STOCK MARKET NEWS: AMC Entertainment goes ‘Ape’ as DoorDash and Carvana gain after hours

Movie theater chain AMC declares special dividend, while DoorDash posts record orders and Carvana focuses on cost cutting. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

AMC Entertainment announced a special dividend to reward the meme stock investors who rescued the world’s largest theater chain from potential bankruptcy.

The company declared a special dividend one AMC Preferred Equity unit for each share of AMC Class A common stock as of the close of business on August 15.

“Today we are rewarding and recognizing our passionate and supportive shareholders, both to our shareholders in the U.S. and internationally, with a dividend of AMC Preferred Equity units that will trade on the NYSE [New York Stock Exchange] under the ticker symbol APE,” chair and chief executive Adam Aron said.

AMC reported second quarter revenue of $1.17 billion compared to o $444.7 million a year ago boosted by blockbusters including “Top Gun: Maverick.” The Wall Street estimate was $1.16 billion.

The net loss narrowed to $121.6 million from $344 million.

DoorDash on Thursday said it received a record number of customer orders in the second quarter, boosted by resilient demand and its acquisition of Finnish delivery service Wolt Enterprises.

DoorDash said orders grew 23% to 426 million in the April-June period, surpassing Wall Street’s expectations. Analysts polled by FactSet forecast total orders of 419 million. The delivery company's gross order volume jumped 25% to $13 billion, also beating expectations.

Based on the strong results, San Francisco-based DoorDash raised its full-year order forecast. The company now expects gross order volumes between $51 billion and $53 billion, up from the $49 billion to $51 billion range it forecast earlier this year.

DoorDash shares jumped 14% in after-hours trading.

DoorDash said its net loss for the quarter more than doubled to $263 million as it closed the $8.1 billion acquisition of Wolt.

DoorDash announced in November its plan to buy Wolt, which operates in 22 countries where DoorDash has no presence, including Germany, Sweden, Hungary and Israel.

Carvana is higher in after hours trading. The online used car retailer expects sequential improvement in selling, general and administrative expenses (SG&A) per retail unit sold in the third and fourth quarters.

The company reported second quarter revenue of $3.884 billion, up 16% from last year. Wall Street was looking for $3.977 billion.

Retail units sold grew 9% to 117,564.

Carvana posted a net loss of $439 million, or $2.35 per share, compared to a year ago profit of $45 million. The mean analyst estimate according to Refinitiv was for a loss of $1.86 per share.

The company retailer launched a co-signer option in South Carolina.

U.S. stocks seesawed between losses and gains ending the session mixed with the Nasdaq Composite posting a 0.4% gain, while the Dow Jones Industrial Average and S&P 500 closed lower with oil companies Chevron and ExxonMobil big drags as crude fell to $88.54 per barrel the lowest level since February.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLE | $71.74 | -2.68 | -3.60 |

| XOM | $87.19 | -3.83 | -4.21 |

| CVX | $151.55 | -3.81 | -2.45 |

| USO | $71.44 | -2.09 | -2.84 |

Facebook-parent Meta Platforms META.O said on Thursday it would make its first-ever bond offering, at a time when the social media company is making massive investments to fund its virtual reality projects.

While Meta did not disclose the size of the offering, IFR News reported the bond sale could fetch between $8.5 billion and $10 billion, citing a source familiar with the matter.

The company said it would use the proceeds for capital expenditures, share repurchases, acquisitions or investments.

Meta received an 'A1' rating from Moody's and an 'AA- rating' and a 'stable' outlook from S&P.

Among big technology companies, Meta is the only one that does not have any debt on its books.

Meta's bond issuance will come after the company issued a gloomy forecast and recorded its first-ever quarterly drop in revenue, with recession fears and competitive pressures weighing on its digital ads sales.

Ball Corp is lower in mid-day trading. The maker of glass jars for home canning is ceasing production at its Phoenix, Arizona, and St. Paul, Minnesota, facilities due to lower customer demand. The company is also delaying construction of a new beverage can manufacturing facility in North Las Vegas, Nevada.

"To balance the near-term effects of economic volatility on consumer demand with long-term growth opportunities for our aluminum packaging portfolio and aerospace technologies, the global team has initiated actions to rephase capital projects and further manage costs to maximize EVA [economic value added], cash, and returns," Ball said.

Second quarter net sales rose 19.5% to $4.1 billion, topping Wall Street expectations. Seven analysts surveyed by Zacks were looking for $3.93 billion.

The company lost $165 million in the quarter compared to a profit of $202 million last year.

Comparable diluted earnings per share were 82 cents. Wall Street was expecting 90 cents.

Coinbase roared out the gate in Thursday trading, briefly gaining more than 40% before giving back some gains.

BlackRock selected the company to provide institutional clients of Aladdin, BlackRock’s end-to-end investment management platform, with direct access to crypto, starting with bitcoin, through connectivity with Coinbase Prime.

Coinbase Prime will provide crypto trading, custody, prime brokerage, and reporting capabilities to Aladdin’s Institutional client base who are also clients of Coinbase.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CROX | $67.33 | -10.05 | -12.99 |

Crocs plunged almost 15% in early morning trading, before cutting losses. The maker of foam clogs cut its full year forecast.

The company now expects consolidated revenues of $3.395 to $3.505 billion, representing growth between 47% and 52% compared to 2021. Last quarter Crocs forecast revenues of $3.5 billion, representing growth between 52% and 55%.

The company offered a improved outlook for its HEYDUDE brand, with implied revenues of $940 to $980 million compared to the previous forecast of $840 to $890 million.

Crocs reported second quarter revenue of $964.6 million, up 50.5% year over year, topping the Wall Street estimate of $937.4 million.

Crocs Brand digital sales grew 16.8%, representing 37.2% of brand revenues versus 36.4% in prior year.

Net income fell 50% to $160.3 million.

Adjusted diluted earnings per share increased 45.3% to $3.24 compared to $2.23 in 2021. The analyst estimate was $2.66.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FMCC | $0.58 | -0.00 | -0.74 |

Freddie Mac said the 30-year fixed rate slid to 4.99%, down 0.8% from 5.30% reported in last week’s survey. A year ago, the 30-year rate stood at 2.77%.

“Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth,” Freddie Mac’s chief economist Sam Khater said.

• The 15-year rate fell 0.6% to 4.26%. A year ago, those mortgages were averaging 2.10%.

• Five-year Treasury indexed hybrid adjustable-rate mortgages dropped 0.3% to 4.25%. A year ago, the rate was 2.40%.

The news comes as weekly jobless claims rose to 260,000, slightly below the eight-month high of 261,000 recorded in mid-July.

Shares of consumer product giant Clorox fell after quarterly revenue and profit missed Wall Street expectations. Fiscal fourth-quarter sales were flat at $1.8 billion., missing the estimate for $1.86 billion. Organic sales did grow 1%. Profit rose 4% to $101 million, or 81 cents per share. Adjusted earnings were 93 cents, below the analyst estimate of 95 cents.

U.S. stocks opened mixed with the Nasdaq Composite notching modest gains while the Dow Jones Industrial Average and S&P 500 slipped. Investors digested an uptick in weekly jobless claims ahead of Friday's employment report for July. In commodities, oil traded lower to the $89 per barrel level.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $73.53 | -2.40 | -3.16 |

| BNO | $30.27 | -1.05 | -3.35 |

Jobless claims came in higher than estimates a potential red flag ahead of Friday's employment report for the month of July.

U.S. equity futures traded higher Thursday morning, following an earnings-powered trading session on Wednesday.

Oil prices traded choppy on Thursday after U.S. data signaled weak fuel demand.

West Texas Intermediate (WTI) crude futures traded around $90.00 a barrel. Brent crude futures traded at $96.00 a barrel.

Clorox shares are 6% lower in premarket trading after quarterly revenue and profit missed Wall Street expectations. Fiscal fourth-quarter sales were flat at $1.8 billion, missing the estimate for $1.86 billion. Organic sales did grow 1%.

Ebay shares are 0.8% higher in premarket trading. The online marketplace topped Wall Street revenue estimates. Second quarter revenue fell 9% to $2.4 billion, but was still higher than the analysts' estimate of $2.37 billion. The company is forecasting negative third quarter and full year organic growth.

Another busy day ahead for 2Q earnings season. Morning results include Cigna, Paramount Global, ConocoPhillips and Eli Lilly. Afternoon highlights will include Warner Brothers Discovery, Live Nation, and Expedia.

The economic calendar will focus on jobless claims and the U.S. trade deficit.

In Asia, Japan's benchmark Nikkei 225 added 0.7%, Hong Kong's Hang Seng rose 2.1% and China's Shanghai Composite climbed 0.8%.

On Wall Street, the S&P 500 rose to 4,155.17, an almost 2-month high. The Nasdaq gained 2.6% to 12,668.16. The Dow Jones Industrial Average rose 1.3% to 32,812.50.

The yield on the 10-year Treasury was at 2.72% on Thursday.

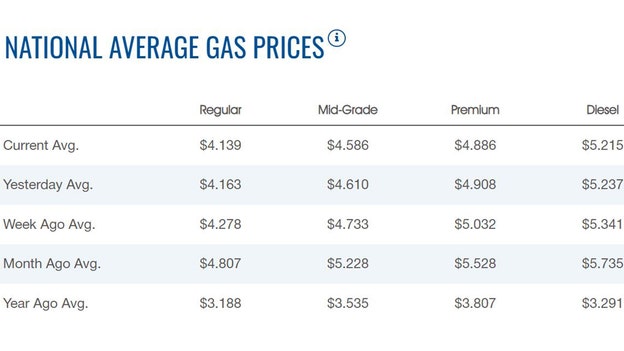

The average price of a gallon of gasoline slipped on Thursday to $4.139, according to AAA. Gas was $4.163 on Wednesday. Gas has been on the decline since hitting a high of $5.016 on June 14. Diesel slipped as well to $5.215 from $5.237.

Oil prices bounced between gains and losses on Thursday after U.S. data signaled weak fuel demand.

West Texas Intermediate (WTI) crude futures traded around $90.00 a barrel. Brent crude futures traded at $96.00 a barrel.

Both benchmarks fell to their weakest levels since February in the previous session after U.S. data showed crude and gasoline stockpiles unexpectedly surged last week.

OPEC+ also agreed to raise its oil output target by 100,000 barrels per day.

U.S. crude oil inventories rose unexpectedly last week as exports fell and refiners lowered runs, while gasoline stocks also posted a surprise build as demand slowed, the Energy Information Administration said.

Bitcoin was trading around $23,000 after snapping a three-day losing streak. In the past week, Bitcoin has lost 0.3%. For the year, the cryptocurrency has lost more than 49%.

Ethereum was trading at $1,600, slipping 1% in the past week. Dogecoin was trading at 6 cents, off more than 1% in the past week.

Live Coverage begins here