Target trouble, mortgage demand hit, gas hits $6 in CA

Get the latest market news on stocks, bonds and commodities with FOX Business. Real-time updates on the markets and corporate news that will impact your portfolio.

Coverage for this event has ended.

Craig Fuller and Jim Iuorio provide insight on supply chain problems, diesel issues for the trucking industry, and high gas prices on 'Making Money.'

"Coming into this year, we anticipated we'd see continued tight conditions and elevated costs and freight markets, but the actual conditions and costs have been much more challenging than expected" said Target CFO John Mulligan in the earnings conference call with analysts.

Kingsview Asset Management CIO Scott Martin discusses the markets and the economy.

Eddie Ghabour, the co-founder of Key Advisors Group LLC, warns the Fed is 'going to suck liquidity out of the system' and the bubble 'is going to burst.'

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TGT | $163.00 | -52.38 | -24.32% |

| WMT | $124.96 | -6.43 | -4.89% |

| DG | $197.47 | -30.16 | -13.25% |

| TJX | $61.57 | +5.37 | +9.56% |

Walmart and Target slammed by inflation, most retailers fall in sympathy but TJX, parent of Marshalls and Home Goods, bucks downtrend after raising its annual forecast.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LOW | $193.87 | -0.85 | -0.44% |

Lowe's Cos Inc. reported a bigger-than-expected drop in same-store sales on Wednesday, as cold and wet weather during April hit demand for seasonal goods.

Same-store sales decreased 4% in the first quarter ended April 29, compared with Wall Street's expectation of a 2.5% fall.

Read the full story: Lowe's sales disappoint as late spring hurts seasonal demand

Target shares fell more than 20% in trading on Wednesday after the company reported earnings that fell far short of Wall Street expectations.

The company's first-quarter profit halved and it warned of a bigger margin hit on Wednesday due to rising fuel and freight costs, in a clear sign that deep-pocketed U.S. retailers are no longer immune to surging inflation.

Read the full story: Target profit halves on rising costs, warns of bigger margin hit

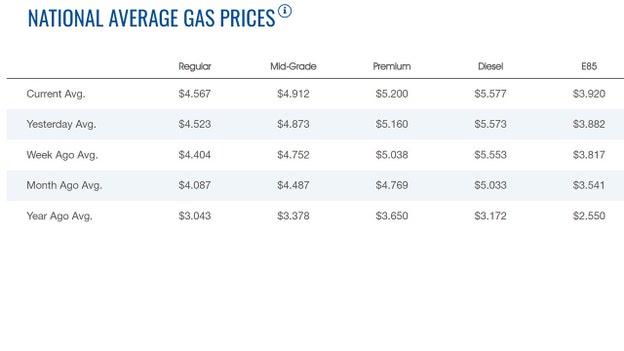

Average gas prices in the U.S. reached a new record high Wednesday, according to AAA's gas price calculator.

The national average cost of a regular gallon of gasoline hit $4.567 early Wednesday morning. This topped Tuesday's record of $4.523, which in turn had beat Monday's record of $4.470.

The price comes as the European Union edges toward oil sanctions on Russia amid the Kremlin's invasion of Ukraine. It also comes amid record-high inflation, with the consumer price index reaching 8.3% in April, hovering near March's 40-year high.

The White House has blamed Russian President Vladimir Putin for the record-high gas prices in the U.S., even coining the surge as the "#PutinPriceHike" and vowing that President Biden will do everything he can to shield Americans from "pain at the pump."

Bitcoin was trading below $30,000 early Wednesday morning after briefly rising, while both Ethereum and Dogecoin were also lower.

At around 4:30 a.m., Bitcoin was trading at approximately $29,720, down $705, or 2.32%. It was down for the week almost 1.5% and for the month, Bitcoin was down about 23%.

Meanwhile, Ethereum was trading at about $2,020, down approximately $70.20 (2.29%). It was down for the week almost 10.25% and for the month, Ethereum was down about 30%.

Dogecoin was trading at approximately 8.85 cents, down 2.10%. For the week, Dogecoin was down about 16% and for the month, it was down nearly 35%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SP500 | $4,088.85 | +80.84 | +2.02% |

| I:COMP | $11,984.52 | +321.73 | +2.76% |

U.S. stocks were choppy early Wednesday morning, turning lower hours before the opening bell.

Retail earnings continue Wednesday, with Target, Lowe’s and TJX Companies among the names reporting ahead of the opening bell. In the afternoon, Bath and Body Works, along with Dow member and communications equipment maker Cisco Systems, report.

Continuing the trend, 463 companies in the S&P 500, or slightly more than 90% of the benchmark index, have posted January through March results, with the numbers coming in well ahead of forecasts.

On Wall Street, the benchmark S&P 500 index rose by an unusually wide daily margin of 2% after positive U.S. retail sales data helped to offset concern about inflation.

The Fed will "have to consider moving more aggressively" if inflation that is running at a four-decade high fails to ease after earlier rate hikes, chair Jerome Powell said at a Wall Street Journal conference.

The Justice Department sued casino mogul Steve Wynn Tuesday to force him to register as a lobbyist in connection with his 2017 efforts to obtain a diplomatic favor long sought by Chinese authorities.

The lawsuit comes almost a year after the department told Wynn to register under the Foreign Agents Registration Act and signaled that it would go to court to compel him to do so if necessary, as The Wall Street Journal reported at the time, citing people familiar with the matter.

In a lawsuit filed in federal court in Washington, the Justice Department said Wynn contacted then-President Donald Trump and members of his administration about the favor in 2017, in order to protect his then-business interests in Macau, China’s gambling hub.

The dispute relates to Wynn’s alleged efforts in the summer of 2017 to persuade U.S. officials to send back to China a Chinese businessman in New York, Guo Wengui, whom Chinese authorities consider a fugitive. Guo has been accused of a range of criminal offenses, from bribery to sexual assault, all of which he has denied.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $81.13 | -2.00 | -2.41% |

| CVX | $173.92 | +0.87 | +0.50% |

| XOM | $92.05 | +1.02 | +1.12% |

Oil prices edged up on Wednesday on expectations that easing COVID-19 restrictions in China will push up demand and as industry data showed drawdowns in U.S crude inventories.

Brent crude was up 23 cents, or 0.2%, at $112.16 a barrel, while U.S. West Texas Intermediate (WTI) crude climbed 71 cents, or 0.6%, to $113.11 a barrel, reversing some of the previous session's losses.

Authorities allowed 864 of Shanghai's financial institutions to resume work, sources said on Wednesday, a day after the Chinese city achieved a milestone of three consecutive days with no new COVID-19 cases outside quarantine zones.

"Less awful news on China offers a nip in the tail in the form of much higher oil demand and prices, which is positive for producers, but harmful for consumer sentiment," Stephen Innes, managing partner at SPI Asset Management, wrote in a note.

Raising supply concerns, U.S. crude and gasoline stocks fell last week, according to market sources who cited American Petroleum Institute figures on Tuesday.

Crude stocks fell by 2.4 million barrels for the week ended May 13, they said.U.S. government data is due on Wednesday.

Live Coverage begins here