STOCK MARKET NEWS: Fed’s Powell drives Dow down 1,000 points in end to rocky week

Fed Chairman Jerome Powell updates investors on the battle against inflation, in takeover news Electronic Arts may be in play and stock investors are winding down what may be a losing week.

Coverage for this event has ended.

The Agriculture Department is warning consumers to check their bags of Purdue Farms chicken tenders for possible foreign materials. There is no recall because products are no longer available in stores. Purdue Farms is a privately-held company.

Kroll Institute chief policy strategist Chris Campbell and TJM Institutional Services managing director of commodities Chris Robinson react to Fed Chair Powell warning of economic 'pain' on 'The Claman Countdown.'

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NKE | $108.42 | -4.80 | -4.24 |

| CRM | $166.06 | -7.85 | -4.51 |

| INTC | $33.80 | -1.09 | -3.12 |

| MRK | $90.08 | -0.19 | -0.21 |

| UNH | $534.50 | -7.07 | -1.31 |

U.S. stocks saw a sharp selloff on Friday with the Dow Jones Industrial Average touching a 1,000+ point drop. The S&P 500 and the Nasdaq Composite shed over 3%. Federal Reserve Chairman Jerome Powell delivered a warning about the health of economy with interest rates expected to rise even further as policymakers try to tame red hot inflation.

Nike, Salesforce and Intel paced the triple digit drop, while Merck and United Healthcare fell the least.

China has agreed to give U.S. regulators access to Chinese accounting firms that audit U.S.-traded Chinese companies in a move that may stop some 200 Chinese firms from losing their U.S. stock exchange listings.

The pact is first step toward opening access for the U.S. accounting regulator to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong completely, consistent with U.S. law.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HON | $195.42 | -5.01 | -2.50 |

| MMM | $136.93 | -5.83 | -4.08 |

| KMB | $130.73 | -2.16 | -1.63 |

| HBI | $8.99 | -0.52 | -5.42 |

N95 masks are off the Food and Drug Administration's medical device shortage list, signaling that demand or projected demand for the protective devices is no longer exceeds the supply.

The action is the result of increased domestic manufacturing of N95 respirators, as well as updates to the FDA’s supply chain assessment.

"Today, our national capacity for production of these devices is stronger and our supply chain is more resilient because of these collective efforts on behalf of the dedicated people working to save lives,” said Suzanne Schwartz, M.D., M.B.A., director of the FDA’s Center for Devices and Radiological Health’s Office of Strategic Partnerships and Technology Innovation.

The FDA will continue to monitor the supply chain and update the device shortage list and device discontinuance list.

The FBI said it had "probable cause" to believe that additional records containing classified information would be found at former President Trump's Florida home beyond what he previously turned over to the National Archives and Records Administration.

U.S. air travel service complaints increased 34.9% in June compared to May and nearly 270% above pre-pandemic levels, the U.S. Department of Transportation said.

Of the 5,862 complaints received in June 2022, 57.7% were against U.S. carriers, 34.5% were against foreign air carriers, and 7.8% were against travel companies.

Flight problems (28.8%) was the highest category of the complaints. Twenty-four-point-five percent (24.5%) concerned refunds.

The Biden administration said on Friday it will propose designating certain "forever chemicals" as hazardous substances under the nation's Superfund program, in a bid to spark cleanup of countless sites that have been found contaminated by the toxic industrial compounds.

The proposal would require companies to report leaks of two of the most widely used per- and polyfluoroalkyl substances (PFAS) and pay for cleanups, and would also provide public funds for cleanups when the culprits cannot be found.

PFAS chemicals — widely used to make household products from nonstick cookware to food packaging — have in recent years been found in dangerous concentrations in drinking water, soils and foods across the country. Because the substances do not break down quickly, they can build up in the body where they have been linked to illnesses ranging from heart problems to low birthweights.

Representatives of U.S. chemicals makers, including the America Chemistry Council, have opposed the proposal to designate PFAS chemicals as hazardous, calling it expensive and ineffective in cleaning up contaminated sites.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DOMO | $21.32 | -7.35 | -25.64 |

Domo plunged more than 25% Friday. The low-code data app platform missed Wall Street’s forecast and revenue estimates.

The company expects fiscal third quarter revenue of $76.0 million to $77.0 million, below analyst expectations of $79.8 million, Benzinga reported. Full year revenue is forecast to come in at $305.0 million to $310.0 million. The forecast was $315.7 million.

Fiscal second quarter revenue rose 20% to $75.5 million. Analysts were looking for $76.4 million. Subscription revenue increased 23% year over year to $67.4 million.

The net loss for the three months ended July 31 widened to $29.1 million from $22.4 million.

The non-GAAP net loss was 26 cents, better than the expected loss of 33 cents.

Federal Reserve Chairman Jerome Powell has a warning for financial markets as policymakers continue their fight to battle back inflation.

U.S. stocks pulled back sharply on the initial headlines which include speculation of further rate hikes.

The Federal Reserve's favorite inflation gauge signaled a glimmer of hope that rising prices may be peaking, yet it likely won't make a major difference for consumers.

U.S. stocks struggled for direction as investors await a 10am ET speech from Federal Reserve Chairman Jerome Powell. He’s expected to address the state of the economy and the battle to bring inflation down. In commodities, oil slipped to the $92 per barrel level.

Elsewhere, Electronic Arts is active after reports swirled that the company may have been eyed by Amazon for a takeover. EA telling FOX Business: "We don’t comment on rumors and speculation relating to M&A."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| EA | $127.61 | 2.00 | 1.59 |

| AMZN | $137.28 | 3.48 | 2.60 |

Moderna is filing patent infringement lawsuits against Pfizer and BioNTech in the U.S. and the Regional Court of Düsseldorf in Germany.

"We are filing these lawsuits to protect the innovative mRNA technology platform that we pioneered, invested billions of dollars in creating, and patented during the decade preceding the COVID-19 pandemic," said Moderna Chief Executive Officer Stéphane Bancel."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MRNA | $142.05 | 0.62 | 0.44 |

| PFE | $47.90 | 0.47 | 0.99 |

| BNTX | $148.56 | 2.32 | 1.59 |

U.S. equity futures were trading lower ahead of Chairman Jerome Powell's speech at the Fed gathering in Jackson Hole.

The major futures indexes suggest a decline of 0.3% ahead of the opening bell.

Oil is heading for a winning week. West Texas Intermediate futures traded around $93.00. Brent crude futures were around $100.00 a barrel.

The Federal Reserve chairman's remarks to investors and economists will be the marque event at the Fed's annual symposium at Jackson Hole.

People will be looking for clues on where the Fed is heading on interest rates, mainly how big and for how long. With inflation around 9%, Powell will likely stress that the Fed is determined to bring it down to its 2% target, no matter what it takes.

Traders will also be watching for data on income & spending, the core PCE index and consumer sentiment.

Shares of Gap and Dell were mixed in premarket trading following quarterly results.

In Asia, the Nikkei 225 in Tokyo rose 0.6%, the Hang Seng in Hong Kong gained 1.0% and China's Shanghai Composite Index shed 0.3%.

On Wall Street, the S&P surged 1.4% to 4,199.12 for its biggest daily increase in nearly two weeks.

The Dow Jones Industrial Average rose 1% to 33,291.78. The Nasdaq composite climbed 1.7% to 12,639.27.Also Thursday.

The government reported the U.S. economy didn’t contract by as much as previously thought during the spring. It shrank 0.6% on an annualized basis, less than the previous 0.9% estimate.

It may be considered Jerome Powell's most significant speech of the year.

The Federal Reserve chairman's remarks to investors and economists will be the marque event at the Fed's annual symposium at Jackson Hole. People will be looking for clues on where the Fed is heading on interest rates, mainly how big and for how long.

Oil prices rose Friday on signs of improving fuel demand.

The market is waiting for clues from the Federal Reserve chairman on the outlook for rate hikes in a speech later in the day.

West Texas Intermediate futures traded around $93.00. Brent crude futures were around $100.00 a barrel.

Both contracts slumped about $2 on Thursday.

The benchmark oil contracts are on track for gains of around 3% for the week.

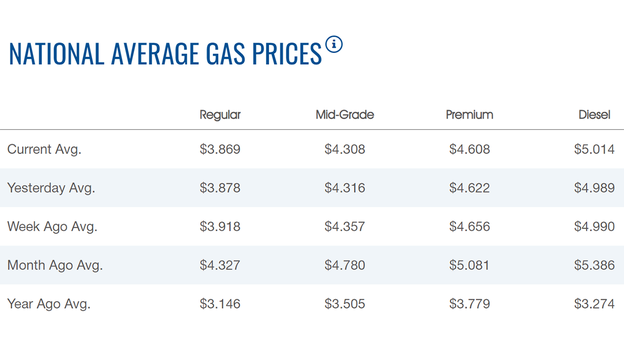

The average price of a gallon of gasoline slipped on Friday to $3.869, according to AAA. Thursday's price was $3.878.

The price dropped below $4 for the first time since March more than a week ago, when the price fell to $3.99. Gas has been on the decline since hitting a high of $5.016 on June 14.

Diesel has gained for a third straight day at $5.014 per gallon.

Bitcoin was trading at around $21,000, after snapping a two-day winning streak.

Bitcoin is off more than 9% month-to-date and down more than 53% year-to-date.

Ethereum was trading at approximately $1,600. Dogecoin was trading at 6 cents.

Live Coverage begins here