STOCK MARKET NEWS: FTX fallout, Macy’s stock jumps, Fed’s Bullard cautious on rates

FTX's crypto contagion, Macy's and Kohl's paint mixed retail picture, Twitter employees face Elon Musk deadline. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

The new CEO of FTX John Ray had some tough words for the former CEO Sam Bankman-Fried and what he observes as the eye-popping lack of oversight at the trading firm.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMZN | $94.85 | -2.27 | -2.34 |

Amazon.com Inc said on Thursday there would be more role reductions as its annual planning process extends into next year and leaders continue to make adjustments.

"Those decisions will be shared with impacted employees and organizations early in 2023", said Andy Jassy, who became the company's Chief Executive Officer in 2021, in a letter to Amazon employees.

Jassy added the company was in the middle of an annual operating planning review where it was making decisions about what should change in each of its business.

Amazon has not yet decided on how many other roles will be impacted from the move.

The online retailer laid off some employees in its devices group on Wednesday and a person familiar with the matter said the company still targeted around 10,000 job cuts, including in its retail division and human resources.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GOOGL | $98.36 | -0.49 | -0.50 |

| ATVI | $73.81 | -0.54 | -0.73 |

Alphabet Inc's Google has struck at least 24 deals with big app developers to stop them from competing with its Play Store, including an agreement to pay Activision Blizzard Inc about $360 million over three years, according to a court filing on Thursday.

Google also agreed in 2020 to pay Tencent Holdings Ltd's Riot Games unit, which makes "League of Legends," about $30 million over one year, the filing stated.

The financial details emerged in a newly unredacted copy of a lawsuit that "Fortnite" video game maker Epic Games first filed against Google in 2020. It alleged anticompetitive practices related to the search giant's Android and Play Store businesses.

Google has called the lawsuit baseless and full of mischaracterizations. It said its deals to keep developers satisfied reflect healthy competition.

Riot said it was reviewing the filing. Activision did not respond to requests for comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| PANW | $156.56 | -2.53 | -1.59 |

Palo Alto Networks is buying Cider Security, a pioneer in application security and software supply chain security.

The proposed acquisition supports Palo Alto Networks Prisma Cloud's platform approach to securing the entire application security lifecycle from code to cloud. Combined with its recently announced Software Composition Analysis capabilities, Prisma Cloud will now provide the industry's most comprehensive supply chain security solution as part of its code-to-cloud security platform.

Under the terms of the agreement, Palo Alto Networks will acquire Cider Security for approximately $195 million in cash, excluding the value of replacement equity awards, subject to adjustment.

The proposed acquisition is expected to close during Palo Alto Networks' second quarter of fiscal 2023, subject to the satisfaction of customary closing conditions. The acquisition is not expected to have a material impact on the company's financials.

Aaron Judge's historic 62nd home run ball is heading for the auction block. The starting bid is $1 million. The auction starts Nov. 29.

Auction house Goldin noted:

"Milestone baseballs like Judge's 62nd home run ball continue to generate excitement and value to the hobby. To put this ball into historical comparison, Mark McGwire's 70th home run baseball sold for $3 million in 1998. A true piece of baseball history, worthy of display at Cooperstown."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GPS | $12.63 | 0.58 | 4.86 |

Gap Inc beat Wall Street estimates for quarterly sales and posted a profit on Thursday, helped by steady demand for its formal clothing and dresses even as decades-high inflation squeezes consumer spending.

Shares of the company jumped about 11% in extended trading.

Affluent consumers have been preferring more formal clothing, dresses, woven tops and pants, shelving casual wear like t-shirts and shorts as they return to travel, work and social occasions after two years of pandemic-induced restrictions.

The owner of Athleta brand expects fourth-quarter net sales to be down in mid-single digits, compared with analysts' expectations of a 0.6% decline, according to Refinitiv IBES data.

Gap's adjusted gross margin came in at 38.7% in the third quarter, down 320 basis points from a year earlier due to the company offering steep discounts to get rid off the excessive and outdated inventory, especially in its Old Navy brand.

The company reported $53 million in impairment charges related to Yeezy Gap. In October, Gap removed products from its Yeezy Gap line created in partnership with Kanye West, and shut down YeezyGap.com following the rapper's anti-Semitic comments.Gap's third-quarter net sales rose 2.5% to $4.04 billion, topping analysts' estimates of $3.80 billion.

The company posted net income of $282 million, or 77 cents per share, for the quarter ended Oct. 29, compared with a net loss of $152 million, or 40 cents, a year earlier.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WSM | $130.39 | 3.69 | 2.91 |

Williams-Sonoma Inc. on Thursday reported fiscal third-quarter net income of $251.7 million.

The San Francisco-based company said it had net income of $3.72 per share.

The results missed Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for earnings of $3.78 per share.

The seller of cookware and home furnishings posted revenue of $2.19 billion in the period, exceeding Street forecasts. Seven analysts surveyed by Zacks expected $2.16 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| KSS | $31.10 | 1.30 | 4.38 |

Kohl's Corp withdrew its 2022 sales and profit forecasts on Thursday, blaming an uncertain economic outlook and the departure of top boss Michelle Gass.

Kohl's has struggled to attract shoppers despite steep discounts to clear excess inventory, as Americans cut back spending on apparel and other discretionary purchases amid decades-high inflation.

The company said it was not planning on repurchasing any more shares until its balance sheet is strengthened.

Its third-quarter comparable sales fell 6.9%, in line with analysts' estimates, according to Refinitiv IBES data.

Net income fell to $97 million, or 82 cents per share, compared with $243 million, or $1.65 per share, a year earlier.

The average long-term U.S. mortgage rate tumbled by nearly a half-point this week, but will likely remain a significant barrier for potential homebuyers as Federal Reserve officials have all but promised more rate hikes in the coming months.

Mortgage buyer Freddie Mac reported Thursday that the average on the key 30-year rate fell to 6.61% from 7.08% last week.

A year ago the average rate was 3.1%.The rate for a 15-year mortgage, popular with those refinancing their homes, fell to 5.98% from 6.38% last week. It was 2.39% one year ago.Late last month, the average long-term U.S. mortgage rate breached 7% for the first time since 2002.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ACHR | $2.42 | -0.15 | -6.03 |

Archer Aviation Inc. publicly unveiled its production aircraft, Midnight, a pilot-plus-four-passenger electric vertical take off and landing (eVTOL) aircraft during its Open House event in Palo Alto, Calif.

Midnight is the evolution of Archer’s demonstrator eVTOL aircraft, Maker, which has validated its proprietary twelve-tilt-six configuration and key enabling technologies.

the plane will have an expected payload of over 1,000 pounds and be optimized for back-to-back 20-mile trips, with a charging time of approximately 10 minutes in-between.

Archer is working to certify Midnight with the FAA in late 2024 and will then use it as part of its urban air mobility (UAM) network, which Archer plans to launch in 2025.

The number of Americans filing new claims for unemployment benefits fell last week, showing widespread layoffs remain low despite a surge in technology-sector job cuts that has raised fears of an imminent recession.

Initial claims for state unemployment benefits dropped 4,000 to a seasonally adjusted 222,000 for the week ended Nov. 12, the Labor Department said on Thursday. Economists polled by Reuters had forecast 225,000 claims for the latest week.

Economists say businesses outside the technology and housing sectors are hoarding workers after difficulties finding labor in the aftermath of the COVID-19 pandemic. With 1.9 job openings for every unemployed person in September, some of the workers being laid off are probably finding new employment quickly.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| UAL | $42.68 | -0.61 | -1.41 |

| AAL | $13.78 | -0.32 | -2.24 |

| DAL | $33.81 | -0.30 | -0.89 |

| LUV | $37.46 | -0.53 | -1.40 |

United Airlines said Wednesday it expects to carry 5.5 million passengers during the Thanksgiving travel period, up about 12% over 2021.

The U.S. carrier will operate more than 3,700 flights per day on average during the Nov. 18-30 period. United forecasts it will carry about as many passengers over the holiday as the pre-pandemic period in 2019.

United also predicts Nov. 27 — the Sunday after Thanksgiving — will be its busiest travel day since before the pandemic with more than 460,000 passengers. United said it had added about 275 extra flights on Sunday to help accommodate this peak demand.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SBUX | $95.78 | -1.29 | -1.33 |

Workers at more than 100 U.S. company-owned Starbucks locations are striking for one day on Thursday to protest what they say is illegal retaliation against their union organizing.

The walkout comes on the one day each year that Starbucks gives away reusable, red, holiday-themed cups to customers with coffee purchases. In the past, the promotion has driven up traffic, resulting in long lines and stores quickly running out of the cups.

The workers say they are underpaid and don't have consistent schedules. They are also protesting firings, store closures and other actions they say are illegal retaliation by Starbucks against them for unionizing.

Starbucks has said it respects employees' right to organize, that store closings were due to safety concerns and that fired employees violated company policies. The company and union have accused each other of stalling bargaining.

The Seattle-based chain did not immediately respond to a request for comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| M | $22.12 | 2.41 | 12.23 |

| KSS | $31.01 | 1.21 | 4.06 |

Upscale U.S. retail chain Macy's Inc raised its annual profit forecast on Thursday on resilient demand for high-end clothes and beauty products, while the inflation squeeze on lower-income shoppers forced rival Kohl's Corp to scrap its forecast.

"The Kohl's customer is being hit by inflation a lot more than Macy's," said Jane Hali & Associates analyst Jessica Ramirez.

Luxury goods sales have held up for Macy's as affluent shoppers returning to social events after the pandemic splurge on pricier handbags, perfumes, clothing and gifts heading into the holiday season.

Inventories at Macy's were up just 4% in the third quarter from a year ago, thanks to heavy discounts to clear excess stocks of casual and athleisure apparel. Kohl's inventories ballooned 34%.

Macy's warned of more promotions heading into the holidays and reversed its earlier position that Christmas shopping would start early, saying consumers were holding out in the hope of getting discounts.

Macy's raised its fiscal 2022 adjusted per-share profit forecast to $4.07 to $4.27 from $4 to $4.20.

UK finance minister Jeremy Hunt on Thursday raised taxes on higher earners and energy companies as part of his new plan to shore up Britain's finances, even as he forecast the economy will shrink next year.

Hunt's budget involves freezing income tax allowances and lowering the threshold at which people start to pay the highest rate of income tax, in order to close a 55-billion pound hole in the public finances.

Laura Hoy, Equity and ESG Analyst at Hargreaves Lansdown said:

“It was encouraging to see Jeremy Hunt address the underlying issue of energy efficiency in the UK with a pledge to double the government’s annual investment and decrease consumption by 15% by 2030. A new energy efficiency task force will be set up to determine exactly how to funnel the additional 6 billion pounds pledged to the projects that need it most.

"However, judgement on whether or not these programs are adequate to truly make a dent in the necessary refurbishments around the country will be reserved for their unveiling.

"The windfall tax has also been accelerated and extended as the government looks to the energy companies riding high on ballooning oil prices to plug its budget shortfalls.

"However the increased tax rate does little to combat the loopholes that allow oil and gas companies to duck their tax obligations by reinvesting in new projects. The eco-credentials of those projects aren’t tied to these breaks, so there’s no added incentive for reinvestment in green energy instead of handing those funds over to the government.”

Reuters contributed to this report.

U.S. stocks fell across the board following comments from St. Louis Federal Reserve President James Bullard signaling rates are not yet at the level they need to be. Investors are also digesting mixed retail earnings with Macy’s lifting its forecast, while Kohl’s warned of challenges tied to inflation. In commodities, oil fell over 1% to the $83 per barrel level.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| M | $19.71 | -1.73 | -8.07 |

| KSS | $29.80 | -2.27 | -7.08 |

U.S. equity futures traded lower Thursday morning, adding to the previous days declines.

The major futures indexes suggest a slight decline when trading begins on Wall Street.

Oil prices continued to move lower on Thursday as concerns over geopolitical tensions eased, while rising numbers of COVID-19 cases in China added to demand worries.

U.S. West Texas Intermediate (WTI) crude futures traded around $85.00 a barrel.

Brent crude futures traded around $92.00 a barrel.

On the economic calendar, traders will examine the latest report on weekly jobless claims. More housing data will be released in the form of housing starts & permits.

Shares of Bath & Body Works are surging 21% in premarket trading. The personal care and home fragrance retailer topped Wall Street revenue estimates.

Cisco Systems shares are higher by 4% in premarket trading. The company beat first-quarter revenue estimates as easing supply chain constraints and a COVID-19 recovery in China helped meet demand for its broad networking products portfolio.

In Asia, Japan's benchmark Nikkei 225 shed 0.4%, Hong Kong's Hang Seng dropped 1.2% and China's Shanghai Composite fell 0.2%.

The S&P 500 fell Wednesday after stronger-than-expected retail sales data kept investors focused on the Federal Reserve's interest-rate path.

The broad stock market index fell 32.94 points, or 0.8%, to 3958.79, while the technology-focused Nasdaq Composite Index retreated 174.75 points, or 1.5%, to 11183.66. The Dow Jones Industrial Average lost 39.09 points, or 0.1%, closing the day at 33553.83.

Bitcoin was trading around $16,000, after snapping a two-day winning streak.

Bitcoin fell on Wednesday after Genesis suspended withdrawals as FTX fallout continues.

For the week, Bitcoin has gained 5%. For the month, the cryptocurrency is down 18%.

Bitcoin is down 64% year-to-date.

Ethereum was trading around $1,200, after gaining 10% in the past week.

Dogecoin was trading at 8 cents, after rising by 15% in the past week.

The family of FTX founder Sam-Bankman Fried has significant ties to the Democratic establishment in Washington, D.C.

With inflation soaring and interest rates rising, Americans have been forced to put some major plans on hold.

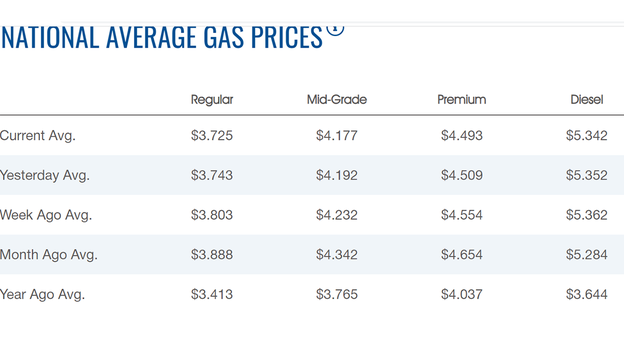

The nationwide price for a gallon of gasoline slipped Thursday to $3.725, according to AAA.

The average price of a gallon of gasoline on Wednesday was $3.743.

One week ago, a gallon of gasoline cost $3.803. A month ago, that same gallon of gasoline cost $3.888.

Gas hit an all-time high of $5.016 on June 14.

Diesel slipped to $5.342.

Oil prices continued to move lower on Thursday as concerns over geopolitical tensions eased, while rising numbers of COVID-19 cases in China added to demand worries.

U.S. West Texas Intermediate (WTI) crude futures traded around $85.00 a barrel.

Brent crude futures traded around $92.00 a barrel.

On Wednesday, WTI fell 1.5% after Russian oil shipments via the Druzhba pipeline to Hungary restarted. Brent dropped by 1.1%.

Poland and military alliance NATO said on Wednesday that a missile which crashed inside NATO member Poland was probably a stray fired by Ukraine's air defenses, according to Reuters.

Crude stocks in the United States fell by 5.4 million barrels in the past week to 435.4 million barrels, the EIA said on Wednesday, much steeper than the 440,000-barrel drop forecast in a Reuters poll.

However, inventories of gasoline and distillate fuels both rose by more than expectations.

Retirement savings slow and the average 401(k) balance slips below six figures

The bankruptcy of FTX Trading and other cryptocurrency companies will give the legal system — like Dorothy Gale in "The Wizard of Oz" — a peek behind the curtain into a private, opaque and largely unregulated world. Dorothy found the man behind the wizard. What the courts will find, according to court observers, is anyone’s guess.

In their quest to understand what took place behind the scenes at FTX, judges and lawyers will confront emerging technologies and unregulated issues, offering the opportunity to set fresh precedents or create new case law.

"There’s going to be very, very difficult forensic accounting questions and some really important questions about concepts, like, how do we understand what cryptocurrency is and is FTX more like a bank or more like a stockbroker?" said Jonathan Lipson, the Harold E. Kohn chair and professor of law at Temple University Beasley School of Law.

"Bankruptcy courts are not strangers to crises with systemic effects or to businesses using complicated technology. They have the tools and the experience to stabilize the situation and bring some order to chaos," Melissa Jacoby told FOX Business. Jacoby is the Graham Kenan professor of law at the University of North Carolina at Chapel Hill.

Read more on the story by clicking here: FTX bankruptcy will offer a look behind crypto’s dark curtain

Live Coverage begins here