STOCK MARKET NEWS: Bed Bath & Beyond drops bombshell, Hasbro cuts jobs, GDP surprises

Bed Bath & Beyond's financial troubles deepen, Boeing in court over 737 MAX crashes, new home sales up for a third month. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RHI | $80.81 | 1.93 | 2.45 |

Robert Half International Inc. on Thursday reported fourth-quarter earnings of $147.7 million.

On a per-share basis, the Menlo Park, California-based company said it had profit of $1.37.The results surpassed Wall Street expectations. The average estimate of six analysts surveyed by Zacks Investment Research was for earnings of $1.35 per share.

The staffing firm posted revenue of $1.73 billion in the period, falling short of Street forecasts. Three analysts surveyed by Zacks expected $1.74 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBBY | $2.56 | -0.68 | -20.94 |

Bed Bath & Beyond has appointed a restructuring specialist to board, according to a securities filing.

Bed Bath & Beyond has appointed Carol Flaton to its board as an independent director, effective immediately.

Flaton was not appointed to any committees.

She serves as an independent director of Talen Energy Supply. According to the biography posted on that company’s website, Flaton previously served as a managing director at AlixPartners. While there, she specialized in restructuring and turnarounds.

Prior to joining AlixPartners, she was a managing director at Lazard Freres restructuring practice.

Prior to Lazard, Flaton was a managing director at Credit Suisse First Boston and Citi where she oversaw distressed positions in the banks’ portfolios.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| V | $224.56 | -0.34 | -0.15 |

Visa Inc's first-quarter profit beat Wall Street targets on Thursday as its payments volume held steady with Americans still spending on international travel despite an economic slowdown.

Shares of the company rose 1.5% in late afternoon trading.

The world's largest payments processor said total cross-border volumes - a key measure that tracks spending on cards beyond the country of issue - jumped 22% on a constant dollar basis in the quarter. Total payment volumes added 7%.

That was, however, far lower than last year's 40% surge in cross-border volumes and a 20% jump in payments volumes.

Visa's revenue rose at the slowest rate in seven quarters, gaining 12% to $7.9 billion.

Earlier in the day, rival Mastercard Inc forecast current-quarter revenue growth below expectations as pent-up demand for travel was seen slowing going forward.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| INTC | $30.02 | 0.33 | 1.09 |

Intel Corp said it expects to lose money in the current quarter, surprising investors with a bleaker-than-expected outlook for both the PC market and slowing growth in its key data center division.

The company's shares fell 7% in trading after the bell.

Two of Intel's most important markets are showing signs of weakness after two years of strong growth as remote work boomed during the pandemic. Now, the PC industry is struggling with a glut of chips after demand for consumer electronics fell off a cliff and business customers wary of a recession are slowing spending on data centers.

The company forecast first-quarter revenue in the range of about $10.5 billion to $11.5 billion.

Analysts on average were expecting total revenue of $13.93 billion, according to Refinitiv data.

The company expects an adjusted loss of 15 cents per share versus expectations of a 24 cents per share profit.

Revenue in the fourth quarter fell 32% to $14 billion. Analysts on average expected revenue of $14.46 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HAS | $63.70 | -0.40 | -0.62 |

Hasbro Inc said on Thursday it would eliminate about 1,000 positions from its global workforce this year, or about 15% of full-time employees, as the toymaker looks to cut costs in a tough macroeconomic backdrop.

Shares of Hasbro fell 4% to $61.30 in after-hours trading.

The company estimated fourth-quarter revenue of about $1.68 billion, down 17% from a year earlier. Analysts on average expect revenue of $1.92 billion, according to Refinitiv IBES data.It forecast quarterly adjusted earnings per share of $1.29 to $1.31, much lower than estimates of $1.48.

Hasbro said President and Chief Operating Officer Eric Nyman is also exiting the company as part of organizational changes.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBBY | $2.68 | -0.56 | -17.29 |

Bed Bath & Beyond has received a credit default notice from administrator JPMorgan.

"As a result of the events of defaults that occurred on or around Jan. 13 and are continuing the principal amount of all outstanding loans under the credit facilities, together with accrued interest thereon, premiums and all fees are due and payable immediately," the domestic retailer said.

The notice assets that Bed Bath & Beyond failed to prepay an overadvance and satisfy a financial covenant.

Bed Bath & Beyond says, "At this time, the company does not have sufficient resources to repay the amounts under the credit facilities and this will lead the company to consider all strategic alternatives, including restructuring its debt under the U.S. Bankruptcy Code.“

The company’s outstanding borrowings under its ABL Facility and FILO Facility were $550.0 million and $375.0 million, respectively, as of Nov. 26, 2022.

In addition, the company had $186.2 million in letters of credit outstanding under its ABL Facility.

The company had $1.030 billion in senior notes (excluding deferred financing costs) outstanding.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $160.18 | 15.75 | 10.91 |

| CVX | $187.46 | 8.38 | 4.68 |

| SP500 | $4,060.43 | 44.21 | 1.10 |

| I:COMP | $11,512.41 | 199.06 | 1.76 |

All three of the major averages tacked on gains helped by positive earnings from Tesla, a major stock buyback from Chevron and a stronger-than-expected read on 4Q GDP. The Nasdaq Composite and S&P 500 rose to the highest levels since December. In commodities, oil rose 1% to $81.01 per barrel.

The FBI revealed on Thursday it had secretly hacked and disrupted a prolific ransomware gang called Hive, a maneuver that allowed the bureau to thwart the group from collecting more than $130 million in ransomware demands from more than 300 victims.

At a news conference, U.S. Attorney General Merrick Garland, FBI Director Christopher Wray, and Deputy U.S. Attorney General Lisa Monaco said government hackers broke into Hive's network and put the gang under surveillance, surreptitiously stealing the digital keys the group used to unlock victim organizations' data.

They were then able to alert victims in advance so they could take steps to protect their systems before Hive demanded the payments.

"Using lawful means, we hacked the hackers," Monaco told reporters. "We turned the tables on Hive."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BA | $212.50 | -0.18 | -0.08 |

Boeing Co pleaded not guilty on Thursday to a 737 MAX fraud conspiracy felony charge after families objected to a 2021 Justice Department agreement to resolve the investigation into the plane's flawed design.

Boeing’s chief safety officer, Mike Delaney, entered the not-guilty plea on behalf of the planemaker at a three-hour hearing. A not-guilty plea is standard in deferred prosecution agreements.

U.S. District Judge Reed O'Connor last week ordered Boeing to appear to be arraigned after he ruled that people killed in the two Boeing 737 MAX crashes are legally considered "crime victims."

The crashes in Indonesia and Ethiopia killed 346 people. They cost Boeing more than $20 billion, led to a 20-month grounding of the best-selling plane and prompted lawmakers to pass sweeping legislation reforming airplane certification.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSCO | $226.88 | 13.06 | 6.11 |

Tractor Supply Co. on Thursday reported fourth-quarter net income of $270.9 million.

On a per-share basis, the Brentwood, Tennessee-based company said it had profit of $2.43.

The results topped Wall Street expectations. The average estimate of 12 analysts surveyed by Zacks Investment Research was for earnings of $2.34 per share.

The retailer for farmers and ranchers posted revenue of $4.01 billion in the period, which also topped Street forecasts. Ten analysts surveyed by Zacks expected $3.88 billion.

For the year, the company reported profit of $1.09 billion, or $9.71 per share. Revenue was reported as $14.2 billion.

Tractor Supply expects full-year earnings to be $10.30 to $10.60 per share, with revenue in the range of $15 billion to $15.3 billion.

Sales of new single‐family houses rose 2.3% in December to a seasonally adjusted annual rate of 616,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

An estimated 644,000 new homes were sold in 2022. This is 16.4% (±3.8%) below the 2021 figure of 771,000.

The median sales price of new houses sold in December 2022 was $442,100. The average sales price was $528,400.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LVMUY | $171.60 | -1.92 | -1.11 |

Luxury goods group LVMH's sales rose 9% in the fourth quarter as shoppers in Europe and the United States splurged over the crucial holiday season, helping partly to offset COVID disruptions in China.

Sales at the world's biggest luxury group reached 22.7 billion euros ($24.65 billion) in the final three months of the year, with the 9% increase on an organic basis a touch above analyst expectations for 7% growth, based on a consensus cited by UBS.

That marked a deceleration from the 20% growth recorded in the first nine months of the year, due to the hit in China from lockdowns and its subsequent exit from a zero-COVID policy, which has spurred a surge of infections in the world's second-largest economy.

"China was sharply down in the fourth quarter," the group's finance chief, Jean-Jacques Guiony, told reporters.

Even so, Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, said, “The group’s also benefitting from the return of travelers as borders reopen, especially China.”

“The ultra-wealthy aren’t put off by economic ups and downs, and inflation is unlikely to dent their spending habits.”Reuters contributed to this report.

Mortgage rates are continuing to tick down and, as a result, home purchase demand is thawing from the months-long freeze that gripped the housing market said Freddie Mac.

Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate inched down to 6.13% from 6.15% last week. A year ago the average rate was 3.55%.

The average long-term rate reached a two-decade high of 7.08% in late October and early November as the Federal Reserve continued to raise its key lending rate in a bid to cool the economy and tame inflation.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LUV | $35.24 | -1.63 | -4.42 |

Southwest Airlines Co on Thursday warned of a loss in the current quarter as passengers shunned the carrier in the immediate aftermath of a tech meltdown that forced it to scrap thousands of flights between Christmas and New Year's Eve.

Analysts on average had expected the company to post a profit of 19 cents a share in the first quarter, Refinitiv IBES data shows.

Southwest, which also reported a loss in the fourth quarter, estimates a revenue hit of between $300 million and $350 million in the first quarter.

The Dallas-based carrier also expects non-fuel operating costs in the March quarter to be higher than its previous estimate, in part due to extra pay it has offered to workers for dealing with the December meltdown.

Current booking trends for March were encouraging, it added.

Operating revenue for the first quarter, when travel demand tends to slow after the holiday season, is expected to rise 20% to 24% against a period last year which was hit by the pandemic.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SHW | $227.21 | -19.88 | -8.05 |

Sherwin-Williams is warning of economic conditions ahead.

“We will not be immune from what we expect to be a very challenging demand environment in 2023. Visibility beyond our first half of the year is limited,” said chair and CEO John Morikis.

On the architectural side, the company expects housing will be under significant pressure this year. Slowing existing home sales and continued high inflation also will be headwinds.

On the industrial side, Sherwin-Williams has already seen a slowdown in Europe, and the same is beginning to appear in the U.S. across several sectors.

In China, COVID remains a factor and the trajectory of economic recovery is difficult to map.

The paint and coatings maker on Thursday reported fourth-quarter net income of $386.3 million.

The Cleveland-based company said it had profit of $1.48 per share. Earnings, adjusted for amortization costs and restructuring costs, were $1.89 per share.

The results surpassed Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for earnings of $1.84 per share.

The paint and coatings maker posted revenue of $5.23 billion in the period, which did not meet Street forecasts. Seven analysts surveyed by Zacks expected $5.24 billion.

The Associated Press contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DOW | $56.85 | -1.04 | -1.80 |

Dow Inc. will eliminate 2,000 jobs worldwide as part of a corporate restructuring plan to secure $1 billion in cost savings in 2023, the company said on Thursday.

The Michigan-based materials science company said the shakeup was necessary amid ‘near-term macroeconomic uncertainty’.

Dow is also shutting down select assets and further evaluating its global asset base while focusing on Europe "to ensure long-term competitiveness and enhance cost efficiency," according to the company.

The restructuring plan will allocate $500 million for structural improvements and $500 million in operating expense reductions with an emphasis on near-term cash flow.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MA | $375.26 | -7.13 | -1.86 |

Mastercard's fourth quarter earnings report beat Wall Street predictions on Thursday.

Fourth-quarter net income reached $2.5 billion, or $2.62 a share, compared with $2.4 billion, or $2.41 a share, in the year-ago quarter.

Adjusted net income for the period also peaked at $2.5 billion, and adjusted diluted EPS of $2.65, while net revenue totaled $5.8 billion, notching an increase of 12%, or 17% on a currency-neutral basis.

Meanwhile, fourth quarter gross dollar volume went up 8% and purchase volume added 11% on a local currency basis.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DEO | $175.40 | -8.96 | -4.86 |

Diageo, the world's largest spirits maker, signaled on Thursday that robust demand for its drinks as people made pricey cocktails at home during COVID-19 lockdowns may be slowing in some parts of the world, particularly North America.

Its shares dropped almost 7%, shaving about 5 billion pounds ($6.2 billion) off the company's market value even as Diageo posted forecast-beating first-half sales thanks to price hikes and as more people drank premium spirits.

Since the pandemic, Diageo has benefited from people splurging on more expensive types of alcohol while staying home under lockdown.

The company and its rivals invested heavily in marketing and improving their products to capitalize on newfound demand, focusing on premium brands such as Bulleit Bourbon and Don Julio tequila.

But Diageo's North America business, which accounts for nearly 30% of overall sales, reported organic sales growth of 3% in the six months ended Dec. 31 versus analyst estimates of over 6%.

The company said it expected North American organic net sales growth to "continue to normalize through the second half of fiscal '23, compared to the double-digit growth in the prior period".

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CMCSA | $40.09 | -0.01 | -0.01 |

Comcast Corp's fourth-quarter revenue beat Wall Street expectations on Thursday, as the media company saw continued demand at its theme parks and experienced modest gains in broadband subscribers outside of regions hit by Hurricane Ian.

Total revenue rose 0.7% to $30.55 billion in the quarter. That beat analysts' estimates of $30.32 billion, according to Refinitiv data.

A broader recovery in outdoor entertainment, coupled with an uptick in ad spending on its networks during the soccer World Cup and U.S. elections in November, helped boost the company's revenue.

Cable revenue grew 1.4% to $16.64 billion, narrowly missing analysts' estimates of $16.67 billion.

Comcast lost 440,000 video subscribers in the quarter, fewer than Factset's estimated loss of 548,000, as the trend of cable TV cord-cutting continued. The company also lost 26,000 broadband customers in the quarter, compared with Factset's estimated loss of 40,000 customers.

Excluding the areas affected by Hurricane Ian, which struck Florida in late September, the company reported a net gain of 4,000 broadband customers.

Revenue at Comcast's NBCUniversal media unit rose 2.6%. The company reported 20 million paid subscribers to its Peacock streaming service, up from the 15 million in October.

NBCU advertising sales grew 4% to $2.86 billion, and theme parks revenue grew 12% to $2.11 billion.

Net income fell 1.1% to $3.02 billion in the fourth quarter.

Excluding items, the company earned 82 cents per share.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAL | $15.85 | -0.41 | -2.52 |

| ALK | $50.41 | -0.64 | -1.25 |

| JBLU | $8.12 | -0.29 | -3.51 |

On Thursday, American Airlines, JetBlue Airways Corp and Alaska Air Group all forecast better-than-expected earnings for the full year.

"As we kick off 2023, we're pleased to see the demand environment remain solid into the seasonally trough period of the year," said Joanna Geraghty, JetBlue president and chief operating officer.

The company's Northeast Alliance partner American Airlines forecast an adjusted profit of $2.50 to $3.50 per share for 2023, handily beating analyst expectations of $1.77, according to Refinitiv data.

The resilient demand has allowed Fort Worth, Texas-based American to focus on fixing its debt-laden balance sheet. It has outlined a goal of paying down $15 billion of totaldebt by 2025-end.

"As we turn our attention to 2023, we will continue to prioritize reliability, profitability and debt reduction," American Airlines Chief Executive Robert Isom said.

Earlier this month, rival carriers United Airlines and Delta Air Lines reported bigger-than-expected quarterly earnings and gave a bullish outlook amid recessionary fears.

Both American Airlines and JetBlue posted fourth-quarter earnings that beat estimates on Thursday.

U.S. stocks rose across the board in early trading following a report on 4Q GDP that showed the economy grew more than expected. Tesla shares also jumped over 9% after strong earnings.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $160.44 | 16.01 | 11.08 |

On the year, the Dow is up around 1.59%, the S&P remains up around 4.60%, and the tech-heavy Nasdaq is now roughly 8.41% higher during the same time.

In commodities, West Texas Intermediate crude futures spiked 1.33% to $81.22 a barrel, as gold lost 0.33% to $1,936.20 an ounce.

Former Speaker of the House Paul Pelosi made another strategic and timely trade in shares of Google just before the DOJ smack down.

Real gross domestic product (GDP) increased more than expected in the first read of the fourth quarter.

The growth in GDP reflected increases in private inventory investment, consumer spending, federal government spending, state and local government spending, and nonresidential fixed investment, according to the commerce department.

Also in the fourth quarter, current‑dollar GDP jumped 6.5% at an annual rate, or $408.6 billion, to a level of $26.13 trillion, while current-dollar personal income added $311 billion, compared with an increase of $283.1 billion in the third quarter.

Personal saving reached $552.9 billion in the fourth quarter, while real GDP spiked 2.1% in 2022 compared with an increase of 5.9% in 2021.

Tesla shares rose than 6% in premarket trading after the company beat analysts' estimate for fourth-quarter revenue on Wednesday, powered by record delivery of electric vehicles during the last three months of 2022.

The company said revenue was $24.32 billion for the three months ended Dec. 31, compared with analysts' average estimate of $24.16 billion, according to IBES data from Refinitiv.

A busy morning of economic data on deck for investors.

Traders will get a first look at fourth-quarter GDP.

Economists surveyed by Refinitiv expect the Commerce Department to say the economy grew at a 2.6% annual rate from October through December. That’s down from a 3.2% pace in the third quarter on strong consumer spending and rising exports.

The Labor Department will tell us how many workers filed new jobless claims last week. Expectations are for 205,000 after falling unexpectedly to 190,000 the previous week, the lowest since September.

Continuing claims, which track the total number of workers collecting unemployment benefits, are expected to edge up to 1.659 million, close to a 10-month high.

At the same time the Commerce Department’s Census Bureau is expected to say that new orders for manufactured big-ticket items jumped 2.5% seasonally adjusted in December, following a deeper-than-expected 2.1% slump the previous month.

If you factor out the transportation component, orders are anticipated to edge down 0.2% after a surprise increase of 0.1% in November. Orders for core capital goods, a closely watched proxy for business spending, are also expected to slip 0.2%, following a surprise increase of 0.1% the previous month.

The Commerce Department is expected to say that sales of new single-family homes fell 3.6% to a seasonally adjusted annual rate of 617 thousand in December. That would follow a surprise surge of 5.8% in November.

Oil prices were steady on Thursday after U.S. crude stocks climbed less than expected.

U.S. West Texas Intermediate (WTI) crude futures traded around $80.00.

Brent crude futures traded around $86.00 per barrel.

Crude inventories edged higher by 533,000 barrels to 448.5 million barrels in the week ending Jan. 20, the Energy Information Administration (EIA) said.

That was substantially short of forecasts for a 1 million barrel rise, though crude stocks are at their highest since June 2021, the EIA said.

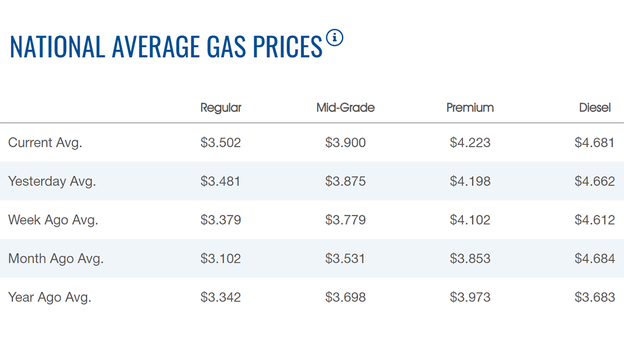

The nationwide price for a gallon of gasoline gained on Thursday to $3.502, according to AAA.

The average price of a gallon of gasoline on Wednesday was $3.481.

A year ago, the price for a gallon of regular gasoline was $3.342.

One week ago, a gallon of gasoline cost $3.379. A month ago, that same gallon of gasoline cost $3.102.

Gas hit an all-time high of $5.016 on June 14.

Diesel gained, but remained below $5.00 per gallon to $4.681, but that is still far from the $3.683 of a year ago.

Boeing representatives and relatives of some of the passengers killed in two crashes of Boeing 737 Max jets will be in a Texas courtroom Thursday.

The aerospace giant will be arraigned on a criminal charge that it thought it had settled two years ago.

The family members were never consulted before Boeing cut a deal with the U.S. Justice Department to avoid prosecution on a felony charge of fraud. Up to a dozen or so people from several countries are expected to testify about how the loss of loved ones has affected them.

There will be two main phases to the arraignment: Boeing will enter a plea, and then relatives of the passengers will ask the court to impose conditions on Boeing much as it would on any criminal defendant.

Boeing has faced civil lawsuits, congressional investigations and massive damage to its business since the crashes in 2018 and 2019, which killed a combined total of 346 people.

Boeing and its top officials have avoided criminal prosecution, however, because of the settlement reached between the company and the government in January 2021.

The Associated Press contributed to this post.

IBM shares are down nearly 2% in premarket trading after the company reported flat sales in the fourth quarter after the strong U.S. dollar hurt its reported revenue by more than $1 billion.

IBM posted net income of $2.71 billion, or $2.96 a share, for the fourth quarter, compared with $2.33 billion, or $2.57 a share, a year earlier.

Adjusted earnings were $3.60 a share, slightly above analysts’ estimates of $3.59 a share.

Revenue edged down to $16.69 billion from $16.70 billion a year earlier. Analysts polled by FactSet expected $16.15 billion.

The IT software and consulting company also forecast annual revenue growth in the mid-single digits on constant currency terms, weaker than the 12% it reported for 2022 but in line with mid-term targets announced in 2021.

IBM's full-year revenue grew 5.5% to $60.53 billion.

IBM joined the wave of companies making layoffs, saying it would cut about 3,900 jobs, according to the Wall Street Journal.

The cuts will stem from Kyndryl Holdings Inc., the IT services business that IBM spun off last year, and its healthcare divestiture, from which the company will incur about a $300 million charge, a spokesman confirmed.

Earnings season continues Thursday, with three Dow members reporting: Intel and Visa in the afternoon, and commodity chemical maker Dow Inc. ahead of the opening bell.

The morning will also see results from telecom and media giant Comcast, aerospace/defense firm Northrop Grumman, credit-card payment processor Mastercard, and paint and coatings manufacturer Sherwin-Williams to name a few.

Also watch for numbers from a handful of airlines: American, Southwest, JetBlue, and Alaska Air.

Bitcoin was trading around $23,000, after gaining in five of the past seven days.

In the past week, Bitcoin has gained more than 11%.

For the month, the cryptocurrency is higher by more than 42%, but remains down more than 35% over the last 52 weeks.

Ethereum was trading around $1,600, after gaining more than 6% in the past week.

Dogecoin was trading at 8 cents, after adding more than 8% in the past week.

Live Coverage begins here