FTX fraud trial of Sam Bankman-Fried

The trial over Sam Bankman-Fried and the collapse of crypto trading firm FTX that erased $1 billion in customer funds ended on its 18th day Thursday with a guilty verdict on all counts for the disgraced crypto king after the jury deliberated for just a few hours. He is facing over 100 years in prison. FOX Business is providing real-time updates from the courtroom.

Coverage for this event has ended.

The jury, which deliberated for just a few hours, found Sam Bankman-Fried guilty on all charges in a stunning move.

The former wunderkind is facing over 100 years in prison for defrauding investors of billions.

The jury is expected to deliberate until 8pm ET, breaking for dinner in between.

In the short time, jurors noticed that a few pieces of evidence were not easily found. The evidence pertained to the “all hands” meeting recording that Caroline Ellison had in the Alameda Hong Kong office explaining to employees what had happened and who was involved.

The recording was critical to prosecutions case because it shows Ellison’s story was the same as her testimony - even going back to before there was an indictment or deal.

Following rebuttals this morning, the case will go to the jury. The judge will give instructions, there 60 pages, then deliberations begin, likely around noon which are expected to carry through dinner.

A rebuttal will kick off the winding down of the Sam Bankman-Fried trial on Thursday.

Late Wednesday, the Defense played up the “good faith” angle hard. “This isn’t a massive coverup” Bankman-Fried's team stressed. He did over 50 interviews after FTX fell, he wasn’t hiding anything. He also talked to Bahamas officials because he was ordered.

Jurors can't trust the government's cooperating witnesses, they struck deals, the government didn’t mention that during their closings. However, it was made clear to jurors the cooperating witnesses had deals. Ellison and Singh both knew months before about the shortfall – neither quit or left. Singh discussed his own personal expenses & came to SBF about backdating transactions.

Bankman-Fried said he only considered because he knew Singh was suicidal. Cooperating witnesses say they didn’t think they did anything wrong yet plead guilty, Bankman-Fried acted in good faith throughout, didn’t defraud anyone.

Sam Bankman-Fried has changed his demeanor at the defense table since his team began its closing arguments. During the prosecution’s speech, he barely looked up from computer as he was typing away throughout. Since his team has started theirs, he’s now attentive to his lawyer and constantly watching the jury, as observed by FOX Business.

The Defense alleges that the “Government tried to turn Sam into a monster or villain” and is based on false premise that FTX was created to steal customer funds from the beginning. They made this math nerd look like a villain the movies. And just like in a movie, 5 people with plea deal agreements said SBF told me to do it. The government left the “why” out of thos movie and didn't present facts that he acted with criminal intent. For example, codes in the FTX website changed for valid reasons – not any scheme, they alleged.

FTX couldn’t open bank accounts so it was fine to use Alameda. In the real world, unlike the movie world, they make mistakes that they later wish they could fix – but that doesn’t fit the government's case.

Until June 2022 – SBF thought he was operating one of the most successful crypto trading firms in the world. He always thought Alameda had assets on and off exchange to cover liabilities. It is not a crime to not have a strong risk system. The government hasn’t met burden of proof. The verdict must be unanimous and government has “heavy burden of proof.”

The govermment needs to prove criminal intent – they didn’t. SBF testified because he wanted to tell you what happened and the government was unfair about his testimony – answers were too long and then they were too short.

He wasn't a polished witnesses, if he was a criminal mastermind, why would he testify before Congress? Does that make any sense? If he was a criminal mastermind, why did he consider shutting down Alameda in September 2022?

Closing arguments start today at 9:30 in the trial of Sam Bankman-Fried. These are expected to last about 2-3 hours for both sides. Rebuttal closings are expected.

Government says theirs will be about 45 minutes. Judge said jury instructions are over 60 pages long with deliberations beginning Thursday.

Defense asked for judegment of acquittal, which can be common in cases, Judge Lewis A. Kaplan quickly denied.

Bankman-Fried says he eventually became concerned about hedging and that management wasn’t handling it as he was not involved in day-to-day trading or core operations.

Defense asked why Bankman-Fried didn't dig deeper in how the $8 billion was spent when he found out it was gone. He said he wasn't looking to assign blame, just wanted to move forward.

Ellison would send him balance sheets often with multiple tabs – she would say which one to look at – doesn’t recall ever going others.

He said the private jet use was always for work purposes, not personal trips or vacations. Jurors were shown a picture of him sleeping on jet. He got a laugh when he says it was “very flattering.”

Days before FTX filed for bankruptcy, Bankman-Fried offered a member of the Bahamas goverment to open withdrawals to FTX's Bahamas clients, knowing the firm was going under.

Bankman-Fried claims Alameda wasn’t spending FTX customer funds but knew they were treated as a liability. He claims he thought it was permissible to FTX customer deposits but never told employees to not spend it. Still, he did not recall doing anything to make sure FTX customer funds were not spent by Alameda.

When he learned of the $8B shortfall, he didn’t know how or who spent what yet he did not fire anyone.

As CEO of FTX he managed risk of customer money but “not as well as I should have” he noted.

Prior, Bankman-Fried had testified to Congress that the money was kept separate.

Bankman-Fried will continue to be cross-examined by the prosecution on what is his fourth day on the stand. The Defense is also expected to question him and then rest their case.

Prosecution plans to call two rebuttal witnesses – an Apollo employee and an FBI data analyst.

On Monday, Bankman-Fried did a 180 when questioned by the Prosecution - he claimed to not remember much, even though he provided many detailed examples during defense questioning. Next, traditional and social media came back to haunt him with the Prosecution aiming use his own words against him to prove he was making misleading statements to the public.

During ex-girlfriend Caroline Ellisson's testimony she said Bankman-Fried kept his unruly hair because it gave him an image. He denounced that view on the stand, saying he didn't cut his hair because he’s lazy. Still the prosecution points to an article that quotes him saying its “important” for him to “look crazy."

Also, Prosecution then asked about his use of private jets. He didn’t recall using one going to Super Bowl or how much he spent annually on travel. In author Michael Lewis's book on Bankman-Fried he details the trip to the 2022 Super Bowl and the attendence of swank Hollywood parties.

Additionally, the team goes through portions of Congressional testimony regarding managing risk that Bankman-Fried says he doesn’t remember saying. He also doesn't recall saying his liquidation mechanism would prevent clawbacks. But the prosecution shows multiple items stating as much.

He also doesn’t recall saying that he used the name Alameda Research to fool regulators, then shown interview where he says he used name to deflect possible attention.

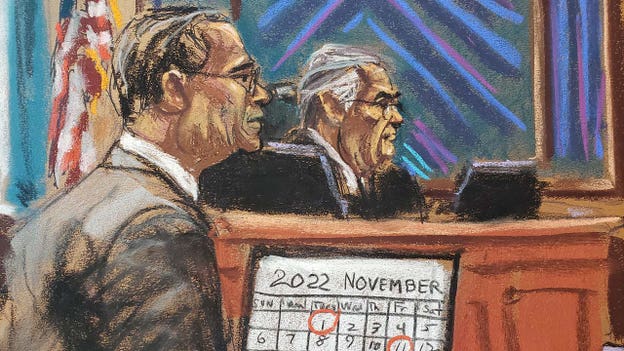

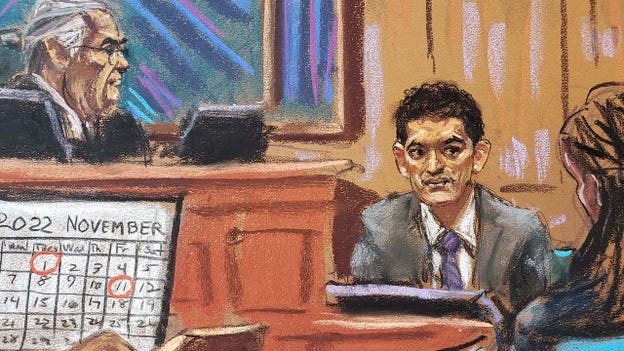

November 6th:

FTX withdrawals jumped to $1 billion, Bankman-Fried detailed while also noting he was concerned there would be a run on the firm, especially after Binance announced its dropping of its FTT (a token providing access to FTX) holdings.

November 7th:

He tweeted a response by Ellison offering to buy all FTT at $22 from Binance, it was trading above $22 at time. He thought this would be a good deal since Binance could get all their money at once instead of months later. Bankman-Fried tweets that a competitor is trying to go after us (Binance) with false rumors and “FTX is fine, assets are fine.”

He assumed the company had the assets to cover. He says, at the time, he believed that to be true and that there were no holes in the balance sheet.

There had also been issues that day with slow FTX withdrawals process for bitcoin which had been declining amid volatility. The largest crypto by market value dipped below $16,000 around FTX's collapse and has since rebounded to the $30,000 level.

November 7th Evening:

FTT fell roughly 80%

Alameda net asset value fell to nearly zero, risked solvency

November 8th:

Bankman-Fried deletes tweet saying FTX is fine. He then began liquidating Alameda, closing positions and contacted possible investors to process customer withdrawls with little delay.

He mentioned he had conversations with Nishmad Singh about his personal finance situation, noting Singh was actively suicidal, had therapist on call for him.

In July 2022, Caroline Ellison broke down in tears, according to Bankman-Fried who had confronted her about the risks FTX sister company Almeda had been taking. According to his account, she offered to resign and said they should have hedged instead of making venture investments.

Bankman-Fried will be questioned by the Defense as the trial resumes on Monday at 9:30 am ET followed by the Prosecution's cross-examination later today.

Legal experts tell FOX Business the back-forth is expected to be very combative as Bankman-Fried will be the last Defense witness.

Sam Bankman-Fried's fraud trial will resume on Monday with the Defense continuing through mid-morrning.

Cross-examinatoin will follow and continue into Tuesday.

Each side plans to call rebuttal witnesses (2 hours max each side)

Closing arguments (2-3 hours each) + rebuttals Court is hoping trial is in jury’s hands by Friday Nov. 3rd.

Bankman-Fried clarified his political donations, primarily to Democratic parties and causes.

“I thought I could have substantial impact on the world” he said according to FOX Business reporting from inside the courtroom.

It was like living in college, as described by Bankman-Fried. At first he lived with 2 roommates but expanded to ten in a swank apartment in the Bahamas.

He began a relationship with one roomate, Caroline Ellison, in 2020 with final breakup in the Spring of 2022. He disclosed, he didn’t have time or energy needed for a relationship. This was a problem he had had with previous relationships as well.

Even so, he would have philosophical conversations with Ellison, which were generally started by her he said.

When Ellison was CEO of Alameda, he would receive balance sheets once every couple of months.

By this time, FTX's marketing team had grown to 15 people and Bankman-Fried had interacted with them at a high level, as CEO.

The original plan for FTX, before the implode, was to build it and sell it. Originally, Bankman-Fried didn't think he would be able to recruit enough customers.

However, as he grew the company, he thought he could do it himself, giving himself a 20% chance it would be success. He didn’t have marketing team or budget in the beginning and eventually decided against selling the trading firm.

Testifying in his own defense, Bankman-Fried says he didn’t commit fraud and didn’t take customer funds.

His vision was to build the best product and best trading platform and instead the opposite happened, FTX went bankrupt and people lost money.

The crypto whiz admits to making a number of small and big mistakes, with the latter being not having a risk management team.

During questioning from his lead lawyer regarding the quick growth of FTX, minus a solid risk management team, he said "We sure should have, but we didn’t" which drew laughter from the overflow room.

Although he did note he received compliance training at trading firm Jane Street, his job before FTX.

Bankman-Fried is facing off with jurors for the first time. On the stand, he denies defrauding anyone and claims he did not take FTX customer funds, despite testimony from his close associates that he was well aware.

Gary Wang and Nishad Singh, former associates who testfied for the prosecution, had permission to work around him since he didn’t know coding.

He added that he various sources of money were used to start sister company Alameda, including his own money, lines of credit, friends etc.

After Thursday's test run during the hearing, Bankman-Fried may face a jury 1-1. Judge Lewis A. Kaplan used his first appearance to determine whether the topics are admissible. FOX Business' team covering the trial noted he was calm but with the prosecution, he paused frequently, looked nervous and avoided answering questions directly.

Bankman-Fried's team could also decide to not let him testisfy.

Among the key points from Thursday's trial:

Bankman-Fried said he can’t remember many conversations Ellison, Wang and Singh that they say occurred and attempted to distance himself from allegations he was involved in the company at every turn.

A direct & cross examination will take day, and could bleed into Monday but the trial is expected to wrap early next week.

Bankman-Fried took the stand in the hearing, the jury was not present at this time.

Highlights:

Bank forms were filled out by Daniel Friedberg, former FTX attorney

He said many would cross his desk and he would sign then assuming they were okay

Alameda & FTX had a payment agreement set up. Bankman-Fried looked over payment agreement between the two companies given to him by Friedberg

Signature for both companies are SBF’s as he was CEO of both at the time

Alameda was the main place customers would send their funds and then funds would be available for customers in FTX account

SBF says he would discuss with counsel when he wanted to take loans for investments. He would describe the investment to them & why he didn’t want it to come directly from FTX

It was decided permissible option to give loans to make deals, SBF took comfort knowing lawyers helped structure the loans.

It was understood that Alameda could borrow from FTX

The last witness for the prosecution, Agent Marc Troiano of the FBI, was less than 30 minutes. He detailed how he was able to identify Bankman-Fried, Carolone Ellison and Gary Wang in text chats.

Troiano said that Bankman-Fried was in 325 Signal chats and 288 had auto-delete enabled.

The Prosecution rests and up next potentially Bankman-Fried himself.

">

Last November, the collapse of crypto trading firm FTX was partly impacted by the selloff in crytocurrencies or the so-called "crypto winter" which pushed Bitcoin down below $16,000. Since, the market has seen a rebound pushing Bitcoin to between $34,000-$35,000.

The trial of the disgraced CEO of FTX will begin Thursday after lawyers confirmed Bankman-Fried will likely take the stand at some point this week.

Live Coverage begins here