Federal Reserve hikes rates, Powell’s press conference: LIVE UPDATES

The Federal Reserve on Wednesday raised its benchmark interest rate by an expected 75-basis points for a second straight month, bringing the target range to 2.25% to 2.5%. WATCH Chairman Jerome Powell discuss the decision and the outlook for the U.S. economy.

Coverage for this event has ended.

When pressed further on the possibility of a recession, Powell said:

"I don't I do not think the U.S. is currently in a recession. And the reason is there are just too many areas of the economy that are that are performing, you know too well. And of course, I would point to the labor market in particular as you mentioned, it's true that growth is slowing. And for reasons that we understand really the growth was extraordinarily high last year, five and a half percent. We would have expected growth to slow. There's also more slowing going on now. But if you look at the labor market, you've got growth."

Stocks surged Wednesday afternoon following the Federal Reserve’s 75 basis point rate hike and Chairman Powell’s commitment to fight inflation with future tightening efforts. Additionally, he said he does not think the U.S. is in a recession. In commodities, oil rose over 2% to $97.26 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $32,197.59 | +436.05 | +1.37% |

| I:COMP | $12,032.42 | +469.85 | +4.06% |

Federal Reserve Chair Jerome Powell ended his news conference by acknowledging that inflation is too high. The latest read on consumer prices showed inflation rose 9.1% in June to the highest since November 1981.

“We understand how painful it is,” Powell said. “It is our institutional role of providing price stability to the American people and we’re going to use our tools to do that.”

The Chair said the U.S. may have to go through a period of growth “below potential” to get inflation back on track towards the Fed’s target rate of 2%. However, he cautioned the Fed doesn’t want that period to be “bigger than it needs to be.”

Powell said he views American households are being in the best shape in a long time, with the middle class having some cushion against economic shocks.

However, people at the lower end of the economic spectrum are suffering. “We’re seeing real declines in food consumption,” Powell noted, explaining that is one reason why the Fed is so concerned about rising prices.

“Price stability is the bedrock of the economy,” Powell said, noting that stable prices enables you to have a strong labor market over time.

All three of the major averages touched session highs after Federal Reserve Chairman Jerome Powell said the U.S. is not in a recession ahead of a fresh read on 2Q GDP due Thursday.

Large-cap technology paced the gains with the Nasdaq Composite up nearly 4%, while the S&P 500 added over 3% and the Dow Jones Industrial Average added 471 points.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SP500 | $4,025.80 | +104.75 | +2.67% |

| I:DJI | $32,248.80 | +487.26 | +1.53% |

Federal Reserve Chair Jerome Powell says he expects the economy to grow this year, though he cautioned there was some slowing in the second quarter.

"We do see weakening, some slowdowns in growth," he said, while also pointing to the strong labor market. “There’s a feeling the labor market is moving back in balance."

Powell said demand is strong and the economy is on track for growth this year.

The Chair also downplayed tomorrow's report on U.S. gross domestic product (GDP) which many economists expect to show a contraction for a second consecutive quarter, the technical definition of a recession. “You tend to take first GDP reports with a grain of salt," Powell said. He said the central bank will look "carefully" at the data.

The labor market is sending such a strong signal of economic strength that it makes you question the GDP data, Powell said.

Powell did not answer the question directly when asked if he sees a recession upon us? -- Sees slowdown and says "we are focused on getting inflation down"...

We don't think we need to have a recession he added...

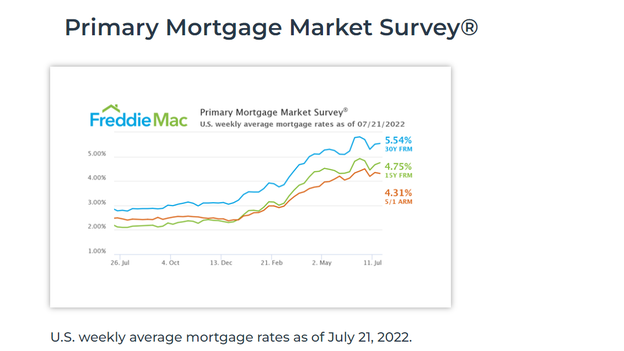

"The Federal Reserve raised its short-term fed funds rate by 75 basis points, but this is unlikely to do any further damage to mortgage rates. The long-term bond market, off of which mortgage rates are generally priced, has mostly priced-in all future actions by the Fed and may have already peaked with the 10-year Treasury shooting up to 3.5% in mid-June. It is at 2.8% a few minutes after the Fed’s decision on its new monetary policy. So, it is possible that the 30-year fixed mortgage rate may settle down at 5.5% to 6% for the remainder of the year. Still, mortgage rates are significantly higher now compared to one year ago, which is why home sales have been falling" stated the National Assn. of Realtors.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TOL | $48.15 | +0.15 | +0.31% |

| LEN | $81.31 | +0.26 | +0.31% |

| DHI | $75.88 | +0.67 | +0.89% |

| MTG | $13.69 | +0.03 | +0.18% |

Another unusually large rate hike after the two back-to-back 75 basis point increases may be appropriate, data depending, says Powell...

Fed must be "nimble" to incoming data during these uncertain times...

Housing has weakened reflecting higher mortage rates, business fixed investment slowing along with consumer spending and production says Powell

Following the 75 basis point rate hike, policymakers also refreshed their view on inflation.

INFLATION REMAINS ELEVATED

REFLECTS SUPPLY & DEMAND IMBALANCES

RELATED TO HIGHER FOOD, ENERGY PRICES

STRONGLY COMMITTED TO GETTING INFLATION TO 2%

HIGHLY ATTENTIVE TO INFLATION RISKS

Live Coverage begins here