STOCK MARKET NEWS: Dow rises, S&P, Nasdaq slip, Telsa stock to split, Pfizer explores deal

The major U.S. stock averages ended mixed as job growth surges and Telsa announces 3-for-1 stock split. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Customers of bankrupt crypto marketplace Voyager Digital will be allowed to make cash withdrawals from their account beginning Thursday, August 11.

“We anticipate customers will receive their funds in about 10 business days after making their requests,” Voyager said after a bankruptcy court approved the company's plan to restore customer access.

The company suspended trading, deposits, withdrawals and loyalty rewards on July 1 and filed for bankruptcy July 6.

Tesla is splitting its stock for the second time in two years. The split will be executed in the form of a stock dividend with shareholders of record on August 17 receiving a dividend of two additional shares of common stock for each then-held share.

The additional shares will be distributed after close of trading on August 24. Trading will begin on a stock split-adjusted basis on August 25.

Elon Musk’s company aims to make stock ownership more accessible to employees and investors.

Tesla shares closed Friday at $864.51 per share, but are falling in after-hours trading.

Shareholders approved the split Thursday.

Texas utility Oncor saw profit grow by a 35%, or $60 million, in the second quarter as the Lonestar Star state endures one of the hottest summers in recent memory.

Texas set several peal demand records during the three months ended June. Weather in Oncor’s service territory was the warmest since 1990 with 208 more cooling degree days than normal based on 20-year averages.

Oncor’s second quarter report comes as the U.S. heads for another hot weekend. Sempra Energy is Oncor’s indirect majority owner.

U.S. stocks ended a choppy day and week mixed. The Dow Jones Industrial Average rose 74 points helped by JPMorgan and Chevron but fell for the week. While the Nasdaq Composite and S&P 500 ended the session modestly lower but notched slight weekly gains. In commodities, oil fell over 9% for the week ending at $89.01 per barrel.

Former CKE Restaurants CEO explains the 'positive' July jobs report is hiding a bigger problem in the work force on 'Cavuto: Coast to Coast.'

JPMorgan and Chevron helped the Dow Jones Industrial Average curb a bulk of its losses Friday afternoon with two hours left in the trading session. The weakest performers included Disney and Cisco.

For the second time this week, Amazon makes a strategic aquisition.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CPS | $8.60 | 3.57 | 70.97 |

Auto parts supplier Cooper-Standard is soaring in Friday trading after topping Wall Street revenue and profit forecasts.

Sales grew 13.6% to $605.9 million, topping the analyst estimate of $576 million.

The net loss was $33.2 million, or $1.93 per share. The adjusted net loss per diluted share was $3.40, better than the estimate of $3.48.

The company said it has begun to see “some improvements” in global market conditions and production levels in the final four weeks of the quarter.

"With further improvements in global production volume expected in the remainder of the year, combined with continuing cost reduction initiatives and anticipated incremental positive impact from our enhanced commercial agreements, we continue to expect to deliver full year adjusted EBITDA in line with our original guidance,” said chair and CEO Jeffrey Edwards.

The company sales its full year sale outlook. It now sees sales of $2.6 - $2.8 billion, up from $2.5 - $2.7 billion.

Cinemark followed competitor AMC Entertainment lower in Friday morning trading.

The third largest North American movie theater chain after AMC and Cineworld unit Regal Cinemas reported a quarterly loss instead of quarterly profit. Revenue topped Wall Street estimates.

Second quarter revenue rose 152.6% to $744.1 million for the highest total since the onset of the coronavirus pandemic.

The net loss was $73.4 million, or 61 cents per diluted share. That was smaller than the $1.19 loss from the same quarter last year, but Wall Street was expecting profit of 22 cents.

In spite of the loss, the company said: “We believe Cinemark remains exceptionally well-positioned to navigate the ongoing recovery of our industry and fully capitalize on its continued resurgence.”

AMC on Thursday booked a larger-than-expected loss on surging costs.

The Nasdaq Composite led a broad decline in equities as investors speculate the Federal Reserve may be more aggressive with future rate hikes after the stronger-than-expected July jobs report that showed the addition of 528,000 roles. Elsewhere, Amazon is buying Roomba for $1.7 billion. In commodities, oil hovered around the $87 per barrel level.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMZN | $142.57 | 3.05 | 2.19 |

Inside's AMC's latest quarterly results and its special dividend.

Job growth in July blew past expectations as employers added 528,000 jobs with the unemployment rate falling to 3.5%.

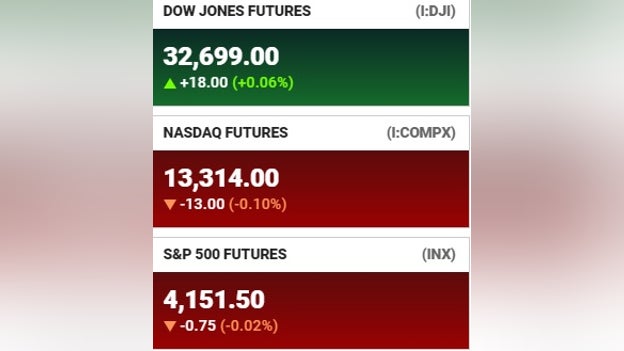

U.S. stock futures are little changed ahead of the release of the July jobs report.

The data from the Labor Department that will be released at 8:30 a.m. ET on Friday is expected to show that payrolls increased by 250,000 last month and the unemployment rate held steady at 3.6%, according to a median estimate by Refinitiv economists.

U.S. job growth likely cooled off in July, suggesting that headwinds from the highest inflation in four decades and rising interest rates are starting to weigh on the labor market.

The Labor Department on Friday morning is releasing its closely watched July jobs report , which is projected to show that payrolls increased by 250,000 last month and the unemployment rate held steady at 3.6%, according to a median estimate by Refinitiv economists.

U.S. equity futures are mixed ahead of the most anticipated economic report of the month.

The major futures indexes are trading between gains and losses.

Oil traded choppy on Friday, attempting a rebound from the previous session, as supply shortage concerns were beating fuel demand worries.

West Texas Intermediate crude traded around $89.00 a barrel. Brent crude was at $94.00 a barrel.

The key economic report of the week comes before the opening bell when the Labor Department is expected to say the U.S. economy added 250,000 new nonfarm jobs in July. "It won't be like the 372,000 we saw in June," said Joanie Bily, Workforce Analyst at Employbridge. "We could see revisions and even see June's number revised."

it would mark the weakest job growth since December 2020, consistent with other data showing cooling labor market. The unemployment rate is anticipated to hold steady at 3.6% for the fifth month in a row.

AMC Entertainment shares are 7% lower in premarket trading after the company reported a bigger-than-expected loss and announced it will pay a special dividend in the form of preferred shares.

DoorDash shares are 11% higher in premarket trading after the company said it received a record number of customer orders in the second quarter, boosted by resilient demand and its acquisition of Finnish delivery service Wolt Enterprises.

The second-busiest week of 2Q earnings season wraps up Friday morning with results from Goodyear Tire, data storage giant Western Digital, broadcasters Gray Television and AMC Networks, movie theater operator Cinemark Holdings, and fantasy and sports betting giant DraftKings among many others.

In Asia, the Nikkei 225 in Tokyo gained 0.9%, the Hang Seng in Hong Kong rose 0.2% and China's Shanghai Composite Index advanced 1.2%.

On Wall Street, the benchmark S&P 500 index closed 0.1% lower on Thursday while investors digested corporate earnings reports and waited for the jobs data.

The S&P 500 declined to 4,151.94 and the Dow Jones Industrial Average fell 0.3% to 32,726.82. The Nasdaq composite rose 0.4% to 12,720.58.

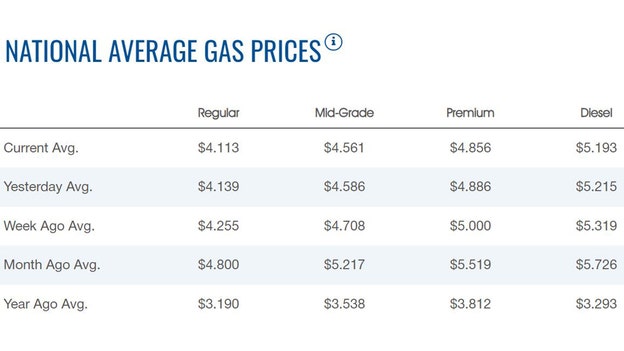

The average price of a gallon of gasoline slipped on Friday to $4.113, according to AAA. Gas was $4.139 on Thursday. Gas has been on the decline since hitting a high of $5.016 on June 14. Diesel slipped as well to $5.193 from $5.215.

Oil prices have rebounded from the previous session, as supply shortage concerns were beating fuel demand worries.

West Texas Intermediate crude traded around $89.00 a barrel. Brent crude was at $94.00 a barrel.

Oil prices have been pressured this week over economic growth concerns. OPEC+ announced this week it will raise its oil output goal in September by 100,000 barrels per day.

Investors are focused on the U.S. employment report to be released later in the day, which is expected to show nonfarm payrolls increased by 250,000 jobs last month, a slowdown from June.

Bitcoin was trading around $23,000, after trading lower in four of the last five days. Bitcoin is off nearly 5% in the past week. For the year, the cryptocurrency is down more than 51%.

Ethereum was trading around $1,600, down more than 6% in the past week.

Dogecoin was just short of 7 cents, down 2% in the past week.

Live Coverage begins here