Stock Market News: Uber shares soar, Yellen warns on debt ceiling, IBM, Chegg CEOs talk AI

Treasury Secretary Janet Yellen warns on debt ceiling as the Federal Reserve begins its two-day meeting. JOLTS report kicks off jobs data. Uber, Pfizer, Starbucks earnings in focus. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SP500 | $4,119.58 | -48.29 | -1.16 |

U.S. stocks ended sharply lower on Tuesday as regional bank shares tumbled on renewed fears over the financial system and as investors tried to gauge how much longer the Federal Reserve may need to hike interest rates.

The Fed is expected to raise rates 25 basis points on Wednesday, and investors are anxious for any signals from the central bank on whether it will be the last hike for now, or if further increases are possible if inflation remains high.

The KBW regional banking index hit its lowest level intraday since late 2020. U.S. regional banks extended losses from Monday after the seizure and auction of First Republic Bank. Most of its assets were bought by JPMorgan Chase & Co in a deal brokered by the Federal Deposit Insurance Corp.

According to preliminary data, the S&P 500 lost 48.82 points, or 1.17%, to end at 4,119.05 points, while the Nasdaq Composite lost 132.49 points, or 1.11%, to 12,077.29. The Dow Jones Industrial Average fell 365.40 points, or 1.09%, to 33,680.41.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VMW | $123.39 | -3.60 | -2.83 |

VMware Inc must pay $84.5 million for infringing two patents belonging to rival software company Densify, a Delaware federal jury said on Monday.

The verdict, made public Tuesday, said VMware willfully violated Densify's patent rights with its software for optimizing "virtual machines" used in cloud computing.

Densify accused Palo Alto, California-based VMware's vROps, vSphere and other software of infringing patents covering "virtualization" technology that enables multiple computer systems to run on a single server.

The lawsuit alleged that VMware used Densify's technology as a "blueprint" for its own. Densify said VMware "dominates the virtual infrastructure market" and that it could "outspend Densify and swamp Densify's marketing and sales" if its infringement is not stopped.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| IEP | $42.79 | -7.63 | -15.14 |

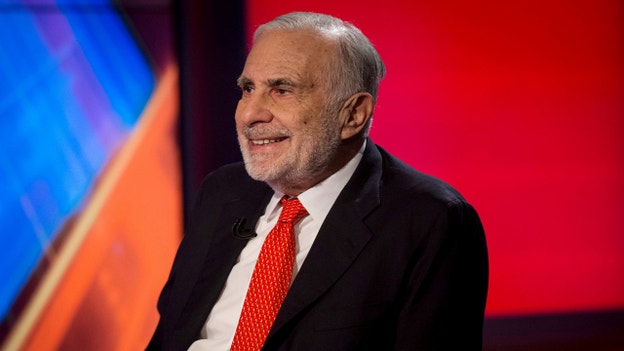

Hindenburg Research said on Tuesday it has a short position in activist investor Carl Icahn-controlled energy-to-pharma conglomerate Icahn Enterprises, making it the latest in a string of recent high-profile targets of the U.S. short seller.

Hindenburg alleges that the valuation of IEP units was inflated by more than 75% and that "IEP trades at a 218% premium to its last reported net asset value (NAV), vastly higher than all comparables."

Hindenburg also claimed Icahn was operating a "ponzi-like economic structure," selling its units to new investors to support its dividend payouts.

Earlier this year, Hindenburg's report on India's Adani Group triggered a more than $100 billion rout in the conglomerate's shares, and last month, the short seller took aim at Jack Dorsey-led Block Inc.

U.S. stocks fell sharply mid-morning with financial shares seeing steep declines following JPMorgan's acquisition of embattled First Republic creating more uncertainty over the sector.

The Dow Jones Industrial Average fell over 500 points.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLE | $80.22 | -3.94 | -4.69 |

| XLF | $32.20 | -0.88 | -2.65 |

| JPM | $139.48 | -1.72 | -1.22 |

| USO | $63.79 | -2.76 | -4.15 |

Energy stocks were also under pressure as oil tumbled 4% to the $72 per barrel level. This ahead of the Federal Reserve's decision on interest rates due tomorrow at 2pm ET.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $11.73 | -0.33 | -2.69 |

Ford Motor Co said Tuesday it is cutting prices on its Mustang Mach-E electric vehicle and reopening orders after a series of price cuts by rival Tesla Inc.

The No. 2 U.S. automaker said it is also increasing the range for standard range battery models as it increases production in the second half of the year.

Ford said it is cutting most Mach-E prices by $3,000 or $4,000 depending on the version. Last month, the federal EV tax credit for the Mach-E fell in half to $3,750 from $7,500 after new battery sourcing requirements took effect.

Mustang Mach-E U.S. sales fell 20% in the first three months of the year.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $162.30 | 0.47 | 0.29 |

Tesla Inc has raised prices in a range of up to $290 in Canada, China, Japan and the United States, its website showed on Monday, after the company slashed prices of its top-selling vehicles since the start of the year.

The hike was the first on its two top-selling models at the same time in multiple markets, although prices across its lineup are much lower than in January, after a round of discounts. Shares rose nearly 2% in early trading.

Chief Executive Elon Musk said the company would prioritize sales growth ahead of margins and look to profit later on its rollout of self-driving software for a larger fleet of vehicles.

Since January, Tesla has shifted to a real-time pricing model that is closer to airlines or ride-sharing from the fixed prices of the traditional auto industry model.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PFE | $39.14 | -0.07 | -0.18 |

Pfizer Inc on Tuesday beat estimates for first-quarter revenue and profit, helped by steady demand for its COVID products and reaffirmed its annual earnings forecast as it banks on newer drugs to contribute to growth later this year.

Pfizer is pumping billions of dollars into research and to buy potential blockbuster assets to mitigate an anticipated $17 billion hit to revenue by 2030 from patent expirations for top drugs, and a decline in demand for its COVID products.

The company said on Tuesday it would become more balanced with allocating capital after a string of deals in the last two years once its recent $43 billion buyout of Seagen was completed. The drugmaker expects annual profit of $3.25 to $3.45 per share and COVID products sales of about $21.5 billion.

Overall revenues for the first quarter fell 29% to $18.3 billion, but topped estimates of $16.59 billion. Excluding items, the U.S. drugmaker posted a better-than -expected profit of $1.23 per share.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CHGG | $9.03 | -8.57 | -48.70 |

Chegg, a US education service, forecast current-quarter revenue below estimates and signaled that the usage of viral chatbot ChatGPT was pressuring customer growth, sending its shares 44% lower in premarket trading on Tuesday.

There are fears Chegg's core business could become extinct as consumers experiment with free artificial intelligence (AI) tools, said analyst Brent Thill at Jefferies, which downgraded the stock to "hold".

Chegg said it was suspending its full-year outlook due to uncertainty of the impact on results and targeted second-quarter total revenue between $175 million and $178 million, which fell short of Wall Street expectations of $186.3 million.

"Chegg has to make significant changes in a rapidly changing environment that is akin to 'dancing in the rain without getting wet,'" said Arvind Ramnani, analyst at Piper Sandler.

Treasury Secretary Janet Yellen said in a letter to Congress that the agency will be unlikely to meet all U.S. government payment obligations "potentially as early as June 1" without action by Congress.

The new potential "X-date," which takes in to account April tax payments, is largely unchanged from a previous estimate, issued in January, that the government could run short of cash around June 5. But Yellen added some wiggle room, noting federal receipts and outlays are "inherently variable." The actual date that Treasury exhausts extraordinary measures "could be a number of weeks later than these estimates," she wrote.

"It is impossible to predict with certainty the exact date when Treasury will be unable to pay the government's bills," she wrote.

After hitting the $31.4 trillion borrowing cap on Jan. 19, Yellen previously told Congress that Treasury would keep up payments on debt, federal benefits and make other spending by using extraordinary cash management measures. One such step Treasury is taking is suspending the sales of securities that state and local governments use to temporarily hold cash.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UBER | $32.74 | 1.69 | 5.44 |

Uber Technologies Inc forecast quarterly core earnings above estimates on Tuesday, after a surge in demand for travel and food delivery helped the U.S. ride-sharing giant report better-than-expected results for the January-March period.

Uber is benefiting from its dominant position in key global markets as travel rebounds from a pandemic-induced lull. A jump in the number of people looking to gain additional income is also helping platforms such as Uber squeeze out higher profit by offering lower incentives to gig workers, analysts have said.

Uber expects adjusted EBITDA between $800 million and $850 million for the June quarter. That was higher than analysts' projection of $749.1 million, according to Refinitiv.

The company also forecast gross bookings, the total dollar value from its services, of between $33 billion and $34 billion, compared with the expectations of $33 billion.

JPMorgan CEO Jamie Dimon swooped in and picked-up embattled First Republic Bank from the FDIC. So, is the banking crisis over?

Live Coverage begins here