STOCK MARKET NEWS: Meta ending Trump suspension, Tesla leads earnings, Manchin on EV tax credit

Stocks end mixed, Tesla, IBM and Levi's report earnings, Manchin wants EV credit action. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| META | $142.20 | -0.94 | -0.66 |

Meta Platforms says it will end former president Donald Trump’s suspension from Facebook and Instagram in the coming weeks.

The company will put guardrails in place to deter repeat offenses.

“Like any other Facebook or Instagram user, Mr. Trump is subject to our Community Standards. In light of his violations, he now also faces heightened penalties for repeat offenses — penalties which will apply to other public figures whose accounts are reinstated from suspensions related to civil unrest under our updated protocol,” Meta said.

“In the event that Mr. Trump posts further violating content, the content will be removed and he will be suspended for between one month and two years, depending on the severity of the violation.”

Meta suspended Trump on Jan. 7, 2021 following his praise for people engaged in violence at the Capitol on January 6.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| URI | $392.76 | -1.04 | -0.26 |

United Rentals Inc. on Wednesday reported fourth-quarter earnings of $639 million.

On a per-share basis, the Stamford, Connecticut-based company said it had net income of $9.15. Earnings, adjusted for non-recurring costs, were $9.74 per share.

The results missed Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for earnings of $10.12 per share.

The equipment rental company posted revenue of $3.3 billion in the period, beating Street forecasts. Eight analysts surveyed by Zacks expected $3.29 billion.

For the year, the company reported profit of $2.11 billion, or $29.65 per share. Revenue was reported as $11.64 billion.

United Rentals expects full-year revenue in the range of $13.7 billion to $14.2 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LEVI | $16.50 | -0.22 | -1.32 |

Levi Strauss & Co forecast annual sales above Wall Street estimates on Wednesday, in a sign that demand for its jeans is holding up better than feared even as consumers shift to purchase more non-denim and office-friendly clothing.

The San Francisco-based jeans maker also got a boost from strong performance at its other brands, including Dockers and Beyond Yoga, helping it cushion a 5% drop in revenue from the Americas region.

The direct-to-consumer business accounts for 36% of the company's total revenue, according to UBS analyst Jay Sole.

That, coupled with higher prices of its jeans, helped Levi's project net revenues between $6.3 billion and $6.4 billion for fiscal 2023, compared with analysts' average estimate of $6.27 billion, according to Refinitiv IBES data.

Net revenue from Levi's other brands jumped 28% to $127 million in the reported quarter, helping the company cushion a blow from an 18% slump in sales in Europe, stemming from macroeconomic pressures in the region and the suspension of business in Russia.

Despite higher prices, Levi's adjusted gross margin fell 230 basis points to 55.8% in the fourth quarter, owing to currency pressures, higher product costs and holiday promotions.

The company said it now expects full-year adjusted profit between $1.30 and $1.40 per share, in line with analysts average estimate of $1.35 per share.

Levi's net revenue declined about 6% to $1.59 billion in the fourth quarter, edging past estimates of $1.57 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| STX | $62.25 | 0.02 | 0.03 |

Seagate Technology Holdings plc (STX) on Wednesday reported a loss of $33 million in its fiscal second quarter.

On a per-share basis, the Dublin-based company said it had a loss of 16 cents. Earnings, adjusted for stock option expense and non-recurring costs, came to 16 cents per share.

The results exceeded Wall Street expectations. The average estimate of six analysts surveyed by Zacks Investment Research was for earnings of 11 cents per share.

The electronic storage maker posted revenue of $1.89 billion in the period, which also beat Street forecasts. Five analysts surveyed by Zacks expected $1.82 billion.

For the current quarter ending in March, Seagate expects its per-share earnings to range from 5 cents to 45 cents.

The company said it expects revenue in the range of $1.85 billion to $2.15 billion for the fiscal third quarter. Analysts surveyed by Zacks had expected revenue of $2.32 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WOLF | $81.93 | 0.32 | 0.39 |

Wolfspeed is lower in extended trading. The semiconductor maker missed Wall Street revenue estimates but beat on profit.

Fiscal second quarter revenue rose 24.8% to $216.1 million. The estimate was $229.14 million.

The net loss for the three months ended Dec. 25 was $90.9 million compared to a loss of $96.7 million a year ago.

The net loss per diluted share was 11 cents, better than the estimate for a loss of 12 cents.

For its third quarter of fiscal 2023, Wolfspeed targets revenue in a range of $210 million to $230 million. GAAP net loss is targeted at $81 million to $88 million, or $0.65 to $0.71 per diluted share.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| IBM | $140.60 | -0.89 | -0.63 |

IBM Corp on Wednesday reported its highest annual revenue growth in a decade and beat Wall Street expectations for the fourth quarter as more businesses looked to optimize their operations and save costs amid an economic downturn.

The IT software and consulting company also forecast annual revenue growth in the mid-single digits on constant currency terms, weaker than the 12% it reported for 2022 but in line with mid-term targets announced in 2021.

Analysts have raised concerns if IBM would be able to deliver on that considering the turbulent macroeconomic backdrop.

IBM's full-year revenue grew 5.5% to $60.53 billion thanks to its shift to the so-called "hybrid cloud" strategy — where the company helps clients set up their own data centers and use leased computing resources.

Its hybrid cloud revenue rose 2% to $6.3 billion in the reported quarter.

Total revenue growth was flat at $16.69 billion in the quarter ended Dec. 31, compared with analysts' estimates of $16.40 billion, according to Refinitiv data.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $144.38 | 0.49 | 0.34 |

Tesla Inc beat analysts' estimate for fourth-quarter revenue on Wednesday, powered by record delivery of electric vehicles during the last three months of 2022.The company said revenue was $24.32 billion for the three months ended Dec. 31, compared with analysts' average estimate of $24.16 billion, according to IBES data from Refinitiv.

Tesla offered discounts in its top markets during the quarter after strong orders had allowed the company to maintain and even raise prices in recent years. CEO Elon Musk said in December "radical interest rate changes" had affected the affordability of all cars.

The EV maker handed over to customers a record 405,278 vehicles in the fourth quarter, even as the company missed its 50% annual growth target.

Net profit for the quarter was $3.69 billion, or $1.07 per share, compared with $2.32 billion, or 68 cents per share, a year earlier.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CSX | $31.02 | -0.84 | -2.64 |

CSX missed Wall Street revenue estimates but beat on profit.

Four quarter revenue rose 9% to $3.73 billion. The company was expected to report a rise in revenue to $3.72 billion.

Operating income of $1.46 billion increased 7% compared to the prior year, with an operating ratio of 60.9%.

Diluted earning per share was 49 cents, topping the estimate of 46 cents.

For the full year 2022, CSX operating income of $6.0 billion was up 8% from the previous year and included $144 million in gains from property sales recognized from the 2021 agreement with the Commonwealth of Virginia.

Full year 2021 operating income included $349 million in gains from this same transaction. Net earnings for the year of $4.17 billion, or $1.95 per share, compared to $3.78 billion, or $1.68 per share, in 2021.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MSGE | $49.13 | 1.06 | 2.21 |

New York Attorney General Letitia James wants to know more about how Madison Square Garden Entertainment is using facial recognition technology to prohibit legitimate ticketholders from entering their venues.

MSG Entertainment owns and operates several large venues in New York, including Madison Square Garden and Radio City Music Hall.

The company has reportedly used facial recognition technology to identify and deny entry to all lawyers who are affiliated with law firms representing clients in pending litigation related to MSG Entertainment.

The Federal Trade Commission (FTC) should examine high egg prices for signs of price gouging from top egg companies, a farm group said, as Americans continue to pay more than ever for the household staple.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CALM | $53.73 | 0.00 | 0.00 |

U.S. regulators, farmers, and industry have often argued in recent years about the power of top agriculture firms to set prices and drive up what consumers pay for groceries, such as when the price of beef skyrocketed in 2021.

The latest concern is eggs, the price of which was up 138% in December from a year prior, to $4.25 a dozen, according to the Bureau of Labor Statistics.

U.S. Senate Energy and Natural Resources Committee chair Joe Manchin on Wednesday introduced legislation that would immediately impose battery sourcing requirements on electric vehicles to qualify for $7,500 tax credits.

The U.S. Treasury in December said it would not issue proposed guidance on battery sourcing rules until March, giving some electric vehicles not meeting new requirements a brief window of eligibility in 2023 before the battery rules take effect. Manchin's legislation would make all of the battery requirements for tax credits retroactive to Jan. 1.

The $430 billion U.S. Inflation Reduction Act passed in August restricts the $7,500 consumer tax credits to North American-made EVs, but the Treasury in December said consumers leasing vehicles assembled outside North America could benefit from the $7,500 commercial green vehicle tax credit

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NEE | $78.71 | -5.19 | -6.19 |

NextEra Energy Inc on Wednesday posted mixed quarterly results, as the top U.S. renewable power producer navigated extreme weather conditions and volatile natural gas prices during the period.

The power sector last year was battered by extreme weather conditions. The historic winter storm Elliott last month knocked out power for more than 1.5 million homes and businesses across the United States.

NextEra was hit by $53 million in storm restoration costs during the reported quarter.

The Juno Beach, Florida-based company's fourth-quarter revenue of $6.16 billion fell short of Wall Street estimates of $6.55 billion, according to Refinitiv data. Adjusted profit of 51 cents per share, however, beat estimates of 49 cents per share.

The company's clean energy unit, logged its best year for renewables and storage, adding more than 8,000 megawatts to its backlog.

The company expects that between 2023 and 2026 it would place into service about 32,700 megawatts to 41,800 megawatts of new renewables and storage.

It also added that Eric Silagy, chief executive of Florida Power & Light (FPL) — NextEra's key division and America's largest electric utility — would retire after 20 years with the unit. Armando Pimentel, who has served in several senior executive roles at NextEra, will succeed as FPL's top boss.

| Symbol | Price | Change | %Change |

|---|---|---|---|

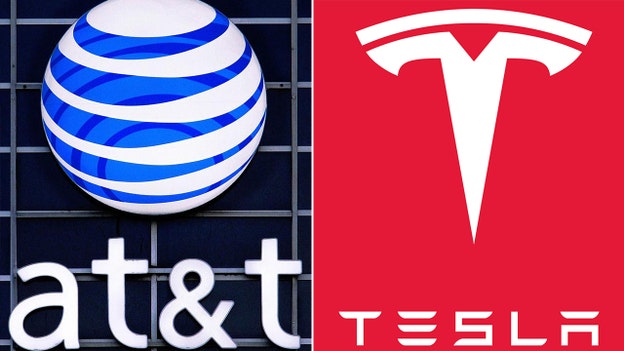

| T | $20.19 | 1.03 | 5.38 |

AT&T Inc's better-than-expected quarterly subscriber additions overshadowed a $25 billion non-cash charge related to the impact of higher interest rates on its businesses and triggered a 6% rise in its shares.

The carrier has used discounts and trade-in offers to lure customers in the highly competitive telecoms market, as it ramps up competition with Verizon and T-Mobile US after shedding its media business last year.

Apart from 5G technology, AT&T is also investing in bolstering its fiber-optic network, which lets it sell both broadband services and video packages. The company added 280,000 fiber customers in the December quarter.

AT&T on Wednesday forecast adjusted earnings in the range of $2.35 and $2.45 per share, which included a 25-cent charge related to non-cash pension costs and an expected higher tax rate. Analysts were expecting a profit of $2.56 per share, according to Refinitiv data.

For the latest quarter, AT&T added 656,000 postpaid phone subscribers, above Factset estimates of 644,800 additions. The number also came in well above Verizon's 217,000 additions, although it failed to match T-Mobile's expected 927,000 additions.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ESYJY | $6.37 | 0.64 | 11.17 |

easyJet is higher in Wednesday trading. The UK discount airline said its passenger count grew 47% in the fiscal first quarter.

Passenger revenue jumped 78% to 975 million pounds sterling ($1.2 billion) while holiday revenue increased 232%.

Moving into the second quarter of this financial year, easyJet expects revenue per seat growth year on year to continue the trend experienced in Q1. This is driven by yield and load factor growth alongside the continued delivery of ancillary products.

CEO Johan Lundgren expects full-year pre-tax income will exceed current market consensus of 126 million pounds sterling.

“If chief executive Johan Lundgren’s profit forecast proves accurate, easyJet will be in the black on an annual basis for the first time since the financial year that ended in September 2019, although from an investor’s perspective, there is still a lot of work to be done as the shares (and annual profits) actually peaked way back in 2015,” said AJ Bell investment director Russ Mould.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GD | $227.26 | -8.19 | -3.48 |

U.S. defense contractor General Dynamics Corp on Wednesday beat expectations for quarterly results, as geopolitical tensions triggered by Russia's invasion of Ukraine led to a surge in demand for weapons.

Sales at General Dynamics' combat systems unit, which makes Abrams tanks and other land warfare systems, rose 15.5% to $2.18 billion in the quarter ended Dec. 31.

However, analysts say Republican Kevin McCarthy's election as the U.S. House Speaker has clouded the near-term outlook for defense contractors. General Dynamics is expected to issue a forecast for 2023 in the analyst call on Wednesday.

Meanwhile, revenue at General Dynamics' aeronautics unit that builds and develops Gulfstream jets fell nearly 4% to $2.45 billion. The unit had gained during the pandemic as more people sought private jets.

General Dynamics' Gulfstream jet delivery fell by one unit to 38 units. Overall book-to-bill ratio, a comparison of orders received to units shipped and billed, was 1.2-to-1 for the quarter, while backlogs stood at $91.1 billion.

The company also benefited from a 9.3% jump in sales at its technologies unit, which provides military tech and software.

Net earnings rose to $3.58 per share from $3.39 per share, a year earlier. Analysts had expected a profit of $3.54 per share, according to Refinitiv IBES data.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NSC | $244.74 | -11.14 | -4.35 |

Norfolk Southern Corp reported a lower-than-expected fourth-quarter profit on Wednesday as U.S. railroad operators struggle with labor shortages, service problems and high fuel prices.

The U.S. railroad industry has faced severe criticism from shippers and the U.S. Surface Transportation Board for cutting staffing in pursuit of a leaner operating model, which left operators struggling to fulfill demand.

Profits have also been pressured by high fuel prices, though railroads were able to pass on some of the costs to customers.

Norfolk, which has connections to every major container port on the Atlantic coast as well as the Gulf of Mexico and Great Lakes, said its railway operating expenses rose 19% to $2.1 billion during the quarter.

The company's operating revenue, however, rose 13% to $3.2 billion.

Norfolk reported a profit of $3.42 per share for the quarter ended December, compared with analysts' average estimate of $3.44 per share, according to Refinitiv data.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BA | $211.15 | -0.83 | -0.39 |

Boeing Co losses widened for 2022 on weakness in its defense unit but the U.S. planemaker reported its first yearly positive cash flow since 2018 on stronger commercial airplane deliveries.

The U.S. planemaker missed Wall Street expectations on revenue and earnings per share in the final quarter of the year.

Boeing said net losses rose to $5 billion for all of 2022 from $4.3 billion in 2021, while losses from operations rose to $3.5 billion in 2022 from $2.9 billion.

Boeing generated $3.1 billion in free cash flow in the final quarter of 2022. Boeing had forecast about $2.5 billion in free cash flow for the fourth quarter. Boeing reported $2.3 billion for all of 2022.

Boeing reported fourth-quarter revenue of $20 billion, up from $14.79 billion in the same quarter in 2022, and a loss per share of $1.75. Boeing had been expected to report $20.38 billion in revenue in the quarter and a gain of $0.26 a share, according to Refinitiv data.

Boeing affirmed it plans to deliver up to 450 737 MAX narrowbody aircraft and 70 to 80 widebody 787 Dreamliners in 2023. The company reiterated it expects to generate $3 billion to $5 billion in free cash flow in 2023.

Earlier this month, Boeing reported a sharp jump in airplane orders and deliveries in 2022. Boeing delivered 480 airplanes and won 774 net new orders after allowing for cancellations in 2022. Boeing in 2021 had delivered 340 planes and reported 479 net new orders.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BA | $211.98 | 2.01 | 0.96 |

| MSFT | $242.04 | -0.54 | -0.22 |

U.S. stocks fell across the board after Boeing and Microsoft became the latest big corporations to report sobering results and outlooks. Both shares weighed heavily on the Dow Jones Industrial Average.

Over the last five days, the Dow is up around 0.69%, the S&P remains up around 1.37%, and the tech-heavy Nasdaq is now roughly 2.41% higher during the same time.

In commodities, oil was little changed at $80 per barrel.

Noted investor Peter Schiff shared his views on inflation, climbing US debt and other factors that may hinder the economy in the coming months.

The Boeing Company recorded a $650 million dip in operating loss over the fourth-quarter, as revenue reached $20 billion, the airplane manufacturer announced on Wednesday.

In pre-market trading, shares for the aerospace company are roughly 2% beneath the redline.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BA | $211.98 | 2.01 | 0.96 |

Meanwhile, operating cash flow improved to $3.5 billion in the quarter, reflecting higher commercial deliveries and timing of receipts and expenditures.

During the quarter, the company secured net orders for 376 aircraft, including an order from United Airlines for 100 737 MAX and 100 787 airplanes. Commercial Airplanes delivered 152 airplanes during the quarter and backlog included over 4,500 airplanes valued at $330 billion.

After multiple stocks experienced trading halts on Tuesday morning due to a technical glitch, the New York Stock Exchange has identified the mishap and means for prevention.

On Wednesday, the NYSE said "a Sell Short Restriction (SSR) state was erroneously triggered in a subset of NYSE listed symbols. The SSR continued state on the attached symbols will be deactivated prior to the NYSE opening today."

Installed in 2010 and called the alternative uptick rule, the SSR states that stocks can't be shorted if they have dropped 10% or more in one day.

Microsoft shares are down 2% in premarket trading after the company narrowly missed Wall Street estimates for second-quarter revenue on Tuesday, squeezed by a slump in the personal computer market that hammered its Windows software business.

Revenue rose 2% to $52.7 billion in the three months ended Dec. 31, compared with the average analyst estimate of $52.94 billion, according to Refinitiv IBES.

They lost nearly a third of their market value in a dismal 2022 for tech stocks.

Microsoft is wrestling with a steep drop in the computing division, which includes products like Windows operating systems and devices, according to Reuters.

PC shipments tumbled nearly 29% between October and December, according to Gartner, the largest quarterly shipment decline since the consulting firm began tracking the market in the mid-1990s.

Advertising spending on Twitter took a drastic hit in December following Elon Musk's takeover of the social media platform.

Data from an advertising research firm showed top advertisers slashed their spending by 71%.

According to the Standard Media Index (SMI) data, ad spending on Twitter in November fell 55% from last year.

Morning reports will come from telecommunications giant AT&T, and Dow member Boeing and also General Dynamics.

Health care will also be in focus with insurer Elevance Health (formerly Anthem) and equipment maker Abbott Labs reporting ahead of the opening bell.

In the afternoon the attention will turn to EV maker Tesla. And we’ll hear from another Dow member, computer services giant IBM.

One-seventh of the companies in the S&P 500 have reported results.

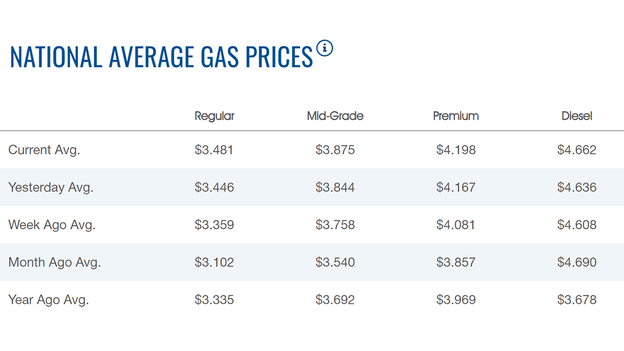

The nationwide price for a gallon of gasoline gained on Wednesday to $3.481, according to AAA.

The average price of a gallon of gasoline on Tuesday was $3.446.

A year ago, the price for a gallon of regular gasoline was $3.335.

One week ago, a gallon of gasoline cost $3.359. A month ago, that same gallon of gasoline cost $3.102.

Gas hit an all-time high of $5.016 on June 14.

Diesel gained, but remained below $5.00 per gallon to $4.662, but that is still a far from the $3.678 of a year ago.

Crude oil prices inched lower on Wednesday adding to recent declines due to economic concerns.

U.S. West Texas Intermediate (WTI) crude traded around $80.00, after a 1.8% drop on Tuesday.

Brent crude traded around $86.00 per barrel after falling 2.3% in the prior session.

Analysts from the Bank of America Securities said the reopening of the Chinese economy after years of tough COVID restrictions could unleash a large wave of pent-up demand over the next 18 months, according to Reuters.

An OPEC+ panel is likely to endorse the producer group's current oil output policy when it meets next week. OPEC+ in October decided to trim output by 2 million barrels per day from November through 2023 on a weaker economic outlook.

U.S. crude stocks rose by about 3.4 million barrels in the week ended Jan. 20, according to market sources citing American Petroleum Institute figures. That was triple the forecast in a preliminary Reuters poll on Monday.

Official data from the U.S. Energy Information Administration will be released later on Wednesday.

Goldman Sachs sees home prices decline this year and says four cities are of a particular concern.

San Jose, California; San Diego, California; Austin, Texas; and Phoenix, Arizona, will likely see noticeable increases before drastic decreases of more than 25%.

These declines would be similar to those witnessed during the Great Recession in 2008.

Bitcoin was trading around $22,000, after trading down in two of the last three days.

For the week, Bitcoin has gained more than 6%.

For the month, the cryptocurrency is up more than 38%, but remains down more than 37% in the last 52 weeks.

Ethereum was trading around $1,500, after losing less than 1% in the past week.

Dogecoin was trading at 8 cents, after gaining 0.8% in the past week.

Live Coverage begins here