New York lawyers offer financial tips to help people recover after a divorce

Reinvent your budget, check your credit report and more tips for financially surviving a divorce

Divorce attorney discusses harm financial ‘secrets’ could have on your marriage

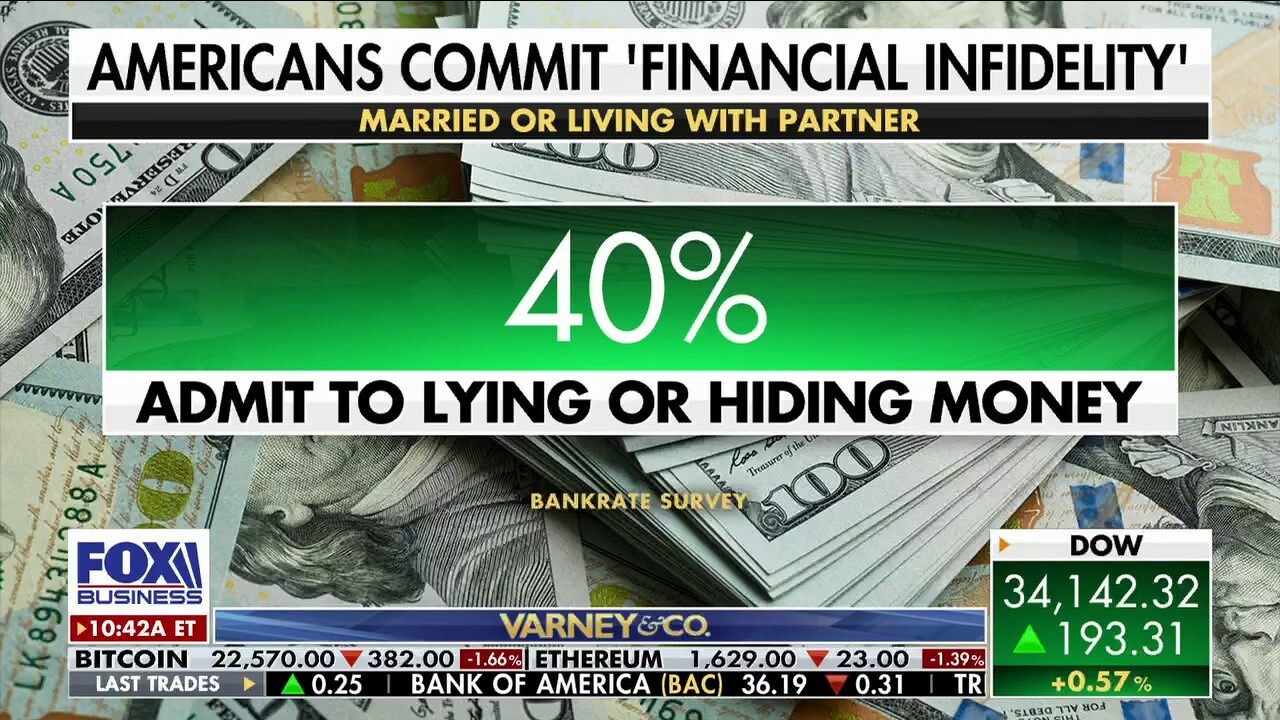

FOX Business’ Lauren Simonetti took to the streets of New York City to get people’s take on the recent Bankrate survey that revealed 40% of Americans who are married or living with a partner commit "financial infidelity."

Divorce can take a huge emotional and financial toll on families. Newly split couples will need to make difficult decisions on how to split major assets, how to adjust lifestyles to fit their new means and how to prepare for retirement.

Though you want to avoid pessimistic thoughts about a potential divorce before you're even married, there are ways to navigate the start of a relationship to keep yourself in a good financial place independently even while you are married.

While you don't want to create a doom-and-gloom situation in your head right off the rip, it is important to be prepared for various situations.

WHO'S RESPONSIBLE FOR STUDENT LOANS IN DIVORCE?

Even when you are married, you can set yourself up to be in a positive financial place independently and in your relationship. (Gary Coronado / Los Angeles Times via Getty Images / Getty Images)

"I've always been a big fan of partnerships as marriages. That does mean a financial partnership as well," Dennis Vetrano, a New York state divorce lawyer, told Fox Business. "So, I think if each person prepares themselves to be able to stand on their own feet independently of their spouse financially, there's not really as much panic or difficulty post-divorce being able to support yourself because you're not really reliant on each other, per se."

Vetrano also says that in a relationship, "you want to be reliant on each other and that you want to be with each other. You want to be a unit together. But by the same token, I think you need to maintain enough, especially financial independence, that if you split, it's not going to be catastrophic."

Prenuptial agreements are often an argument-starter. Though this may be true, the discussion could be beneficial to both parties in case of an unfortunate divorce and is one worth having. Each state in the U.S. varies in terms of guidelines when splitting assets, so beware of this if you've moved across the country for a partner.

"You have to enter into an agreement in advance of the marriage that says, 'We're getting married, we agree, but here's how we want to treat our assets and income that we receive during the marriage. Mine is going to be mine, yours is going to be yours,'" Lara Badain, Esq. of Badain & Crowder, a firm based in Rochester, New York, told Fox Business.

Once a divorce has been finalized, there are ways to financially plan for the future as a single person. Below are some tips to follow in the case of a split with your spouse.

- Construct a detailed net-worth statement

- Reinvent your budget

- Check your credit report

- Make decisions about major assets

- Gather all your financial documents

- Mull over retirement plans

1. Construct a detailed net-worth statement

Some partners in a marriage are completely unaware of the cost of living while married. Often, one partner is more aware of finances than the other, as each person tends to take on certain tasks. Dealing with the finances is often a responsibility that is primarily taken on by one person in the relationship.

6 OF THE MOST EXPENSIVE BILLIONAIRE DIVORCES: FROM JEFF BEZOS TO ELON MUSK

When one spouse handles most of the finances throughout a marriage, it can cause the other to unknowingly be left in the dark. (iStock / iStock)

"Usually, there's one spouse who's managed the household income and paid the bills and the other spouse really doesn't know what's going on," Badain said.

This often leads to one person being surprised by the cost of bills, especially once the sole responsibility falls on them and is realized.

"I think one of the most important things people can do throughout the divorce process is just get a handle on what their finances are," Vetrano said.

Questions like "What do you pay for cable each month?" "What's your water bill?" "Do you know how much your car payment is?" "What is your gross pay?" are all questions Vetrano highlighted as important ones to know the answers to. This can be done by creating a detailed net-worth statement.

Getting a grasp on your finances and figuring out your expenses can be a stressful task but a necessary one to creating a positive trajectory for your financial future. (iStock / iStock)

"You list all of your expenses line by line. All of your income, and that's pre-tax income and post-tax income, all of your assets and all of your liabilities," Vetrano explained. "That'll give you a clearer picture of what your financial health or what your financial life looks like. I think as part of that process, once you have a clearer picture of what the actual reality of your finances are, you can tweak from there."

2. Reinvent your budget

With less income and more bills, a new budget is going to need to be established. This new budget is going to look different for everyone, depending on factors like lifestyle choices and circumstances.

Reinventing your budget may include things like decreasing credit card debt, finding ways to increase income and overall lowering spending habits.

"I think you really need to get a handle on what your finances really are, and if you want to live a certain lifestyle, you need to make more money, and you need to live within your means," said Vetrano.

This can be done with the help of professionals and financial planners, who can provide assistance for those who need to find a healthy place financially post-divorce.

After a divorce, you will likely need to cut expenses and make various lifestyle changes. (iStock / iStock)

7 SECRETS TO CREATING A BUDGET

"There are special financial planners who specifically deal with helping women after divorce manage their money, so that they are able to survive as a single person," Badain explained. "That's if you're lucky enough that there is money. Some people get divorced and there is no money. A lot of people get divorced and all they have is debt."

She added, "I would say, talk to a professional who knows how to help you manage the assets that you're going to get out of the divorce."

3. Check your credit report

Checking your credit report and being aware of your credit score is a good practice throughout your life, regardless of relationship status.

While your credit score won't be directly impacted based on the fact that you got divorced alone, there are indirect ways it could be affected. Factors like joint loans and poor spending choices can impact your credit once you are divorced and cause you to plummet quickly into debt.

It's also good practice to give your credit report a good look and be sure you don't see anything suspicious amid a divorce.

"I often tell people to [check their credit report] because, especially in cases where things are pretty contentious, I've had cases where spouses have gone and run up the other spouse's credit card," Badain explained. "So, you should pull a credit report and make sure everything looks right."

FILING TAXES AFTER DIVORCE: WHO CAN CLAIM DEPENDENTS?

Be sure to check your credit report after a divorce and be on the lookout for any strange charges. (iStock / iStock)

4. Make decisions about major assets

One of the many tough choices that have to be made after divorce is what to do with major assets. Vetrano noted the key to this is to be realistic in your choices.

"The starting point is you have to look at the divorce like it's your opportunity to reevaluate your financial circumstances, 'Where are you at?' ‘Where are you going?’ and it necessarily needs to be coupled with ‘What [do] you want out of life?'" Vetrano said. "So, once you get a better handle on the lifestyle you want to live and finding a way to have your budget fit within your means, then that's part of how you evaluate what you're doing with your major assets post-divorce."

Once you have this nailed down, you can answer questions for yourself, like whether it is worth it for you to keep your large house or downsize into something more affordable.

"I think it involves making some tough choices and being honest with yourself about your finances and knowing what you can really afford and knowing what's a good idea," Vetrano added.

5. Gather all your financial documents

Having all your financial documents in check can make an already difficult process go a bit smoother.

Go over your plans for long-term finances, like retirement, and be sure you are in good shape. (iStock / iStock)

"Nobody likes to think about these things. It's like writing a will. Nobody likes to think about that until you need it," Badain explained. "So, if you end up getting divorced, it's probably a good idea to know where your last year's income tax returns are. It's probably a good idea to know where the statements are for your 4019k or your IRA or your bank accounts."

All of these different financial factors are going to play into how assets are divided during a divorce, which varies on a state-by-state basis. As an overall rule of thumb, keep your financial paperwork updated and accurate throughout your marriage in case of a divorce.

6. Mull over retirement plans

When assessing your retirement plans post-divorce, Vetrano recommends starting with the basics. The basics include questions like if you're putting anything aside into a 401k or whether you have a pension.

"Maybe your rental properties is your pension. Maybe it's your other investments. Maybe it's this business that you've created. But I think you have to have an eye towards what's going to happen in the future," Vetrano said. "Social Security will play into that as well, whether or not you're entitled to any portion of your spouse's pension or 401k."

Vetrano also discussed working with a financial planner to "maximize the amount of return you can get."

Retirement plans will need to be looked over once again after a divorce. (iStock / iStock)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"You want to counterbalance the risk based on what your age is, how many assets you have, those sorts of things. So, I think the best thing you can do in that regard is work with a financial planner, work with an accountant, work with people that you trust to put you on the right path," Vetrano said.

All in all, when developing financial plans for the future and going over the numbers with your ex-spouse, it's important to try to work together to create the best financial situation possible for the family.

"I think the best thing parties can do is try to work together to maximize the financial resources for the family, collectively, post-divorce, and find ways that are creative to keep the brunt of the child support or spousal support payments on the payor as minimal as possible and maximize the amount of benefit that the payee can get, and there are creative ways to do that," said Vetrano.