STOCK MARKET NEWS: Bank shares tumble, Silicon Valley Bank sued, United Airlines profit warning

Investors remain skittish despite the emergency backstop for Silicon Valley Bank, stocks and banking shares, including First Republic remain in focus after regulators moved to stabilized the financial system, United Airlines sees first-quarter loss. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SIVB | $106.04 | -,161.79 | -60.41 |

SVB Financial Group and two top executives were sued on Monday by shareholders who accused them of concealing how rising interest rates would leave its Silicon Valley Bank unit, which failed last week, "particularly susceptible" to a bank run.

The proposed class action against SVB, Chief Executive Greg Becker and Chief Financial Officer Daniel Beck was filed in the federal court in San Jose, California.

It appeared to be the first of many likely lawsuits over the demise of Silicon Valley Bank, which U.S. regulators seized on March 10 following a surge of deposit withdrawals.

SVB had surprised the market two days earlier by disclosing a $1.8 billion after-tax loss from investment sales and that it planned to raise capital, as it scrambled to meet redemption requests.

Silicon Valley Bank had an estimated $209 billion of assets and $175.4 billion of deposits before its collapse, in the largest U.S. bank failure since the 2008 financial crisis.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BA | $203.37 | 0.30 | 0.15 |

Boeing Co is expected to sell nearly 80 787 Dreamliner airplanes to two Saudi Arabian airlines, a source briefed on the matter said on Monday.

An announcement of the plan reported earlier by the Wall Street Journal is expected as soon as Tuesday, and the list prices for 78 planes would total nearly $37 billion. Airlines typically get undisclosed discounts when buying airplanes.

State-owned Saudi Arabian Airlines (Saudia) and new national airline Riyadh Air will both be acquiring Boeing 787s, the source said. The airlines are expected to buy a total of 78 787s split between the two buyers and have options to buy another 43, the source said.

Saudi Arabia's Crown Prince Mohammed bin Salman formally announced on Sunday the creation of Riyadh Air, with industry veteran Tony Douglas as chief executive, as the kingdom moves to compete with regional transport and travel hubs.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UAL | $48.83 | -2.14 | -4.20 |

United Airlines Holdings Inc on Monday forecast a loss for the first quarter, compared with its earlier estimate for a profit, on account of higher costs and weaker-than-expected pricing power.

It now expects an adjusted diluted loss between $0.60 and $1.00 per share. The company in January forecast adjusted profit between $0.50 and $1.00 per share for the quarter.

Shares of the carrier were down 8% at $45 aftermarket.

The airline said it expects to benefit from a seasonality shift in the second quarter with current booked yield and revenue higher relative to 2019."

As a result, the company's outlook for the second quarter 2023 has improved, with total operating revenue now expected to be up in the mid-teens versus second quarter 2022," the airline said in a filing.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| OMER | $3.45 | 0.19 | 5.83 |

Omeros Corporation (OMER) on Monday reported earnings of $128.7 million in its fourth quarter.

The Seattle-based company said it had net income of $2.05 per share. Losses, adjusted to account for discontinued operations, were 73 cents per share.

For the year, the company reported profit of $47.4 million, or 76 cents per share.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GTLB | $44.60 | 0.24 | 0.55 |

GitLab topped Wall Street revenue and profit estimates but issued a forecast that disappointed investors.

The comprehensive DevSecOps Platform guided to fiscal 2024 revenue of $529.0 - $533.0 million and a net loss of $(64.0) - $(59.0) million.

Fourth quarter rose 58% to $122.9 million. Wall Street expected $119.56 million.

The net loss of the three months ended Jan. 31, 2023 narrowed to $38.7 million from $45.8 million.

The per share loss was 3 cents, topping the estimate of a 14 cent loss.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HEAR | $6.89 | -0.44 | -6.00 |

Turtle Beach Corporation is extending its share repurchase program for an additional two years, through April 9, 2025.

Under the program, the company is authorized to acquire up to a total of $25 million of shares of its common stock, including those shares already acquired under the program before this extension, at its discretion from time to time in the open market, or in block purchase transactions.

Additionally the gaming accessory maker forecast adjusted EBITDA of approximately $5 million, a $23 million improvement compared to 2022.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FRC | $28.50 | -53.26 | -65.14 |

| PACW | $7.29 | -5.06 | -40.97 |

| KEY | $11.67 | -3.99 | -25.48 |

| HBAN | $10.82 | -2.54 | -19.04 |

| BAC | $28.14 | -2.13 | -7.02 |

| JPM | $129.91 | -3.74 | -2.80 |

| SCHW | $47.50 | -11.20 | -19.08 |

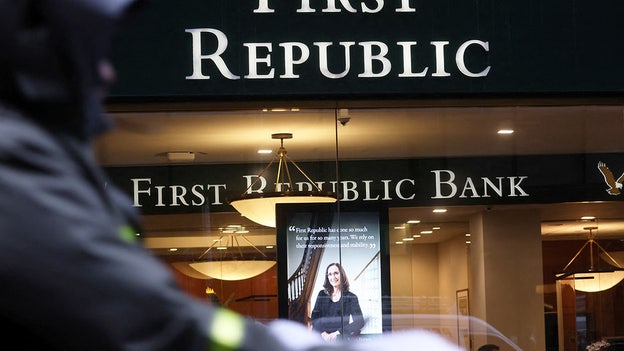

U.S. stocks bounced sharply between losses and gains before ending the session mixed with the Nasdaq Composite closing higher, as the Dow and S&P 500 trailed. Investors attempted to gauge whether there will be contagion to other banks following the collapse of Silicon Valley Bank Friday, followed by government intervention on Sunday.

Within the sector, S&P 500 financials lost 4%, while mid-sized-regional banks lost nearly 12% as tracked by the KBW Nasdaq Bank Index.

Banks that saw heavy selling included First Republic, PacWest, KeyCorp, Huntington Bancorp. Larger firms were also under pressure with JPMorgan, BofA and Charles Schwab falling.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ILMN | $232.27 | 38.26 | 19.72 |

Activist investor Carl Icahn on Monday launched a proxy fight at Illumina Inc, saying the life sciences company's takeover of Grail Inc had cost shareholders about $50 billion since the closing of the deal.

Icahn plans to nominate three people to Illumina's board at the company's upcoming shareholder meeting, he said in a letter sent to shareholders.

The billionaire also said he had been working privately with Illumina's board for the last few weeks but could not come to an agreement.

The company did not immediately respond to a Reuters request for comment.

According to the latest regulatory filings, Icahn beneficially owns about 2.2 million shares, or about 1.4%, of the company.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAL | $14.79 | -0.67 | -4.33 |

| DAL | $35.65 | -1.60 | -4.31 |

| LUV | $31.19 | -1.58 | -4.83 |

| UAL | $48.47 | -2.50 | -4.90 |

The Biden administration on Monday asked U.S. lawmakers to approve legislation to bar airlines from charging family seating fees if adjacent seats are available during booking.

U.S. Transportation Secretary (USDOT) Pete Buttigieg wrote lawmakers and sent them draft legislation that would ban airlines from charging an accompanying adult to sit next to children 13 or younger if certain conditions are met.

Buttigieg wrote USDOT "remains concerned that airlines' policies do not guarantee adjacent seats for young children traveling with a family member and that airlines do not guarantee the adjacent seating at no additional cost."

The draft proposal reviewed by Reuters would apply to families traveling on the same reservation and in the same class of service and would make requirements effective 180 days after passage, subjecting airlines not in compliance to potential fines.

The bill would direct airlines to offer refunds or seats on another flight if adjacent seats were unavailable under certain conditions.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FRC | $30.16 | -51.60 | -63.11 |

| JPM | $131.71 | -1.94 | -1.45 |

First Republic Bank has been able to meet withdrawal demands on Monday with the help of additional funding from JPMorgan Chase & Co, the mid-cap lender's Executive Chair Jim Herbert told CNBC.

The bank was not seeing massive outflow of deposits, Herbert said.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SIVB | $106.04 | -,161.79 | -60.41 |

| HSBC | $34.71 | -0.60 | -1.70 |

HSBC bought the UK arm of Silicon Valley Bank for a symbolic one pound on Monday, rescuing a key lender for technology start-ups in Britain, as the biggest bank collapse since the financial crash continued to roil markets.

The deal, which sees one of the world's biggest banks, with $2.9 trillion of assets, take the doomed British arm of the tech lender under its wing, brought to an end frantic weekend talks between the government, regulators, and prospective buyers.

It came after U.S. authorities moved on Sunday to shore up deposits and try to stem any wider contagion from the sudden collapse of its parent Silicon Valley Bank.“After a number of offers from smaller banks, HSBC has agreed to scoop up the beleaguered UK arm of SVB, which should end the nightmare thousands of tech firms had been experiencing over the past few days,” said Susannah Streeter, head of money and markets, Hargreaves Lansdown.

“HSBC shareholders may have some concerns about the bank snapping up assets which have been under such a cloud of uncertainty, particularly the exposure to bonds, but HSBC says it expects a gain to arise from the acquisition.”

Reuters contributed to this report.

The CFO of Charles Schwab stepped up to defend the company's solid position as shares tumbled nearly 20% heading for the worst day on record after the FDIC closed Silicon Valley Bank on Friday and regulators swept in for a backstop on Sunday.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMZN | $90.49 | -0.24 | -0.27 |

| RIVN | $13.90 | -0.26 | -1.86 |

Electric-vehicle maker Rivian Automotive Inc and its largest shareholder Amazon.com Inc are in talks to end the exclusivity part of their electric van deal, the Wall Street Journal reported on Monday citing people familiar with the matter.

Online retailer Amazon had placed an order for 100,000 electric delivery vans (EDVs) from the Irvine, California-based EV maker in 2019, as part of the company's plans to cut carbon emissions. It has taken deliveries and inducted the EDVs into its fleet, with over 10 million packages delivered using the vans.

Amazon informed the EV maker it wanted to buy about 10,000 vans this year, which was at the low end of a range it previously provided Rivian, the report added.

Rivian said it continues to work closely with Amazon. Shares of the EV maker fell around 3% in trading before the bell.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| COIN | $53.96 | 0.52 | 0.97 |

| SIVB | $106.04 | -,161.79 | -60.41 |

Coinbase Global Inc has about $240 million in corporate cash balance with Signature Bank, the U.S. crypto exchange said in a tweet on Sunday, hours after the state regulators closed the New York-based lender.

"Due to FDIC's hold on Signature's transactions, we're currently facilitating all client cash transactions with other banking partners," the tweet added.

The closure comes just two days after California authorities shuttered Silicon Valley Bank, in a collapse that roiled global markets and left billions of dollars of deposits belonging to companies and investors stranded.

The U.S. Treasury Department and other bank regulators said in a joint statement that all depositors of Signature Bank will be made whole, and "no losses will be borne by the taxpayer."

The Signature failure is the third largest in the U.S. history.

Bitcoin prices recovered somewhat after falling below the $20,000 level last week as Silicon Valley Bank was shutdown by the FDIC.

The emergency plan for the bank, announced Sunday by the Federal Reserve, FDIC and U.S. Treasury Department, firmed up prices.

President Biden suggested that he will seek stronger regulations on banks after the sudden collapse of Silicon Valley Bank sent shockwaves through the country, igniting fears of broader damage to the U.S. financial system.

The president did not provide any specific proposals.

"During the Obama-Biden administration, we put into place tough requirements on banks, like Silicon Valley Bank and Signature Bank, including the Dodd-Frank law, to make sure the crisis we saw in 2008 would not happen again," Biden said during his brief, five-minute speech.

Congress approved a bipartisan bill in 2018 dismantling parts of those banking rules, a move regarded as a big victory for small and mid-size banks.

The rollback eased regulation on some big banks, granted consumers the right to free credit freezes and provided relief to smaller banks by softening the Volcker Rule, which prohibited banks from making their own investments with customers’ deposits.

"I am going to ask Congress and the banking regulators to strengthen the rules for banks to make it less likely this bank failure will happen again," Biden said on Monday.

President Biden assured Americans on Monday morning that the U.S. banking system remains safe after U.S. regulators seized the assets of Silicon Valley Bank, roiling global financial markets and setting investors on edge.

“You can have confidence that the banking system is safe," Biden said. "Your deposits will be there when you need them.”

Financial regulators closed Silicon Valley Bank – the 16th largest in the country – on Friday afternoon after a run on the bank, marking the largest U.S. bank failure since the global financial crisis in 2008.

Goldman Sachs is changing its outlook for future rates hikes, in the near-term, after the emergency backstop of Silicon Valley Bank threatens the stability of the U.S. economy.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| FRC | $81.76 | -14.25 | -14.84 |

First Republic Bank investors are scrambling, with the shares down double-digits, despite the Sunday night emergency backstop for Silicon Valley Bank depositors and the closing of Signature Bank.

Monday morning its executive team attempted to ease fears of a crunch.

Jim Herbert, Founder and Executive Chairman and Mike Roffler, CEO and President of First Republic Bank said, “First Republic’s capital and liquidity positions are very strong, and its capital remains well above the regulatory threshold for well-capitalized banks. As we have done since 1985, we operate with an emphasis on safety and stability at all times, while maintaining a well-diversified deposit base. First Republic continues to fund loans, process transactions and fully serve the needs of clients by delivering exceptional service.”

The Federal Reserve, the FDIC and the U.S. Treasury Department wrapped Signature Bank into the backstop emergency plan to stabilize Silicon Valley Bank and its depositors. The bank will close.

Pfizer on Monday announced it will acquire biotechnology company Seagen in a deal valued at $43 billion to boost it’s portfolio of cancer treatments.

“Together, Pfizer and Seagen seek to accelerate the next generation of cancer breakthroughs and bring new solutions to patients by combining the power of Seagen’s antibody-drug conjugate (ADC) technology with the scale and strength of Pfizer’s capabilities and expertise,” Pfizer CEO Albert Bourla said in a statement.

The deal, Pfizer's largest since its $67 billion acquisition of Wyeth in 2009, will add four approved cancer therapies with combined sales of nearly $2 billion in 2022.

“The proposed combination with Pfizer is the right next step for Seagen to further its strategy, and this compelling transaction will deliver significant and immediate value to our stockholders and provide new opportunities for our colleagues as part of a larger science-driven, patient-centric, global company,” Seagen CEO David Epstein said in a statement.

Pfizer has offered $229 in cash per Seagen share, a 32.7% premium to Friday's closing price.

Reuters contributed to this report

Kids retailer Camp and coffee company Compass Coffee are among businesses affected by the shutdown of Silicon Valley Bank.

Camp wrote Friday on Instagram that its bank "got shut down by regulators" and that it was offering 40% discounts on products online when customers used a promotional code.

"We’re asking that you RUN, don’t walk to our BANKRUN sale," the company wrote on Instagram.

Kaufman told FOX Business in an email the company doesn’t "know when we can access our cash." He said there has been an "outpouring of customer support which will hopefully see us through" the situation. Camp is "hopeful it will be resolved by someone swooping in and restoring balances," according to Kaufman.

The District of Columbia-based Compass Coffee, meanwhile, faced impact in connection to its payroll, according to an email from CEO Michael Haft that was obtained by FOX Business.

Haft said in the email that Compass Coffee’s payroll provider was "severely impacted" by the collapse of Silicon Valley Bank, with the coffee company learning its payroll "was not processed by the bank as planned" this week.

President Biden said on Sunday that he is "pleased" with how the Treasury Department and other agencies responded in the wake of the Silicon Valley Bank collapse, the second-biggest bank failure in U.S. history.

"At my direction, [Treasury Secretary Janet] Yellen and my National Economic Council Director worked with banking regulators to address problems at Silicon Valley Bank and Signature Bank," Biden noted on Twitter Sunday night. "I’m pleased they reached a solution that protects workers, small businesses, taxpayers, and our financial system."

The president also vowed accountability for those responsible, without specifying any particular actions his administration would take.

Biden is expected to speak on the SVB collapse on Monday morning.

Depositors of the Silicon Valley Bank will have access to all of their money – following the bank’s failure on Friday – at no loss to American taxpayers, the Treasury Department, Federal Reserve, and the Federal Deposit Insurance Corporation (FDIC) said in a joint statement Sunday.

"Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system," the joint statement read. "This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth."

The statement said Treasury Secretary Janet Yellen had approved actions enabling the FDIC to complete its resolution of SVB "in a manner that fully protects depositors." Depositors will have access to all of their money starting Monday, March 13. The taxpayer will bear no losses associated with the resolution of SVB.

Live Coverage begins here