Stock futures cautious, oil, gold lower, Mexico suspends gas subsidy as Americans look for deals

FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Kaltbaum Capital Management President Gary Kaltbaum gives his take on investing in Disney as controversy rises due to the company's statement on Florida's Parental Rights in Education bill on "Making Money."

JPMorgan Chase CEO Jamie Dimon warned in his annual shareholder letter that the U.S. economy faces a potential convergence of unprecedented risks in the year ahead that have him preparing for the worst.

Rental car company Hertz said on Monday it has agreed to purchase up to 65,000 electric vehicles from Polestar over the next five years.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HTZ | $22.94 | +1.82 | +8.62% |

The vehicles will be available starting in spring 2022 in Europe and late 2022 in North America and Australia.

Brent crude futures traded around $108 a barrel while West Texas Intermediate futures traded at about $103 per barrel.

Read the full story: Stocks mixed, oil prices climb as economic concerns weigh

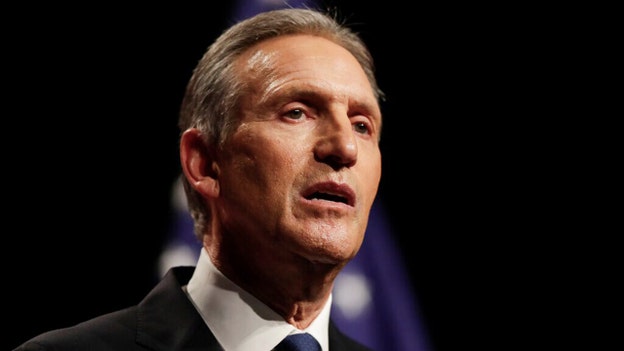

In his first letter to employees upon returning as interim CEO on Monday, Howard Schultz announced that the coffee giant is suspending its stock repurchasing program effective immediately to refocus its capital.

"This decision will allow us to invest more profit into our people and our stores — the only way to create long-term value for all stakeholders," Schultz wrote.

Read the full story: Starbucks interim CEO Schultz suspends stock repurchasing

Crytpocurrency prices were mixed early Monday morning.

Bitcoin was trading at nearly $46,250 (-0.24%), while Ethereum and Dogecoin traded at $3,500 (+0.25%) and 14.4 cents (+2.50%), respectively, Coindesk reported.

Bitcoin ended the week last week trading around $45,000, but was down for the third consecutive day Friday.

U.S. stocks were choppy early Monday morning, whipsawing between gains and losses hours before the opening bell.

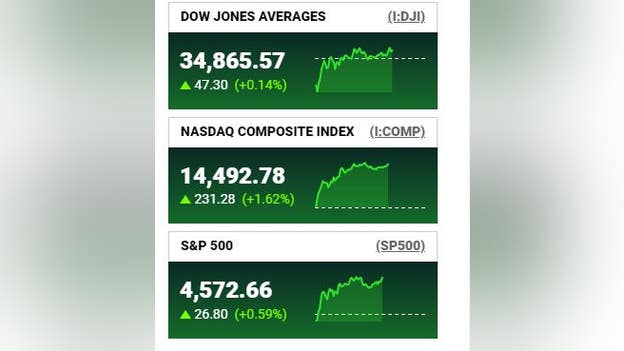

U.S. stocks edged higher Friday, buoyed by a solid employment report that showed the country's jobless rate returning to pre-pandemic levels.

The Dow Jones Industrial Average rose 139.92 points, or 0.4%, to 34818.27, while the S&P 500 climbed 15.45 points, or 0.3%, to 4545.86 and the Nasdaq Composite added 40.98 points, or 0.3%, to 14261.50.

All three indexes started the day higher, edged lower in midday trading as yields on government bonds surged, then climbed again to end the day in the green.

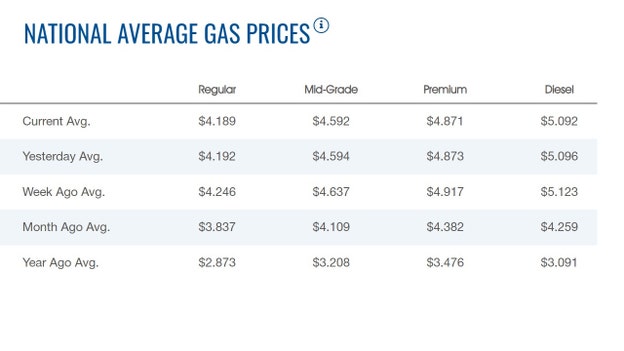

The average price for a gallon of gasoline in the U.S. slipped on Monday to $4.189, according to the latest numbers from AAA.

The price on Sunday was $4.192.

The previous record high was $4.33, set on Friday March 11, 2022.

Oil prices fell at the start of Asian trade on Sunday, after the United Arab Emirates and the Iran-aligned Houthi group welcomed a truce that would halt military operations on the Saudi-Yemeni border, alleviating some concerns about potential supply issues.

The early losses this week come after oil prices settled down around 13% last week - their biggest weekly falls in two years - when U.S. President Joe Biden announced the largest-ever U.S. oil reserves release.

Brent crude futures fell $1.01, or 1%, to $103.38 a barrel by 2223 GMT. WTI crude futures fell 84 cents, or 0.9%, to $98.43 a barrel.

Gold was flat in early Asian trading Monday.

The precious metal is weighed by a strong U.S. jobs report, which "strengthened the Fed's case to use aggressive rate hikes to tame inflation," boosting Treasury yields and the U.S. dollar at the expense of bullion, ANZ reported.

However, the ongoing Russian invasion of Ukraine boost is boosting demand for safe-haven assets like gold, ANZ added. Secondary effects of the war, such as inflation, are also supportive, it said.

Gold futures posted a weekly loss of more than 1%, with prices pressured by a rise in Treasury yields on the heels of a climb in U.S. March employment and wages.

Mexico, which has been subsidizing gasoline to soften price spikes, said on Saturday the policy would not apply in the U.S. border region this week, citing shortages as more Americans drive south to fill their tanks.

The suspension of the subsidy from April 2-8 covers cities in the border states of Tamaulipas, Nuevo Leon, Coahuila, Chihuahua, Sonora and Baja California, including Tijuana, one of the world's busiest border crossings.

"In the United States, gasoline prices are higher than in Mexico, and citizens of that country cross the border to stock up," the finance ministry said.

As fuel prices have spiked after Russia invaded Ukraine, more people living in the United States are driving across the border into Mexico in search of lower gas prices.

Live Coverage begins here