STOCK MARKET NEWS: Virgin Orbit layoffs, Bed Bath & Beyond warning, Nikola investment

Stocks continue gains as Virgin Orbit lays off 85% of staff, Bed Bath & Beyond warns of bankruptcy again and Nikola kicks off a $100 million stock offering as Q4 GDP revised lower and jobless claims jump. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VORB | $0.34 | -0.06 | -16.02 |

Rocket maker Virgin Orbit Holdings on Thursday said it was laying off about 85% of staff, or approximately 675 employees.

Richard Branson's company is making the move to reduce expenses in light of the company's inability to secure meaningful funding.

Virgin Orbit expects incur aggregate charges of approximately $15 million for the workforce reduction, which is expected to be completed by April 3.

The company also sold $10.9 million of convertible notes to Virgin Investments Limited.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SVT | $10.65 | -0.10 | -0.93 |

Servotronics, Inc., a designer and manufacturer of servo-control components and other advanced technology products, today announced that the Company's Board of Directors has authorized the review of strategic alternatives for the Consumer Products Group (CPG) with a goal of enhancing shareholder value.

The Group consists of the Ontario Knife Company (OKC), a USA Heritage Brand that traces its origins to 1889, that currently markets a complete line of knives and tools for tactical, outdoor and home use. In 2022, CPG generated revenues of approximately $8.6 million.

We are taking actions that are in line with our recently announced long-term strategy, and that centers around our core markets in the aerospace industry. The Ontario Knife Company will be a prime business addition to an organization that is more significantly invested in OKC's primary markets.

There is no set timetable for the strategic review process, and Servotronics does not intend to provide updates until the Board approves a specific action.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NKLA | $1.40 | -0.10 | -6.67 |

Electric truck maker Nikola has launched a $100 million public offering of common stock, with an additional $15 million set aside for underwriters.

Concurrently with the public offering, Nikola has entered into a forward stock purchase agreement with an investor, whereby the investor has agreed to purchase up to $100 million of shares of common stock at the public offering price.

The public offering is not conditioned on the closing of the concurrent registered direct offering, and the closing of the concurrent registered direct offering is not conditioned on the closing of the public offering.

The company currently plans to use the net proceeds from the public offering and the concurrent registered direct offering for working capital and other general corporate purposes.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| JPM | $128.84 | -0.30 | -0.23 |

| AXP | $162.57 | -1.01 | -0.62 |

| V | $222.51 | -0.79 | -0.35 |

| QQQ | $315.68 | 2.96 | 0.95 |

| XLY | $145.64 | 1.28 | 0.89 |

| XLF | $31.80 | -0.07 | -0.22 |

U.S. stocks rose across the board led the tech-heavy Nasdaq Composite which clocked a second consecutive session of gains. Along with tech, consumer discretionary companies were among the leaders. Financials lagged as JPMorgan, Visa and American Express limited gains in the Dow Jones Industrial Average.

In commodities, oil jumped 1.9% to $74.37 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ROKU | $63.91 | 3.31 | 5.46 |

Roku Inc will lay off 6% of its workforce, or 200 employees, in its second round of job cuts , the U.S. streaming device maker said.

In a bid to lower expenses, the company also decided to exit and sub-lease office facilities that it did not currently occupy.

Roku, which had about 3,600 full-time employees as of Dec. 31, expects to incur charges of between $30 million and $35 million related to the restructuring.

Majority of the restructuring charges will be incurred in the first quarter of fiscal 2023, while the job cuts will be completed by the end of the second quarter, the company said.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBBY | $0.76 | -0.04 | -5.29 |

Bed Bath & Beyond has launched a program to sell up to $300 million of common stock with B. Riley.

Simultaneously, the Company is terminating its previous public equity offering and all outstanding warrants for Series A Convertible Preferred Stock associated with that offering.

In conjunction with today’s business update, Bed Bath & Beyond issued preliminary financial results for the fiscal 2022 fourth quarter (ended February 25, 2023):

• Net Sales of approximately $1.2 billion

• Comparable Sales decline in the 40% to 50% range

• Continuation of negative operating losses

• Modest free cash flow usage

The company has not yet completed its fiscal year 2022 fourth quarter and full year financial close and plans to provide its full financial results for the fiscal 2022 fourth quarter and full year at the end of April 2023.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $12.31 | 0.26 | 2.15 |

Ford Motor Co has raised the base price of its popular F-150 Lightning electric pickup truck again, the automaker's website showed on Thursday, the latest in a series of price hikes aimed at offsetting high costs.

The base variant of Ford's electric F-150 truck now starts at $59,974, excluding shipping and taxes, up nearly 50% from its starting price when launched last year.

The Detroit automaker resumed production of the F-150 Lightning earlier this month after recalling 18 electric trucks due to a battery-cell manufacturing defect.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WFC | $37.26 | -0.71 | -1.87 |

Wells Fargo & Co will pay fines of about $97.8 million for inadequate oversight of its compliance risks, enabling the apparent violation of U.S. sanctions against Iran, Syria and Sudan, federal authorities said on Thursday.

The Federal Reserve and the Treasury Department's Office of Foreign Assets Control (OFAC) said the bank's deficient oversight enabled it to violate U.S. sanctions by providing a trade finance platform to a foreign bank that used it to process $532 million in prohibited transactions.

The Fed fined Wells Fargo $67.8 million, while OFAC fined the bank $30 million for inadequate oversight of its compliance risks from 2010 to 2015.

“Wells Fargo is pleased to resolve this legacy matter involving conduct that ended in 2015, which we voluntarily self-reported and fully cooperated with OFAC and the Federal Reserve Board to address," a Wells Fargo spokesperson said in a statement.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMZN | $101.27 | 1.02 | 1.02 |

The White House on Thursday highlighted new U.S. company moves to support electric vehicles (EVs), as final rules on tax credits aimed at boosting the industry are expected this week.

Amazon is rolling out the first 3,000 delivery vehicles it has acquired as part of a commitment to bring 100,000 vehicles to the road by 2030, the White House said, and First Student, a major supplier of school bus services, is pledging to replace 30,000 fossil fuel-powered school buses with electric buses by 2035.

The federal government will buy 13,000 light- and medium-duty zero emission vehicles this fiscal year, about four times more than last fiscal year, the White House said.

The average long-term U.S. mortgage rate inched down this week to its lowest level in six weeks, just as the spring buying season gets underway.

Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate fell for the third straight week, to 6.32%, from 6.42% last week. The average rate a year ago was 4.67%.

The recent decline in mortgage rates is good news for prospective homebuyers, as many were pushed to the sidelines during the past year as the Federal Reserve cranked up its main borrowing rate nine straight times in a bid to bring down stubborn, four-decade high inflation.

U.S. applications for jobless benefits rose last week but remain at historically low levels despite efforts by the Federal Reserve to cool the economy and the job market in its fight against inflation.

Jobless claims in the U.S. for the week ending March 25 rose by 7,000 to 198,000 from the previous week, the Labor Department said Thursday.

The four-week moving average of claims, which evens out some of the week-to-week fluctuations, rose by 2,000 to 198,250, remaining below the 200,000 threshold for the tenth straight week.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ILMN | $222.63 | 0.59 | 0.27 |

| IEP | $51.60 | -0.17 | -0.33 |

Illumina is urging shareholders to choose its nominees for the company’s board of directors over those offered by activist investor Carl Icahn.

Icahn, who owns 1.4% of Illumina, is pushing for Illumina to unwind its buyout of cancer detection test maker Grail and is seeking three board seats after weeks of private discussions failed to yield results.

“Mr. Icahn is not a long-term Illumina shareholder and made no attempt to engage constructively with the company before demanding board representation,” Illumina said in a press release.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| EVGO | $7.16 | 1.41 | 24.52 |

EVgo topped Wall Street revenue and profit estimates.

Fourth quarter revenue rose 283.5% to $27.3 million from a year ago; analysts expected $21.82 million.

The net loss narrowed to $17 million from $46.32 million.

The adjusted loss was 6 cents per share for the quarter ended in December. The mean expectation of twelve analysts for the quarter was for a loss of 16 cents per share.

“We expect 2023 will be another banner year for EVgo as we expand our network and revenue base, and deliver financial results that demonstrate discipline, agility, and innovation in serving the rapidly growing EV sector,” said CEO Cathy Zoi.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $12.26 | 0.20 | 1.70 |

U.S. carmaker Ford has joined PT Vale Indonesia and China's Zhejiang Huayou Cobalt's as their new partner in a $4.5 billion nickel processing plant in Indonesia, the companies said on Thursday.

The investment is Ford's first in the Southeast Asian country and underscores growing appetite among automakers for raw materials used in producing electric vehicle (EV) batteries, which account for about 40% of a vehicle's sticker price, aiming to cut costs and close the gap on EV market leader Tesla.

Indonesia, which has the world's biggest nickel reserves, has been trying to develop downstream industries for the metal, ultimately aiming to produce batteries and electric vehicles.

Average Wall Street bonuses dropped sharply last year to $176,700 amid lagging profits and recession fears, New York state's comptroller reported Thursday.

The bonuses for employees in New York City’s securities industry dropped 26% from 2021, when the average was a record $240,400, according to New York state Comptroller Thomas DiNapoli’s annual estimate. DiNapoli noted that bonuses last year returned to pre-pandemic levels.

“Wall Street’s cash bonuses were expected to fall as several factors weighed on the securities’ industry profitability in 2022,” DiNapoli said in a prepared release.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BSET | $18.22 | -0.69 | -3.65 |

Bassett Furniture missed Wall Street revenue and profit expectations.

Fourth quarter revenue fell 8.7% to $107.7 million, which is lower than the estimate of $108.24 million.

Net income for the quarter ended Feb. 25 was $1.4 million, down from $5.6 million prior year.

The company reported profits of 16 cents per share, 41 cents lower than the same quarter last year when the company reported EPS of 57 cents. Profits of 24 cents per share were anticipated by the two analysts providing estimates for the quarter.

The company said COVID-10 related disruptions are behind it.

“Armed with the results of a thorough line-wide cost analysis, we plan to sharpen price points on key items across the line to enhance sales and improve overhead absorption in our factories. We will implement the new pricing strategy in our stores and to our wholesale customers sometime in April, which we believe will not adversely affect wholesale margins based on our internal calculations,” said chair and CEO Robert H. Spilman, Jr.

Reuters contributed to this report.

Indicted FTX cryptocurrency exchange founder Sam Bankman-Fried pleaded not guilty on Thursday to new U.S. charges of conspiring to violate campaign finance laws and bribe Chinese authorities.

Bankman-Fried, 31, entered the plea to the new, 13-count indictment at a hearing before U.S. District Judge Lewis Kaplan in Manhattan federal court.

He had earlier pleaded not guilty to eight counts of fraud and conspiracy for allegedly stealing billions in FTX customer funds to plug losses at his hedge fund, Alameda Research.

The new charges add to the pressure on Bankman-Fried, who faces a possible sentence of decades in prison if convicted at a trial set to start on Oct. 2.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PHG | $17.75 | 0.85 | 5.06 |

Dutch health technology company Philips expects to reach settlements this year relating to its global recall of respiratory devices, CEO Roy Jakobs said in an interview with Dutch financial daily FD published on Thursday.

"I think we can at least reach a settlement on economic damages this year," Jakobs said without giving details on the expected costs.

Jakobs added he "hopes and expects" to also reach a settlement with the U.S. Food and Drug Administration this year.

A settlement with patients who claim the use of the recalled machines made them sick probably will take longer, he said.

A spokesperson for Philips confirmed the quotations in the newspaper were accurate.

The U.S. economy maintained its resilience from October through December despite rising interest rates, growing at a 2.6% annual pace, the government said Thursday in a slight downgrade from its previous estimate. But consumer spending, which drives most of the economy's growth, was revised sharply down.

The government had previously estimated that the economy expanded at a 2.7% annual rate last quarter.

The rise in the gross domestic product — the economy’s total output of goods and services — for the October-December quarter was down from the 3.2% growth rate from July through September. For all of 2022, the U.S. economy expanded 2.1%, down significantly from a robust 5.9% in 2021.

The report suggested that the economy was losing momentum at the end of 2022.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DIS | $96.87 | 2.05 | 2.16 |

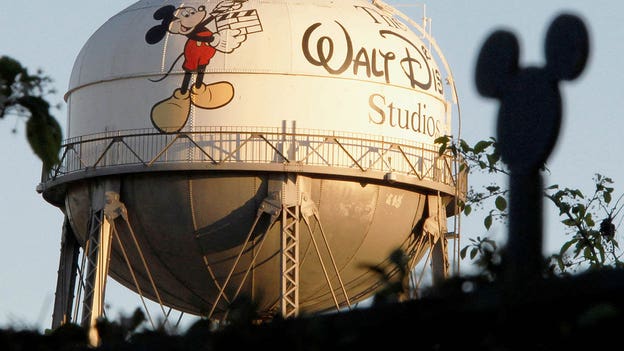

Board members picked by Florida Gov. Ron DeSantis to oversee the governance of Walt Disney World said Wednesday that their Disney-controlled predecessors pulled a fast one on them by passing restrictive covenants that strip the new board of many of its powers.

The current supervisors of the Central Florida Tourism Oversight District said at a meeting that their predecessors last month signed a development agreement with the company that gave Disney maximum developmental power over the theme park resort's 27,000 acres in central Florida.

The five supervisors were appointed by the Republican governor to the board after the Florida Legislature overhauled Disney's government in retaliation for the entertainment giant publicly opposing so-called “Don’t Say Gay” legislation that bars instruction on sexual orientation and gender identity in kindergarten through third grade, as well as lessons deemed not age-appropriate.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DIS | $96.87 | 2.05 | 2.16 |

Walt Disney Co has laid off Marvel Entertainment Chairman Isaac "Ike" Perlmutter as part of a cost-cutting campaign, a source confirmed on Wednesday.

Perlmutter, 80, had supported activist shareholder Nelson Peltz's unsuccessful bid this year to obtain a seat on Disney's corporate board.

The executive was informed by phone Wednesday that Marvel Entertainment, a small division within the company responsible for comic book publishing and some consumer products, would be merged into larger Disney business units, according to a second source with knowledge of the matter.

Perlmutter could not be immediately reached for comment.

A Minnesota town outside of Minneapolis has been ordered to evacuate Thursday morning after a Burlington Northern Santa Fe train carrying "a form of ethanol" and "a corn syrup liquid" derailed and caught on fire, police say.

The accident follows the February 3 derailment of a Norfolk Southern train that spilled toxic chemicals in East Palestine, Ohio sparking a fallout and calls from lawmakers for tighter rail standards.

Videogame publisher Electronic Arts said on Wednesday it will lay off about 6% of its workforce and reduce office space in an attempt to cut costs.

EA had about 12,900 staff as of March-end last year.

The Madden NFL publisher also said it will move away from projects that do not contribute to its strategy.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| EA | $119.19 | 1.17 | 0.99 |

Live Coverage begins here