STOCK MARKET NEWS: Disney layoffs begin, Chipotle settles labor complaint, First Citizens-SVB deal

Stocks finished mixed as Disney CEO Bob Iger kicks off layoffs, Chipotle settles dispute over closed Maine store and First Citizens acquiring Silicon Valley Bank assets. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VORB | $0.54 | -0.26 | -33.03 |

Billionaire Richard Branson's cash-strapped satellite launch company Virgin Orbit Holdings said on Thursday it is in talks with "interested parties" about an investment in the company.

Reuters reported on Wednesday that Texas venture capital investor Matthew Brown was nearing a deal to invest $200 million in the space startup via a private share placement, citing a term sheet Reuters had seen.

"The company can confirm that it is in discussions with interested parties about a potential investment in the company," Virgin Orbit added. "Beyond this, we will not comment on market rumors.

"Without elaborating, Virgin Orbit also acknowledged comments made by Brown on a Thursday interview with CNBC TV. Brown confirmed on CNBC he wants to buy Virgin in a deal he hopes to close by the end of Friday.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PVH | $73.62 | 0.86 | 1.18 |

PVH Corp., the owner of Calivn Klein and Tommy Hilfiger on Monday reported fiscal fourth-quarter net income of $138.7 million.

The New York-based company said it had profit of $2.18 per share, surpassing Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for earnings of $1.64 per share.

PVH posted revenue of $2.49 billion in the period, also exceeding Street forecasts. Seven analysts surveyed by Zacks expected $2.34 billion.

For the year, the company reported profit of $200.4 million, or $3.03 per share. Revenue was reported as $9.02 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| KORE | $1.25 | 0.01 | 0.81 |

KORE Group beat Wall Street revenue and profit expectations.

Fourth quarter revenue fell 3.1% to $62.4 million. Analysts expected $60.9 million.

The net loss widened to $68.8 million, or $0.90 per share, compared to $12.2 million, or $0.17 per share, a year ago. The primary drivers for the increase in net loss were an approximate $57 million non-cash goodwill impairment charge related to the decline in the company's share price, an increase in expenses, and higher interest costs due to the rise in interest rates.

Analysts expected a per-share loss of 9 cents.

KORE is a pioneer, leader, and trusted advisor delivering mission-critical Internet of Things solutions and services.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NKLA | $1.51 | 0.01 | 0.67 |

Electric-truck maker Nikola Corp said on Monday Kim Brady will retire as chief financial officer on April 7 and insider Anastasiya Pasterick will take over the role.

Pasterick was key in taking the company public through a merger with a blank-check firm in 2020, the company said.

Brady will remain employed with Nikola through April 28 in an advisory capacity.

Last month, the Arizona-based truckmaker said issues hitting demand for its battery-powered trucks are not expected to ease in the near future. It delivered fewer than a sixth of the battery-powered trucks it made in the fourth quarter.

U.S. stocks closed mixed and off the best levels of the session, even as financials led the S&P 500 higher after First Citizen's purchase of Silicon Valley Bank assets easing investor contagion fears. The Nasdaq Composite was pressured as Apple and Meta shares slipped.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLF | $31.28 | 0.29 | 0.94 |

| I:BKX | $80.02 | 1.64 | 2.09 |

| FRC | $13.79 | 1.43 | 11.59 |

| JPM | $126.48 | 1.57 | 1.26 |

| C | $44.30 | 1.20 | 2.77 |

| WFC | $37.16 | 0.93 | 2.55 |

| BAC | $28.00 | 0.86 | 3.17 |

In commodities, oil jumped 5% to $72.81 per share.

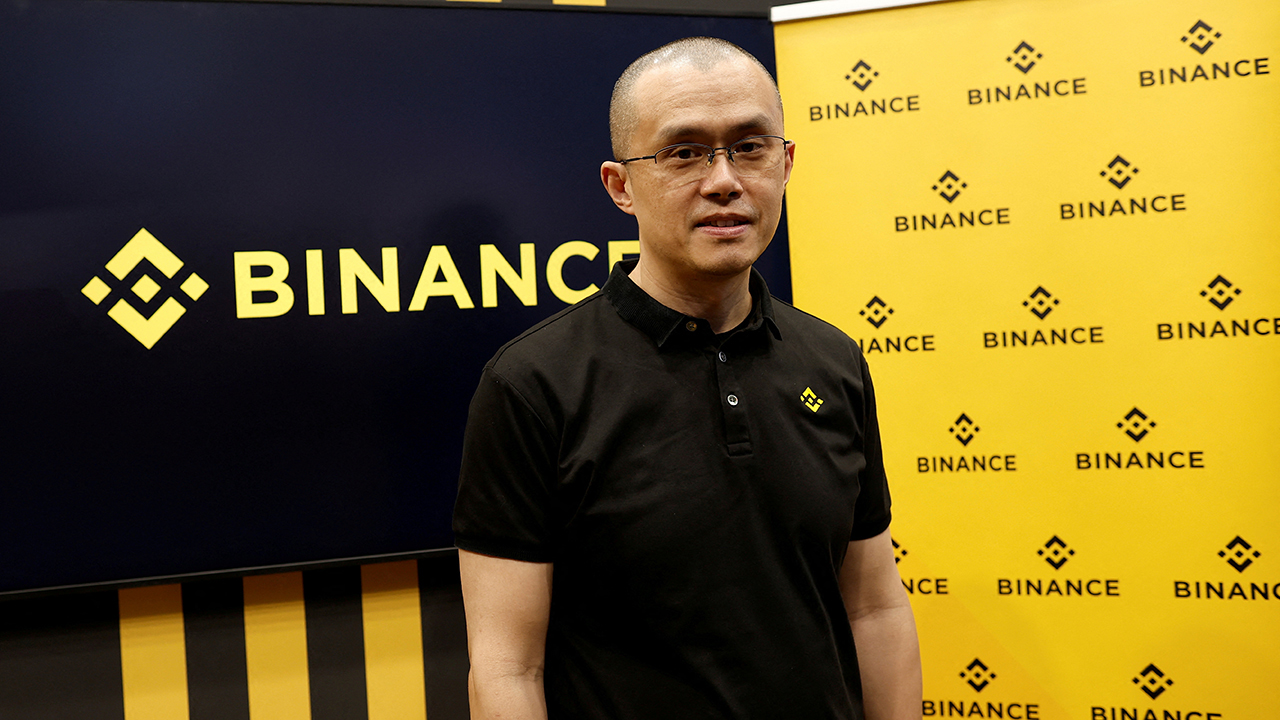

Major cryptocurrency exchange Binance and its Chief Executive Changpeng Zhao have been sued by the Commodity Futures Trading Commission (CFTC) over regulatory violations, according to a court filing on Monday.

Binance did not immediately respond to a request for comment. A spokesperson for the CFTC did not respond immediately to requests for comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CI | $262.78 | 2.57 | 0.99 |

| HUM | $508.37 | 5.94 | 1.18 |

Three pharmacy benefit management (PBM) companies are being sued in Ohio over allegations of drug price fixing.

Ohio is accusing pharmacy benefit managers Express Scripts and Prime Therapeutics of using a little-known, Switzerland-based company to illegally drive up drug prices and ultimately push those higher costs onto patients who rely on lifesaving drugs such as insulin.

Express Scripts, by health insurer Cigna, set up a firm called Ascent Health Services in Switzerland in 2019, with Prime Therapeutics, another PBM, later taking a minority stake, the report said, citing the lawsuit.

The lawsuit alleges that Express Scripts, Prime and Humana's PBM, which is a customer of Ascent, used it to coordinate their negotiations and fix amounts of rebates.

PBMs act as middlemen in the drug supply chain, negotiating drug prices with pharmaceutical companies for employers and health insurers.

The suit alleges multiple violations of the Valentine Act, Ohio’s antitrust law, which prohibits price fixing, controlled sales and other agreements that restrain trade and hurt competition. The Valentine Act is broader than its federal corollary, the Sherman Act, in that the Ohio law prohibits market harms, in addition to consumer harms.

A spokesperson for Prime said the company does not comment on pending litigation.

Cigna and Humana did not respond to Reuters' requests for comment.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CMG | $1,653.76 | 29.51 | 1.82 |

Chipotle Mexican Grill has agreed to pay $240,000 to former employees as part of a settlement stemming from a complaint that the company violated federal law by closing a restaurant where workers wanted to unionize.

Chipotle announced it was permanently closing its Augusta, Maine, location last year after workers filed a National Labor Relations Board petition for a union election. The NLRB later said the closure was illegal.

The Maine location was the first in the chain to file a union petition. The settlement, released by union officials on Monday, states that two dozen employees will receive payments from Chipotle and they will be placed on a preferential hiring list for other Maine locations.

The company must also post a notice in dozens of stores in New England that it won't close stores or discriminate against employees due to union support, the settlement states.

"We closed the Maine restaurant because of staffing and other issues and not because of any union activities of the employees there," said Chipotle Chief Corporate Affairs Officer Laurie Schalow in a statement.

The Associated Press contributed to this story.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BAYRY | $15.17 | 0.14 | 0.94 |

Bayer said the focus of its drug research would shift away from women's health, a traditional pillar of Germany's largest drugmaker, to hone in on neurology, rare diseases and immunology.

"When it comes to research and the subsequent clinical phases, we will no longer have an explicit focus on women's health," the head of Bayer's pharmaceuticals unit, Stefan Oelrich, told Reuters on Friday.

Bayer, the maker of the Yasmin brand of birth-control pills and the Mirena intrauterine device, added it would nevertheless continue to pursue the development of non-hormonal menopausal symptoms relief elinzanetant as one of its four most promising pharma products.

Bayer, which acquired a large women's health business under the 2006 takeover of Schering Pharma, will focus drugs research on oncology, cardiovascular disease, neurology, rare diseases and immunology, the company said in a statement.

Research efforts in immunology could still yield products in women's health but Bayer's dedicated work on the therapeutic area overall had fallen short of expectations, he said.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DIS | $94.94 | 0.86 | 0.92 |

Walt Disney Co on Monday began 7,000 layoffs announced earlier this year, as it seeks to control costs and create a more "streamlined" business, according to a letter Chief Executive Bob Iger sent to employees and seen by Reuters.

Several major divisions of the company — Disney Entertainment, Disney Parks, Experiences and Products, and corporate — will be impacted, according to a person familiar with the matter. ESPN is not touched by this week's round of cuts, but is anticipated to be included in later rounds.

Iger said Disney would begin notifying the first group of employees who are impacted by the workforce reductions over the next four days. A second, larger round of job cuts will happen in April, "with several thousand more staff reductions." The final round will start before the beginning of the summer, the letter said.

The Burbank entertainment conglomerate announced the layoffs in February as part of an effort to save $5.5 billion in costs and make its money-losing streaming business profitable.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMZN | $97.39 | -0.74 | -0.75 |

Amazon.com Inc must face consumer claims that its pricing practices artificially drove up the cost of goods sold by other retailers in violation of U.S. antitrust law, a federal judge has ruled.

The ruling by U.S. District Judge Richard Jones in Seattle on Friday came in a prospective antitrust class action that has estimated damages of between $55 billion to $172 billion.

The lawsuit was filed in 2020 by residents of 18 states, including Virginia, Texas, California, Florida and Illinois, challenging an Amazon policy that retailers cannot offer lower prices for goods sold elsewhere if they also want their product available on the Amazon Marketplace platform.

Jones' order trimmed the lawsuit but said consumers can move ahead with their case.

Alibaba founder Jack Ma has resurfaced in China after months of overseas travel, visiting a school Monday in the city where his company is headquartered and discussed topics such as artificial intelligence.

Ma founded e-commerce firm Alibaba in the 1990s and was once China’s richest man. He has kept a low profile with few public appearances since Nov. 2020, when he had publicly criticized China's regulators and financial systems during a speech in Shanghai.

In the past year, Ma has been travelling, with reports of sightings in Europe, Japan, Thailand and Hong Kong. His itinerary has been closely watched as a barometer of Beijing’s attitude towards private businesses.

On Monday, Ma visited the Yungu School in Hangzhou, in eastern China, that was established by Ma and other partners of Alibaba, according to a WeChat post by the school. Ma discussed technologies such as the artificial intelligence chatbot ChatGPT, and spoke of his passion for learning.

Alibaba did not immediately respond to a request for comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NVS | $89.62 | 6.03 | 7.21 |

| PFE | $40.26 | -0.13 | -0.32 |

Novartis's Kisqali breast cancer drug cut the risk of recurrence in women who were diagnosed at an early stage of the disease in a pivotal trial, providing a confidence boost for the drugmaker's growth prospects.

The Swiss firm said a panel of independent supervisors recommended stopping the trial early because an interim analysis had shown a clear benefit.

The late-stage trial of the drug in a type of cancer that grows in response to hormones showed that Kisqali significantly cut the risk of recurrence when used with standard endocrine therapy, rather than endocrine therapy alone, the firm added.

Kisqali has been approved to treat hormone-driven breast cancer that has spread to other body parts, where it has taken market share from Pfizer's Ibrance.

Airports and bus and train stations across Germany were at a standstill on Monday, causing disruption for millions at the start of the working week during one of the largest walkouts in decades as Europe's biggest economy reels from inflation.

The 24-hour "warning" strikes called by the Verdi trade union and railway and transport union EVG were the latest in months of industrial action which has hit major European economies as higher food and energy prices dent living standards.

They kicked off three days of wage talks which could lead to further strikes if they fail to yield a compromise. Employers have offered 5% more wages over a period of 27 months and a one-off payment of 2,500 euros - proposals unions, which are calling for double digit hikes, call unacceptable amid soaring inflation which reached 9.3% in February.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CCL | $9.24 | 0.01 | 0.16 |

Cruise operator Carnival Corp reported a smaller-than-expected first-quarter loss and beat Wall Street estimates for revenue on Monday, helped by resilient demand for leisure travel and on-board spending.

Consumers at the higher end of the income rung who remain undeterred by elevated levels of inflation helped boost booking volumes and occupancy rates as restrictions imposed during the pandemic were lifted.

Carnival also benefited from easing of on-board COVID-19 protocols that ensured strong spending in casinos and spas.

The company was well booked for the remainder of the year at higher prices, Chief Executive Officer Josh Weinstein said.

Carnival posted an adjusted net loss of 55 cents per share in the first quarter, compared with estimates of a loss of 60 cents per share, according to Refinitiv.

The company's revenue rose to $4.43 billion from $1.62 billion a year earlier, beating estimates of $4.33 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SI | $1.78 | 0.06 | 3.49 |

| MSTR | $255.08 | -1.59 | -0.62 |

Silvergate Bank has agreed to accept a $161 million prepayment to satisfy a $205 million secured term loan issued to a subsidiary of MicroStrategy Incorporated, the crypto lender said in a securities filing.

The loan was collateralized by bitcoin owned by borrower and a $5.0 million cash reserve account.

Silvergate waived the prepayment charge due upon such prepayment pursuant to the credit agreement and upon receipt of the payoff amount, the credit agreement was terminated, and Silvergate released its security interest in all of the borrower's assets collateralizing the term loan, including the bitcoin that was serving as collateral.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HTZ | $15.62 | -0.81 | -4.93 |

Rental car firm Hertz Global Holdings Inc said on Monday its Chief Financial Officer Kenny Cheung was leaving the company to pursue other opportunities.

The company said Chief Accounting Officer Alexandra Brooks will serve as interim finance chief, effective April 1.

Cheung's departure comes at a time when Hertz's profitability has come under pressure in recent months due to higher car maintenance costs.

For the first quarter, the company's profit is expected to fall 84%, according to Refinitiv data, as demand for car rentals also wane on lower seasonal travel.

Cheung will remain in the company until April 14, the company said, as it kick-starts a formal search process for a new CFO.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PHAR | $14.96 | 3.69 | 32.74 |

The U.S. Food and Drug Administration (FDA) on Friday approved Pharming Group's drug to treat a rare genetic disorder that leads to a weakened immune system, the Dutch company said.

Leniolisib, to be sold under the brand name Joenja, becomes the first approved drug in the United States to treat activated phosphoinositide 3-kinase delta syndrome (APDS), a primary immunodeficiency that affects about 1 to 2 people in a million.

Joenja is expected to launch in the U.S. in early April and will be available for shipment in mid-April, the company said.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DISH | $8.75 | -0.09 | -1.02 |

DISH Network is facing a securities class action lawsuit.

The complaint alleges that the satellite pay television provider made materially false and misleading statements between Feb. 22, 2021 and Feb. 27, 2023, inclusive.

Specifically, DISH is accused of overstating its operational efficiency and maintaining a deficient cybersecurity and information technology infrastructure.

As a result, the lawsuit asserts the company was unable to properly secure customer data, leaving it vulnerable to access by malicious third parties and rendering DISH’s operations susceptible to widespread service outages, while hindering its ability to respond to such outages.

DISH reported and confirmed a “network outage” in February, causing its share price to fall 6.48%, to close at $11.41 per share on Feb. 28, 2023.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CRM | $190.06 | 2.62 | 1.40 |

Salesforce Inc said on Monday activist investor Elliott Management Corp has decided to not proceed with director nominations to the board of the cloud-based software provider , due to its strong earnings and 2024 transformation initiatives.

"Salesforce and Elliott have committed to continue the productive working relationship they have developed together," a joint statement from the companies said.

Earlier this month, Reuters reported Elliott nominated a slate of directors to Salesforce's board.

Elliott unveiled its multi-billion dollar stake in Salesforce January. Other hedge funds with stakes include Jeff Ubben's Inclusive Capital Partners, Jeff Smith's Starboard Value, ValueAct Capital and Third Point.

First-Citizens Bank & Trust Company of Raleigh, North Carolina will buy all deposits and loans of Silicon Valley Bridge Bank, the FDIC announced.

The deal includes $167 billion in total assets and about $119 billion in total deposits. The transaction also includes the purchase of about $72 billion of Silicon Valley Bridge Bank, National Association's assets at a discount of $16.5 billion.

The deal sent bank shares higher in early trading including First Republic Bank, PacWest and Deutsche Bank.

Amid rising tensions between China and the U.S., Apple CEO Tim Cook made an appearance at a conference sponsored by the Chinese government.

Investors will count down the final week of a volatile month as lawmakers take on the collapse of Silicon Valley Bank with a series of hearings, additionally investors will have a fair amount of earnings and economic data, including the Fed's preferred gauge of inflation, to digest.

The Federal Reserve warned last week that credit will likely tighten on the heels of the collapse of Silicon Valley Bank which is roiling other smaller, regional banks on contagion fears. Here's what that means.

Live Coverage begins here