STOCK MARKET NEWS: Bed Bath & Beyond tanks, jobless claims, housing data in focus

Stocks struggled for direction as investors take in a basket of economic news including home sales, mortgage rates and jobless claims. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BILL | $149.40 | -1.98 | -1.31 |

Bill.com is surging in after-hours trading. The provider of cloud-based software that simplifies, digitizes, and automates financial operations topped Wall Street revenue and profit estimates.

Fiscal fourth quarter revenue grew 156% to $200.2 million. Analysts expected $183.1 million. Core revenue, which consists of subscription and transaction fees, rose 151% to $194.8 million.

The net loss for the three months ended June more than doubled to $84.9 million from $41.9 million.

The non-GAAP loss was 3 cents, beating the analyst estimate of 14 cents.

“Looking ahead, we expect to deliver high revenue growth and to transition to being a non-GAAP profitable company in fiscal year 2023,” CEO John Rettig said.

Revenue for the next quarter is expected to be $208.0 — $211.0 million. Full year 2023 revenue is guided to $955.5 — $973.5 million.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMC | $19.64 | -1.73 | -8.08 |

AMC Entertainment chair and chief executive Adam Aron says the movie theater operator remains “confident” about its future.

Aron took to Twitter to refute comments by Cineworld. The second-largest movie theater circuit behind AMC said “recent admission levels have been below expectations.”

“These lower levels of admissions are due to a limited film slate that is anticipated to continue until November 2022 and are expected to negatively impact trading and the group's liquidity position in the near term,” Cineworld said.

Aron said he continues to be “quite optimistic” about the fourth quarter and 2023.

The fall movie schedule includes "Black Panther: Wakanda Forever" in November and sequels to "Shazam" and "Avatar" in December.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBBY | $17.83 | -5.25 | -22.75 |

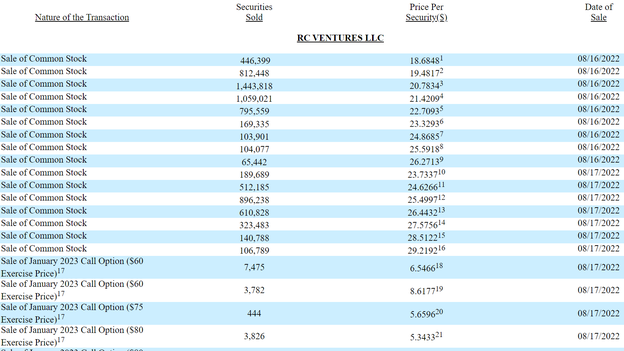

Investor Ryan Cohen has sold his shares of Bed Bath & Beyond for average prices between $18.68 to $29.22 per share, a regulatory filing said.

The GameStop chair sold the stock Tuesday and Wednesday.

Cohen’s interest in Bed Bath & Beyond sent shares of the home goods retailer surging.

BED BATH & BEYOND SLIDES AFTER RYAN COHEN FILES FOR STAKE SALE

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ROSS | $9.87 | 0.01 | 0.15 |

Ross Stores fell in Thursday trading. The off-price retailer topped Wall Street profit estimates but missed on revenue.

Second quarter revenue was little changed at $4.58 billion. The analyst estimate was $4.61 billion.

Comparable store sales dropped 7% in the second quarter and are expected to fall 7% to 9% year over year in the third quarter.

Profit came in at $384.5 million, down 22%, or $1.11 per diluted share, topping the estimate of 99 cents.

“We are disappointed with our sales results, which were impacted by the mounting inflationary pressures our customers faced as well as an increasingly promotional retail environment,” said CEO Barbara Rentler.

"Given our first half results, as well as the increasingly challenging and unpredictable macro-economic landscape and today’s more promotional retail environment, we believe it is prudent to adopt a more conservative outlook for the balance of the year."

Full year earnings per share are estimated to be in the range of $3.84 to $4.12, down from previous guidance of $4.34 to $4.58.

U.S. stocks drifted for most of the session before all three of the major averages posted modest gains with energy companies leading the S&P as oil prices rose nearly 3% to close at $90.50, while healthcare stocks lagged as the worst group. Investors digested weaker data on housing against jobless claims which were little changed.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BVNRY | $17.55 | 1.33 | 8.20 |

Danish biotech firm Bavarian Nordic said on Thursday it has signed up a U.S.-based manufacturer to package its Jynneos monkeypox vaccine and the production is expected to begin later this year.

The company aims to finish the technology transfer in three months to Michigan-based Grand River Aseptic.

More than 13,500 cases of the disease, which cause flu-like symptoms and skin lesions, have been reported in the United States as of Aug. 17.

The government's Biomedical Advanced Research and Development Authority, which procures the vaccine, has requested 5.5 million doses for delivery this year and the next, the company said.

This includes an additional order for 2.5 million doses that Bavarian Nordic received last month.

Besides allowing faster deliveries to the United States, the agreement will free up the company's capacity for other countries.

The Danish company has doubled its capacity from before the outbreak started in May and expects to further increase it even as it explores more partnerships to improve global access to the vaccine.

To boost the supply of monkeypox vaccines, the United States is making an additional 1.8 million doses of the Jynneos vaccine available for orders starting Aug. 22.

Alliance for Automotive Innovation President and CEO John Bozella discusses the prices and innovation of electric vehicles, arguing the U.S. needs access to raw materials.

Douglas Herman vice chair Dottie Herman discusses if the existing home sales slide is a warning sign for the economy on 'Cavuto: Coast to Coast.'

| Symbol | Price | Change | %Change |

|---|---|---|---|

| YUM | $118.03 | -1.08 | -0.91 |

Yum Brands unit Taco Bell is testing a new plant-based protein in Birmingham, Alabama.

The soy and pea protein proprietary blend is inspired by classic Taco Bell flavors. It will be available with a new crispy melt taco, Nachos BellGrande or any other menu item through order customization.

The protein is certified vegan by the American Vegetarian Association (AVA).

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CRMT | $94.72 | -24.75 | -20.72 |

America’s Car-Mart fell more than 20% in Thursday trading. The used car dealer topped Wall Street sales estimates for the fiscal first quarter but missed on profit.

Revenues for the three months ended July rose 23% to $344.88 million, above the estimate of $322.4 million.

Retail units sold grew 2.1%.

Profit was $13.2 million compared to $24.97 million a year ago.

Diluted earning per share came in at $2.00, well below analyst expectations of $3.14.

“We believe that when supply in our market eventually returns to more normal levels, our productivity will increase as affordability is most certainly keeping many good customers out of the market,” said Jeff Williams, Chief Executive Officer.

America's Car-Mart operates 154 automotive dealerships in twelve states and is one of the largest publicly held automotive retailers in the United States focused exclusively on the "Buy Here/Pay Here" segment of the used car market.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TWTR | $44.21 | 0.22 | 0.50 |

Twitter employees are reportedly fleeing the social media company as faith in management sinks due to the controversy created by billionaire Elon Musk’s embattled buyout of the company.

The New York Post reports management turnover and cost-cutting, including a hiring freeze, are also reasons for high turnover.

“Dozens of workers” have reportedly left in the last several weeks. One worker quoted in the story said so many people quit that layoffs may no longer be necessary.

Twitter told the Post employee turnover was “slightly higher” than expected but “inline with current industry standards.”

TWITTER TO GIVE ELON MUSK DOCUMENTS FROM FORMER EXEC KAYVON BEYKPOUR: COURT ORDER

| Symbol | Price | Change | %Change |

|---|---|---|---|

| KSS | $31.85 | -2.10 | -6.19 |

| LVMUY | $142.57 | -0.38 | -0.27 |

Kohl’s is trading lower. The department store chain cut its full-year sales and profit forecasts, saying full year net sales are expected to decline 5% to 6% versus last year.

The announcement came days after Kohl’s named a new chief marketing officer.

The company also announced Sephora will expand its presence at all of Kohl’s 1,100+ locations. Sephora is currently in 600 stores. Sephora is owned by LVMH Moet Hennessy Louis Vuitton.

U.S. stocks struggled for direction on Thursday as investors digest more retail earnings and economic data including jobless claims and mortgage rates. In corporate news, Bed Bath & Beyond shares tumbled after the troubled retailer’s largest shareholder, RC Ventures, filed an intent to sell his entire stake. In commodities, oil neared $90 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBBY | $20.29 | -2.79 | -12.09 |

Bed Bath & Beyond shares tumbled after the company's largest shareholder Ryan Cohen's RC Ventures filed an intent to sell his nearly 10% stake. He is the troubled retailer's largest individual shareholder. In the past month, the stock has advanced over 300+%.

The number of Americans filing for unemployment benefits last week fell slightly but remained above the typical pre-pandemic level, evidence that the historically tight labor market is losing steam.

Figures released Thursday by the Labor Department show that applications for the week ended Aug. 13 edged down to 250,000 from the downwardly revised 252,000 recorded a week earlier.

U.S. equity futures turned higher after being lower overnight, following a day that saw stocks fall after the Federal Reserve said U.S. inflation is too high, suggesting support for more aggressive interest rate hikes.

The major futures indexes suggest a small gain when trading begins on Wall Street.

Oil prices added to gains Thursday morning.

U.S. crude futures traded around $89.00 a barrel. Brent crude futures traded around $94.00 a barrel.

Watch shares of Bed, Bath & Beyond, which are 12% lower in premarket trading following an earlier 45% surge. At the root of the wild swings is investor and GameStop Chairman Ryan Cohen who filed for a proposed sale of his stake in the struggling home goods retailer.

Meanwhile, shares of the chipmaker Wolfspeed are up 22% in premarket trading. The developer of wide bandgap semiconductors topped Wall Street revenue and profit estimates.

The parade of retail-related earnings continues Thursday, with BJ’s Wholesale Club, Kohl’s, Coach and Kate Spade parent Tapestry, and Estee Lauder reporting ahead of the opening bell.

Economic reports include jobless claims and existing home sales.

Asian markets following the U.S. session lower. The Nikkei 225 in Tokyo sank 0.9%, the Hang Seng in Hong Kong shed 0.8% and China's Shanghai Composite Index lost 0.5%.

Wall Street's benchmark S&P 500 index lost 0.7% to 4,274.04 on Wednesday. The loss wiped out the week's gains and left the index down 0.1% since Monday.

The Dow Jones Industrial Average sank 0.5% to 33,980.32 and the Nasdaq slid 1.3%. to 12,938.12.

The Commerce Department reported July retail sales were flat compared with the previous month. Retail chain Target fell 2.7% after reporting a nearly 90% plunge in second quarter profits.

The once red-hot housing market is rapidly losing steam.

A slew of new economic data published this week shows the sector is starting to cool off: Homebuilders' sentiment about the industry plunged to the lowest level in two years, and buyers are retreating from the market as they cancel home sales at the fastest pace since 2020 and builders are rethinking construction.

Oil prices added to gains Thursday morning.

U.S. crude futures traded around $89.00 a barrel. Brent crude futures traded around $94.00 a barrel.

Prices rose more than 1% during the previous session. Futures have fallen over the past few months, on concerns about a potential recession that could hurt energy demand.

U.S. crude inventories fell by 7.1 million barrels in the week to Aug. 12, higher than expectations for a 275,000-barrel drop.

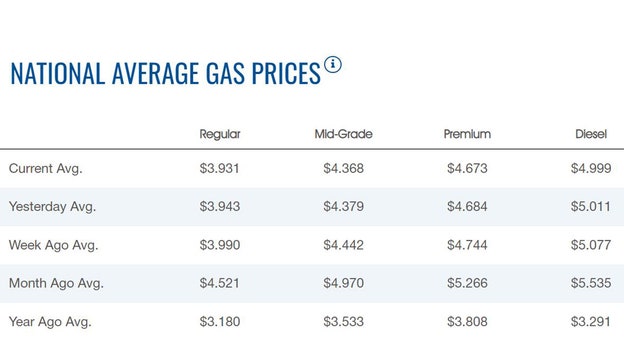

The average price of a gallon of gasoline slipped on Thursday to $3.931, according to AAA. Wednesday's price was $3.943. The price dropped below $4 for the first time since March a week ago, when the price fell to $3.99.

Gas has been on the decline since hitting a high of $5.016 on June 14. Diesel has slipped below $5.00 a gallon to $4.999 from $5.011.

Bitcoin was trading at around $23,000, after trading lower for four days, losing 4% during that time. For the week, bitcoin was down by more than 2%.

For the month, the cryptocurrency was off more than 1%. Year-to-date bitcoin is down more than 49%.

Ethereum was trading around $1,800, down 0.8% in the past week.

Dogecoin was trading at 8 cents, up 13% in the past week.

Live Coverage begins here