STOCK MARKET NEWS: GM dividend update, Bed Bath & Beyond craters, futures slide

Stock futures suggest ending the week on a low note. Cryptocurrencies drop. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $15.86 | -0.29 | -1.80 |

An Atlanta-area jury has ordered Ford Motor to pay $1.7 billion in punitive damages in connection with the 2014 death of a Georgia couple, the Atlanta Journal-Constitution reports.

The wrongful death verdict is the largest in state history, and unanimous, the report said.

The Middle Georgia couple died when a tire blue out on their 2002 Ford Super Duty F-250, causing a rollover.

A Gwinnett County jury determined the roofs of 1999 to 2016 “Super Duty” models were not strong enough to prevent passengers from being crushed in a rollover.

The couple’s children sued parties including Ford and Pep Boys. The jury determined Pep Boys shared partial blame for installing wrong sized tires.

Georgia law requires three-quarters of the punitive damages in product liability cases to go to the state, the Journal-Constitution said.

The newspaper did not say whether the verdict would be appealed.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| KDP | $39.96 | -0.07 | -0.17 |

Keurig Dr Pepper dismissed speculation that the beverage maker was interested in buying Bang Energy.

“We are not pursuing a partnership with Vita Pharmaceuticals for the Bang brand,” said Keurig Dr Pepper.

The owner of brands include Dr Pepper, 7UP and Snapple did say its top capital allocation priority is growing its business through mergers and acquisitions and brand/distribution partnerships: “We are active in evaluating many opportunities that arise, including in the energy space.”

Media reports said Bang Energy could sell for more than $3 billion.

The Federal Deposit Insurance Corporation (FDIC) is telling five companies to take immediate corrective action to address these false or misleading statements about FDIC deposit insurance.The FDIC claims each of these companies made false representations—including on their websites and social media accounts—stating or suggesting that certain crypto–related products are FDIC–insured or that stocks held in brokerage accounts are FDIC–insured.

• Read the FDIC’s letter to Cryptonews.com

• Read the FDIC’s letter to Cryptosec.info

• Read the FDIC’s letter to SmartAsset.com

• Read the FDIC’s letter to FTX US

• Read the FDIC’s letter to FDICCrypto.com

The Dow, S&P 500 and Nasdaq ended the week lower as fears resurfaced over a September rate hike by the Fed. The Dow lost almost 300 points on the day. Bed Bath & Beyond dropped more than 40% in the wake of investor Ryan Cohen’s sale of his entire stake.

Oil lost ground but natural gas rose. Russia’s Gazprom announced a three-day shutdown of the Nord Stream 1 pipeline.

Michael Gayed and Tom Sosnoff provide insight on retail investing and the impact of money printing on 'Making Money.'

North Dakota Republican argues the U.S. power grid is currently unable to meet the increasing demand of the president's green energy plan, telling 'Cavuto: Coast to Coast' Biden is 'handcuffing' energy producers.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FL | $38.65 | 6.67 | 20.85 |

Foot Locker gained as much as 25% in Friday trading. The footwear retailer named a new chief executive and reported quarterly profit that topped Wall Street estimates.

The company appointed former Ulta Beauty CEO Mary Dillion as its new chief executive, effective Sept. 1 to replace retiring chair and CEO Richard Johnson. Lead independent director Dona Young will become non-executive chair, effective Feb. 1.

Second quarter revenue fell 9.2% to $2.07 billion, matching the analyst estimate. Comparable store sales fell 10.3% versus record levels from last year.

Net income was $94 million compared to $430 million in the prior year. Non-GAAP earnings per share was $1.10, topped the estimate of 79 cents.

The company lowered its full-year financial outlook. Sales are expected to drop 6% to 7%. The previous forecast was for a decline of 4% to 6%.Comparable sales are forecast to fall 8% to 9% compared to the previously estimated 8% to 10%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GM | $39.39 | 0.67 | 1.73 |

The 9 cent per share dividend will be paid on Sept. 15, 2022, to shareholders of record as of the close of business on Aug. 31, 2022.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GCT | $27.84 | 1.20 | 4.50 |

Hong Kong-based GigaCloud Technology is soaring in its first day of trading on the Nasdaq. The wholesale marketplace operator for furniture and other large parcel merchandise raised $36 million in its initial public offering.

GigaCloud Technology sold 2.9 million shares at $12.25.The company plans to use proceeds from the offering for working capital, operating expenses, capital expenditures and other general corporate purposes.

GigaCloud reported 2021 revenue of $414.2 million, up 50% year over year. Net income fell 26% to $27.8 million.

The Nasdaq Composite led the major stock averages lower as the week winds down with Bed Bath & Beyond weighing heavily, down over 40%+ after shareholder Ryan Cohen sold the majority of his stake. In commodities, oil ticked higher by 0.3% to $90.42 per barrel

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:COMP | $12,800.99 | -,164.35 | -1.27 |

| BBBY | $18.55 | -4.53 | -19.63 |

| DE | $367.99 | 3.30 | 0.90 |

General Motors, which suspended its dividend during the height of the pandemic, is returning capital to shareholders.

$0.09 per share quarterly dividend

Shareholders of record on 8/31/22

Paid 9/15/22

"Opportunistic" share repurchases to resume

"The Board increased the capacity under the company's existing repurchase program to $5.0 billion of common stock, up from the $3.3 billion previously remaining under the program."GM is investing more than $35 billion through 2025 to advance our growth plan, including rapidly expanding our electric vehicle portfolio and creating a domestic battery manufacturing infrastructure," said Mary Barra, GM Chair and CEO. "Progress on these key strategic initiatives has improved our visibility and strengthened confidence in our capacity to fund growth while also returning capital to shareholders" Barra stated in the announcement.

It's going to be another volatile day for shares of Bed Bath & Beyond. Here's why.

U.S. equity futures were giving back gains from the previous session as investors analyzed conflicting economic signals ahead of a Federal Reserve conference next week.

The major futures indexes suggest a decline of 0.5% when the opening bell rings.

Oil prices edged lower on Friday, putting the brakes on a rally in the last couple of days.

U.S. West Texas Intermediate crude was around $89.00 a barrel, following a 2.7% increase in the previous session. Brent crude futures traded around $95.00 a barrel. after settling 3.1% higher on Thursday.

Still, the benchmark contracts were headed for weekly losses of about 1.5%.

Shares of Bed, Bath & Beyond are plunging another 39% in premarket trading after Investor Ryan Cohen sold his shares for average prices between $18.68 to $29.22 per share, a regulatory filing said. The GameStop chair sold the stock Tuesday and Wednesday. The premarket drop follows a nearly 20% fall in the regular trading session.

A banner week for retail earnings wraps up Friday morning with a pair of specialty names: footwear favorite Foot Locker, and apparel retailer The Buckle. Also watch for results from agricultural machinery maker Deere, and live entertainment producer Madison Square Garden Entertainment.

Cryptocurrencies fell sharply on Friday dragging bitcoin to a three-week low. The reason for the drop was not immediately known.

Bitcoin fell as much as 7.7% to $21,404 over a few minutes overnight. Bitcoin rebounded a bit to nearly $22,000. but was down more than 2% in the past week.

In Asia, the Nikkei 225 in Tokyo shed less than 0.1%, the Hang Seng in Hong Kong added 0.1% and China's Shanghai Composite Index lost 0.6%.

Wall Street rebounded after corporate results and fewer unemployment claims than expected suggested the U.S. economy has pockets of resiliency despite repeated interest rate hikes.

The S&P 500 rose 0.2% to 4,283.74, the Dow Jones Industrial Average gained 0.1% to 33,999.04, the Nasdaq added 0.2% to 12,965.34.

Cryptocurrencies fell sharply on Friday dragging bitcoin to a three-week low. The reason for the drop was not immediately known.

Bitcoin fell as much as 7.7% to $21,404 over a few minutes overnight. Bitcoin rebounded a bit to nearly $22,000. but was down more than 2% in the past week. For the month, the cryptocurrency was off by more than 1% and down more than 49% year-to-date.

Ethereum fell more than 5% to around $1,700 and is down more than 1% in the past week.

Dogecoin was trading at 6 cents, off 6%, but remains up more than 5% in the past week.

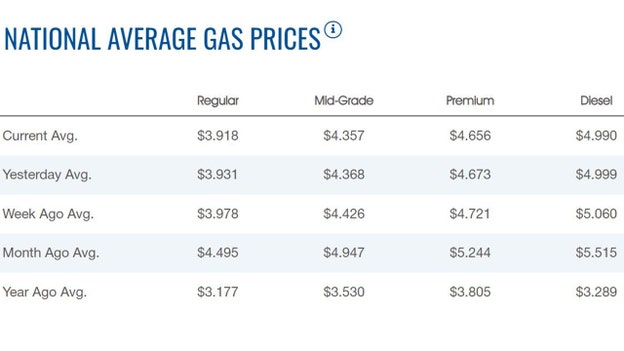

The average price of a gallon of gasoline slipped on Friday to $3.918, according to AAA. Thursday's price was $3.931. The price dropped below $4 for the first time since March a week ago, when the price fell to $3.99.

Gas has been on the decline since hitting a high of $5.016 on June 14.

Diesel has slipped below $5.00 a gallon to $4.99 from $4.999.

Oil prices edged lower on Friday, putting the brakes on a rally in the last couple of days. Investors tried to weigh hopes for strong fuel demand after a larger-than-expected drawdown in U.S. crude stocks.

U.S. West Texas Intermediate crude was around $90.00 a barrel, following a 2.7% increase in the previous session.

Brent crude futures traded around $96.00 a barrel. after settling 3.1% higher on Thursday.

Still, the benchmark contracts were headed for weekly losses of about 1.5%.

U.S. crude inventories fell sharply as the nation exported a record 5 million barrels of oil a day in the most recent week. Oil supply fell by 7.1 million barrels in the past week.

Live Coverage begins here