LIVE BLOG: Stocks, Bitcoin volatile amid Russia-Ukraine tensions, oil, natural gas jumps

FOX Business is providing real-time updates on financial markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $65.73 | +0.98 | +1.52% |

| UNG | $15.66 | +0.26 | +1.67% |

Consumer and producer prices are already at record levels...Russia-Ukraine could upend energy and grain supplies...

President Biden announces first list of sanctions and promises more will follow -- today's include two banks VEB and its military bank as well as their sovereign debt.

Russia-Ukraine tensions roil market sentiment...

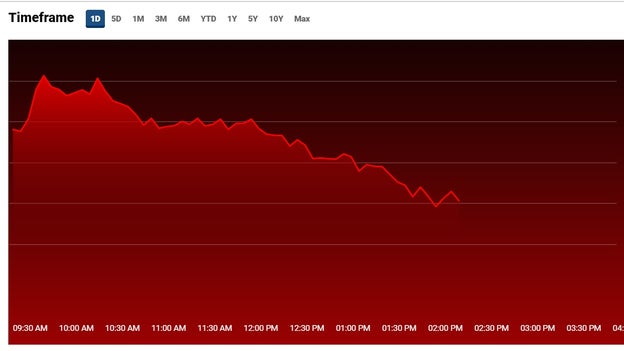

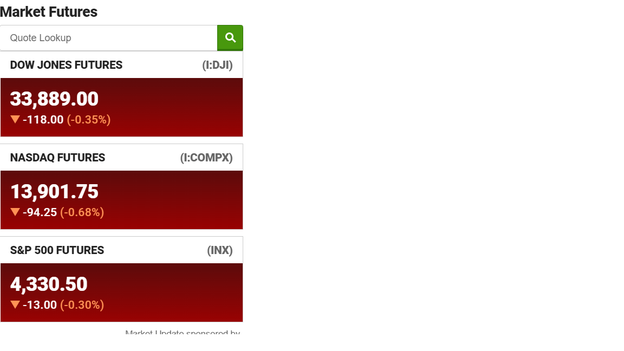

All three of the major US averages sank, while oil and natural gas jumped amid Russia-Ukraine tensions...

| Symbol | Price | Change | %Change |

|---|---|---|---|

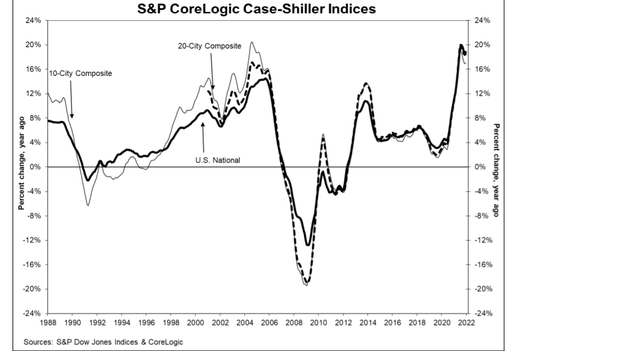

| TOL | $54.03 | +0.16 | +0.30% |

| LEN | $89.43 | +0.10 | +0.11% |

| DHI | $83.44 | +0.69 | +0.83% |

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported an 18.8% annual gain in December, remaining the same from the previous month.

Phoenix, Tampa, and Miami reported the highest year-over-year gains among the 20 cities in December. Phoenix led the way with a 32.5% year-over-year price increase, followed by Tampa with a 29.4% increase and Miami with a 27.3% increase. Fifteen of the 20 cities reported higher price increases in the year ending December 2021 versus the year ending November 2021.

Stocks remained lower but curbed steep overnight + morning losses...

Germany is going to "reassess" the certification of the Nord Stream 2 pipeline in response to Russia's actions toward Ukraine, Chancellor Olaf Scholz said Tuesday.

The 750-mile pipeline that would carry natural gas from Russia to Germany has not begun operating.

Earlier this month, President Biden promised to "bring an end" to Nord Stream 2 if Russia invaded Ukraine.

The escalating crisis between Russia and Ukraine has prompted investors to brace for a bad day for Russian, Ukrainian, U.S., and global markets when they reopen on Tuesday, according to a report.Monday's decisions from Putin are expected to hurt global markets that have already been negatively impacted by the growing tensions between the two countries.

This year, tens of billions of dollars were eliminated from the value of Russian and Ukrainian assets, Reuters reported.

"It is probably an understatement to say that it will be an ugly day [for the markets] tomorrow," said Viktor Szabo, an emerging market portfolio manager at abrdn, a United Kingdom-based global investment company.

"I was hoping we weren't going to get here, but this is a significant step," Szabo added.Analysts at the Commonwealth Bank of Australia warned that Putin's decision on the separatist regions would place a fan under the already heated tensions."Financial market participants now wait for a response from the United States and Europe," they added.

Russian President Vladimir Putin has ordered Russian troops into the two breakaway regions of Ukraine after recognizing their independence, The Wall Street Journal reported.

The Russian government's legal portal published his two decrees following a televised address late Monday.

An emergency meeting of the United Nations Security Council convened, with the United States and allies seeking to isolate Russia and condemning the deployment of Russian troops. Ukraine requested the late-night meeting.

Meanwhile, a witness sent Reuters footage of columns of military vehicles, including tanks and APCs, moving on the outskirts of Donetsk early on Tuesday.

Donetsk is one of the two break-away regions that Putin recognized on Monday. This move seems to comport with Putin's orders.

Cryptocurrency was trending downward early Tuesday as investors worried about Russia’s moves into eastern Ukraine and the prospect for a long war in the region.

Bitcoin was trading at approximately $37,115, down nearly 5% overnight. Ethereum and Dogecoin were also down during the overnight period, trading at nearly $2,540 (-6.72%) and 12.8 cents per coin (-8.3%), respectively, according to Coindesk.

Bitcoin was directionless during the early European hours on Tuesday, Coindesk reported, while traditional markets saw another wave of risk aversion after Russian President Vladimir Putin ordered troops to move into eastern Ukraine.

"In a tense situation, investors will prioritize commodities such as gold and crude oil rather than riskier stocks and cryptos," said Griffin Ardern, a volatility trader from crypto-asset management company Blofin.

U.S. and Asian stocks were sinking lower early Tuesday morning after Russian President Vladimir Putin ordered troops into separatist regions of eastern Ukraine, suggesting a long-feared invasion was possibly underway.

Western powers fear Russia might use skirmishes in Ukraine's eastern regions as a pretext for an attack on the democracy, which has defied Moscow’s attempts to pull it back into its orbit.

A vaguely worded decree signed by Putin cast the order for troops to move into eastern Ukraine as an effort to "maintain peace." He also recognized the independence of the separatist regions, apparently dashing slim remaining hopes of averting a conflict that could cause massive casualties, energy shortages on the continent and economic chaos around the globe.

The White House issued an executive order to prohibit U.S. investment and trade in the separatist regions, and additional measures — likely sanctions — were to be announced Tuesday.

Western powers fear Russia might use skirmishes in Ukraine's eastern regions as a pretext for an attack on the democracy, which has defied Moscow’s attempts to pull it back into its orbit.

The tensions in Eastern Europe have added to uncertainty at a time when markets have been preoccupied over how the world’s central banks, especially the U.S. Federal Reserve, will act to counter surging inflation while coronavirus outbreaks fueled by the highly contagious omicron variant cloud the outlook.

SINGAPORE - Oil jumped to a seven-year high, safe-havens rallied and U.S. stock futures dived on Tuesday as Europe's eastern flank stood on the brink of war after Russian President Vladimir Putin ordered troops into breakaway regions of eastern Ukraine.

Brent crude futures rose 4% to $97.35, their highest since September 2014. S&P 500 futures fell 2% and Nasdaq futures fell 2.7%.

European equities dropped 1.3% overnight to a four-month low, while the Russian rouble tanked and Russia's MOEX equity index fell 10.5%. Australia's ASX 200 fell 1.3% in early trade.

Putin on Monday recognised two breakaway regions in eastern Ukraine as independent and ordered the Russian army to launch what Moscow called a peacekeeping operation into the area, upping the ante in a crisis that could unleash a major war.

Live Coverage begins here