STOCK MARKET NEWS: Powell testifies, 242k private jobs added, Silvergate Bank liquidating

The Dow falls but the S&P 500 and Nasdaq finish higher as Fed Chair Jerome Powell’s testimony puts steeper rate hikes on the table, ADP’s private payroll report shows better than expected growth while job openings remain high. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TACT | $7.65 | 0.15 | 2.00 |

TransAct Technologies is higher in extended trading after reporting preliminary fourth quarter and full year 2022 financial results.

Fourth quarter net sales rose 61% to $18.0 million.

Net income was $0.3 million, or $0.03 net income per diluted share, compared to a year ago net loss of $(0.8) million, or $(0.08) net loss per diluted share.

TransAct Technologies develops and sells software-driven technology and printing solutions for high-growth markets including food service, casino and gaming, and POS automation.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SI | $4.91 | -0.30 | -5.76 |

Silvergate Capital announced its intent to wind down operations and voluntarily liquidate Silvergate Bank in an orderly manner and in accordance with applicable regulatory processes.

"In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of bank operations and a voluntary liquidation of the bank is the best path forward," the company said.

The bank’s wind down and liquidation plan includes full repayment of all deposits. The company is also considering how best to resolve claims and preserve the residual value of its assets, including its proprietary technology and tax assets.

In addition, Silvergate Bank is discontinuing the Silvergate Exchange Network, which it announced on March 3, 2023 on its public website.

All other deposit-related services remain operational. Customers will be notified should there be any further changes.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AXP | $174.83 | -0.49 | -0.28 |

The Board of Directors of American Express Company approved the repurchase of up to 120 million common shares.

The authorization replaces the previous plan to repurchase approximately 36 million common shares.

The timing and amount of common shares purchased under the company’s authorized capital plans will depend on various factors, including the company’s business plans, financial performance and market conditions.

Separately, the Board of Directors approved a $0.08 — or 15% — increase in the quarterly dividend on the company’s common stock, consistent with the planned increase discussed in the company’s fourth-quarter 2022 earnings release.

The dividend was raised to $0.60 per common share, from $0.52, payable on May 10, 2023, to shareholders of record on April 7, 2023.

U.S. stocks ended a choppy session mixed, with the Nasdaq Composite gaining, as investors weighed the second day of testimony from Federal Reserve Chairman Jerome Powell which reinforced what will likely be more aggressive rate hikes perhaps at the next meeting on March 22. Additionally, a stronger-than-expected ADP jobs report creates more headwinds for policymakers trying to cool the economy.

Tech and utilities were S&P 500 leaders, while energy and healthcare lagged.

In commodities, oil fell 1% to $76.66 per barrel.

Federal Reserve Chairman Jerome Powell stressed Wednesday that the central bank's policymakers have yet to decide how large an interest rate hike to impose at its next meeting in two weeks in its drive to defeat high inflation.

“If — and I stress that no decision has been made on this — if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes,” Powell said on his second day of semi-annual testimony to Congress.

The Fed chair had made a similar comment Tuesday to a Senate panel but had not included the caveat that “no decision has been made.” Some economists and Wall Street traders had interpreted those remarks as a signal that the Fed would raise its benchmark rate by a substantial half-point at its March 21-22 meeting.

As a result, stock prices tumbled Tuesday, and some bond yields rose as markets anticipated a faster pace of rate hikes.

U.S. employers posted 10.8 million job openings in January, indicating the American job market continues to run too hot for the inflation fighters at the Federal Reserve.

Job openings fell from 11.2 million in December but remained high by historical standards, the Labor Department reported Wednesday. Employers also hired more workers in January. But layoffs rose.

Still, there some signs the job market is cooling in the Labor Department's monthly Job Openings and Labor Turnover Summary (JOLTS) report. Amid high-profile job cuts at many big tech companies such as Google and Amazon, overall layoffs rose in January to 1.7 million, highest since December 2020. And the number of Americans quitting their jobs – a sign they are confident they can find better pay or working conditions elsewhere – fell to the lowest level since April 2021.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BA | $207.68 | -0.24 | -0.12 |

Boeing and Shield AI will explore strategic collaboration on autonomous capabilities and artificial intelligence on current and future defense programs, the companies said.

“Collaborating with Shield AI, the leader in AI pilots, will accelerate our ability to deliver these capabilities to the warfighter,” said Steve Nordlund, vice president and general manager for Boeing’s Air Dominance organization.

Shield AI created Hivemind, an artificial intelligence pilot that has flown a variety of aircraft. According to Shield AI, the AI pilot can also enable swarms of drones and aircraft to operate autonomously without GPS, communications or a human pilot in the cockpit.

| Symbol | Price | Change | %Change |

|---|---|---|---|

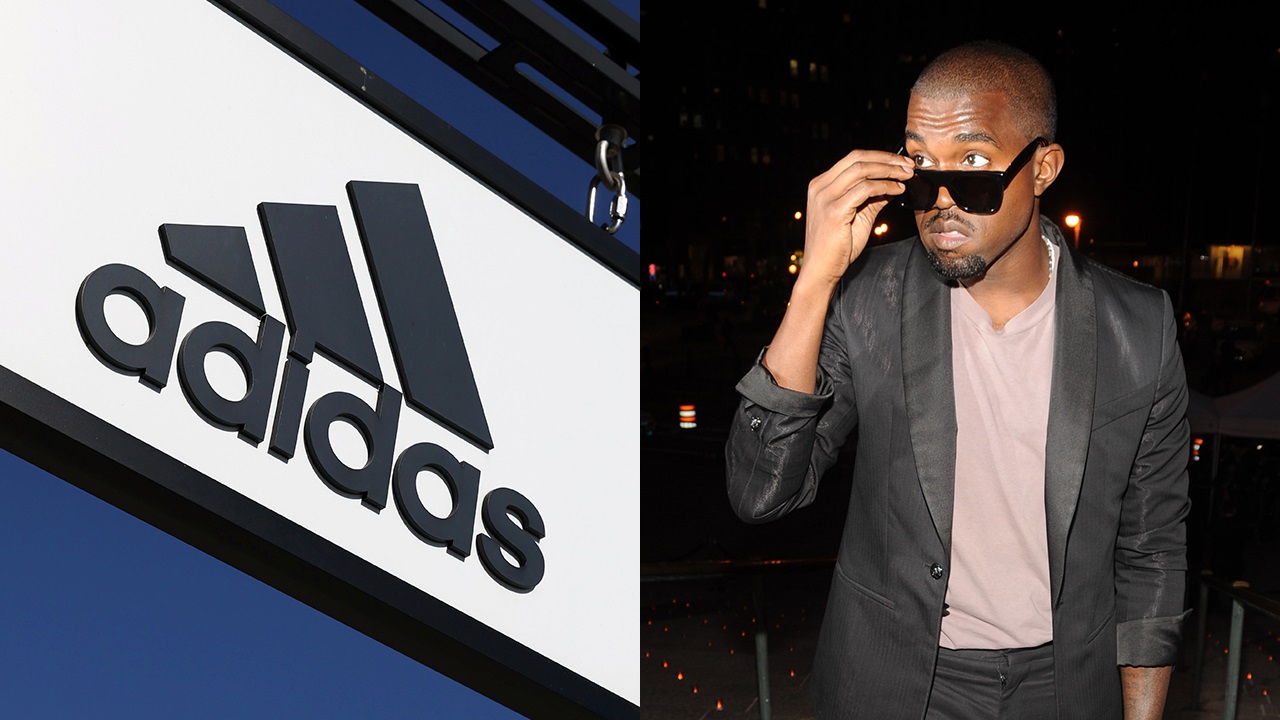

| ADDYY | $77.78 | 1.75 | 2.30 |

Adidas will slash its 2022 dividend, the sportswear maker said on Wednesday, after warning a split with the artist formerly known as Kanye West could push it to its first annual loss in three decades this year.

Chief Executive Bjorn Gulden, speaking to investors for the first time since taking the reins on Jan. 1, pledged to rebuild the bruised brand after dealing with the fallout from ending Adidas' partnership with West, who now goes by Ye, which yielded the lucrative Yeezy sneaker line.

Adidas has not said how much the Yeezy brand has made since its first deal with Ye at the end of 2013, but analysts estimate it accounted for as much as 7% of total sales in its best years.

The company will recommend a dividend of 0.70 euros ($0.7374) per share, down from 3.30 euros a share in 2021, at a May 11 annual general meeting, it said.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| OXY | $62.37 | 1.52 | 2.50 |

Warren Buffett's Berkshire Hathaway Inc has resumed its purchases of Occidental Petroleum Corp shares after a five-month hiatus, increasing its stake in the oil company to about 22.2%, a regulatory filing showed on Tuesday.

Berkshire paid about $355 million for 5.8 million Occidental shares between March 3 and March 7, according to the filing.

The purchases were the first Berkshire has disclosed since late September. It ended last year with a 21.4% stake.In August, Berkshire won U.S. Federal Energy Regulatory Commission permission to buy up to 50% of Occidental's common stock.

Buffett's company now owns about 200.2 million Occidental shares worth $12.2 billion, based on Tuesday's closing price of $60.85.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $183.05 | -4.66 | -2.48 |

The National Highway Traffic Safety Administration (NHTSA) said Wednesday it is opening a preliminary investigation into 120,000 2023 Tesla Model Y vehicles after two reports of steering wheels falling off while driving.

The U.S. auto safety regulator said the steering wheels in both vehicles, which had a low mileage, completely detached. The vehicles were delivered to owners missing the retaining bolt that attaches the steering wheel to the steering column.

The agency is opening a preliminary investigation to assess the "scope, frequency, and manufacturing processes associated with this condition."

The investigation is a first step before NHTSA could demand a recall.

The agency said it received a complaint from a parent who had bought a new Model Y five days earlier and was on Route 1 South in Woodbridge, New Jersey on Jan. 29 "and all the sudden steering wheel" fell off.

Tesla did not immediately respond to a request for comment.

The major U.S. benchmarks are wobbling on Wednesday as Wall Street readies for another day of Fed Chair Jerome Powell testimony before lawmakers.

The Dow Jones, S&P and Nasdaq are up and down with shares of Tesla and Occidental Petroleum moving in opposite directions after news the EV maker was under investigation for faulty steering wheels and Warren Buffett's Berkshire Hathaway announced an increase in ownership in the oil producer and energy company.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $182.71 | -5.00 | -2.66 |

| OXY | $62.99 | 2.14 | 3.52 |

In commodities, oil is down, slipping approximately 1.29% to $76.58 a barrel as gold moves roughly between small gains and losses near $1,819.20 an ounce.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VRA | $5.44 | 0.09 | 1.68 |

Vera Bradley Inc. on Wednesday reported a loss of $28.2 million in its fiscal fourth quarter.

The Roanoke, Indiana-based company said it had a loss of 91 cents per share. Earnings, adjusted for non-recurring costs, were 16 cents per share.

The handbag and accessories company posted revenue of $147.1 million in the period.

For the year, the company reported a loss of $59.7 million, or $1.90 per share. Revenue was reported as $500 million.

Vera Bradley expects full-year earnings to be 40 cents to 50 cents per share, with revenue in the range of $490 million to $510 million.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CPB | $52.13 | -0.45 | -0.86 |

Campbell Soup Co raised its annual sales forecast on Wednesday after its quarterly results topped Wall Street estimates, powered by higher prices, improved supply and strong demand for packaged meals and snacks.

While inflation has strained household budgets, Americans are still snacking on Campbell's cookies and salty snacks while a continued preference for cooking at home bolstered demand for its ready-to-eat meals.

Consumers were turning to Campbell's products as a means to stretch their food budgets in the tough economic environment, Chief Executive Mark Clouse said.

A recovery in supply chains also helped Campbell put more products on store shelves and ramp up shipments in its food service segment, boosting second-quarter net sales that rose 12% to $2.49 billion, above Refinitiv estimates of $2.44 billion.

New Jersey-based Campbell expects fiscal 2023 net sales to rise between 8.5% and 10%, up from its previous growth forecast of 7% to 9%. Analysts on average were expecting an 8.3% jump.It also projected annual adjusted earnings of $2.95 to $3.00 per share, compared with a prior target of $2.90 to $3.00.

Excluding items, Campbell earned 80 cents per share in the quarter ended Jan. 29, beating estimates of 74 cents.

Warren Buffett's Berkshire Hathaway made some adjustments to its portfolio, as disclosed in filings with the Securities and Exchange Commission, which included a major move with Occidental Petroleum.

The ADP private payrolls report came in hotter than expected creating more challenges for a Federal Reserve trying to cool the economy.

Live Coverage begins here