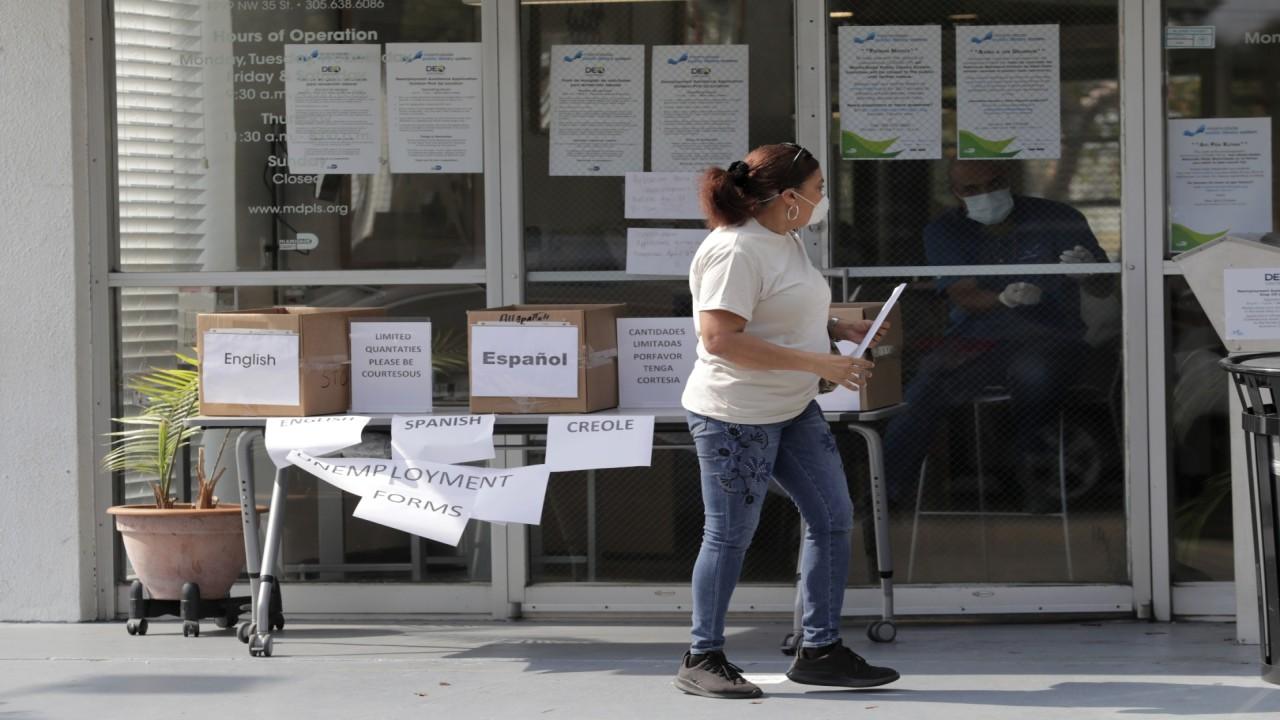

Roughly half of all U.S. workers stand to earn more in unemployment benefits than they did at their jobs before the coronavirus pandemic shut down wide swaths of the U.S. economy, and employers say the government relief is complicating plans to reopen businesses.

The package of coronavirus stimulus laws Congress passed and President Trump signed in March included a $600 boost to weekly unemployment benefits through July 31. As that support is added to state benefits over the coming weeks, the average weekly payment to a laid-off worker should rise to about $978 from the $377.97 the Labor Department said was paid on average late last year.

Qualified workers will receive the government payout every week through July, and in most cases, the combined $978 weekly payout amounts to better pay than what many workers received before the crisis hit. Labor Department statistics show half of full-time workers earned $957 or less a week in the first quarter of 2020.

The stimulus measure means many low-wage workers will avoid significant harm to their finances in the coming months. It puts money in consumers' pockets and the U.S. economy on firmer footing to rebound once authorities allow businesses to reopen. But enhanced benefits also create disincentives that might hamper efforts by employers to recall workers when some states are trying to reopen their economies.

It is possible that workers could ask their bosses to leave them on furlough so they can collect the larger payments while avoiding potential health risks of returning to crowded workplaces. Employers, meanwhile, are in the position of asking workers to get back on the payroll, either so companies can reopen, or the business can qualify for forgiveness of government loans.

Tom Hoffman Jr. found out last week that his Hoffman Car Wash locations in Albany, N.Y., qualified for a government small business loan. To get that loan forgiven, he is recalling the more than 500 employees -- many who work part-time -- he furloughed when state officials ordered car washes to close and sales fell sharply at his nine oil change shops.

While he is happy to have the loan, Mr. Hoffman knows some of his workers will be worse off financially.

(iStock)

"Our interior-cleaning staff are going to have to come back on the payroll rather than making the equivalent of $23 an hour to stay home," Mr. Hoffman said. Those workers earn about $13 an hour, which is above the state's minimum wage. He will use the loan to pay them their regular wages, but will still ask them to not report to work.

State regulators recently allowed exterior car washes to reopen but still prohibit interior cleaning, limiting on-site staff to two, Mr. Hoffman said: "The problem is there's nothing for them to do."

Figures on prior earnings of the more than 26 million Americans who sought unemployment benefits from March 15 through April 18 aren't yet available, but the initial wave of job losses were concentrated among restaurant, hospitality and retail workers, whose median hourly pay is less than the minimum now paid under enhanced unemployment benefits.

The $600 bonus payment was intended to make sure the average U.S. worker had full wage replacement in the months following mass layoffs caused by the pandemic. Last year, state unemployment benefits replaced about 45% of laid-off workers' wages, according to the National Employment Law Project, which advocates for low-wage workers.

STATES DEPLETING UNEMPLOYMENT FUNDS AS CORONAVIRUS CAUSES MASSIVE SURGE IN JOBLESS CLAIMS

Congress opted for a flat amount because decades-old technology underpinning state unemployment systems didn't allow for payments to be calibrated to each worker's lost wages.

"If we waited for the systems to be set for 100% wage replacement, the payments wouldn't go out until June," said Michele Evermore, a NELP senior policy analyst. She added that under the existing system, many laid-off workers waited weeks to have their unemployment claims processed and some still are waiting for the enhanced payments.

The $600 payment aligns with working full time at $15 an hour -- the minimum-wage level many Democrats in Congress support. The federal minimum wage -- followed by 21 states -- is $7.25 an hour and has been unchanged for a decade. Restaurant and front-end retail workers in those states, including Texas and Georgia, are likely to receive more in benefits than from their jobs.

SMALL BUSINESS LOAN PROGRAM STILL HINDERED BY GLITCHES IN SECOND DAY OF RELAUNCH

Tracy Jackson, 50, of Nacogdoches, Texas, started receiving unemployment benefits after losing her job as a cook at a college. Her benefits total $1,200 every two weeks, almost twice what she would earn on the job.

She wants to return to work, but being stuck at home has given her time to reflect. The extra money she receives in unemployment benefits has made her conclude she had been underpaid at her previous job, earning $10.30 an hour after five years.

"I like the college, I really do," she said. "But they're going to have to come with more money. If they don't, I'm not going to be there."

Still, Ms. Jackson is itching to go back to work. She inquired about a night-shift position at a factory making plastic containers, but there were no openings. "I just can't sit here," she said. "I ain't never in my life been out of work."

Maria Lourdes Leon, a 44-year-old Chicago waitress, lost jobs at a diner and a Mexican restaurant after state authorities closed restaurants and bars last month. She is qualified for jobless benefits but has yet to receive the additional $600.

When she does, it would still be less than the $1,400 she would earn during her busiest weeks, but the payment may be more than she will earn once restaurants are allowed to reopen.

"Nothing is going to be the same," she said, adding she nonetheless wants to return to work. "There's only going to be a few tables and too many servers. We make money because we have a lot of tables but social distancing is going to change that. People aren't going to come out."

The enhanced payments create a tricky situation for restaurant owners, especially in states such as Georgia and Alaska that are looking to restart businesses in the coming weeks. Nationally, median hourly pay in food-service occupations was $11.65 an hour in 2019, or $466 for a 40-hour a week. In some states, restaurant workers could be receiving double their usual pay on unemployment benefits.

"The unemployment benefits are so generous that in many places workers are telling their bosses they'd rather be unemployed than return to their jobs," said Sean Kennedy, executive vice president of public affairs at the National Restaurant Association. "It's not that these workers are lazy, they're just making the best economic decision for their families."

Workers should be ineligible for unemployment benefits if a job is made available to them. But Mr. Kennedy said restaurant owners are reluctant to report workers to authorities and sever relationships with employees they may need more later in the year, when dining demand is expected to pick up.

The issue is an unintended consequence of an understandably rushed relief bill, he said. Democrats wanted "unemployment benefits on steroids" and Republicans wanted loans tied to workers staying on payrolls.

CORONAVIRUS SMALL BUSINESS BILL STILL INCLUDES LOOPHOLE FOR BIG COMPANIES

"The programs collided and it creates a real headache for small businesses trying to reopen," Mr. Kennedy said.

Ms. Evermore, of NELP, however, said extra payments to low-wage workers -- who will have a high propensity to spend -- is a minimal concern in the context of a $2 trillion relief bill. She added that without income support, low-wage workers would likely seek out other jobs, including side hustles and gig work, which could expose them and their households to the virus.

"The point is you want people not to work so we can stop this virus and, as quickly as possible, get the economy back on track," she said.

Gas-station and convenience-store operator Sheetz Inc. allowed employees over 65 and those with underlying health conditions to take paid leave and allowed any other employees to take unpaid leave.

If those workers can qualify for unemployment benefits, which varies by state, they would be receiving more in benefits than on their jobs. The top end of the nonmanagement payscale is about $15 an hour, said Joe Sheetz, chief executive of the Altoona, Pa., company. But he said he is doubtful many of his employees are staying home to collect benefits. Some workers who could be on paid leave continue to report to work, he said, in part because in many rural communities the Sheetz store is one of few still open.

"The bigger issue will be trying to hire outsiders who are on unemployment," as the company needs to staff back up, Mr. Sheetz said. Typically Sheetz hires in the spring ahead of the summer travel season. "Hard to compete with an extra $600 per week for hourly jobs," he said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE