STOCK MARKET NEWS: Bank shares tumble, Credit Suisse shares hit new low, producer inflation data

Stocks sink as bank contagion fears spook investors, Credit Suisse in crosshairs as shares hit a record low, regional banks see sharp declines and producer prices ease in latest inflation data. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LPSN | $9.77 | 0.29 | 3.06 |

LivePerson is lower in extended trading. The conversational commerce and AI software company missed Wall Street estimates.

Fourth quarter revenue fell 1% to $122.5 million, missing the estimate of $127.01 million.

Business operations revenue decreased 1% from the comparable prior-year period to $113.0 million, and revenue from consumer operations decreased 3% from the comparable prior-year period to $9.4 million.

The net loss narrowed to $41.72 million from $49.85 million.

The per share loss was 55 cents, higher than the estimate of 22 cents.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ADBE | $333.61 | 0.28 | 0.08 |

Adobe Systems Inc. on Wednesday reported fiscal first-quarter earnings of $1.25 billion.

On a per-share basis, the San Jose, California-based company said it had net income of $2.71. Earnings, adjusted for one-time gains and costs, were $3.80 per share.

The results surpassed Wall Street expectations . The average estimate of 12 analysts surveyed by Zacks Investment Research was for earnings of $3.66 per share.

The software maker posted revenue of $4.66 billion in the period, which also topped Street forecasts. Ten analysts surveyed by Zacks expected $4.61 billion.

For the current quarter ending in May, Adobe expects its per-share earnings to range from $3.75 to $3.80. Analysts surveyed by Zacks had forecast adjusted earnings per share of $3.43.

The company said it expects revenue in the range of $4.75 billion to $4.78 billion for the fiscal second quarter. Analysts surveyed by Zacks had expected revenue of $4.6 billion.

Adobe expects full-year earnings in the range of $15.30 to $15.60 per share.

Oil prices plunged more than $5 a barrel on Wednesday to their lowest in more than a year as unease over Credit Suisse spooked world markets and offset hopes of a Chinese oil demand recovery.

Early signs of a return to market stability faded after Credit Suisse's largest investor said it could not provide the Swiss bank with more financial assistance, sending its shares and other European equities sliding.

"It doesn't matter what your risk asset is: at this point people are pulling the plug across different instruments here," said Robert Yawger, director of energy futures at Mizuho in New York. "Nobody wants to go home with a big position on anything today. ... You have nowhere to hide really."

Both crude benchmarks hit their lowest since December 2021 and have fallen for three straight days.

Brent crude was down $3.76, or 4.9%, to $73.69 a barrel. U.S. West Texas Intermediate crude (WTI) was down $3.72, or 5.2%, at $67.61, breaking through technical levels of $70 and $68 and extending the sell-off.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TMUS | $143.88 | 0.87 | 0.61 |

T-Mobile US Inc said on Wednesday it would buy Ka'ena Corp, the owner of Ryan Reynolds-backed budget service provider Mint Mobile, for up to $1.35 billion, as the telecom operator looks to maintain growth in a competitive market.

The deal will allow T-Mobile to tap a larger share of the pay-as-you-go customer base, whose numbers are expected to swell as credit-challenged people shy away from hefty monthly bills.

It will also provide a boost to T-Mobile's business at a time when promotions from rivals Verizon and AT&T have driven up its churn rate, which refers to the percentage of customers who stop using a service.

The agreement consists of 39% cash and 61% stock, with the final purchase price set to be decided by Ka'ena's performance during certain periods before and after the closing of the deal that is expected later this year.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| I:BKX | $81.10 | -2.97 | -3.54 |

| XLF | $31.38 | -0.90 | -2.79 |

| CS | $2.01 | -0.50 | -19.92 |

| XLE | $77.56 | -4.19 | -5.13 |

| SP500 | $3,893.15 | -26.14 | -0.67 |

U.S. stocks curbed some of the losses in the final hour of trading after the Swiss National Bank said it stands ready to assist Credit Suisse, if needed. The Nasdaq Composite posted fractional gains, as the Dow Jones Industrial Average and S&P closed lower.

Fresh fears of a banking contagion rocked stocks Wednesday with heavy selling in all three of the major U.S. benchmark averages at the open after Credit Suisse shares hit a record low. Regional U.S. bank stocks were also under pressure in more fallout from Silicon Valley Bank’s collapse.

In commodities, oil fell over 4.8% to a one-year low, dropping to $73.69 per barrel level pressuring energy stocks.

The Swiss National Bank, in a statement Wednesday afternoon, said it stands ready to assist embattled Credit Suisse as it monitors the volatility hitting the global financial system.

"The Swiss National Bank SNB and the Swiss Financial Market Supervisory Authority FINMA assert that the problems of certain banks in the USA do not pose a direct risk of contagion for the Swiss financial markets. The strict capital and liquidity requirements applicable to Swiss financial institutions ensure their stability. Credit Suisse meets the capital and liquidity requirements imposed on systemically important banks. If necessary, the SNB will provide CS with liquidity" the bank said on an update posted to its website.

Democratic U.S. Senator Elizabeth Warren on Tuesday called on Federal Reserve Chair Jerome Powell to recuse himself from an internal review of recent bank failures, saying his actions "directly contributed" to them.

The Federal Reserve said on Monday it is reviewing its oversight of the bank in the wake of its abrupt failure Friday. Warren argued that Powell's prior support for easing bank rules indicates he should not participate in the review. Fed Vice Chairman Michael Barr, who President Joe Biden nominated, is leading that review.

"Fed Chair Powell's actions directly contributed to these bank failures. For the Fed’s inquiry to have credibility, Powell must recuse himself from this internal review," she said in a Twitter post.

"It’s appropriate for Vice Chair for Supervision Barr to have the independence necessary to do his job," said Warren, a Democrat, who has been a sharp critic of Powell.

A Fed representative declined to comment. Becker could not be immediately reached for comment.

A business tycoon long sought by the government of China and known for cultivating ties to Trump administration figures including Steve Bannon was arrested Wednesday in New York on charges that he oversaw a $1 billion fraud conspiracy.

Guo Wengui, 54, and his financier, Kin Ming Je, faced an indictment in federal court in Manhattan charging them with various crimes, including wire, securities and bank fraud. Guo was charged in court papers under the name Ho Wan Kwok.

U.S. prosecutors said the indictment stemmed from a complex scheme in which Guo lied to hundreds of thousands of online followers in the United States and around the world before misappropriating hundreds of millions of dollars.

Kin Ming Je, 55, has not been arrested. Guo was expected to appear in court Wednesday. His attorney did not immediately comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

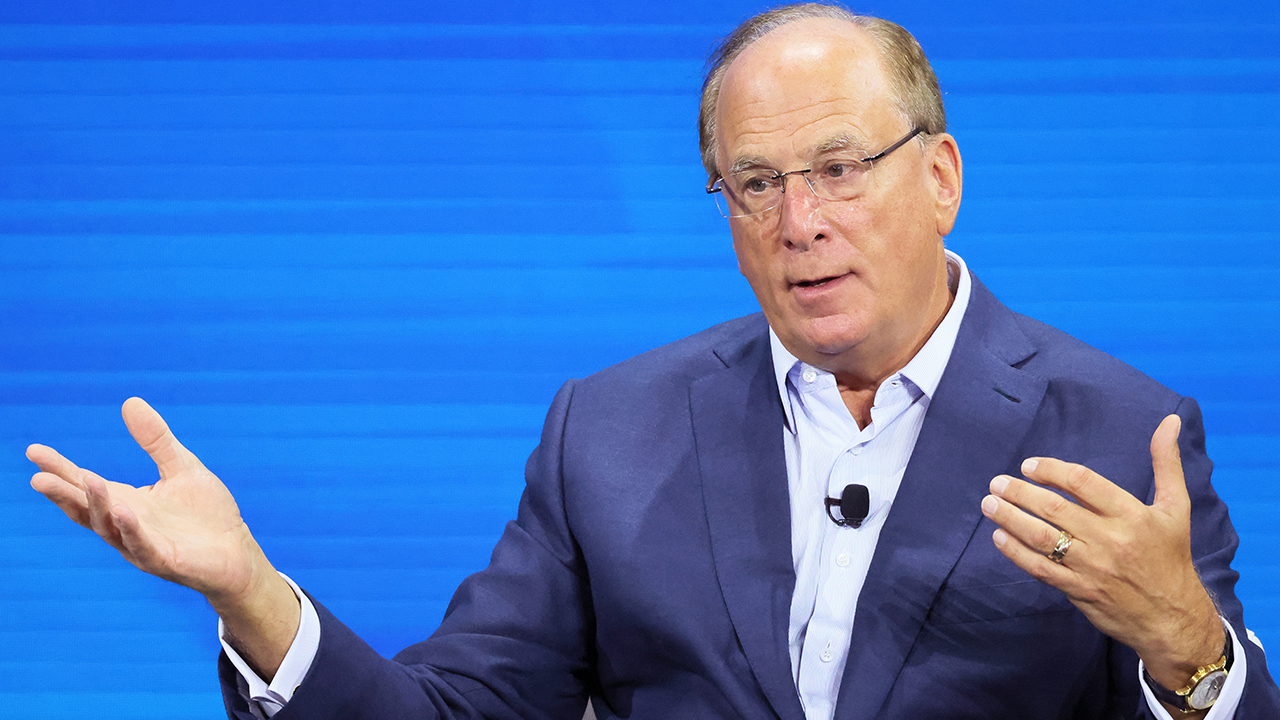

| BLK | $628.34 | -9.49 | -1.49 |

BlackRock Inc Chief Executive Laurence Fink warned on Wednesday the U.S. regional banking sector remains at risk after the collapse of Silicon Valley Bank and that inflation will persist and rates would continue to rise.

In an annual letter, Fink described the current financial situation as the "price of easy money" after the Federal Reserve had to hike rates nearly 500 basis points to fight inflation, and that he expects more Fed rate increases.

Fink wrote that after the regional banking crisis, the financial industry could see what he termed "liquidity mismatches." That is because the low rates have driven some asset owners to raise their exposure to higher-yielding investments that are not easy to sell.

“Bond markets were down 15% last year, but it still seemed, as they say in those old Western movies, ‘quiet, too quiet,’” Fink said in his letter, which was seen by Reuters. “Something else had to give as the fastest pace of rate hikes since the 1980s exposed cracks in the financial system."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CP | $76.23 | 3.25 | 4.46 |

The first major railroad merger in more than two decades will go forward after federal regulators approved Canadian Pacific’s $31 billion acquisition of Kansas City Southern.

The two are the smallest among the nations seven major railroads, but their coupling will create the only railroad linking Canada, Mexico and the United States. The approval Wednesday by the U.S. Surface Transportation Board comes after an arduous two-year review.

The combined company will have little to no track redundancies or overlapping routes, and is also expected to add more than 800 new union jobs in the U.S., according to the board.

The new single-line service is expected to "foster the growth of rail traffic, shifting approximately 64,000 truckloads annually from North America’s roads to rail, and will support investment in infrastructure, service quality, and safety," the board said.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SBGI | $13.50 | -1.09 | -7.47 |

Diamond Sports Holdings, which operates a number of regional sports channels under the Bally Sports name, filed for Chapter 11 bankruptcy protection on Tuesday, just two weeks before the start of the Major League Baseball season.

Bally Sports has the rights to televise 14 MLB teams: Arizona Diamondbacks, Atlanta Braves, Cincinnati Reds, Cleveland Guardians, Detroit Tigers, Kansas City Royals, Los Angeles Angels, Miami Marlins, Milwaukee Brewers, Minnesota Twins, St. Louis Cardinals, San Diego Padres, Tampa Bay Rays and Texas Rangers.

MLB created contingency plans to televise games for those teams through MLB Network and the MLB.TV app, but Diamond Sports Group is confident that will not be necessary.

"We are utilizing this process to reset our capital structure and strengthen our balance sheet through the elimination of approximately $8 billion of debt," Diamond Sports CEO David Preschlack said in a statement. "The financial flexibility attained through this restructuring will allow DSG to evolve our business while continuing to provide exceptional live sports productions for our fans.

"Bally Sports has the rights to televise 46 pro sports teams across the NBA, NHL and MLB.

Despite the selling on Wall Street, Bitcoin is holding up against the downward volatility.

The largest crypto by market value is trading around the $24,000 level after dropping below $20,000 last week.

Zara owner Inditex said its spring-summer 2023 collection flew off the shelves over the last six weeks but shares in the world's biggest fashion retailer fell after it flagged higher spending on technology and automation.

Inditex's 2022 profit jumped by 27% as sales exceeded pre-pandemic levels.

In-store and online sales rose 18% to 32.6 billion euros ($34.99 billion) and were 15% higher than in 2019.

Inditex announced a 29% dividend increase to 1.20 euros per share, slightly disappointing shareholders hoping for a more generous payout.

It said a rapid pace of sales had continued in the first six weeks of the 2023 fiscal year, which started on Feb 1.

Excluding Russia, where Inditex stores have been closed since the Ukraine conflict started, sales between Feb. 1 and March 13 were up 17.5% from the same period a year earlier.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HNNMY | $2.28 | -0.24 | -9.52 |

H&M, the world's second-biggest fashion retailer, reported on Wednesday a smaller-than-expected increase in sales in the latest sign it is struggling to compete with Zara-owner Inditex.

The Swedish group said sales measured in local currencies for the period, its fiscal first quarter, rose 3% from a year earlier.

Jefferies said local-currency sales, the figures most watched by markets, were significantly lighter than consensus estimates and implied that sales in reality fell 3% in February.

The broker called the results "worse than feared" and that it expected a loss in earnings before interest and taxes (EBIT) when the group reports its full first quarter results on March 31.Credit Suisse also predicted a "material" operating loss.

H&M, which is in the middle of a program to reduce staff and cut other costs, said net sales were up 12% from a year earlier to 54.9 billion crowns ($5.26 billion).

Wholesale price increases in the United States slowed sharply last month as food and energy costs declined, a sign that inflationary pressures may be easing.

From January to February, the government’s producer price index fell 0.1%, after a 0.3% rise from December to January, which was revised sharply lower. Compared with a year ago, wholesale prices rose 4.6%, a big drop from the 5.7% annual increase in January.

A significant driver of last month's wholesale inflation slowdown was a huge drop in the prices of eggs, which plummeted 36.1% just in February. Egg prices had previously surged after a widespread outbreak of avian flu.

Excluding volatile food and energy costs, so-called core wholesale prices were unchanged from January to February. The core measure can provide a better read of longer-term inflation trends.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| USO | $60.82 | -2.11 | -3.36 |

| XLE | $79.15 | -2.60 | -3.18 |

Crude continued to slide Wednesday as the fallout in global stocks hits commodities. U.S. oil fell to the $68 per barrel level, while Brent, the global benchmark, hit the $74 per barrel level.

The drop also spilled over into energy stocks.

Credit Suisse lost almost a quarter of its value on Wednesday, dropping to a new record low after its largest investor said it could not provide the Swiss bank with more financial assistance.

"We cannot, because we would go above 10%. It’s a regulatory issue," Saudi National Bank chairman Ammar Al Khudairy said on Wednesday.

The Saudi lender acquired a stake of almost 10% last year after taking part in Credit Suisse's capital raising and committed to investing up to 1.5 billion Swiss francs ($1.5 billion).

Broader equity markets fell sharply, reversing earlier gains, as Credit Suisse's drop by as much as 24% re-ignited some of the jitters among investors about the resilience of the global banking system after the collapse of Silicon Valley Bank.

European shares fell on Wednesday as bank stocks resumed their selloff, after a short-lived bounce in the previous session, with Credit Suisse plunging to a fresh record low.

The pan-European STOXX 600 index .STOXX fell 2.5% by 1118 GMT, languishing at 10-week lows, as was the banks sector index after plunging nearly 6%.

The bank index is set to lose more than 120 billion euros ($127.26 billion) in market value since the close of March 8.Spain and Italy's lender-heavy indexes fell almost 4% each.

Shares of Credit Suisse fell below 2 Swiss francs ($2.18) after the lender's biggest shareholder said it could not raise its 10% stake, citing regulatory issues. The market regulator halted trading in the stock several times as volumes soared and the stock plummeted.

There was also a cooling of optimism that the U.S. Federal Reserve will tone down its rate-hiking spree next week in the aftermath of Silicon Valley Bank's (SVB) collapse.

"It doesn't feel as if SVB at the moment is deflecting central banks, or at least the Fed from it's designed to keep pressing hard against inflation," said Russ Mould, investment director at AJ Bell."Some of that early-year optimism (that) we would get a cooling in inflation... (and) that we get a pivot in rates... might not come to pass."

All eyes will now be on the European Central Bank, which is still leaning toward a half-percentage-point rate hike on Thursday, despite turmoil in the banking sector, as they expect inflation will remain too high in coming years, a source told Reuters.

Live Coverage begins here