STOCK MARKET NEWS: Stocks fall, Ford sinks, jobs growth surges, China's spy balloon chaos

A strong jobs report pushes stocks lower, Chinese weather balloon floats over U.S., Nordstrom responds to activist. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

January's employment report did not disappoint, with job growth during the month surprisingly strong, creating a new wrinkle for the Federal Reserve. Additionally, the unemployment rate fell to the lowest since 1969.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| JWN | $26.38 | 5.24 | 24.79 |

Nordstrom says it is open to dialogue with activist investor Ryan Cohen.

The billionaire investor is building a large stake in the luxury retailer and plans to push the upscale retailer to shake up its board as its performance has lagged behind rivals, people familiar with the matter said on Thursday.

Cohen, who built his fortune by co-founding online pet retailer Chewy Inc and cemented it with investments in videogame retailer GameStop and Apple Inc, would like to replace at least one director on Nordstrom's 10-member board, the people said.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $13.23 | -1.09 | -7.61 |

| FWONA | $64.62 | 0.05 | 0.08 |

Ford announced Friday that it is returning to Formula 1 racing in 2026.

Ford will team up with Red Bull Powertrains, which is based at the F1 team's factory in Milton Keynes, England.

The partnership was formally announced as Red Bull unveiled its 2023 car in New York on Friday.

Ford last was involved in F1 in 2003, when it earned its last victory with Giancarlo Fisichella driving in Brazil, and 2004. Before that, Ford's Cosworth engines were regulars in F1 from the 1960s through the 1990s, and the engine-maker produced 176 wins in 523 starts.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GOOG | $105.22 | -3.58 | -3.29 |

Google workers are protesting the tech company’s recent round of layoffs.

For the fourth quarter, Alphabet said it generated $76.05 billion in revenue, an increase of 1% from the $75.33 billion the company reported in the same period the prior year. Its net income, meanwhile, was $13.62 billion.

In a tweet about the company’s financial results, the Alphabet Workers Union said it was "clear that Google has debunked its own rationale for laying off 12,000 of our coworkers."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LOW | $215.97 | -5.57 | -2.51 |

Lowe's Companies has completed the sale of its Canadian retail business to Sycamore Partners, a private equity firm specializing in retail, consumer and distribution-related investments.

The business will operate under the name RONA. With headquarters in Boucherville, Québec, RONA operates or services approximately 450 corporate and independent affiliate dealer stores under several banners, including RONA, Lowe's, Réno-Dépôt and Dick's Lumber.

"With the closing of this transaction, we are now singularly focused on the transformation of our U.S. home improvement business, where we have a great opportunity to simplify Lowe's operations and take market share," said Marvin R. Ellison, Lowe's chair and CEO. "Our simplified business model will support our efforts to improve operating margin and ROIC, while delivering sustainable value to our shareholders.”

U.S. Secretary of State Antony Blinken postponed a visit to China that had been expected to start on Friday after a Chinese spy balloon was tracked flying across the United States in what Washington called a "clear violation" of U.S. sovereignty.

The Pentagon said on Thursday it was tracking a high-altitude surveillance balloon over the continental United States. Officials said military leaders considered shooting it down over Montana on Wednesday but eventually recommended against this to President Joe Biden because of the safety risk from debris.

White House spokesperson Karine Jean-Pierre said Biden was briefed on the balloon flight on Tuesday and there was an administration "consensus that it was not appropriate to travel to the People's Republic of China at this time."

The administration was aware of China's statement of regret "but the presence of this balloon in our airspace, it is a clear violation of our sovereignty as well as international law. It is unacceptable this occurred," she told a regular briefing.

U.S. stocks fell on Friday as investors sold shares of Amazon and Ford on disappointing earnings. Still, for the week the Nasdaq Composite rose 3.4%, while the S&P edged up by 1.6%. The Dow Jones Industrial Average was little changed. In commodities, oil fell 7.9% this week to $73.39 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GM | $41.81 | 0.31 | 0.75 |

| NFLX | $376.30 | 9.41 | 2.56 |

Netflix Inc has unveiled a new star for some of its upcoming programming: electric vehicles from General Motors and other automakers.

The streaming service announced an agreement on Thursday to feature vehicles including the Chevrolet Bolt, the electric GMC Hummer pickup and the Cadillac Lyriq in TV series and films "where relevant."

The companies will highlight the partnership in a commercial featuring Will Ferrell that will air during the Feb. 12 Super Bowl. Netflix and GM called the agreement "part of a commitment to a more sustainable future."

Financial terms were not disclosed.

Twitter will start sharing revenue from advertisements with some of its content creators, Chief Executive Elon Musk said on Friday.

Effective Friday, revenue from ads that appear on a creator's reply threads, will be shared. The user must be a subscriber of Blue Verified, Musk said.

Musk, however, did not give details about the portion of revenue that would be shared with users.

Twitter has seen advertisers flee amid worries about Musk's approach to content moderation rules, impacting its revenue.

Days after taking charge of the company, Musk said Twitter had seen a "massive" drop in revenue and blamed activist groups for pressuring advertisers.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $13.36 | -0.96 | -6.74 |

| GM | $41.63 | 0.13 | 0.32 |

| TSLA | $196.19 | 7.92 | 4.21 |

| VWAPY | $14.24 | -0.26 | -1.79 |

le]The U.S. Treasury Department said Friday it will make more Tesla, Ford Motor, General Motors and Volkswagen electric vehicles eligible for up to $7,500 tax credits after it revised its vehicle classification definitions.

The move is a win for Tesla, GM, Ford and other automakers which had pressed the Biden administration to change the vehicle definitions.

Under the $430 billion climate bill approved in August, SUVs can be priced at up to $80,000 to qualify for EV tax credits, while cars, sedans and wagons can only be priced at up to $55,000.

The decision raises the retail price cap to $80,000 from $55,000 for GM's Cadillac Lyriq, Tesla's five-seat Model Y, Volkswagen's ID.4, the Ford Mustang Mach-E and Escape Plug-in Hybrid.

Only one version of the VW 1D.4 had been considered an SUV.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GPRO | $5.87 | -0.59 | -9.13 |

GoPro is lower after missing Wall Street revenue estimates but topping profit forecasts.

The action camera maker said fourth-quarter revenue fell 18% to $321 million, which is lower than the estimated $322.8 million.

GoPro.com revenue, including subscription and service revenue, was flat year-over-year at $128 million, or 40% of total revenue.

Net income fell 94% to $3.1 million for the three months ended December compared to $52.6 million a year ago.

The company reported profits of 12 cents per share, 29 cents lower than the same quarter last year when the company reported EPS of 41 cents. Profits of 9 cents per share were anticipated by the six analysts providing estimates for the quarter.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ATVI | $75.85 | -1.26 | -1.63 |

Activision Blizzard Inc has agreed to pay $35 million to settle U.S. Securities and Exchange Commission charges that it failed to have systems in place to properly handle employee complaints and violated whistleblower protection rules, the regulator said on Friday.

The SEC said the company knew employee retention issues were "a particularly important risk in its business" but did not have adequate measures in place to manage workplace misconduct complaints between 2018 and 2021.

"Activision Blizzard failed to implement necessary controls to collect and review employee complaints about workplace misconduct, which left it without the means to determine whether larger issues existed that needed to be disclosed to investors,” said Jason Burt, who heads the SEC's Denver office, said in a statement.

The company, which makes the popular "Call of Duty" game, also required employees between 2016 and 2021 to tell the company if the SEC contacted them for information — a violation of whistleblower protection rules, the agency said in the statement.

Representatives for Activision Blizzard, which did not admit or deny the SEC's charges, said in a statement they were "pleased to have amicably resolved this matter" and had "enhanced" their workplace reporting and contract language.

Ford shares tumbled after a disappointing quarter and an admission by CEO Jim Farley on the automaker's short comings.

“We should have done much better last year,” added Farley. “We left about $2 billion in profits on the table that were within our control, and we’re going to correct that with improved execution and performance.”

For the full year, Ford lost $2 billion in net income, while total revenues climbed to $158 billion vs. $136 billion in the prior year period.

Ford's total revenues were $44B vs. $37.7 in the same period a year ago.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| EAF | $5.57 | -1.02 | -15.55 |

GraftTech International is trading lower after missing Wall Street profit estimates. The manufacturer of high-quality graphite electrode products beat on revenue.

Fourth quarter net sales fell 32% to $247.52 million, which is higher than the estimated $221 million.

Net income fell for the three months ended December fell to $44.76 million from $93.88 million a year ago.

The company reported profits of 17 cents per share, 33 cents lower than the same quarter last year when the company reported EPS of 50 cents. Profits of 22 cents per share were anticipated by the three analysts providing estimates for the quarter.

The company said it anticipates continued soft demand for graphite electrodes due to ongoing economic uncertainty and geopolitical conflict.

In addition, GrafTech expects the suspension of operations in Monterrey, Mexico in late 2022 will significantly impact our sales volume for the first half of 2023.

Reflecting these factors, the company estimates sales volume for the first six months of 2023 will be approximately half of the level reported in the same period of 2022, with the largest impact occurring in the first quarter.

Reuters contributed to this report.

All three of the major U.S. benchmarks curbed morning losses as investors digested a basket of lukewarm earnings results from large-cap tech companies.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMZN | $107.65 | -5.26 | -4.66 |

| GOOGL | $106.45 | -1.28 | -1.19 |

Amazon led the drop among the three while Amazon and Apple curbed earlier losses. Apple shares are now higher.

Meanwhile, commodities were mixed with gold falling around 2%, while oil rose by the same amount.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| REGN | $769.02 | 17.82 | 2.37 |

Regeneron Pharmaceuticals Inc reported a better-than-expected fourth-quarter profit on Friday, as strong demand for eczema drug Dupixent helped shield a drop in U.S. sales of its blockbuster eye drug, Eylea.

Eylea, which recorded total sales of $9.65 billion in 2022, has been a key growth driver for the company ever since its launch more than a decade ago. But analysts have flagged competition from Roche's Vabysmo, which was approved last year.Sales of Eylea, used to treat vision loss causing age-related macular degeneration, were impacted by temporary closing of a fund during the quarter that provides co-pay assistance to patients. U.S. sales of the drug were down 3.3% to $1.50 billion in the fourth quarter.

However, the company last month said that patients, who had switched to a less expensive alternative, were already beginning to use Eylea again.

Quarterly sales of the company's Dupixent, recorded by its partner Sanofi, rose 38% to $2.45 billion, with Regeneron's collaboration revenue from the French company jumping about 61% to $836 million.

Dupixent is an anti-inflammatory drug, which was approved in 2017, and has also been a booster for Regeneron with the treatment currently approved for five indications, including asthma and atopic dermatitis, or eczema.

Excluding items, the company reported a profit of $12.56 per share for the quarter ended Dec. 31, above analysts' estimates of $10.03, according to Refinitiv IBES data.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GILD | $86.11 | 4.72 | 5.81 |

Gilead Sciences Inc on Thursday reported a higher-than-expected fourth-quarter profit driven by strong demand for its HIV and cancer drugs, while COVID-19 antiviral Veklury had sales that were double Wall Street estimates.

The U.S. biotech company also forecast 2023 sales of $26 billion to $26.5 billion, ahead of analyst expectations of $25.8 billion, and adjusted earnings of $6.60 to $7 per share. The midpoint of the earnings forecast is also above analysts' estimates for $6.73 per share.

Sales of COVID-19 treatment remdesivir, sold under the brand name Veklury, were $1 billion, far beyond the $511 million analysts had expected even as they slowed 26% from the previous year.

The company said adjusted profit rose to $1.67 per share, ahead of analyst expectations of $1.50, according to Refinitiv data, and up from 69 cents per share a year earlier, when it took $1.85 billion in charges mostly for a legal settlement.

Quarterly revenue rose 2% to $7.4 billion, topping analysts' estimates of $6.64 billion.

Gilead's HIV sales increased 5% to $4.8 billion in the quarter, with Biktarvy rising 15% to $2.9 billion versus the $2.8 billion analysts expected.

Descovy sales rose 13% to $537 million, outstripping the analysts' forecast of $495 million.

Gilead's cancer franchise also saw sales increase by 71% to $419 million. Yescarta, a CAR-T lymphoma treatment, booked $337 million, while leukemia and lymphoma treatment Tecartus came in at $82 million.

Silver, like other commodities including gold and oil, is a haven for traders during times of economic downturn, and particularly inflation, where the strength of the U.S. dollar is weakened, and investors begin looking for material wealth.

Already, the price of silver has reached roughly $22 per ounce in 2023 and is up approximately 9% the last three months.

A Kitco News' online survey showed investors could see silver jump more than 50% this year to reach $38 an ounce.

While the volatility of silver prices can be two to three times greater than that of gold on a given day, silver’s increasing applications in industry could begin closing the gap on the yellow metal in 2023, particularly as the automotive sector makes greater shifts to electric, and alternate forms of energy are harnessed through solar.

Often considered recession or inflation-proof, silver outpaced the three major U.S. stock averages in 2022. The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite all finished lower last year.

Technology earnings sent stocks higher on Thursday and another round of companies from that sector will give those gains back on Friday.

U.S. equity futures suggest a decline on the tech-heavy Nasdaq of 1.5% when trading begins.

Amazon.com shares are down 5% in premarket trading after the company announced that income declined from a year ago.

Alphabet shares are more than 4% lower in premarket trading after the company reported lower-than-expected quarterly revenue.

Apple shares are trading 3% lower in premarket trading after the company reported sales and profits that missed Wall Street expectations.

One bright spot is Nordstrom. Shares of the department store are jumping 30% in premarket trading following reports that billionaire Ryan Cohen has taken a sizable stake in the chain.

The major oil benchmarks are heading for a second straight week of losses.

U.S. West Texas Intermediate crude futures traded around $75.00.

Brent crude futures traded around $82.00 a barrel.

January’s employment report will be released this morning before the opening bell.

Economists surveyed by Refinitiv say the U.S. economy likely added 185,000 new nonfarm jobs. That’s down from a stronger-than-expected tally of 223,000 in December.

In Asia, Japan's benchmark Nikkei 225 added 0.4%, Hong Kong's Hang Seng slipped 1.4% and China's Shanghai Composite dropped 0.7%.

On Thursday, the S&P 500 rallied 1.5% to 4,179.76 a day after hitting its best level since August. The Nasdaq composite soared 3.3% to 12,200.82, while the Dow Jones Industrial Average slipped 0.1% to 34,053.94.

Meta helped lead the way with a 23.3% leap after it reported better revenue for the latest quarter than analysts expected and said it expects to spend less this year than earlier forecast.

Apple shares are trading 3% lower in premarket trading after the company reported sales and profits that missed Wall Street expectations driven by weak iPhone sales after COVID lockdowns in China disrupted production of the company's biggest seller.

Apple sales fell 5% to $117.2 billion and were down in every part of the world in the quarter. Sales from each product category dropped, except for gains in services and iPads. Earnings per share were $1.88, Apple's first miss of Wall Street's profits expectations since 2016.

Analysts had expected sales of $121.1 billion and profits of $1.94 per share, according to IBES data from Refinitiv.

Apple Chief Executive Tim Cook told Reuters that the production disruptions that plagued Apple's key quarter were now over.

Sales of the company's Mac computers, which had boomed during the wave of working from home during the pandemic, declined 29% year over year to $7.7 billion, compared with expectations of $9.6 billion, according to Refinitiv data.

Sales of the iPad, which also saw a pandemic-related boost, grew 30% to $9.4 billion, compared with analyst expectations of $7.8 billion, according to Refinitiv data. The wearable and accessories segment, which includes the Apple Watch and AirPods, fell 8% to $13.5 billion compared with analyst estimates of $15.2 billion, according to Refinitiv data.

Posted by Reuters

Alphabet shares are more than 4% lower in premarket trading after the company reported lower-than-expected quarterly revenue as the Google parent's digital ad business struggled under an economic slowdown that has choked corporate spending and triggered mass layoffs.

Revenue from Google advertising, which includes Search and YouTube, fell to $59.04 billion from $61.24 billion, as advertisers — the biggest contributors to Alphabet's sales — dialed back spending to cope with persistent inflation, high interest rates and recession fears.

Big Tech peer Meta Platforms Inc had, however, impressed investors with a quarterly results announcement that featured promises to slash costs and boost offerings to capitalize better on ad dollars.

Alphabet's net income fell to $13.62 billion, or $1.05 per share, from $20.64 billion, or $1.53 per share, a year earlier.

Revenue rose to $76.05 billion in the fourth quarter from $75.33 billion a year ago. Analysts were expecting $76.53 billion, according to IBES data from Refinitiv.

Posted by Reuters

Amazon.com shares are down 5% in premarket trading after the company announced that income declined from a year ago.

Amazon did however beat Wall Street estimates for quarterly sales, as the retailer's marketing blitz during the holiday period helped attract shoppers.

Amazon tapped into its huge base of Prime subscribers during the crucial holiday season with attractive early offers and discounts that helped drive business on its e-commerce platform, despite economic turbulence.

Nordstrom shares are jumping 30% in premarket trading following reports that billionaire Ryan Cohen has taken a sizable stake in the department store.

Cohen is one of the top-five non-family shareholders of Nordstrom and has been known to ignite rallies in so-called meme stocks, including GameStop.

Cohen built his fortune as the founder of the online pet retailer Chewy.

Another busy week of fourth-quarter earnings wraps up Friday morning.

Reports are expected from some health care names: managed-care and insurance giant Cigna; biotech firm Regeneron Pharmaceuticals; and medical device maker Zimmer Biomet.

Also watch for numbers from Dutch commodity chemical maker LyondellBasell, British multinational financial services firm Aon PLC, and consumer products maker Church & Dwight.

About half of the companies in the S&P 500 have reported results, and so far the numbers are coming in ahead of estimates

The major oil benchmarks are heading for a second straight week of losses.

The market is looking for awaited further signs of fuel demand recovery in China.

U.S. West Texas Intermediate crude futures traded around $76.00.

WTI has fallen by nearly 5%, after sliding 2% in the prior week.

Brent crude futures traded around $82.00 a barrel.

Brent has also dropped more than 5%, extending a 1% loss from the previous week.

Mixed signals on fuel demand recovery in China, the world's top oil importer, have kept a lid prices.

While supported by a weaker greenback, oil's gains have been limited by the prospect of slow growth in the United States, the world's biggest oil consumer, and recessions in places including Britain, Europe, Japan and Canada.

The U.S. central bank scaled back to a milder rate increase after a year of larger hikes, but policymakers also projected that "ongoing increases" in borrowing costs would be needed.

Reuters contributed to this post.

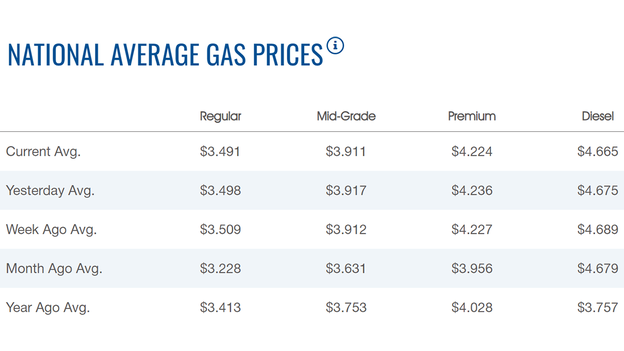

The price of gasoline continued to tick lower on Friday.

The nationwide price for a gallon of gasoline declined to $3.491, according to AAA.

The average price of a gallon of gasoline on Thursday was $3.498.

A year ago, the price for a gallon of regular gasoline was $3.413.

One week ago, a gallon of gasoline cost $3.509. A month ago, that same gallon of gasoline cost $3.228.

Gas hit an all-time high of $5.016 on June 14.

Diesel remains below $5.00 per gallon at $4.665, but that is still far from the $3.757 of a year ago.

Bitcoin was trading around $23,000, after snapping a two-day winning streak.

The cryptocurrency has gained 2% in the past week.

Bitcoin has added more than 42% year-to-date, but is down more than 36% from 52 weeks ago.

Ethereum was trading around $1,600, after gaining more than 2% in the past week.

Dogecoin was trading at 9 cents, after adding more than 5% in the past week.

Live Coverage begins here