STOCK MARKET NEWS: Market holiday, gas declines, FTX fallout

Federal Reserve pushes for reducing rate hike “soon.” FTX bankruptcy prompts crypto recovery. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Following three days of up and down trading, markets will pause on Thanksgiving Day.

There will be no trading in stocks as U.S. equity markets will be closed.

U.S. Treasury markets will also be closed, so no trading in bonds.

Stock futures will trade on an abbreviated schedule. They will trade until 1 p.m. ET.

Bitcoin was trading around $16,000, after a two-day winning streak.

For the week, Bitcoin was fractionally lower.

For the month, the cryptocurrency is off 19% and down 64% year-to-date.

Ethereum was trading around $1,200, after losing 2% in the past week.

Dogecoin was trading at 8 cents, after losing 4% in the past week.

Twitter CEO Elon Musk is setting the record straight on FTX’s disgraced founder Sam Bankman-Fried and his alleged ownership of Twitter shares.

In a series of tweets Wednesday afternoon, Musk called out a "fake news" report that alleged Bankman-Fried rolled his $100 million holdings of Twitter, when it was public, into private shares.

Musk discredited a report, written by Semafor’s Liz Hoffman, alleging Bankman-Fried "owns a sizable chunk of a now privately held and debt-laden Twitter." Hoffman cited a "FTX balance sheet prepared after the takeover closed on Oct. 28 and circulated to investors earlier this month."

The company contracted to recover assets of the failed cryptocurrency exchange FTX says it has managed to recover more than $740 million so far.

However, it is just a fraction of the potentially billions of dollars likely missing from the company's coffers.

The custodial company BitGo was hired in the hours after FTX filed for bankruptcy on Nov. 11.

The assets recovered were disclosed in court filings on Wednesday.

The biggest worry for many of FTX's customers is they'll never see their money again.

FTX failed because its founder and former CEO Sam Bankman-Fried and his lieutenants used customer assets to make bets in FTX's closely related trading firm, Alameda Research.

Read more on the story by clicking here: Crypto assets worth $740M recovered in FTX bankruptcy so far

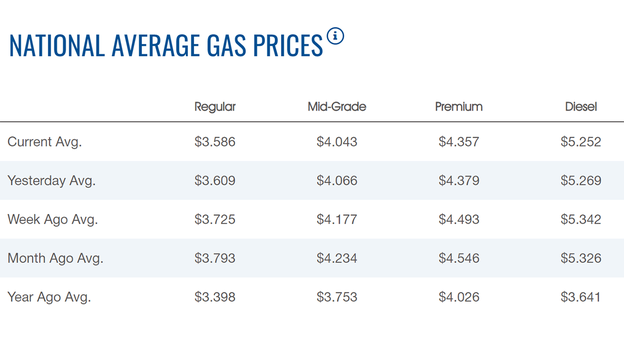

Drivers are experiencing some relief at the pump as millions hit the road for Thanksgiving.

While prices have declined recently, they are still very high for the annual Thanksgiving holiday.

The nationwide price for a gallon of gasoline slipped Thursday to $3.586, according to AAA.

The average price of a gallon of gasoline on Wednesday was $3.609.

One week ago, a gallon of gasoline cost $3.725. A month ago, that same gallon of gasoline cost $3.793.

Gas hit an all-time high of $5.016 on June 14.

Diesel declined to $5.252.

Gas prices over Thanksgiving 2022 are the highest ever recorded, according to AAA. However, that's not stopping Americans from traveling over the long holiday weekend.

The national average price for a regular gallon of gasoline is about $3.60, the highest figure for Thanksgiving since AAA has been tracking this data since 2000.

Last year, costs were still elevated, sitting around $3.40, according to AAA. Gas was also selling at that level in 2012. Historically, AAA data shows that the national average is more like $2.50 this time of year.

Thanksgiving travelers faced major price hurdles this holiday.

Decades-high inflation, coupled with a continued travel rebound stemming from the COVID-19 pandemic, is leading to higher prices for just about everything travel-related, including airfare, hotels and gas. Inflation cooled slightly in October, but still hit 7.7%.

The average price for a domestic round-trip flight the week of Thanksgiving was $468 if it was booked in early November, with prices only increasing as the month went on, according to Kayak. That marks a 48% increase from 2021. And another headache: United Airlines expects the holiday will be its busiest period since the beginning of the pandemic.

Oil traded around two-month lows on Thursday following a proposed price cap on Russian oil from Group of Seven (G7) nations, alleviating concerns over tight supply.

U.S. West Texas Intermediate (WTI) crude futures traded around $77.00 a barrel.

Brent crude futures traded around $85.00 a barrel.

A greater-than-expected build in U.S. gasoline inventories and widening COVID controls in China added to downward pressure, according to Reuters..

Both benchmarks plunged more than 3% on Wednesday on news the planned price cap on Russian oil could be above the current market level.

Live Coverage begins here