STOCK MARKET NEWS: Inflation cools, Salesforce co-CEO resigns, FTX’s SBF speaks out

Stocks finished mixed ahead of Friday's jobs report, the Fed's top inflation gauge cools, Sam Bankman-Fried speaks out. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CP | $82.65 | 0.74 | 0.90 |

| CNI | $128.57 | 0.14 | 0.11 |

| CSX | $32.60 | -0.09 | -0.28 |

| NSC | $256.19 | -0.31 | -0.12 |

| UNP | $215.55 | -1.88 | -0.86 |

The U.S. Senate backed a measure to block a potentially devastating railroad strike after President Joe Biden had warned that the economic impacts could have been felt in the coming days.

At least 73 senators voted to impose a tentative contract deal reached in September on 115,000 workers after four of 12 unions rejected the deal.

The Senate earlier defeated a bid to require railroads to offer workers seven days of paid sick leave.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BLK | $718.36 | 2.36 | 0.33 |

Florida's Chief Financial Officer said on Thursday his department would pull $2 billion worth of its assets managed by BlackRock Inc, the biggest such divestment by a state opposed to the asset manager's environmental, social and corporate governance (ESG) policies.

The move will hardly dent BlackRock's $8 trillion in assets and drew a strong response from the company, which said the action put politics over investor interests. Nonetheless it underscores how a backlash among many Republican leaders, such as those in Florida, against ESG investing, which they see as promoting a "woke agenda" is gathering steam.

Republicans are set to assume control of the U.S. House of Representatives in January. This will allow them to hold hearings on ESG and grill the chief executives of BlackRock and other major assets managers about their ESG policies, and also pressure regulators to scrutinize them.

In a statement, Florida CFO Jimmy Patronis said the state's Treasury, which he oversees, would remove BlackRock as manager of about $600 million of short-term investments and have its custodian freeze $1.43 billion of long-term securities now with BlackRock, with an eye on reallocating the money to other money managers by the start of 2023.

Patronis accused BlackRock of focusing on ESG rather than higher returns for investors.

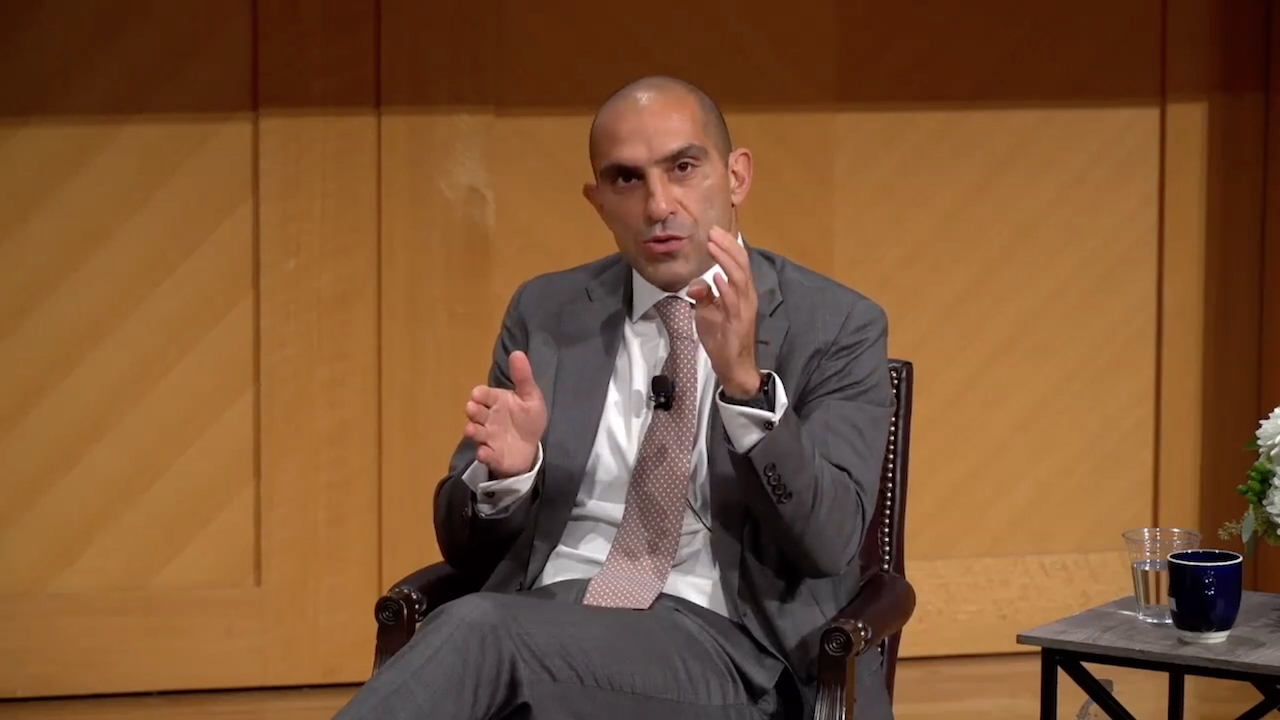

Economist Austan Goolsbee has been named president and chief executive officer of the Federal Reserve Bank of Chicago effective Jan. 9, 2023. He succeeds Charles Evans, who is retiring in January.

Goolsbee will fulfill the remainder of President Evans’ current five-year term that commenced on Mar. 1, 2021 and ends on Feb. 28, 2026 at which time he will be considered for reappointment.

He is currently the Robert P. Gwinn Professor of Economics at the University of Chicago Booth School of Business where he is in his 28th year on the faculty. He previously served in Washington as Chair of the Council of Economic Advisers and a member of the President’s cabinet.

Ye is not longer interested in buying Parler.

The artist formerly known as Kanye West had planned to purchase Parler, a social media platform devoted to free speech and making its users "uncancelable."The acquisition was expected to close by year end.

KANYE WEST TO BUY PARLER, VOWS TO MAKE CONSERVATIVE OPINIONS 'UNCANCELABLE'

President Joe Biden’s student loan forgiveness program is headed for the Supreme Court.

The case likely won't be decided until around June, around the same time the pause on loan repayments is set to expire.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ASAN | $18.08 | -0.08 | -0.44 |

Asana is plunging in extended trading. The work management platform topped Wall Street estimates but lowered its fiscal 2023 forecast.

The company expects revenues of $541.0 million to $543.0 million, representing year over year growth of 43%. The previous forecast was for revenues of $544.0 million to $547.0 million, representing year over year growth of 44% to 45%.

Fiscal third quarter revenue rose 41% to $141.4 million.

The GAAP operating loss was $101.1 million, or 71% of revenues, compared to GAAP operating loss of $68.1 million, or 68% of revenues, in the third quarter of fiscal 2022.The non-GAAP net loss per share of $0.23, topping the estimate of a net loss of $0.32 per share.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CRM | $146.91 | -13.34 | -8.32 |

U.S. stocks ended a choppy session with the Nasdaq Composite posting fractional gains while the S&P and Dow Jones Industrial Average slipped as Salesforce shares sank over 8% following the CEO shake-up. In commodities, oil rose 0.8% to $81.22 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PRTY | $0.66 | -0.05 | -6.97 |

Party City has reportedly resumed talks with creditors over liquidity.

Bloomberg, citing people with knowledge of the situation, said the company is working with longstanding advisors Moelis & Company and law firm Paul Weiss Rifkind Wharton & Garrison.

Standard & Poor’s downgraded Party City last month on worsening macro conditions and tightening liquidity.

The ratings agency views the company’s capital structure as unsustainable and said it could pursue a restructuring within the next 12 months.

“Given the weak business trends and upcoming [debt] maturities, we believe a proactive restructuring is increasingly likely. Additionally, we believe distressed trading on the company's notes creates an economic incentive for the company to purchase the debt below par, which we may consider tantamount to a default in the future,” S&P said,

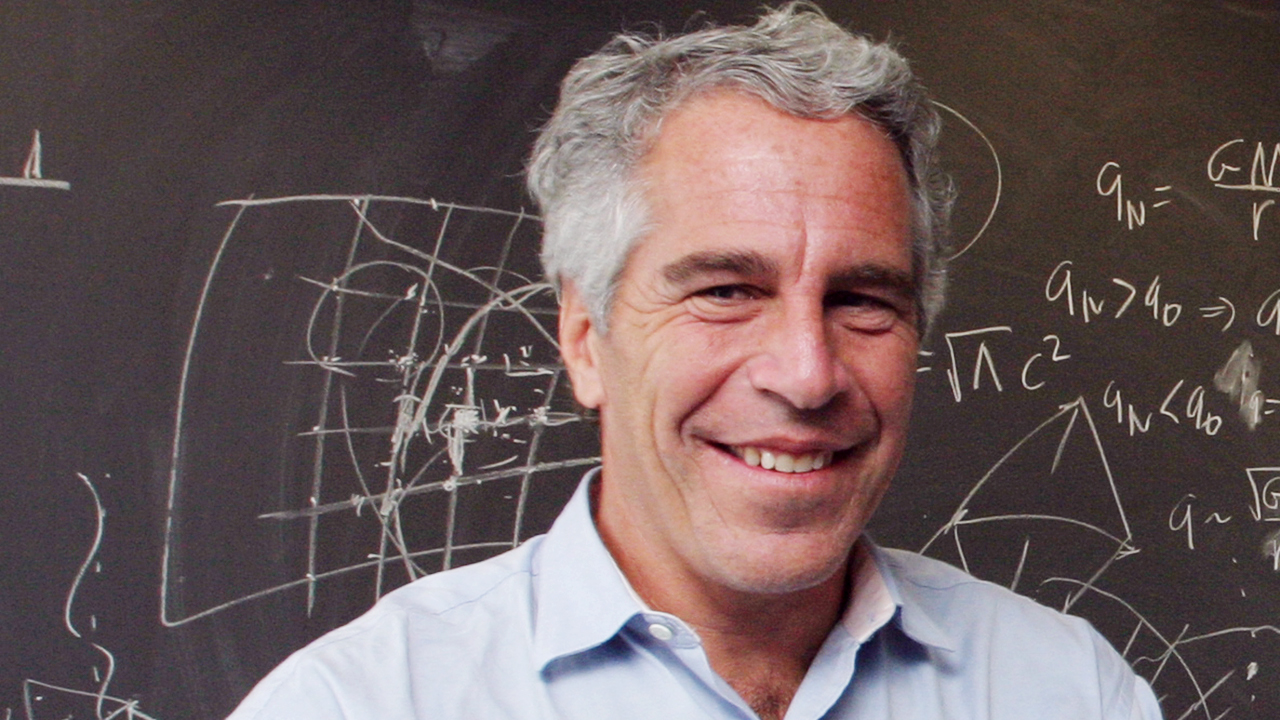

Jeffrey Epstein's estate has reached a nine-figure settlement with the U.S. Virgin Islands to settle claims the disgraced late financier used the territory as a base for his decades-long sex-trafficking operation.

Denise George, the territory's attorney general, on Wednesday said the estate will pay $105 million in cash plus half the proceeds from the sale of Little St. James, a private island where Epstein lived and allegedly conducted many crimes.

The settlement includes the return of more than $80 million in tax benefits that one of Epstein's companies, Southern Trust Co, obtained fraudulently to fuel his criminal activity, George said.

Daniel Weiner, a lawyer for the estate, said there was no admission of liability, and the estate's executors Darren Indyke and Richard Kahn denied wrongdoing. Indyke and Kahn had been longtime business advisers to Epstein.

Economic activity in the manufacturing sector contracted in November for the first time since May 2020 after 29 consecutive months of growth, say the nation's supply executives in the latest Manufacturing ISM Report on Business.

The November manufacturing purchasing manager’s index registered 49%, 1.2 percentage points lower than the 50.2% recorded in October.

The manufacturing PMI figure was the lowest since May 2020, when it registered 43.5%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LLY | $372.04 | 0.96 | 0.26 |

Eli Lilly and Co's COVID-19 drug bebtelovimab is not currently authorized for emergency use in the United States, the Food and Drug Administration said, citing it is not expected to neutralize the dominant BQ.1 and BQ.1.1 subvariants of Omicron.

Wednesday's announcement takes away authorization from the last COVID-19 monoclonal antibody treatment, leaving Pfizer Inc's antiviral drug Paxlovid, Merck's Lagevrio and Gilead Sciences' Veklury as treatments for the disease, besides convalescent plasma for some patients.

Eli Lilly and its authorized distributors have paused commercial distribution of the monoclonal antibody until further notice from the agency, while the U.S. government has also paused fulfillment of any pending requests under its scheme to help uninsured and underinsured Americans access the drug.

The drug, which was discovered by Abcellera and commercialized by Eli Lilly, received an authorization from the FDA in February.

The average long-term U.S. mortgage rate ticked down for the third week in a row and have fallen more than a half-point since hitting a 20-year high less than a month ago.

Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate fell to 6.49% from 6.58% last week. A year ago the average rate was 3.11%.

The rate for a 15-year mortgage, popular with those refinancing their homes, edged down to 5.76% from 5.90% last week. It was 2.39% one year ago.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| KR | $48.34 | -0.85 | -1.74 |

Kroger Co raised its annual same-store sales and profit forecasts on Thursday, boosted by steady demand for groceries and household essentials, and as it kept prices relatively cheaper than rivals.

Kroger forecast fiscal 2022 adjusted same-store sales growth of 5.1% to 5.3%, compared with a 4% to 4.5% rise previously. It lifted its annual earnings per share forecast to between $4.05 and $4.15 from $3.95 to $4.05.Kroger's blowout quarterly results and forecast are not expected to add to anti-competition concerns regulators have regarding the company's Albertsons acquisition, according to Sundaram.

"Politicians will use the quarterly results as more ammo to push back on the merger, but the topics the FTC (U.S. Federal Trade Commission) is looking at are more to do with grocery market share and store divestment, rather than Kroger's top and bottom line this quarter," Sundaram said.Kroger's same-store sales, excluding fuel, climbed 6.9% in the third quarter ended Nov. 5, beating estimates of 4.5%, according to Refinitiv IBES data.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FIVE | $183.05 | 22.19 | 13.79 |

Five Below topped Wall Street revenue and profit estimates, sending shares higher.

Fiscal third quarter net sales increased by 6.2% to $645.0 million, which is higher than the estimated $613 million. Comparable sales decreased by 2.7% for the three months ended Oct. 29.

Net income was $16.1 million compared to $24.2 million in the third quarter of fiscal 2021.

The company reported profits of 29 cents per share. Profits of 14 cents per share were anticipated by the twenty analysts providing estimates for the quarter.

Joel Anderson, President and CEO of Five Below, said, “We delivered third quarter results that were better than our guidance in spite of the difficult macro environment and challenging year-over-year comparison. Our performance was driven by ticket and transaction metrics that improved throughout the quarter, disciplined expense management and continued focus on our long-term Triple Double vision.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LE | $8.44 | -3.12 | -26.97 |

Lands’ End is lower in Thursday trading. The uni-channel retailer of casual clothing, accessories, footwear and home products missed Wall Street revenue and profit estimates.

Fiscal third quarter net revenue decreased 1.3% to $371.0 million. The estimate was $383.36 million.

The net loss was $4.7 million, or $0.14 loss per diluted share. This compares to net income of $7.4 million or $0.22 earnings per diluted share in the third quarter of fiscal 2021.

Profits of 7 cents per share were anticipated by the three analysts providing estimates for the quarter.

Jim Gooch, President and Chief Financial Officer, continued, “We have revised our full year outlook to account for the uncertain macro environment. We anticipate that the fourth quarter will be highly promotional and we plan to remain competitive with our pricing to drive traffic through the holiday season.”

Reuters contributed to this report.

The Congressional Budget Office sees higher interest rates, higher inflation, and slower economic growth ahead.

Those conditions will give households less buying power and lead to larger deficits for the federal government," the CBO said.

The agency expects 2023 gross domestic product, adjusted for higher inflation, to range from -2.0% to 1.8%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BIG | $17.17 | -2.30 | -11.84 |

Big Lots Inc. on Thursday reported a loss of $103 million in its fiscal third quarter.

The Columbus, Ohio-based company said it had a loss of $3.56 per share. Losses, adjusted for asset impairment costs, were $2.99 per share.

The results did not meet Wall Street expectations. The average estimate of seven analysts surveyed by Zacks Investment Research was for a loss of $2.92 per share.

The discount retailer posted revenue of $1.2 billion in the period, which also fell short of Street forecasts. Six analysts surveyed by Zacks expected $1.21 billion.

Big Lots shares have dropped 57% since the beginning of the year. The stock has declined 55% in the last 12 months.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DG | $232.43 | -23.15 | -9.06 |

Dollar General Corp. on Thursday reported fiscal third-quarter net income of $526.2 million.

On a per-share basis, the Goodlettsville, Tennessee-based company said it had net income of $2.33.

The results fell short of Wall Street expectations. The average estimate of 23 analysts surveyed by Zacks Investment Research was for earnings of $2.55 per share.

The discount retailer posted revenue of $9.46 billion in the period, beating Street forecasts. Twenty-two analysts surveyed by Zacks expected $9.43 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BX | $85.74 | -5.79 | -6.33 |

| VICI | $33.92 | -0.28 | -0.80 |

Blackstone Inc will sell its 49.9% stake in the joint venture that owns the MGM Grand Las Vegas and Mandalay Bay resorts to co-owner VICI Properties Inc for about $1.27 billion in cash, the companies said on Thursday.

The deal includes the assumption of Blackstone Real Estate Investment Trust's (BREIT) existing property-level debt that has a principal balance of $3 billion.

The New York-based private equity firm is paring some real-estate investments as interest rates climb and turmoil brews in the housing market. The company was set to sell a $400 million stake in Indian REIT Embassy, Reuters has reported.

The stake sale in the two Las Vegas resorts will generate a profit of more than $700 million for Blackstone in less than three years, including rent from the operator, the Wall Street Journal, which first reported the deal said.

VICI Properties, which owns properties such as the Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, expects the deal to be immediately add to adjusted funds from operations (AFFO) per share upon closing.

The sale is expected to be completed early in the first quarter of 2023.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $195.65 | 0.95 | 0.49 |

Tesla Inc will issue software updates for more than 435,000 vehicles in China to fix an issue with side marker lights that could in extreme circumstances lead to a collision, a regulatory body said.

The fix, which counts as a recall, will be issued by an over-the-air update.

It covers 142,277 Model 3 cars and 292,855 Model Ys, according to a statement by the State Administration for Market Regulation.

The electric vehicle giant also recalled more than 80,000 Model S, Model X and Model 3 cars last week in China for software and seat belt issues.

Separately, Tesla's retail sales in China nearly doubled in the Nov. 1 to Nov. 27 period from a year earlier, brokerage data showed, after the company cut prices for the Model 3 and Model Y and offered incentives.

As Sam Bankman-Fried makes the media rounds, lawmakers are grilling regulators to find out what exactly happened with the FTX blowup.

One agency in particular, the CFTC, is in the crosshairs.

Stock investors are attempting to keep the rally, driven by Federal Reserve Chairman Powell’s signal that smaller rate hikes are in the cards, going Thursday with the S&P and Nasdaq marching higher. The Dow Jones Industrial Average slipped as shares of Salesforce tumbled after Co-CEO Bret Taylor abruptly resigned leaving Marc Benioff solo at the helm. In commodities, oil rose nearly 3% to the $83 per barrel level.

The Fed's preferred measure of inflation cooled slightly but remains problematic.

The chairman of the Commodity Futures Trading Commission will be in the hot seat on Capitol Hill.

Bitcoin was trading around $17,000, after trading higher in four of the last five days.

For the week, Bitcoin has gained more than 3%.

For the month, the cryptocurrency was down more than 16% and is down 63% year-to-date.

Ethereum was trading around $1,200, after gaining more than 9% in the past week.

Dogecoin was trading at 10 cents, after gaining more than 31% in the past week.

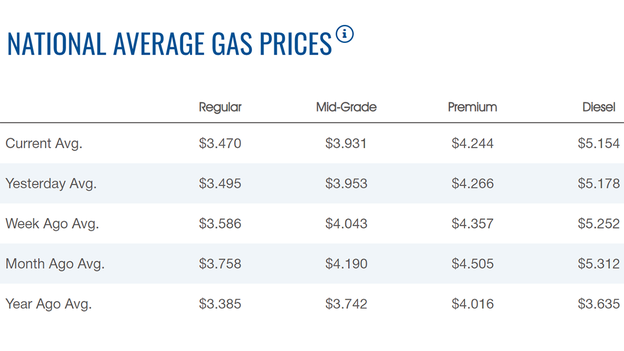

The nationwide price for a gallon of gasoline slipped Thursday to $3.470, according to AAA.

The average price of a gallon of gasoline on Wednesday was $3.495.

One week ago, a gallon of gasoline cost $3.586. A month ago, that same gallon of gasoline cost $3.758.

Gas hit an all-time high of $5.016 on June 14.

Diesel declined to $5.154.

Oil traded higher Thursday ahead of a weekend meeting of OPEC+ which may cut supply further.

U.S. West Texas Intermediate crude futures traded around $80.00.

Brent crude was trading around $86.00 a barrel.

Crude gained further support, and the U.S. dollar weakened, after the Federal Reserve Chair opened the door to a slowdown in the pace of rate hikes.

Dollar weakness makes oil cheaper for other currency holders and tends to support risk assets, according to Reuters.

A slide in U.S. crude inventories in weekly data added further price support.

Live Coverage begins here