STOCK MARKET NEWS: Retail sales jump, stocks rise, Buffett’s Apple move, Chipotle launch

Stock close higher after retail sales jump despite strong inflation, Roblox tops estimates, Warren Buffett updates Apple and Taiwan Semiconductor positions. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

A former dean of Stanford's law school and a computer science researcher at the university co-signed indicted FTX cryptocurrency exchange founder Sam Bankman-Fried's bond, according to court records made public on Wednesday.

Bankman-Fried, 30, has pleaded not guilty to fraud charges over the collapse of the now-bankrupt cryptocurrency exchange. Federal prosecutors in Manhattan say he diverted billions of dollars in FTX customer funds to Alameda Research, his hedge fund.

Bankman-Fried has been out on $250 million bond co-signed by his parents, Joseph Bankman and Barbara Fried, professors at Stanford Law School who pledged their Palo Alto, California, home as collateral for their son's return to court. His trial is set to begin in October.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CMG | $1,644.52 | 30.21 | 1.87 |

Chipotle Mexican Grill is opening a new restaurant called Farmesa at Third Street Promenade in Santa Monica, Calf. in partnership with Kitchen United Mix.

The concept will help the fast casual dining chain test and learn on future restaurant concepts.

Farmesa will feature proteins, greens, grains and vegetables that are inspired by Chipotle's Food with Integrity standards. The concept will soft open with an abbreviated menu and limited hours before officially rolling out next month.

The concept's full menu will include dishes like Classic Santa Maria-Style Grilled Tri-Tip Steak, Everything Spice-Crusted Ora King Salmon, Whipped Potatoes, Golden Beets, Sprouted Cauliflower, and Sweet Potato Chips.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ROKU | $63.49 | 6.85 | 12.09 |

Roku Inc forecast first-quarter revenue above analysts' estimates on Wednesday, betting on its streaming devices and content platform to drive growth.

Shares of the San Jose, California-based company rose nearly 12% in trading after the bell.

A pandemic winner, Roku is benefiting from the ongoing trend of people ditching their traditional cable packages and flocking to subscription-based streaming services.

The company's push towards more original content on its own streaming channel has only helped it to strengthen the influx of subscribers and advertisers.

Many advertisers have been forced to decrease their marketing budgets in response to record-high inflation rates and continued uncertainty about a recession.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CSCO | $48.45 | 0.75 | 1.57 |

Cisco Systems Inc raised its full-year revenue growth forecast on Wednesday, banking on its ability to push backlog orders quickly and rapid adoption of 5G technology to keep demand upbeat.

Cisco's shares rose 10% in extended trading.

The company forecast fiscal 2023 revenue growth between 9% and 10.5%, compared with its earlier forecast of 4.5% to 6.5% growth.

Cisco, whose products are core to a firm's networking infrastructure, has benefited as companies are increasingly adopting technologies like cloud and digital workloads to support hybrid work.

The company, which reeled from chip shortages and excess inventory buildup last year, is also pushing to clear the backlog orders, which the management described last quarter as historically high.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLY | $153.53 | 1.41 | 0.93 |

| XLC | $56.13 | 0.37 | 0.66 |

| XLE | $88.33 | -1.69 | -1.87 |

All three of the major U.S. averages rose as communication and consumer discretionary stocks paced the gains, while energy lagged. following a surprise jump in retail sales last month. The 10-year Treasury yield continued its climb hitting 3.80% - the highest since January. In commodities, oil slipped to $78.59 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HYMTF | $35.32 | 0.32 | 0.91 |

Hyundai Motor and Kia Corp will offer software upgrades to 8.3 million U.S. vehicles to help curb increasing car thefts using a method popularized on TikTok and other social media channels, the Korean automakers said on Tuesday.

TikTok videos showing how to steal cars made from 2015 to 2019 without push-button ignitions and immobilizing anti-theft devices has spread nationwide. This had led to at least 14 reported crashes and eight fatalities," the National Highway Traffic Safety Administration (NHTSA) said.

The free upgrade will be offered for 3.8 million Hyundai and 4.5 million Kia vehicles in the United States, the automakers and NHTSA said.

The acting head of the Federal Aviation Administration (FAA) is forming a team of experts to review airline safety after several recent near miss incidents raised questions about the U.S. aviation system.

Acting FAA Administrator Billy Nolen in a "call to action" memo on Tuesday seen by Reuters said the safety review team will "examine the U.S. aerospace system’s structure, culture, processes, systems, and integration of safety efforts."

The FAA will hold a safety summit in March to examine what additional actions "the aviation community needs to take to maintain our safety record."

The National Transportation Safety Board (NTSB) is investigating a series of serious close calls including a near collision last month between FedEx FDX.N and Southwest Airlines LUV.N planes in Austin and a runway incursion at New York's John F. Kennedy Airport.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $12.74 | -0.23 | -1.73 |

Ford Motor Co has identified measures to secure 8% margins on its next-generation electric vehicles due at mid-decade, but could take years to close an overall cost disadvantage of up to $8 billion against competitors, executives said on Wednesday

.Ford can save up to $2.5 billion this year through better management of production schedules and a drop in commodity prices, the company's chief financial officer, John Lawler, said at an auto conference.

Longer term, the company aims to reduce dealer inventories and drive more transactions online, among other measures, according to Chief Executive Jim Farley.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SABR | $5.80 | -1.08 | -15.75 |

Sabre Corp. on Wednesday reported a loss of $160.1 million in its fourth quarter.

On a per-share basis, the Southlake, Texas-based company said it had a loss of 50 cents. Losses, adjusted for pretax expenses and stock option expense, were 36 cents per share.

The results missed Wall Street expectations. The average estimate of four analysts surveyed by Zacks Investment Research was for a loss of 32 cents per share.

The provider of technology services to the travel industry posted revenue of $631.2 million in the period, which also missed Street forecasts. Three analysts surveyed by Zacks expected $673.9 million.

For the year, the company reported a loss of $435.4 million, or $1.40 per share. Revenue was reported as $2.54 billion.

Sabre expects full-year revenue in the range of $2.8 billion to $3 billion.

The U.S. stock indexes are down again on Wednesday despite a surge in January’s retail sales.

The Dow, S&P and Nasdaq are all trading well beneath the redline after the commerce department reported a 3% spike in U.S. retailers last month.

Shares of Chevron and Intel Corporation are leading the fall for the blue-chip Dow, slipping roughly 1.5% and 1.17%, respectively.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CVX | $168.75 | -2.06 | -1.21 |

| INTC | $28.38 | -0.26 | -0.91 |

Meanwhile, commodities are also down in early trading, with oil falling around 1% to $78.27 a barrel as gold retreats approximately 0.93% to $1,848 an ounce.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HEINY | $49.71 | 0.39 | 0.79 |

Heineken, the world's second-largest brewer, repeated its forecast of a profit increase this year despite weakness in Europe, as it reported a higher-than-expected 2022 profit on the back of a recovery in beer drinking to pre-pandemic levels.

The Dutch-based company whose brands include Tiger and Sol said operating profit would grow but at a slower mid- to high-single-digit percentage rate in 2023, reflecting continued cost savings, a challenging economy and lower consumer confidence in some markets.

“Heineken has shown the benefits of having strong brands during tough times . The group owns high-end favorites such as Heineken, Birra Moretti, Amstel and many more,” said Aarin Chiekrie, equity analyst at Hargreaves Lansdown. “Despite consumers tightening their purse strings in other areas of the market, beer has remained as much of a staple as ever. Both sales and profits rose substantially as consumers drank more beer at higher prices.”

Chiekrie added a cautionary note.

“Sales and profits are expected to moderate next year, cooling down to more sustainable levels of growth in the single digits. Cost inflation is a serious concern for the group too. Input costs are expected to jump by a high teens percentage which will be tough to fully offset, even with further price hikes.”

Reuters contributed to this report.

America's consumers rebounded last month from a weak holiday shopping season by boosting their spending at stores and restaurants at the fastest pace in nearly two years, underscoring the economy's resilience in the face of higher prices and multiple interest rate hikes by the Federal Reserve.

The government said Wednesday that retail sales jumped 3% in January, after having sunk the previous two months. It was the largest one-month increase since March 2021.

Driving the gain was a jump in car sales, along with healthy spending at restaurants, electronics stores and furniture outlets. Some of the supply shortages that had slowed auto production have eased, and more cars are gradually moving onto dealer lots. The enlarged inventories have enabled dealers to meet more of the nation's pent-up demand for vehicles.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RBLX | $35.67 | 1.24 | 3.60 |

Roblox Corp. on Wednesday reported a loss of $289.9 million in its fourth quarter.

The San Mateo, California-based company said it had a loss of 48 cents per share.

The results surpassed Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for a loss of 55 cents per share.

The online gaming platform posted revenue of $579 million in the period. Its adjusted revenue was $899.4 million, which also beat Street forecasts. Nine analysts surveyed by Zacks expected $888.5 million.

For the year, the company reported a loss of $924.4 million, or $1.55 per share. Revenue was reported as $2.87 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HNNMY | $2.42 | -0.01 | -0.62 |

H&M, the world's second biggest fashion retailer, said on Wednesday it had formed a joint venture with German recycling group Remondis to collect, sort and sell used and unwanted garments and textiles.

The fast-fashion industry to which H&M belongs is looking for ways to curb its carbon footprint in response to growing demands from investors to take more responsibility for the environment.

The 50-50 owned venture, called Looper Textile, is starting its operations in Europe and aims to extend the life cycle of some 40 million garments in 2023, H&M said in a statement.

The venture plans to test new collection schemes and implementing automated technologies, including "near-infrared sorting", H&M said.

Elon Musk, the world's richest man, donated nearly $2 billion to charity using Tesla stock.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| KHC | $39.88 | -0.45 | -1.12 |

Kraft Heinz forecast annual profit below Wall Street estimates on Wednesday, expecting cost inflation to eat into margins even as higher prices boost sales.

Kraft said average selling prices rose 15.2 percentage points in the fourth quarter, driving sales 10% higher to $7.38 billion, above analysts' average estimate of $7.27 billion in Refinitiv IBES data.

Excluding one-off items, Kraft earned 85 cents per share, topping analysts' estimate of 78 cents per share.

The company forecast annual adjusted earnings of between $2.67 and $2.75 per share, below the market estimate of $2.77 per share.

The Pittsburgh-based maker of Kool-Aid and Velveeta Cheese also said it expected organic net sales growth of 4% to 6% in 2023, slightly above estimate of 4.8%.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ADI | $182.54 | 2.09 | 1.16 |

Analog Devices Inc. on Wednesday reported fiscal first-quarter profit of $961.5 million.

The Wilmington, Massachusetts-based company said it had profit of $1.88 per share. Earnings, adjusted for costs related to mergers and acquisitions, came to $2.75 per share.

The results surpassed Wall Street expectations. The average estimate of 12 analysts surveyed by Zacks Investment Research was for earnings of $2.59 per share.

The semiconductor maker posted revenue of $3.25 billion in the period, also topping Street forecasts. Eleven analysts surveyed by Zacks expected $3.14 billion.

For the current quarter ending in April, Analog Devices expects its per-share earnings to range from $2.65 to $2.85. Analysts surveyed by Zacks had forecast adjusted earnings per share of $2.50.

The company said it expects revenue in the range of $3.1 billion to $3.3 billion for the fiscal second quarter. Analysts surveyed by Zacks had expected revenue of $3.11 billion.

Analog Devices shares have increased 11% since the beginning of the year, while the S&P's 500 index has climbed almost 8%. The stock has risen 19% in the last 12 months.

Exchange-traded funds include a basket of thousands of individual securities, offer all the liquidity of a stock and the diversity of a mutual fund while offering protection against inflationary pressures and a weakened U.S. dollar.

ETFs operate much like mutual funds but are built to track a specific or basket of financial assets. While ETFs have lower costs, better intraday liquidity and are considered more tax efficient, many are also more passive in nature than mutual funds, which have an actively managed fund structure.

TFs tracking companies like Coca-Cola, General Mills, Costco, Colgate-Palmolive, and Campbell Soup are common for Wall Street traders in a shrunken economy with diminished currency, as are funds based on material wealth like gold and silver.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| KO | $59.59 | -1.01 | -1.67 |

| GIS | $75.35 | -1.25 | -1.63 |

| COST | $503.22 | -3.23 | -0.64 |

| CL | $73.18 | -0.59 | -0.80 |

| CPB | $51.02 | -0.78 | -1.51 |

Consumer staple stocks are always in demand, even during economic downturns, because consumers will always need to eat, drink, and rely on household products including cleaners and soaps.

All types of investors may utilize ETFs, from passive savers pursuing broad market exposure to sophisticated investors looking for exposure to a particular segment of the market.

Republican lawmakers in Alaska are urging the Biden administration to allow a major oil project on the petroleum-rich North Slope to continue.

The Biden administration "damn well better not kill the project, period," Sen. Lisa Murkowski told a group of reporters on Tuesday. The project has been described as economically critical for Indigenous communities and important for the nation's energy security.

The lawmaker’s comments come after the U.S. Bureau of Land Management conducted an environmental review earlier this month of an initial proposal of ConocoPhillips Alaska's Willow project, ultimately reducing the number of proposed drill sites.

The preferred alternative that was offered reduced the five drill sites favored by the company to just three suggested by the government. The alternative has its proponents, including Alaska's bipartisan congressional delegation.

U.S. equity futures traded lower Wednesday morning ahead of the latest retail reading.

The major futures indexes suggest a decline of 0.3% when the opening bell rings.

Oil prices added to recent losses Wednesday as a much bigger-than-expected surge in the U.S. crude inventories.

West Texas Intermediate (WTI) crude futures traded around $78.00 per barrel.

Brent crude futures traded around $84.00 per barrel.

On the economic agenda, the consumer will take center stage with the January retail sales report.

Economists surveyed by Refinitiv anticipate consumer spending rose 1.8% after a larger-than-expected decline of 1.1% in December.

Excluding the automotive component, spending is seen climbing 0.8% in January, also rebounding from a drop of 1.1% the prior month.

Major earnings reports are expected from Kraft Heinz, Biogen, Cisco Systems and AIG.

In Asia, the Nikkei 225 in Tokyo gave up 0.4%, the Hang Seng in Hong Kong tumbled 1.4% and China's Shanghai Composite Index lost 0.4%.

Wall Street ended mixed Tuesday after inflation slowed to 6.4% in January from the previous month’s 6.5%.

The benchmark S&P 500 index edged down less than 0.1% to 4,136.13. The Dow Jones Industrial Average lost 0.5% to 34,089.27 while the Nasdaq gained 0.6% to 11,960.15.

Berkshire Hathaway added to some holdings and cut back on others last quarter.

Taiwan Semiconductor shares are down 6% in premarket trading as Berkshire cut its stake.

The company also trimmed back some bank shares and added to its Apple holdings.

Airbnb shares are gaining 9% in premarket trading after the company forecast current-quarter revenue above Wall Street estimates as demand for travel shows little signs of cooling off.

A stronger U.S. dollar and reopening of closed borders have empowered consumers to spend more on travel even as recession fears have sparked concerns over discretionary spending.

Airbnb said travel demand continues to be strong in the first quarter despite recessionary fears sparking concerns around consumer spending.

"We're particularly encouraged by European guests booking their summer travel earlier this year," Airbnb said.

The company forecast first-quarter revenue between $1.75 billion and $1.82 billion, higher than analysts' expectations of $1.69 billion, as per Refinitiv data.

Revenue rose 24% to $1.90 billion during the holiday quarter ended December, lower than the preceding two quarters, but beat analysts' average estimate of $1.86 billion.

Airbnb reported a quarterly net profit of $319 million, or 48 cents per share, compared with a profit of $55 million, or 8 cents per share, a year earlier.

Posted by Reuters

Tripadvisor shares are 9% higher in premarket trading after the company topped Wall Street estimates.

Fourth quarter revenue rose 47% to $354 million. Analysts expected $343.9 million.

Net income was $24 million for the three months ended Dec. 31. compared to a year ago loss of $1 million.

Non-GAAP earnings were 16 cents, topping the estimate of 4 cents.

“Our results reflect a combination of continued strength in the travel industry, the value our portfolio provides to travelers and partners, and the focus of our teams,” said CEO Matt Goldberg. “As we enter 2023, we will continue to leverage these strengths while identifying new opportunities to reinforce and accelerate our performance and drive sustainable profitable growth.”

In the morning watch for numbers from food giant Kraft Heinz, auto retailer Lithia Motors, chip maker Analog Devices, homebuilder Taylor Morrison Home, and biotechnology firm Biogen among more.

Networking equipment maker and Dow member Cisco Systems will be in the earnings spotlight Wednesday afternoon.

Investors will also watch for results from insurer AIG, e-commerce firm Shopify, and hospitality REIT Host Hotels & Resorts among others.

An exceptionally busy morning of economic data awaits investors on Wednesday.

The consumer will take center stage with the January retail sales report. Economists surveyed by Refinitiv anticipate consumer spending rose 1.8% after a larger-than-expected decline of 1.1% in December.

Excluding the automotive component, spending is seen climbing 0.8% in January, also rebounding from a drop of 1.1% the prior month.

The New York Federal Reserve will release its closely watched gauge of regional manufacturing activity. The Empire State Manufacturing Survey is expected to rise to -18.0 this month. That’s after tumbling unexpectedly to -32.9 in January, the lowest since May 2020, on weak demand.

A number below zero means that more New York-area manufacturers say business conditions are worsening than improving.

The Federal Reserve will post industrial production data for January.

Watch for when the National Association of Homebuilders releases its Housing Market Index for February.

We'll also get December business inventories.

Oil prices added to recent losses Wednesday as a much bigger-than-expected surge in the U.S. crude inventories and expectations of further interest rate hikes sparked concerns over demand and economic recession.

West Texas Intermediate (WTI) crude futures traded around $78.00 per barrel.

Brent crude futures traded around $84.00 per barrel.

U.S. crude inventories rose by about 10.5 million barrels in the week ended Feb. 10, according to market sources citing American Petroleum Institute (API) figures on Tuesday.

The build was much larger than the 1.2 million-barrel rise that nine analysts polled by Reuters had expected.

Official government inventory estimates are due Wednesday morning.

Meanwhile, a Federal Reserve official said on Tuesday the U.S. central bank will need to keep gradually raising interest rates to beat inflation after data showed that U.S consumer prices accelerated in January.

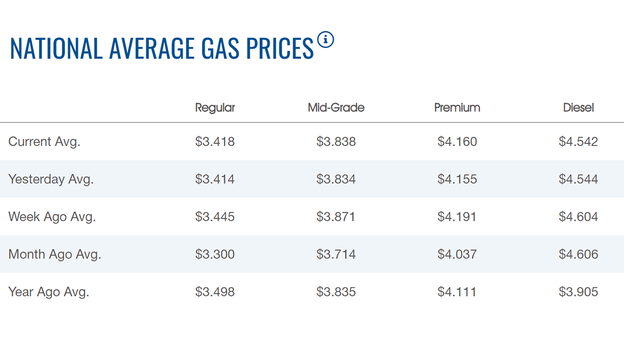

The price of gasoline moved higher on Wednesday.

The nationwide price for a gallon of gasoline ticked higher to $3.418, according to AAA.

The average price of a gallon of gasoline on Tuesday was $3.414.

A year ago, the price for a gallon of regular gasoline was $3.498.

One week ago, a gallon of gasoline cost $3.445. A month ago, that same gallon of gasoline cost $3.30.

Gas hit an all-time high of $5.016 on June 14.

Diesel remains below $5.00 per gallon at $4.542, but that is still far from the $3.905 of a year ago.

Bitcoin was trading around $22,000, after snapping a two-day losing streak.

For the week, Bitcoin was down more than 4%.

For the month, the cryptocurrency was off 3%, but up more than 34% year-to-date.

Ethereum was trading around $1,500, after losing nearly 7% in the past week.

Dogecoin was trading at 8 cents, after losing more than 9% in the past week.

Live Coverage begins here