Stock Market News: Home Depot slides, Buffett’s bank buy, Tesla meeting

Investors took a cautious tone after Home Depot disappoints and retail sales rose less than expected last month, this as debt ceiling talks are set to resume. Also, on tap the CEO of OpenAI will be on Capitol Hill and Elon Musk will preside over the automaker’s annual meeting. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

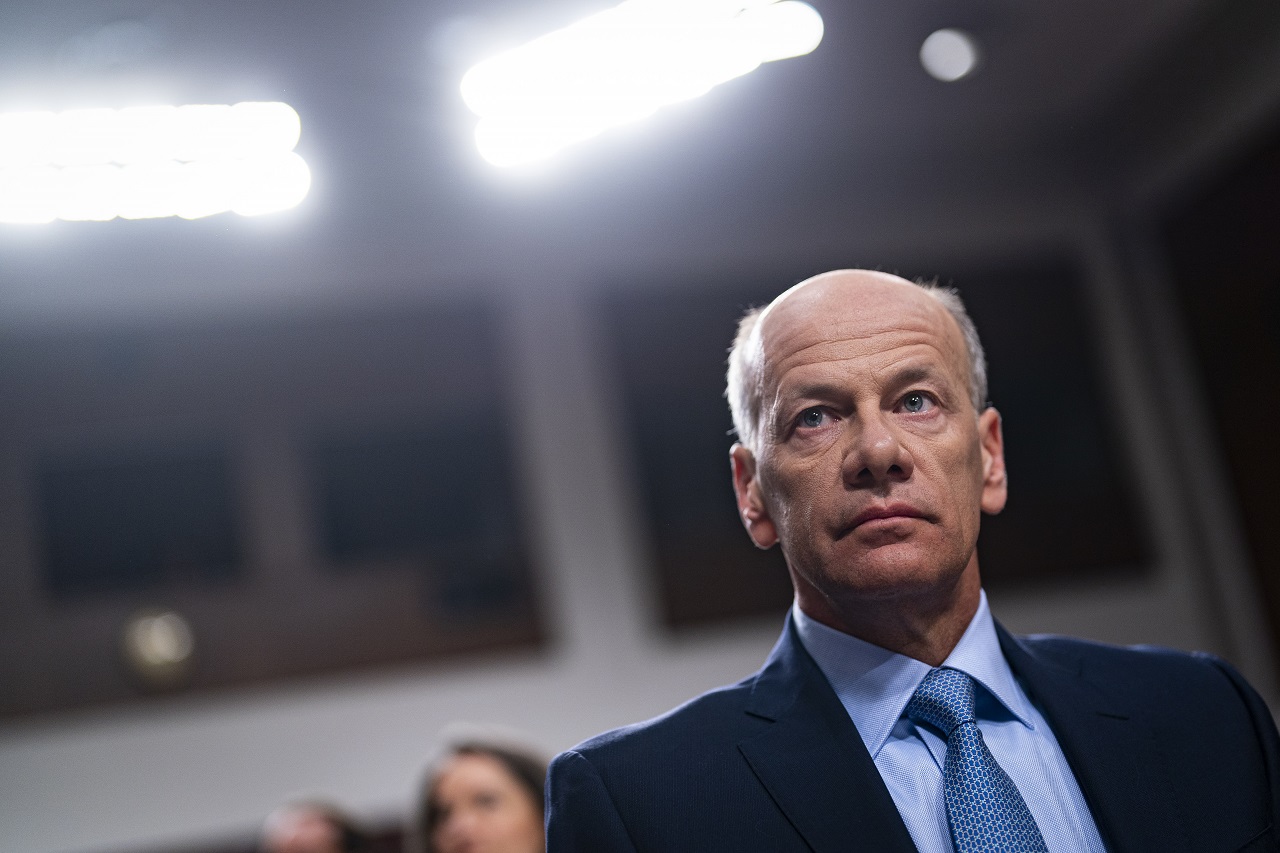

The embattled former CEO of Silicon Valley Bank, Greg Becker, explains what happened to fuel the largest bank collapse since 2008.

Warren Buffett’s Berkshire Hathaway purchased 9.9 million shares of Capital One Financial Corp. and dropped its stakes in the Bank of New York Mellon and U.S. Bancorp, according to a regulatory filing.

The Capital One stake would be worth $954 million, based on the closing price on March 31.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| COF | $91.28 | 2.16 | 2.42 |

Meanwhile, Buffett's company was a net seller of stocks in the last quarter, buying $2.87 billion and selling $13.28 billion as it devoted resources elsewhere, including $8.2 billion to boost its stake in truck stop operator Pilot Travel Centers to 80% from 38.6%.

Home Depot sales fell as the retailer faces more headwinds from a slowing housing market.

Sales: -4.2% to $37.3B

Comp Sales: -4.5%

U.S. Sales: -4.6%

Tesla CEO Elon Musk, days after naming a Twitter's new CEO Linda Yaccarino, will host his annual shareholders meeting in Texas. Investors are hoping to get more color on whether Musk will re-focus on the electric vehicle maker.

Retail sales rebounded last month but not as much as economists had expected. Here's what it may mean for the U.S. economy.

Live Coverage begins here