STOCK MARKET NEWS: Dow, S&P rebound, Yellen visits Ukraine, Union Pacific replaces CEO

U.S. stocks rebound following the worst week of the year as bond yields retreat, orders of big-ticket items fall short, Yellen makes surprise visit to Ukraine, Union Pacific replaces CEO amid safety concerns, Nokia changes iconic logo. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NOK | $4.67 | 0.09 | 1.97 |

Nokia announced plans on Sunday to change its brand identity for the first time in nearly 60 years, complete with a new logo, as the telecom equipment maker focuses on aggressive growth.

The new logo comprises five different shapes forming the word NOKIA. The iconic blue color of the old logo has been dropped for a range of colors depending on the use.

While Nokia still aims to grow its service provider business, where it sells equipment to telecom companies, its main focus is now to sell gear to other businesses.

Nokia plans to review the growth path of its different businesses and consider alternatives, including divestment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ZM | $73.72 | -0.21 | -0.28 |

Zoom Video Communications Inc on Monday forecast annual profit above Wall Street estimates, benefiting from cost-cutting measures and steady demand for its video-conferencing service from the ongoing shift to hybrid work models.

Shares of the San Jose, California-based company rose 6% in trading after the bell.

Zoom became a household name during the pandemic when many organizations stuck with lockdowns flocked to its platform to maintain easy communication with its employees.

The company has expanded its offerings to include connected conference rooms, cloud-calling products, workspaces and online webinars to attract both small and large businesses amid high competition and slow economic growth.

Zoom forecast annual profit between $4.11 per share and $4.18 per share, compared with estimates of $3.66 per share, according to Refinitiv data.

Revenue for the quarter ended Jan. 31 was $1.12 billion, compared with analysts' average expectation of $1.10 billion.

However, the company expects fiscal 2024 revenue to be between $4.44 billion and $4.46 billion, compared with analysts' average estimate of $4.60 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WDAY | $184.93 | 1.80 | 0.98 |

Workday Inc. (WDAY) on Monday reported a loss of $125.7 million in its fiscal fourth quarter.

The Pleasanton, California-based company said it had a loss of 49 cents per share. Earnings, adjusted for stock option expense and non-recurring costs, came to 99 cents per share.

The results surpassed Wall Street expectations. The average estimate of 30 analysts surveyed by Zacks Investment Research was for earnings of 89 cents per share.

The maker of human resources software posted revenue of $1.65 billion in the period, which also beat Street forecasts. Thirty-one analysts surveyed by Zacks expected $1.63 billion.For the year, the company reported a loss of $366.7 million, or $1.44 per share. Revenue was reported as $6.22 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TBPH | $10.56 | 0.69 | 6.99 |

Activist investor Irenic Capital Management is urging Theravance Biopharma Inc to initiate a review of strategic alternatives, including a full sale, and to add a shareholder to its board, according to a letter seen by Reuters.

Irenic owns a 4.2% stake in the biotechnology company and has criticized its lagging valuation and stock-based compensation to Chief Executive Rick Winningham, who is also board chair.

Theravance, which sells a treatment for chronic obstructive pulmonary disease, could be worth $21 a share, roughly double its $9.87 closing price last week, Irenic co-founders Adam Katz and Andy Dodge wrote in the letter.

Irenic also called on Theravance to use excess cash to immediately issue a $300 million special dividend to shareholders. The company does not pay a dividend now but has been repurchasing its stock and has said it plans to continue repurchases this year.

Theravance's largest shareholders include The Baupost Group and Madison Avenue Partners.

U.S. stocks posted modest gains on Monday led by consumer discretionary and industrial companies as investors await a slew of retail earnings from the likes of Target, due Tuesday and Costco, out Thursday. In commodities, oil slipped 0.8% to $75.68 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLI | $101.11 | 0.80 | 0.79 |

| XLV | $128.03 | -0.48 | -0.37 |

| TGT | $166.02 | -0.94 | -0.56 |

| COST | $486.61 | -2.00 | -0.41 |

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PLTR | $7.97 | -0.12 | -1.48 |

Data analytics firm Palantir Technologies said on Monday it has cut about 2% of its workforce, joining a raft of U.S. companies that have laid off thousands of workers amid an economic downturn.

"To continue to evolve, we are making the tough choice of reducing teams in several areas," the company said.

"While less than 2% of our workforce is impacted by these changes, these are incredibly painful decisions but the right ones for the company's future."

Palantir, known for its work with the U.S. Central Intelligence Agency, had 3,838 full-time employees as of Dec. 31, 2022.The headcount reduction was first reported by Bloomberg News.

Contracts to buy U.S. previously owned homes rose by the most in more than 2-1/2 years in January, but a resurgence in mortgage rates could delay a much-awaited housing market turnaround.

The National Association of Realtors (NAR) said on Monday its Pending Home Sales Index, based on signed contracts, jumped 8.1% last month, the biggest increase since June 2020. Economists polled by Reuters had forecast contracts, which become sales after a month or two, rising 1.0%.

The second straight monthly increase in contracts could see existing home sales rebounding or posting another small decline after logging their 12th straight monthly decrease in January. Contracts increased in all four regions. Pending home sales decreased 24.1% in January on a year-on-year basis.

"Home sales activity looks to be bottoming out in the first quarter of this year, before incremental improvements will occur," said NAR Chief Economist Lawrence Yun.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UNP | $194.02 | 0.70 | 0.36 |

Union Pacific announced plans Sunday to replace its CEO later this year after a hedge fund that holds a $1.6 billion stake in the railroad went public with its concerns about his leadership.

The managing partner of Soroban Capital Partners, Eric Mandelblatt, said in a letter that the Omaha, Nebraska-based railroad has lagged behind its peers during Lance Fritz' tenure over the past eight years and that a leadership change is overdue. The hedge fund has been privately pressuring Union Pacific to oust Fritz at least since last year.

Mandelblatt urged the railroad to hire former Chief Operations Officer Jim Vena, who helped overhaul Union Pacific's operations several years ago. But the railroad's board said in a statement that it has been working with a leadership consultant since last year to identify the best internal and external candidates for the job.

Vena was brought in to Union Pacific in 2019 from Canadian National to help the railroad change to a new operating model that relies on fewer, longer trains and significantly fewer employees and locomotives to move freight, but Vena left after less than two years on the job.

Treasury Secretary Janet Yellen said Monday her first visit to Ukraine underscored Washington's commitment to continuing its economic support for the country, as the din of air raid sirens echoed across the Ukrainian capital.

Yellen said following talks with Ukrainian Prime Minister Denys Shmyhal that the US has provided nearly $50 billion in security, economic and humanitarian assistance and announced another multibillion dollar package to boost the country's economy.

Shmyhal offered thanks to the U.S. for its support and hailed Yellen as a "friend of Ukraine.” He said Ukraine's budget deficit now stands at $38 billion and that the U.S. will provide another $10 billion in assistance by September.Shmyhal and Yellen also discussed sanctions aimed at weakening Russia's economy as well as the possibility of using Russian frozen assets to help in Ukraine's economic recovery.

NASA scrubbed Elon Musk's latest SpaceX launch but is putting it back on the board for later this week.

Coming off the worst week for investors of 2023, the major U.S. stock indexes are rallying on Monday.

The Dow Jones Industrial, S&P 500 and Nasdaq are all in positive territory, with the tech-heavy index leading the way as shares of Microsoft, Apple and Nvidia add early gains.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MSFT | $250.66 | 1.44 | 0.58 |

| AAPL | $148.01 | 1.30 | 0.89 |

| NVDA | $235.37 | 2.50 | 1.08 |

In commodities, oil is off approximately 0.71% to $75.78 a barrel as gold adds roughly 0.36% to $1,823.70 an ounce.

Meanwhile, silver is down, falling around 0.96% to $20.73 an ounce.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SNAP | $10.09 | 0.28 | 2.80 |

Snap is launching a new chatbot running the latest version of OpenAI's GPT technology. Called My AI, the chatbot will be available as an experimental feature for Snapchat+ subscribers, beginning this week.

My AI can recommend birthday gift ideas for your BFF, plan a hiking trip for a long weekend, suggest a recipe for dinner, or even write a haiku about cheese for your cheddar-obsessed pal. Make My AI your own by giving it a name and customizing the wallpaper for your Chat.

All conversations with My AI will be stored and may be reviewed to improve the product experience.

While My AI is designed to avoid biased, incorrect, harmful, or misleading information, mistakes may occur.

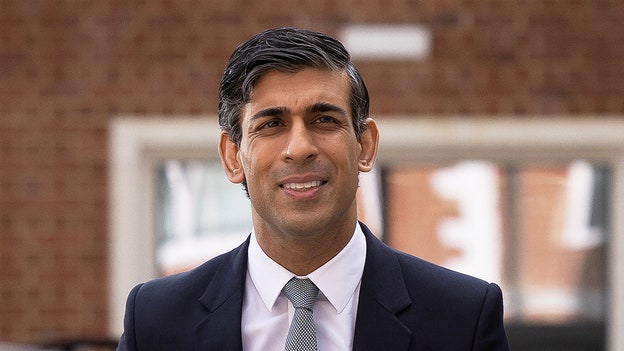

British Prime Minister Rishi Sunak has struck a new deal on post-Brexit trade rules for Northern Ireland, gambling that the reward of better ties with the European Union is worth any discord it might cause within his own party.

A government source said Sunak had agreed the terms with European Commission President Ursula von der Leyen as they met at a hotel west of London. They will hold a joint news conference at 1530 GMT.

The agreement marks a high-risk strategy for Sunak who has been looking to secure a compromise and improve relations with Brussels—and the United States—without sufficiently angering the wing of his party most wedded to Brexit.

The deal seeks to resolve tensions caused by the 2020 post-Brexit arrangements governing Northern Ireland, a British province, and its open border with EU member Ireland.

It remains to be seen, though, whether it will go far enough to end political deadlock in Northern Ireland and satisfy critics in Britain and the province.

London could also set some tax and state aid rules.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FUBO | $1.94 | -0.39 | -16.59 |

Fubotv is falling in Monday trading. The TV streaming platform is forecasting slower subscriber growth in North America for 2023.

Average North American subscribers jumped 31% in 2022 to 1,380,956. For 2023, the company predicts growth of about 11% to 1,510,000-1,530,000.

Fourth quarter revenue rose 38% to 319.3 million, which is higher than the estimated $285.54 million.

The net loss was $95.9 million,

On a per share basis, the company reported losses of -76 cents per share an identical amount to that earned in the same quarter last year. Losses of -71 cents per share were anticipated by the seven analysts providing estimates for the quarter.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SGEN | $161.37 | -0.82 | -0.51 |

| PFE | $41.75 | -0.55 | -1.30 |

Pfizer Inc is in early-stage talks to acquire cancer drugmaker Seagen Inc in what could be a multi-billion dollar deal, the Wall Street Journal reported on Sunday, citing people familiar with the matter.

Seagen had a market capitalization of roughly $30 billion, as of Friday's close.

Seagen was in advanced talks to be acquired by Merck, in a deal that would have been worth $40 billion or more, the Journal reported last year, but the two sides failed to reach an agreement, according to multiple reports.

Pfizer declined to comment on the WSJ report, while Seagen did not immediately respond to a Reuters request for comment.

Seagen makes "guided-missile" cancer drugs known as antibody-drug conjugates. The company reported total 2022 revenues of nearly $2 billion, driven by demand for its approved therapies such as lymphoma treatment Adcetris and breast cancer drug Tukysa.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $196.88 | -5.19 | -2.57 |

Tesla's German plant in Brandenburg near Berlin is now producing 4,000 cars per week, the company said on Monday, quadrupling from May when Chief Executive Elon Musk had compared investment in Tesla's new plants to "gigantic money furnaces."

The Berlin plant hit the production target three weeks ahead of a production schedule reviewed by Reuters.

At its new weekly output, Tesla's plant in Germany would have annual output of over 200,000 vehicles. The maximum capacity planned for the Brandenburg plant is 500,000 cars a year, nearing 10,000 per week, the company has said.

Output from the plant in Germany is now a third of the Model Y output in Shanghai, where Tesla planned to keep an average total output of 13,000 Model Ys per week — around 1,000 below maximum capacity — and a further 7,000 Model 3s in February and March, according to the production plan.

Tesla was planning to ramp up output from Brandenburg to 4,000 in the week of March 13 and to more than 5,000 by the end of June.

The ramp up in output in Germany would allow Tesla to use a larger share of its Shanghai production for markets outside Europe, including Thailand, where it has just launched sales.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $196.88 | -5.19 | -2.57 |

| BRK.A | $461,705.01 | 2,330.01 | 0.51 |

| SGEN | $161.37 | -0.82 | -0.51 |

| PFE | $41.75 | -0.55 | -1.30 |

Futures tracking the main U.S. stock indexes rose on Monday after Wall Street's worst weekly performance of 2023 on fears that the Federal Reserve would keep raising rates this year.

The blue-chip Dow erased its gains for the year in Friday's selloff and the S&P 500 logged its third straight week of losses on worries that strength in the U.S. economy and elevated inflation will give the Fed more room for rate hikes.

Futures pointed to a slight recovery in sentiment on Monday as some of the rate-sensitive growth stocks rose in premarket trading.

Tesla added 2.6% after the electric automaker said its plant in Brandenburg near Berlin is producing 4,000 cars a week, three weeks ahead of schedule according to a recent production plan reviewed by Reuters.

Warren Buffett's Berkshire Hathaway Inc reported its highest-ever annual operating profit, even as foreign currency losses and rising rates led to lower earnings in the fourth quarter.

Seagen Inc surged 14.6% after the Wall Street Journal reported that Pfizer was in early talks to acquire the biotech firm. Pfizer's shares slipped 1.1%.

U.S. railroad operator Union Pacific jumped 9.3% as Chief Executive Lance Fritz said he would step down, a move that follows calls from hedge fund Soroban Capital Partners for his ouster.

America's top economists are growing more divided about the state of the U.S. economy amid inflation and a the jobs market.

Sports apparel giant Under Armour ushers in new CEO Stephanie Linnartz who is faced with a number of challenges including a stock price lagging rival Nike and the S&P 500.

In the Oracle of Omaha's annual letter, Warren Buffett had a strong message for critics of stock buybacks.

Live Coverage begins here