STOCK MARKET NEWS: eBay shares up, Clorox down, Nasdaq leads rally, Ford shares soar

Earnings reports sent eBay share higher and Clorox lower. Oil is also in focus as OPEC tweaked production. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Twinkie maker Hostess Brands is handing out bonuses of up to $1,000 to each of its nearly 2,000 bakery and warehouse employees.

The ‘thank you’ awards are the second bonuses this year and recognize the hard work and dedication of Hostess employees over the past several months.

Hostess Brands operates five North American bakeries in Chicago; Emporia, Kansas; Indianapolis; Columbus, Georgia; and Burlington, Ontario, Canada.

Clorox is down in after hours trading. Quarterly revenue and profit missed Wall Street expectations.

Fiscal fourth quarter sales were flat at $1.8 billion. Five analysts surveyed by Zacks were looking for $1.86 billion. Organic sales did grow 1%. Lower shipments were offset by pricing.

"Over this quarter and the fiscal year, we navigated through challenging operating conditions by taking pro-active steps to rebuild margin and invest in the areas of the business that would best position Clorox for long-term success,” CEO Linda Rendle said.

Profit rose 4% to $101 million, or 81 cents per share, for the quarter ended June 30. Adjusted earnings were 93 cents, below the analyst estimate of 95 cents.

For the full year, net sales fell 3%.

“Looking to fiscal year 2023, the environment remains difficult, with consumer behaviors adapting to ongoing inflation as well as continued normalization in our cleaning and disinfecting portfolio,” Clorox said.

eBay is higher in after hours trading. The online marketplace topped Wall Street revenue estimates.

Second quarter revenue fell 9% to $2.4 billion, but was still higher than the analysts' estimate of $2.37 billion, according to IBES data from Refinitiv.

Gross merchandise volume (GMV) declined 18% to $18.5 billion.

Net income dropped 18% to $554 million.

eBay is forecasting negative third quarter and full year organic growth.

The company is planning to close its GittiGidiyor marketplace business in Turkey. The closure is not expected to have a material impact on revenue and operating income going forward, but its three million active buyers were included in the company's second quarter active buyer count from the Turkish marketplace.

U.S. stocks staged a solid rally powered by better-than-expected earnings and the ISM’s services data which hit a three-month high. In commodities, oil sank nearly 4% to $90.66 the lowest level since Russia’s invasion of Ukraine.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:COMP | $12,668.16 | 319.40 | 2.59 |

| SP500 | $4,155.17 | 63.98 | 1.56 |

| I:DJI | $32,812.50 | 416.33 | 1.29 |

Michael Saylor provides insight on the company after stepping down as CEO on ‘Making Money.’

Moderna is trading higher Wednesday. The COVID-19 vaccine maker topped Wall Street profit estimates and announced a $3 billion share repurchase plan.

Shares rose as much as 17% in intraday trading.

Second quarter revenue came in at $4.7 billion, up 9% year over year. Growth was primarily due to increased product sales from sales of the COVID-19 vaccine.

Net income fell 21% to $2.2 billion, or $5.24 per diluted share. The average analyst estimate was $4.55 per share.

The drugmaker reiterated that it has advance purchase agreements for expected delivery in 2022 of around $21 billion of sales.

"Right now, we have four infectious disease vaccines in Phase 3 trials, and later this year, we expect important data from proof-of-concept studies in rare diseases and immuno-oncology,” Moderna said.

Thousands of cryptocurrency wallets in the Solana ecosystem have been drained of millions of dollars in an apparent hacking attack.

Solana Status confirmed the attack in a tweet, stating the incident is under investigation.

“This does not appear to be a bug with Solana core code, but in software used by several software wallets popular among users of the network,” the group tweeted.

“There’s no evidence hardware wallets have been impacted — and users are strongly encouraged to use hardware wallets,” Solana Status said. “Wallets drained should be treated as compromised, and abandoned."

Blockchain analysis firm Elliptic tweeted that over $5.2 million in funds are gone.

"The stolen assets include SOL, a small number of non-fungible tokens (NFTs) and over 300 Solana-based tokens," the firm said.

Tupperware Brands jumped as much as 65% in Wednesday morning trading before giving back some gains.

The container maker topped Wall Street sales and profit estimates.

Tupperware reported said second quarter revenue fell 18% to $340.4 million, topping the analyst forecast of $321.4 million. The decrease was driven by lockdowns in China, and lower consumer sentiment in Europe.

Adjusted diluted earnings per share from continuing operations was 41 cents, almost double the 22 cent per share Wall Street estimate, but less than half the 90 cents per share the company reported a year ago in the comparable quarter.

“Our second quarter performance reflects our improving ability to respond to high inflation and supply chain challenges," chief financial officer Mariela Matute said.

Ford Motor reported total vehicle sales jumped 36.6% against an declining industry average. Electric vehicle sales were the standout jumping 168.7% as CEO Jim Farley continues to make the push into EVs.

U.S. stocks rose across the board led by the Nasdaq Composite after positive earnings from the likes of CVS and Moderna. Separately, Ford shares jumped after reporting a 36% rise in monthly sales. In commodities, oil was little changed, hovering at the $94 level, after OPEC agreed to a small production boost.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $15.16 | -0.18 | -1.17 |

| CVS | $95.37 | -0.65 | -0.68 |

| MRNA | $160.81 | -0.70 | -0.43 |

Warner Brothers Discovery, under the new direction of David Zaslav, may see a shakeup, according to FOX Business.

Prospective home buyers shopping for a 30-year fixed mortgage got a repreive last week. Here's why...

U.S. equity futures traded higher Wednesday morning, following losses in the prior session as political tensions were in focus over House Speaker Nancy Pelosi's visit to Taiwan.

The major futures indexes suggest a gain of 0.2% when trading begins.

Beijing announced a ban on imports of some Taiwanese goods but no immediate major penalties following the arrival of Pelosi.

Oil prices traded lower Wednesday morning ahead of a meeting OPEC+ producers on fears of a slowdown in global growth hitting fuel demand. West Texas Intermediate crude traded around $93.00 a barrel. Brent crude futures were around $99.00 a barrel.

PayPal shares are surging 10% in premarket trading. The online payments company has entered an information sharing agreement with activist investor Elliott Investment Management to evaluate capital return alternatives.

PayPal reported net revenues of $6.8 billion, up 9% year over year in the second quarter and a net loss of $341 million, or 29 cents per diluted share. Last year, the company recorded net income of $1.18 billion, or $1.00 per diluted share.

Airbnb shares dropped more than 7% in premarket trading after the company issued a weaker-than-expected outlook that overshadowed otherwise strong results.

Another busy day coming up for earnings, with a big focus on health care. We’ll hear from CVS Health, AmerisourceBergen, Moderna, and Regeneron Pharmaceuticals ahead of the opening bell. Also watch for hotel and casino play MGM Resorts, online auctioneer Ebay, and household products maker Clorox to name a few.

On the economic calendar, traders will watch for data on the services sector and manufacturing orders.

In Asia, the Shanghai Composite Index lost 0.7%, the Nikkei 225 in Tokyo rose 0.5% and the Hang Seng in Hong Kong added 0.4%.

Wall Street's benchmark S&P 500 index lost 0.7% on Tuesday after the Labor Department said American employers posted fewer job openings than expected in June following interest rate hikes to cool surging inflation.

The S&P 500 fell to 4,091.19. It is down nearly 1% this week. The Dow Jones Industrial Average lost 1.2% to 32,396.17. The Nasdaq composite slipped 0.2% to 12,348.76.

Oil prices traded lower Wednesday morning ahead of a meeting of OPEC+ producers on fears of a slowdown in global growth hitting fuel demand.

West Texas Intermediate crude traded around $93.00 a barrel. Brent crude futures were around $99.00 a barrel. There will be a meeting of OPEC+ on Wednesday, with the group expected to keep output unchanged in September, or raise it slightly.

Due to an outlook for weak demand as recession fears grow, top producer Saudi Arabia may be reluctant to beef up output.

Ahead of the meeting, OPEC+ trimmed its forecast for an oil market surplus this year by 200,000 barrels per day to 800,000. according to Reuters.

A stronger dollar, bolstered by comments from U.S. Federal Reserve officials hinting at more interest rate hikes to cool inflation, also weighed on oil prices as a firmer greenback makes oil more expensive for holders of other currencies.

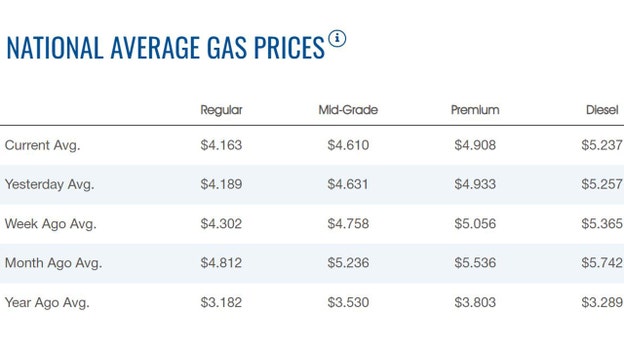

The average price of a gallon of gasoline slipped on Wednesday to $4.163, according to AAA. Gas was $4.189 on Tuesday. Gas has been on the decline since hitting a high of $5.016 on June 14. Diesel slipped as well to $5.237 from $5.257.

Bitcoin was around $23,000, trading lower in four of the last five days. For the past week, Bitcoin was trading higher by more than 8%. For the year, the cryptocurrency is down more than 50%.

Ethereum was trading at approximately $1,600 and is up more than 14% in the past week. Dogecoin was trading at 6 cents, up more than 7% in the past week.

Live Coverage begins here