Dollar General invests $100M in staffing, store enhancement

The discount retailer added 10K new jobs in 2022

Discount retailer Dollar General is planning to invest $100 million in its stores this year, with a primary focus on staffing.

"Looking ahead, we are excited about our plans for fiscal 2023, which include continued investment in our strategic initiatives and an incremental investment of approximately $100 million in our stores, primarily in incremental labor hours," Dollar General CEO Jeff Owen told analysts Thursday in its latest earnings report.

The hefty investment will further enhance "store standards and the in-store experience" and is projected to help Dollar General garner more sales and capture additional market share, Owen continued.

DOLLAR GENERAL PRICE AUDIT FINDS DOUBLE FIGURE ERROR RATES UP TO 88%

The company created more than 10,000 new jobs last year. It's total store count sits at just over 19,000 as of February.

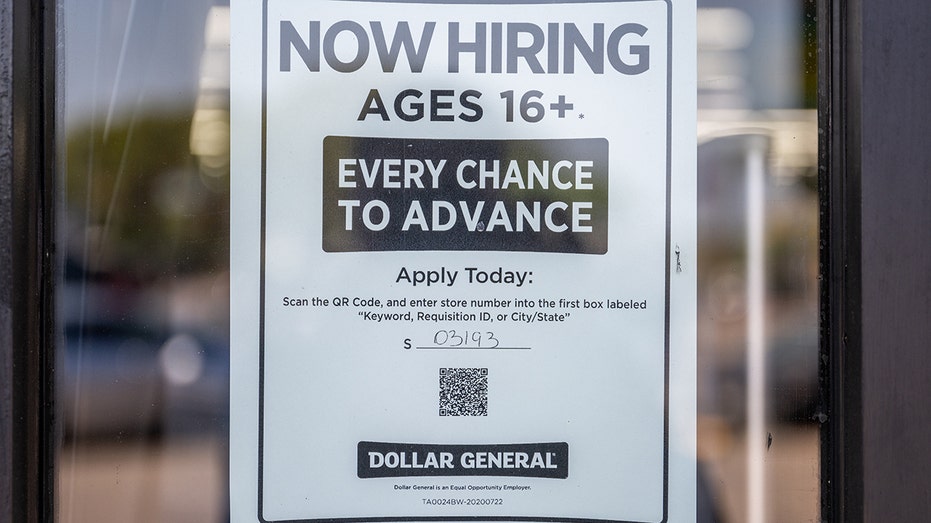

A call for employment sign is displayed on a Dollar General convenience store on Mar. 10, 2023 in Austin, Tex. (Brandon Bell/Getty Images / Getty Images)

"We feel great about our staffing levels, our ability to attract and our ability to retain our talent. And so that's why we're investing in hours," Owen told analysts on a call Thursday.

The comments come just days after the company got hit with another $1 million fine from the Labor Department over workplace safety violations. Since 2017, the company has been handed more than $15 million in fines from the federal government.

Dollar General Corp

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DG | DOLLAR GENERAL CORP. | 146.65 | +1.75 | +1.21% |

For its fiscal fourth-quarter, the company reported net income of $659.1 million, up 10.3% over the last year. On a per-share basis, the company earned $2.96, topping the average estimate of $2.94 by Zacks Investment Research.

The Tennessee-based retailer also posted revenue of $10.2 billion in three months ended Feb 3. Sales increased 17.9% but still missed Wall Street forecasts. Twenty-one analysts surveyed by Zacks expected $10.24 billion.

Sales at stores open for at least a year increased 5.7% compared to the same period in 2021. Growth was "driven by an increase in average transaction amount" while also being "partially offset by a modest decrease in customer traffic," according to the company.

Signage at a Dollar General store in Simpsonville, Ky., Aug. 12, 2021. (Luke Sharrett/Bloomberg via Getty Images / Getty Images)

CFO John Garratt told analysts on a call Thursday that the company "anticipates the challenging economic and operating environment to continue into 2023." Still, he believes the company is well position to drive strong growth through the year.

Owen believes this latest $100 million investment will yield strong returns and create long-term sustainable growth and value for shareholders.

It also comes at a time when inflation — though easing — continues to squeeze household budgets.

"We believe we will be increasingly important to them [customers] in the year ahead," Owen told analysts.

The Associated Press contributed to this report.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Lydia Hu: Egg prices have increased 70% over the last year

FOX Business’ Lydia Hu joined ‘Varney & Co.’ to report on how farmers are combating the rising prices of eggs in America.