Holiday shopping: Credit cards with the best rewards

Shoppers with bad credit should use the Discover it Secured Credit Card, according to WalletHub

NerdWallet CEO reveals the best credit cards for ‘trimming costs’ amid record inflation

NerdWallet founder and CEO Tim Chen provides economic analysis of the best credit cards available, breaking down the benefits and drawbacks of each on ‘Mornings with Maria.’

With high inflation, more consumers than ever are relying on credit cards to manage the cost of gifts for this holiday season.

In a recent report, National Retail Federation CEO Matthew Shay said "many households will supplement spending with savings and credit to provide a cushion" for themselves.

Experts have seen increased interest in signing up for store credit cards to offset the financial strain on their wallets, despite the high annual percentage rates (APRs) attached to those cards.

HOLIDAY SHOPPERS SPEND $72B IN OCTOBER AS EARLY DEALS KICK IN

To help shoppers stretch their tighter than normal budgets, WalletHub listed credit cards that offer upfront bonuses for signing up, savings of up to 5% on purchases and 0% introductory interest rates. In some cases, the cards will have a combination of high savings and low rates, at least for the first year.

Here are some of the top credit cards for shopping, according to WalletHub:

1. Blue Cash Preferred from American Express

The card offers new customers $250 for spending $3,000 within six months of opening an account. When making purchases, cardholders can earn anywhere between 1% and 6% cash back.

Customer holds a credit card for payment at the check-out desk of a Caprabo SA supermarket in Barcelona, Spain, Fri., Nov. 4, 2022. (Angel Garcia/Bloomberg via Getty Images / Getty Images)

The card also offers 0% APR for the first year on purchases and balance transfers. Cardholders won't have to pay an intro annual fee for the first year.

ONLINE HOLIDAY SHOPPING SALES TO REACH $209.7B THIS YEAR: ADOBE

Afterward, they'll have to pay $95 per year for the card. The card also has a high APR after the first year, between 17.74% and 28.74%.

2. Chase Freedom Unlimited

The card doesn't offer a sign-up bonus, but it does offer between 1.5% and 5% cash back on purchases. It also gives new cardholders an extra 1.5% cash back on everything for up to $20,000 in the first year.

Users will be able to get 5% cash back on travel when booked through Chase, 3% back when making purchases at restaurants and drugstores, and 1.5% cash back on everything else.

Customer inserts a credit card into Square Inc. device while making a payment in San Francisco, Calif., on Tues., Mar. 27, 2018. (David Paul Morris/Bloomberg via Getty Images / Getty Images)

The card doesn't have an annual fee and is offering an introductory APR of 0% for 15 months. After the first 15 months though, there is a high APR between 17.99% and 26.74%.

3. Wells Fargo Active

Cardholders will get a $200 bonus after spending $1,000 in the first 3 months and can earn 2% in cash rewards on every purchase.

This card has no annual fee and an introductory APR of 0% for 15 months.

HOLIDAY SHOPPING: CONSUMERS LEAN ON STORE CREDIT CARDS TO OFFSET FINANCIAL BURDEN

However, there is a high interest rate after the first 15 months between 18.74% and 28.74%.

4. Instacart Mastercard

WalletHub ranked this card the best for grocery shopping. It has no annual fee and also gives cardholders 5% cash back on Instacart purchases. Approved cardholders will also get a free year of Instacart+ as well as a $100 Instacart credit.

Cardholders can get 5% cash back on travel that's booked through Chase and between 1% and 2% cash back on other purchases.

5. Discover it Secured Credit Card

This card is the best for people who want to earn rewards but have bad or limited credit, according to WalletHub.

Cardholders will be able to get at least 1% cash back on all purchases. For the first $1,000 spent per quarter at gas stations and restaurants, cardholders will get 2% back.

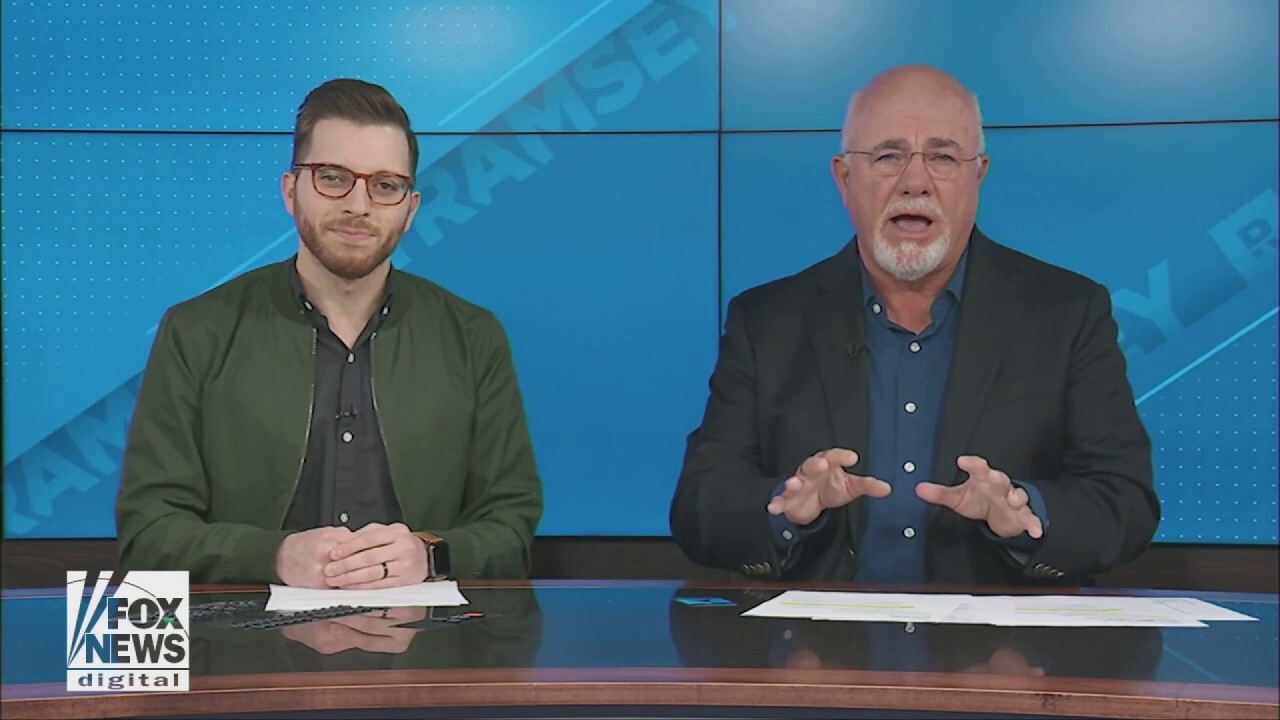

Tips to live without a credit card

Credit cards can be a trap. Money expert Dave Ramsey reveals his best tips on cutting out cards.

After a year of opening the card, cardholders will get a bonus that is equal to their total rewards earnings from the first year, according to WalletHub.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

However, the drawback is that cardholders will have to put down a refundable security deposit of at least $200, which will also be the same amount of the account’s spending limit.