How luxury brands are tapping into consignment -- and winning

Designer labels are teaming up with luxury resale companies to boost revenue streams and sustainability

Luxury designer brands are becoming thriftier.

As consignment shopping thrives during the coronavirus-driven e-commerce boom and consumer demand shifts toward sustainability, high-end labels are tapping into secondhand markets.

RETAILERS LOOK TO SELL PRE-OWNED CLOTHING IN PANDEMIC PERK UP

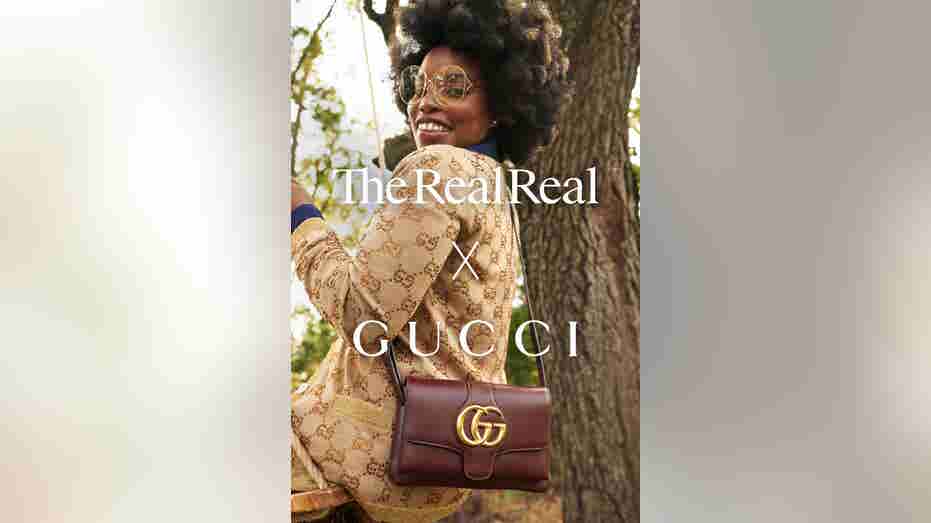

Most recently, Gucci announced a multi-prong partnership with The RealReal, featuring an exclusive Gucci e-shop of consigned products in addition to merchandise fetched directly from the Italian fashion house. Burberry and Stella McCartney have also collaborated with the luxury resale platform.

(Credit: The Real Real)

Gucci’s foray into the secondary market comes on the heels of a drop in the fashion house’s third-quarter sales, down 12% due to tightened travel restrictions and the lack of tourism retail. And with a robust brand performance on The RealReal, generating the highest demand of all men’s brands as well as 19% growth year-over-year, Gucci is positioned to exceed its current favor.

(Credit: The RealReal)

In efforts to not only boost revenue streams but also push for sustainability, brands like Gucci are breaking down the exclusivity barriers.

“By encouraging their community to shop resale, Gucci is helping us bring more people into the circular economy and show that resale is complementary to brands,” Allison Sommer, senior director of Strategic Initiatives for The RealReal, told FOX Business. “Gucci is also able to introduce new buyers to their brand with our 17M+ members around the world. By making luxury more accessible, we’re serving as a gateway and building earlier affinity for luxury brands, like Gucci, that ultimately expands their audience.”

Even though luxury fashion tends to skew to an older demographic of shoppers, the rise of the secondary market is gaining recognition through the consumer habits of a younger demographic. According to thredUp’s 2020 resale report, young shoppers are adopting secondhand fashion faster than any age group.

Not only are consignment designer items picking up traction with younger shoppers, but brands are also focusing on making merchandise with materials that are eco-friendly.

Since the pandemic, sustainable shopping has transitioned from a perk to a priority, with nearly 2.5 times more consumers planning to shift their spending to sustainable brands.

In anticipation for the younger shoppers of today to grow older and increase their earning power, many brands will increasingly feel the need to meet the demands of their future customer base, according to Ben Hemminger, CEO of Fashionphile, a reseller of luxury handbags, accessories and jewelry.

TIFFANY LAWSUIT FOR $16B LVMH DEAL FAST-TRACKED FOR JANUARY TRIAL

“What this means for the luxury tier and how it will evolve is that brands will not try to distance themselves from the secondary market, which was the case in the past,” Hemminger told FOX Business. “Brands will not only start to embrace it and increase their access to it but also have a more sustainable business.”

(Credit: Fashionphile)

It didn’t used to be that individual designer labels did this and instead resisted secondhand markets in fear of weaker full-sale prices. However, Neiman Marcus’s investment in Fashionphile last year became the first major partnership to blur the lines between shoppers who buy in-season, full price and pre-owned, luxury items.

CLICK HERE TO READ MORE ON FOX BUSINESS

According to Hemminger, every brand will eventually participate in the secondary market, whether it’s through incorporating trade-in and trade-up programs or partnering with recommerce to allow their customers a way to partake in the circular economy.

On top of sustainability concerns, there is also economic logic that will evolve with the luxury recommerce market. Just like the auto industry where the pre-owned car market has overtaken the new model market for luxury cars, the secondhand market is expected to overtake the designer market for high fashion.

And the pandemic has created a niche for luxury to enter what could be a more profitable, sustainable and strategic business expansion. Fashionphile is in talks with partnerships to come in the near future.

“The pandemic has been felt in the fact that there’s more discretionary income as people stay at home instead of vacation or other things, and they’re turning to making their lives more interesting at home,” Hemminger said. “And the secondary market is an amazing opportunity to find really interesting and unique stuff from all seasons and items that are not available in stores anymore.”