STOCK MARKET NEWS: Stocks finish higher, FedEx accelerates cost reductions, oil gains

Stocks snap four-day losing streak, FedEx identifies $3.7B in cost savings, Nike tops estimates. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAL | $12.53 | 0.05 | 0.40 |

| DAL | $32.90 | -0.02 | -0.06 |

| LUV | $36.39 | 0.04 | 0.11 |

| UAL | $38.55 | 0.57 | 1.50 |

Airlines are issuing travel waivers ahead of storm front moving from the Pacific Northwest, across the Great Lakes and Ohio Valley and into the Northeast and New England.

The weather system could turn into a bomb cyclone in the Midwest and Great Lakes this week, just days ahead of Christmas.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AEL | $43.12 | 2.82 | 7.00 |

American Equity Investment Life Holding is rejecting an unsolicited, non-binding proposal from Prosperity Group Holdings and its principal shareholder, Elliott Investment Management.

Prosperity and Elliott offered $45.00 per share in cash.

“Consistent with its fiduciary obligations and in consultation with independent financial and legal advisors, the Board has carefully evaluated Prosperity and Elliott’s opportunistic proposal and unanimously determined that it significantly undervalues the company,” said chair David Mulcahy.

American Equity provides financial dignity solutions through general account annuities.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NKE | $102.19 | -0.85 | -0.83 |

Nike Inc beat Wall Street estimates for quarterly revenue on Tuesday, helped by persistent demand for its sneakers and sportswear in North America and Europe.

Shares of the company rose marginally in extended trading.

Nike reported a 30% jump in its largest market, North America, helping offset a sales slump in China after COVID-related restrictions in the country impacted sales in the region.

The world's largest sportswear maker said revenue rose to $13.32 billion for the second quarter from $11.36 billion a year earlier. Analysts had expected $12.57 billion, according to IBES data from Refinitiv.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FDX | $164.35 | -4.43 | -2.62 |

FedEx is prioritizing actions to quickly reduce costs in order to align fiscal 2023 costs with weaker-than-expected volume.

The package delivery company has identified an incremental $1 billion in cost savings beyond its September forecast, and now expects to generate total fiscal 2023 cost savings of approximately $3.7 billion relative to its initial fiscal 2023 business plan.

The company also said it is unable to provide a fiscal 2023 earnings per share or effective tax rate (ETR) outlook on a GAAP basis due to fiscal 2023 mark-to-market (MTM) retirement plans accounting adjustments.

Fiscal second quarter revenue fell to $22.8 billion from $23.5 billion.

Net income for the three months ended Nov. 30 was $788 million, down from $1.04 billion.

Stocks finished the day with gains for the first time in four days.

• The Dow Jones Industrial Average added almost 0.3%.

• The S&P 500 finished the day up over 0.1%.

• The Nasdaq Composite barely rose above break even, up .01%.

Equities opened the day lower after the Bank of Japan surprised investors with a surprise tweak to bond yield control, allowing long-term interest rates to rise more in a move aimed at easing some of the costs of prolonged monetary stimulus.

"Japan has been consistently consistent for many years," said Matthew Keator, managing partner in the Keator Group, a wealth management firm in Lenox, Mass. "The slightest tweak in their policy has investors scratching their heads as to how to interpret that going forward."

Stocks rebounded within an hour as equity investors shopped for bargains.

Oil prices ended higher on Tuesday in a volatile session as a worsening outlook for a major U.S. winter storm sparked fears that millions of Americans might curb travel plans during the holiday season.

Brent crude LCOc1 futures settled up 19 cents, or 0.2%, to $79.99 per barrel while U.S. West Texas Intermediate (WTI) crude futures CLc1 settled up 90 cents at $76.09 per barrel.

Reuters contributed to this report.

Stocks are moving between gains and losses as investors look towards the remaining earnings and economic reports of 2022.FedEx reports after the U.S. close, along with Nike and Blackberry.

“FedEx spooked markets last time out with a profit warning in the face of what it called a bleak economic outlook. Investors will be hoping for a little more positivity from the parcel giant, just a whiff of better news is likely to send equities higher and, whisper it, there are distant bells ringing a ‘Santa rally’ chorus,” said Danni Hewson, AJ Bell financial analyst.

The S&P 500, the Dow and the Nasdaq are all on track to notch their biggest annual percentage drops since 2008, the darkest year of the Global Financial crisis

."I would not look at 2022 as a playbook for 2023," Oliver Pursche told Reuters. Pursche is a senior vice president at Wealthspire Advisors, in New York. "I would think that at some next year there will be a change in market leadership and growth will once again outperform value."

Oil is lower.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| OSK | $87.13 | 1.67 | 1.95 |

The United States Postal Service plans to acquire at least 66,000 battery electric delivery vehicles as part of its 106,000 vehicle acquisition plan for deliveries between now and 2028.

The vehicles are part of a plan to replace the Postal Service’s aging delivery fleet of over 220,000 vehicles.

The total investment is expected to reach $9.6 billion including $3 billion from Inflation Reduction Act funds.

New NGDVs are expected to start servicing postal routes in late 2023.

The vehicles are built by Oshkosh Defense.

With a revamped $7,500 electric vehicle tax credit taking effect Jan. 1, the U.S. Treasury Department said on Monday it will delay until March its release of proposed guidance on the required sourcing of electric vehicle batteries.

The announcement means some electric vehicles that will not meet the new requirements may have a brief window of eligibility in 2023 before the battery rules take effect.

Some requirements for tax credits take immediate effect on Jan. 1 including new caps on income of buyers and retail prices for qualifying vehicles. But Treasury's announcement Monday means some buyers could receive tax credits for purchases of electric vehicles that ultimately will not comply with battery sourcing rules when finally unveiled.

The Treasury guidance being delayed until sometime in March details requirements that make $3,750 contingent on at least 40% of the value of the critical minerals in the battery having been extracted or processed in the United States or a country with a U.S. free-trade agreement, or recycled in North America.

The other $3,750 requires that at least 50% of battery components were manufactured or assembled in North America. Both percentages rise annually.

Twitter Inc on Tuesday was accused by 100 former employees of various legal violations stemming from Elon Musk's takeover of the company, including targeting women for layoffs and failing to pay promised severance.

Shannon Liss-Riordan, a lawyer for the workers, said she had filed 100 demands for arbitration against Twitter that make similar claims to four class action lawsuits pending in California federal court.

The workers all signed agreements to bring legal disputes against the company in arbitration rather than court, Liss-Riordan said, which means they will likely be barred from participating in the class actions.

Twitter laid off roughly 3,700 employees in early November in a cost-cutting measure by Musk, who paid $44 billion to acquire the social media platform, and hundreds more subsequently resigned.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VRNA | $18.00 | 4.51 | 33.43 |

Verona Pharma announced positive results of its Phase 3 ENHANCE-1 trial evaluating nebulized ensifentrine for the maintenance treatment of chronic obstructive pulmonary disease (COPD).

The ENHANCE-1 trial successfully demonstrated significant improvements in lung function, symptoms and quality of life measures. In addition, ensifentrine substantially reduced the rate and risk of COPD exacerbations.

Ensifentrine is a first-in-class, selective dual inhibitor of the enzymes phosphodiesterase 3 and 4 combining bronchodilator and non-steroidal anti-inflammatory activities in one compound.

Verona Pharma is a clinical-stage biopharmaceutical company focused on developing and commercializing innovative therapies for the treatment of respiratory diseases with significant unmet medical needs.

Single-family homebuilding tumbled to a 2-1/2 year low in November and permits for future construction plunged as higher mortgage rates continued to depress housing market activity.

The dour report from the Commerce Department on Tuesday followed on the heels of news on Monday that confidence among homebuilders plummeted for a record 12th month in December.

The housing market has borne the brunt of the Federal Reserve's fastest interest rate-hiking cycle since the 1980s as the U.S. central bank wages war against inflation.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WFC | $41.82 | 0.63 | 1.53 |

The Consumer Financial Protection Bureau (CFPB) is ordering Wells Fargo Bank to pay more than $2 billion in redress to consumers and a $1.7 billion civil penalty for legal violations across several of its largest product lines.

The bank’s illegal conduct led to billions of dollars in financial harm to its customers and, for thousands of customers, the loss of their vehicles and homes.

Consumers were illegally assessed fees and interest charges on auto and mortgage loans, had their cars wrongly repossessed, and had payments to auto and mortgage loans misapplied by the bank.

Wells Fargo also charged consumers unlawful surprise overdraft fees and applied other incorrect charges to checking and savings accounts.

Under the terms of the order, Wells Fargo will pay redress to the over 16 million affected consumer accounts, and pay a $1.7 billion fine, which will go to the CFPB's Civil Penalty Fund, where it will be used to provide relief to victims of consumer financial law violations.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GIS | $84.42 | -2.70 | -3.10 |

General Mills expects input cost inflation of 14% to 15% of total cost of goods sold and moderately lower supply chain disruptions in fiscal 2023.

The consumer products maker continues to expect the largest factors impacting its performance in fiscal 2023 will be the economic health of consumers, the inflationary cost environment, and the frequency and severity of disruptions in the supply chain.

General Mills on Tuesday reported fiscal second-quarter net income of $605.9 million.

On a per-share basis, the Minneapolis-based company said it had net income of $1.01. Earnings, adjusted for non-recurring costs and restructuring costs, came to $1.10 per share.

The results exceeded Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for earnings of $1.06 per share.

The maker of Cheerios cereal, Yoplait yogurt and other packaged foods posted revenue of $5.22 billion in the period, which also topped Street forecasts. Seven analysts surveyed by Zacks expected $5.15 billion.

The Associated Press contributed to this report.

A surprise policy move by the Bank of Japan helped hold stocks lower.

The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite all opened with losses.

The BoJ decided to allow the 10-year bond yield to move 50 basis points, or 0.5%, either side of its 0% target, allowing for a larger rise in long-term interest rates. The change widens the previous target that was set at 25 basis points.

The move prompted a jump in the yen and a share sell-off.

“The decision is being read as a sign of testing the water, for a potential withdrawal of the stimulus which has been pumped into the economy to try and prod demand and wake up prices,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.Asian markets finished lower.

The major indices in Europe were negative or little changed.

Oil is higher.

Reuters contributed to this report.

The Bank of Japan shocked markets on Tuesday with a surprise tweak to its bond yield control that allows long-term interest rates to rise more, a move aimed at easing some of the costs of prolonged monetary stimulus.

Shares tanked, while the yen and bond yields spiked following the decision, which caught off-guard investors who had expected the BOJ to make no changes to its yield curve control (YCC) until Governor Haruhiko Kuroda steps down in April.

In a move explained as seeking to breathe life back into a dormant bond market, the BOJ decided to allow the 10-year bond yield to move 50 basis points either side of its 0% target, wider than the previous 25 basis point band.

But the central bank kept its yield target unchanged and said it will sharply increase bond buying, a sign the move was a fine-tuning of existing ultra-loose monetary policy rather than a withdrawal of stimulus.

U.S. stock futures are in the red again on Tuesday as commodities like oil and gold move higher.

The Dow Jones Industrial Average futures is off roughly 23 points, or 0.07%, while the S&P and Nasdaq futures are approximately 0.27% and 0.58% lower, respectively.

Over the last five days, the Dow remains down near 3.72%, the S&P is off nearly 4.56% and the tech-heavy Nasdaq is roughly 5.77% lower.

Travel shares are down across the board as Southwest Airlines dropped around 0.25%, United Airlines dropped roughly 0.21%, while Delta Air Lines and American Airlines slipped approximately 0.36% and 0.56%, respectively.

In commodities, West Texas Intermediate crude futures spiked 0.50% to $75.69 a barrel, as gold popped 0.67% to $1,809.70 an ounce.

Cryptocurrency prices were higher early Tuesday.

At approximately 4:50 a.m. ET, Bitcoin was trading at nearly $16,822 (+2.38%), or higher by $391.

For the week, Bitcoin was trading lower by nearly 4.5%. For the month, the cryptocurrency was lower by nearly 1.6%.

Ethereum was trading at approximately $1,209 (+3.51%), or higher by about $41.

For the week, Ethereum was trading lower by slightly more than 8.4%. For the month, it was trading lower by approximately 4.1%.

Dogecoin was trading at $0.074196 (+3.92%), or higher by approximately $0.002802.

For the week, Dogecoin was lower by almost 21%. For the month, the crypto was lower by nearly 15.6%.

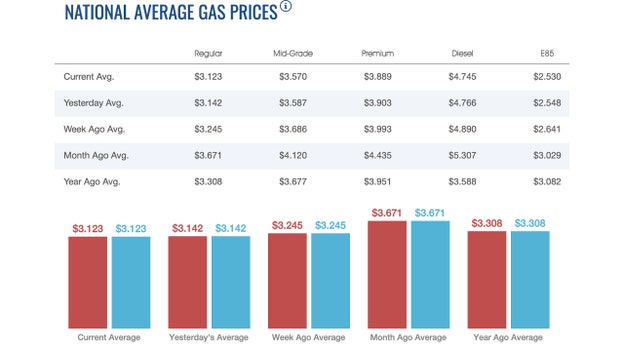

The nationwide price for a gallon of gasoline slipped on Tuesday to $3.123. On Monday, that same gallon of gasoline cost $3.142, according to AAA. The average price of a gallon of gasoline on Sunday was $3.159.

One week ago, a gallon of gasoline cost $3.245. A month ago, that same gallon of gasoline cost $3.671. A year ago, the price for a gallon of regular gasoline was $3.308.

Everyone remembers when gas hit an all-time high of $5.016 on June 14.

Diesel remained below $5.00 per gallon, costing $4.745 on Tuesday. On Monday, diesel cost $4.766 per gallon, according to AAA.

One week ago, a gallon of diesel cost $4.89. A month ago, that same gallon of diesel cost $5.307. A year ago, a gallon of diesel cost $3.588.

This morning, at 8:30 a.m. ET, will bring the second of four housing-related economic reports out this week, as the Commerce Department is expected to say the number of homes under construction in November fell nearly 2%, to a seasonally adjusted annual rate of 1.40 million.

That figure - the lowest since July – followed a smaller-than-expected decline of 4.2% in October as rapidly rising mortgage rates and high prices continued to dampen demand for housing.

Housing starts have tumbled 21.2% in the six months since April when they hit a near 16-year high of 1.810 million (the highest since June 2006).

Permits for future construction, a good gauge of upcoming housing activity, are anticipated to fall 1.8% as well to 1.485 million in November, the lowest since August 2020 (for context, January’s print of 1.899 million was the highest since May 2006).

The report follows Monday’s NAHB’s housing market index, which fell more than expected to the lowest since June 2012 as high mortgage rates and soaring construction costs weighed on the mood of homebuilders. Watch for existing home sales on Wednesday and new home sales on Friday, both for the month of November

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:DJI | $32,757.54 | -,162.92 | -0.49 |

| SP500 | $3,817.66 | -34.70 | -0.90 |

| I:COMP | $10,546.03 | -,159.38 | -1.49 |

US stocks whipsawed overnight , falling after the Bank of Japan announced it would widen its yield target range and on fears about weaker global economic growth as banks raise interest rates to cool inflation.

Markets are sliding after the U.S. Federal Reserve raised its key lending rate last week and the European Central Bank said more rate hikes are ahead. That fueled investor fears central bankers might be willing to cause a recession to fight inflation that is at multi-decade highs.

“The tone in markets reflects a cloudy outlook for the global economy,” Anderson Alves of ActivTrades said in a report.

On Wall Street, the future for the benchmark S&P 500 index was off 0.6%. That for the Dow Jones Industrial Average lost 0.4%.

On Monday, the S&P 500 fell 0.9% for its fifth daily decline as communications services stocks, technology companies and retailers retreated. The index is sliding after the Fed said last week that rates might have to stay elevated longer than previously forecast. It is down about 20% this year with less than two weeks left in 2022.

The Dow Jones Industrial Average fell 0.5%. The Nasdaq composite lost 1.5%. The Fed raised its short-term lending rate last week by one-half percentage point in its seventh increase this year.

That dashed investor hopes the U.S. central bank might ease off rate hike plans due to data showing economic activity cooling. The federal funds rate stands at a 15-year high of 4.25% to 4.5%. The Fed forecast that it will reach a range of 5% to 5.25% by the end of 2023.

The forecast doesn’t call for a cut before 2024. Investors were looking ahead to U.S. economic reports this week for an update on the path of inflation. It has declined from its 9.1% high in June but still stood at 7.1% in November.

The National Association of Realtors reports November home sales on Wednesday. Also Wednesday, the Conference Board releases its consumer confidence report for December.

On Friday, the U.S. government will report November consumer spending. The report is watched by the Fed as a barometer of inflation.

In Asia, the Nikkei 225 in Tokyo tumbled 2.5% to 26,568.03 after Japan’s central bank, which has avoided joining the Fed and other central banks in raising rates, widened the range in which government bond yields will be allowed to fluctuate. That will allow market interest rates to edge higher.

The Shanghai Composite Index lost 1.1% to 3,073.76 after the World Bank cut its forecast of China's economic growth this year to 2.7% from its June outlook of 4.3%. The bank cited repeated shutdowns of major cities to fight COVID-19 outbreaks.

The Hang Seng in Hong Kong sank 1.3% to 19,094.80 and the Kospi in Seoul lost 0.8% to 2,333.29. Sydney's S&P-ASX 200 fell 1.5% to 7,024.03 while India's Sensex gained 0.8% to 61,806.19. New Zealand and Southeast Asian markets retreated.

In early trading, the FTSE in London fell 0.7% to 7,311.82. The DAX in Frankfurt lost 0.9% to 13,812.03 and the CAC 40 in Paris tumbled 1.1% to 6,403.95.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $66.07 | 1.17 | 1.80 |

| CVX | $169.88 | 1.16 | 0.69 |

| XOM | $105.17 | 0.47 | 0.45 |

Oil prices inched higher on Tuesday, supported by a softer dollar and a U.S. plan to restock petroleum reserves, but gains were capped by uncertainty over the impact of rising COVID-19 cases in top oil importer China.

Brent crude futures were up 15 cents, or 0.2%, at $79.95 a barrel at 0710 GMT, adding to a 76 cent gain in the previous session. U.S. West Texas Intermediate (WTI) crude futures rose 32 cents, or 0.4%, to $75.51 a barrel, after climbing 90 cents in the previous session. Both contracts rose by more than $1 earlier in the session.

Oil prices have been buoyed by a U.S. plan announced last week to buy up to 3 million barrels of oil for the Strategic Petroleum Reserve following this year's record release of 180 million barrels from the stock.

A weaker greenback has also supported prices, making oil cheaper for those holding other currencies.

However, analysts said clear signs of growing demand were needed for prices to climb further.

U.S. crude oil stocks were expected to have dropped last week by about 200,000 barrels, while gasoline and distillates inventories were seen higher, a preliminary Reuters poll showed on Monday.

The poll was conducted ahead of reports from the American Petroleum Institute on Tuesday, and the Energy Information Administration, the statistical arm of the U.S. Department of Energy, due on Wednesday.

Live Coverage begins here